Realty Income: Monthly Dividend Is Worth The Inferior Growth

Summary

- Realty Income has a huge following on Seeking Alpha and is loved for its growing monthly dividend.

- The company has, however, got too big and growth is likely to slow significantly going forward due to limited internal and external growth prospects.

- While the company will likely not generate alpha, it can provide safe long-term returns in line with the market and pay investors a nice dividend every month.

- Realty Income remains a staple and should be in every REIT investor's portfolio.

Kirk Fisher

Dear reader/followers,

I've recently written articles on two net lease REITs (EPRT and NNN) and explained why I believe they are well positioned to endure the difficult macroeconomics conditions we have ahead of us. In this article I want to compare them to the largest net lease REIT of all - Realty Income (NYSE:O) and determine whether O deserves a premium because of its superior quality.

Overview

Realty Income has a huge following on Seeking Alpha, partly because it is a quality business and partly because it pays a growing monthly dividend, so I will only go through the things that actually differentiate O from other net lease REITs and link the presentation for anyone not familiar with company.

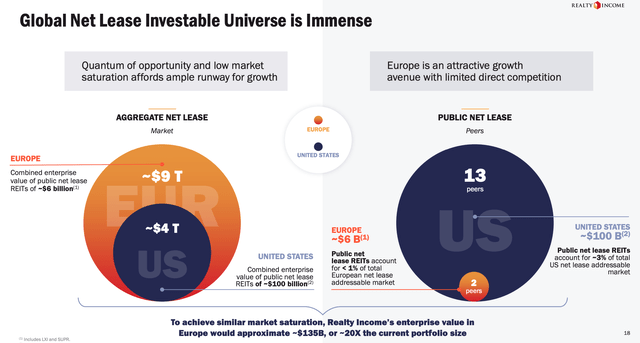

- The company has about 10% of its exposure in Europe (primarily in grocery stores in the UK), which could allow for superior growth as the European net lease market is almost 40x less saturated than the US market with only two relevant public net REITs. Unfortunately to date, we have seen no plans to double down on the expansion in Europe

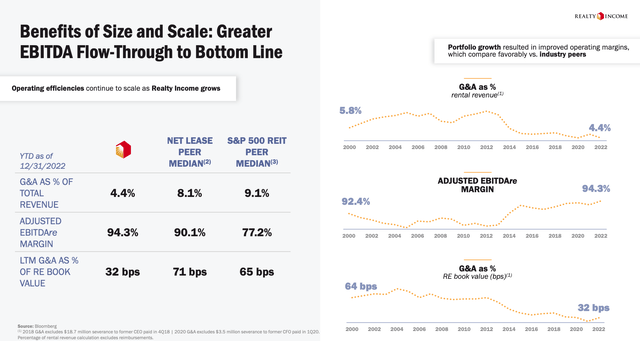

- With a market cap of $40 Billion, the size allows for economies of scale. In particular, general & administrative expense accounted for only 4.4% of O's 2022 revenue (compared to the net lease peer median of 8.1%). This contributed to O's significantly higher EBITDAre margin of 94.3% compared to 90.1% of its net lease peers. The scale also allows the company to close on huge sale-leaseback transactions without compromising prudent client and industry diversification metrics. On the flip side, the size makes it much harder for the company to grow externally by acquiring new properties.

- The company focuses on leases to big-name institutional tenants with about 40% of their clients being investment grade, meaning that in general they hold higher quality assets occupied by higher quality tenants. The average asset size of over $5 Million is significantly above average in the industry, driven mainly by big box stores leased to companies such as Walmart or Home Depot. Unfortunately the focus on higher quality means acquisitions at lower cap rates which significantly reduces the spread that O earns, which can potentially be painful in today's higher interest rate environment and make external growth more difficult.

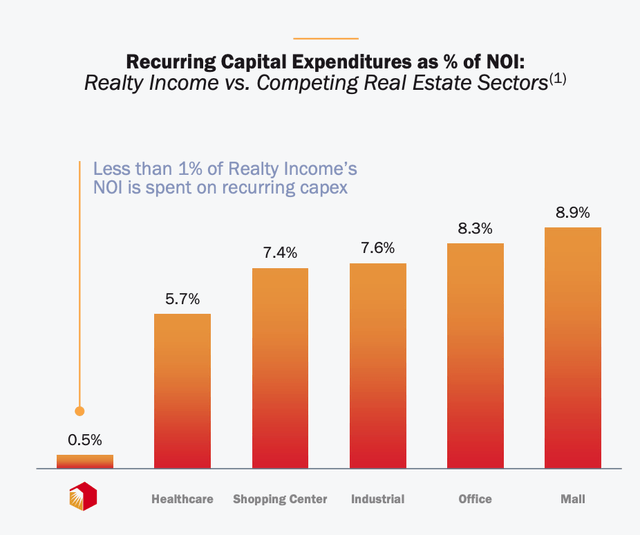

- Some of O's leases are actually not triple net but only double net with some capex responsibility. Half a percent of NOI for capex may seem insignificant but when you consider that the average rent increase built into the lease agreements is just 0.9% per year, it is clear this can significantly slow the company's internal NOI growth.

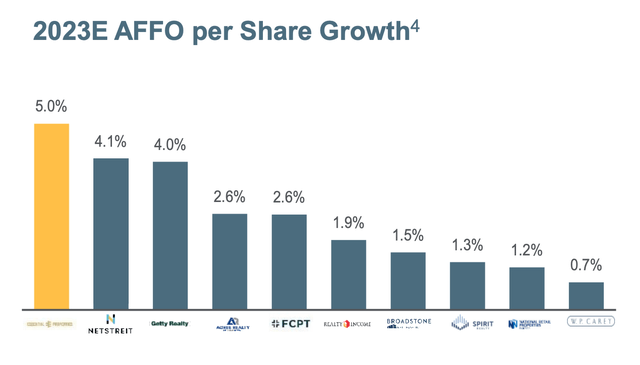

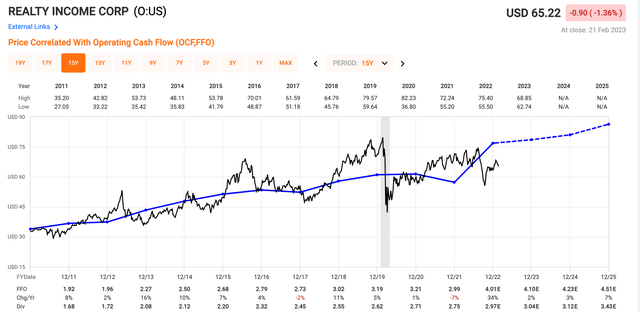

So to sum up, there are a couple of factors that will determine O's growth going forward. First internally, the company is unlikely to grow its same store NOI much as it 0.9% average rent increase is offset by 0.5% in capex spending. Externally, future growth will be difficult because of the sheer size of the company as well as the focus on quality assets/tenants which results in lower acquisition cap rates leading to lower spreads. My outlook is consistent with management's 2023 guidance where they expect FFO to reach $4.01-4.13 vs $4.06 in 2022. Even at the top end of the range, this is sub 2% growth, which is low and significantly below some of its peers as seen in the chart below.

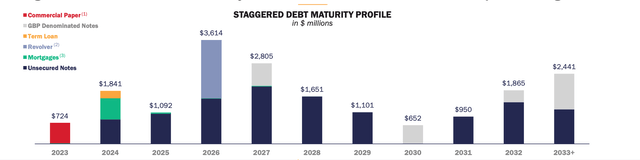

On the positive side, the REIT has one of the strongest balance sheets in the REIT space. In fact it is one of only seven REIT that have a rating of A- or better resulting in a low weighted average interest rate of 3.37% (85% fixed). Debt maturities are spread over time, but there are significant repayments due in 2023 and 2024 that will need to be refinanced. With a solid rating and $1.7 Billion in liquidity (of which $170 Million in cash) I think the company will be able to refinance easily, though likely at a higher rate.

Valuation

The company is currently trading at 16.2x FFO. This is below its historical average of 19x FFO. Personally, I feel that this average should be adjusted somewhat to reflect the fact that the company is unlikely to reach the high growth rates it experienced in the past. I would regard a multiple of 17.50x as fair going forward. That still leaves some upside when things normalize - in particular we could see an annual return of about 2.5% from multiple expansion over the next three years.

Below is a comparison of Realty Income vs peers. O stock is trading at exactly the same valuation as EPRT, although it is expected to grow much slower (1.9% vs 5.0%). Compared to NNN, growth is similar, but O is more expensive on a P/FFO basis. Both of these can likely be attributed to the fact that Realty Income is a safer play.

| O | EPRT | NNN | |

| FFO growth | 1.9% | 5.0% | 1.2% |

| P/FFO | 16.2x | 16.3x | 14.6x |

| Dividend yield | 4.7% | 4.4% | 4.6% |

| Implied cap rate | 5.6% | 5.6% | 6.3% |

The question is whether the extra quality is worth the inferior growth prospects. If we can expect to generate returns that are at least in line with the expected market return (8%), I would say that it is, for some investors. So what return can we reasonably expect from O?

- 4.7% dividend yield (growing slowly at 1% per year)

- max. 2% FFO growth for the next two to three years

- 2.5% return from multiple expansion

- -> total return of 9.2% per year

This is slightly above the expected return of the market even with a conservative exit P/FFO multiple so O is by no means a bad buy here. I rate it as a "HOLD" here at $65.00 per share. Personally I will not be adding to my position here, because I already have a sizeable position in the company, but for income-oriented and defensive investors, the current price can be an attractive entry point to start a position and hopefully add if the price drops to $60 per share.

Remember how I generate alpha:

- start with a thesis why a given industry/sector should outperform

- stay overweight in those sectors for as long as the thesis is valid

- look for companies with sound fundamentals that are either undervalued or fairly valued with exceptional growth prospects

- if a company becomes overvalued, trim the position and rotate into another stock/sector that is still undervalued

- if a company becomes increasingly undervalued and the thesis is still valid, add to the position

- generate alpha and repeat

My total return then comes from the dividend yield, EPS growth and multiple expansion as the valuation normalizes over time. I always target a total return in excess of market returns (>8%) to generate alpha.

What things do I look for when selecting individual stocks to buy?

- strong and safe fundamentals

- good management teams with a track-record of caring about shareholders

- healthy EPS growth

- well-covered dividend

- discount relative to peers and/or historical fair multiples

- other catalysts

This article was written by

Disclosure: I/we have a beneficial long position in the shares of O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.