GeoPark: Reserve Replacement Has Been Inferior

Summary

- GeoPark published an updated certified reserves summary, which indicated significant YoY drop in almost all categories.

- As a result of that and higher taxes, the estimated NPV of the 2P reserves dropped 21.7% YoY to US$1.8B.

- While the current EV is well below that number, other Colombian peers appear to be cheaper based on multiples.

bymuratdeniz

Back in October, I wrote an article about GeoPark (NYSE:GPRK) – an oil and gas company with primary focus on Colombia. Now that GPRK has updated its reserve estimates and the tax reform in Colombia, levying higher burden on energy firms has been implemented, it’s worth taking a second look at GeoPark. Unfortunately, it appears that the reserves in almost all categories fell significantly with very little additions from discoveries and extensions. In combination to the burdensome tax changes, regarding oil and gas companies, this has led to a deterioration of the estimated NPV of the 2P reserves of GPRK. While the current EV is still below the indicated NAV, the company is trading at higher multiples than the cohort of Colombian peers.

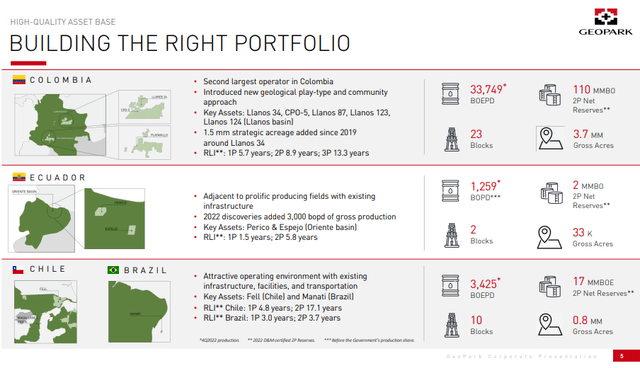

Company overview

GeoPark Limited is a Bermuda registered company, which through its subsidiaries engages in oil exploration, development and extraction in LATAM with primary focus on Colombia. As I’ve covered the company before, I’m not going to discuss the operations in detail, but will instead focus on the new developments.

Operational update

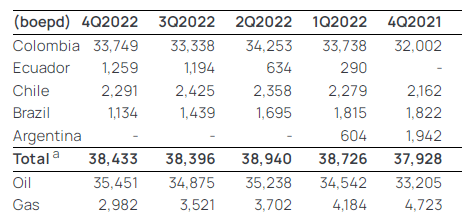

The latest operational update revealed Q4’22 production of around 38.4kBOE (+1.3% YoY), while on a quarterly basis the amount was almost flat. However, the Q4’21 data includes the divested Argentinian assets, while adjusted growth (ex. Argentina) was 6.8% YoY. Oil dominated the latest quarter’s production with 92.2% share, while gas amounted to 7.8%.

GeoPark's production summary (GeoPark)

In terms of shareholder returns, the company distributed US$25M to its shareholders in 2022 as dividends. Also, the share repurchase program continues, as the share count has shrunk to 57.6M as of 2022 year-end, compared to 60.2M as of 2021 year-end.

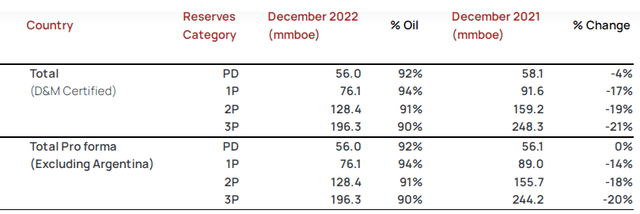

Reserves update

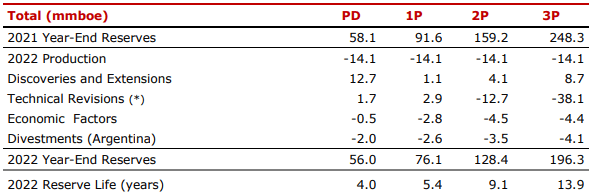

In February, GeoPark published a summary of its certified reserves. The process was done by DeGolyer and MacNaughton Corp. (D&M) and the estimates are as of 31 December 2022. The summary reveals that discoveries and extensions throughout the year were not enough to cover the approximately 14.1MBOE produced in 2022.

GeoPark's reserves summery (GeoPark)

Only in the Prove Developed or PD category, the figures were close to each other. However, other categories suffered from additional downward revisions due to technicalities. Economic factors also weighed on the downside. As a result, every reserve category, other than PD posted a double-digit decline.

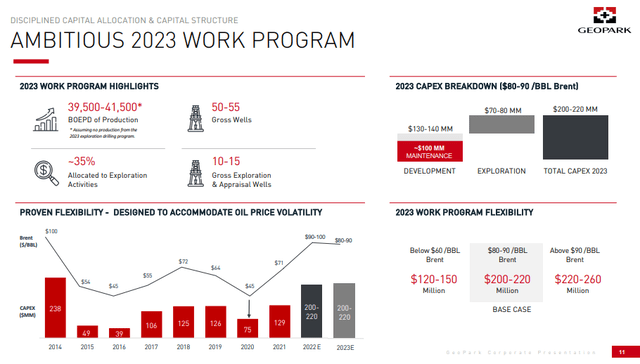

Capital expenditures

The deteriorating reserves might have been a result of relatively low CAPEX budget in the last few years. The full effect of the increased budget for 2022 are yet to be felt on reserves. 2023 budget is also expected to be north of US$200M, however around half of it will be spent just on maintaining production. It’s worth noting that the 2023 budgeting was done assuming US$80-90/barrel Brent prices, which are a bit higher than the prevailing YtD price.

Valuation

The changes in reserves were accompanied with another negative development that negatively impacted the company – the new Colombia tax regime for oil and gas companies. Basically, firms will have to pay additional levies if Brent prices are above certain thresholds. The combined effect of lower reserves and higher taxes has led to a 21.7% YoY contraction to the estimated NPV of GeoPark’s 2P reserves to US$1.8B from US$2.3B a year ago. This figure is still well above the current EV of GeoPark, which stands at around US$1.16B.

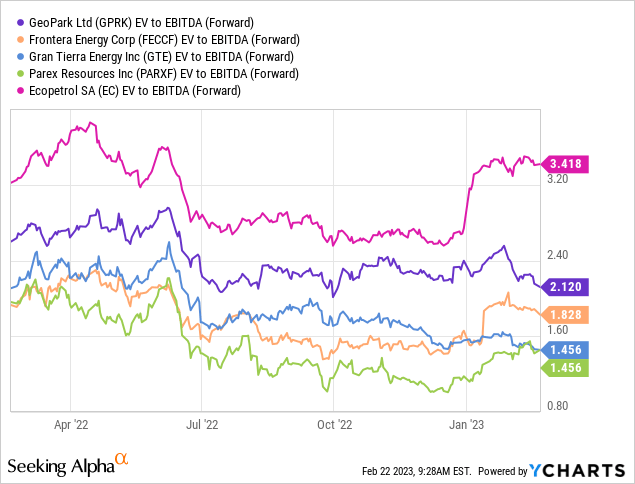

However, looking at the cohort of Colombian peers, all companies (except the state-owned Ecopetrol) are trading at lower Forward EV/EBITDA ratios, implying that they might be even more undervalued than GeoPark.

Conclusion

The latest update on GeoPark’s resources and the new tax regime in Colombia have impacted the company negatively. The estimated NPV of the 2P reserves fell substantially, but still remains comfortably above the current EV of the company. However, multiples comparison with other Colombia-focused oil and gas firms indicates that GPRK is trading at higher multiples than the peer group, indicating that likely there are even more undervalued companies with exposure to the country.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FECCF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.