A Pretty Darn Good Stock Market (And Sentiment Results)...

Summary

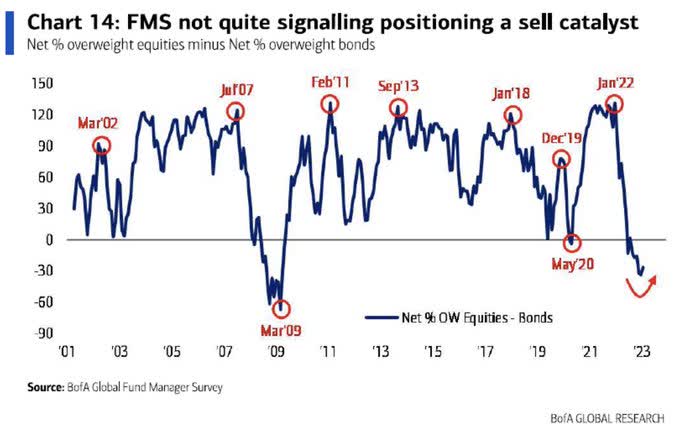

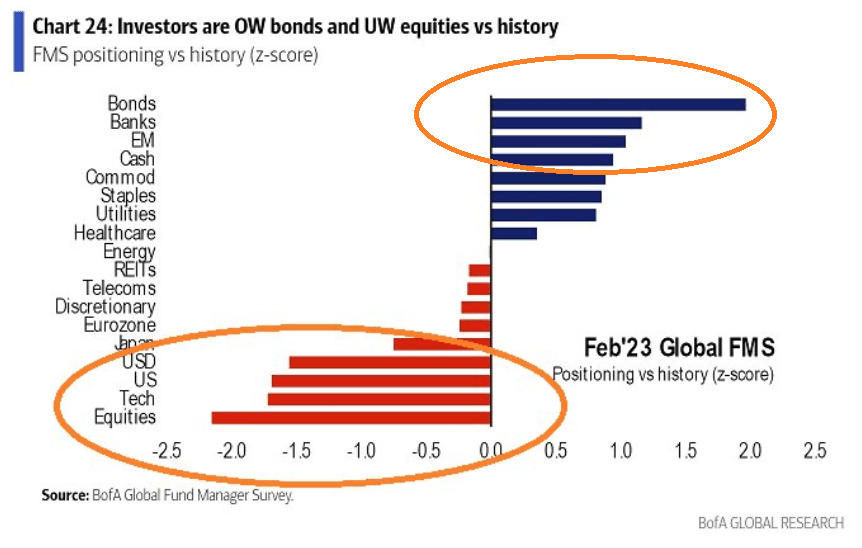

- Markets don’t top when everyone is overweight bonds; they top when everyone is overweight stocks.

- The trends are your friends.

- The intermediate-term outlook for equities is pretty darn good.

Matteo Colombo

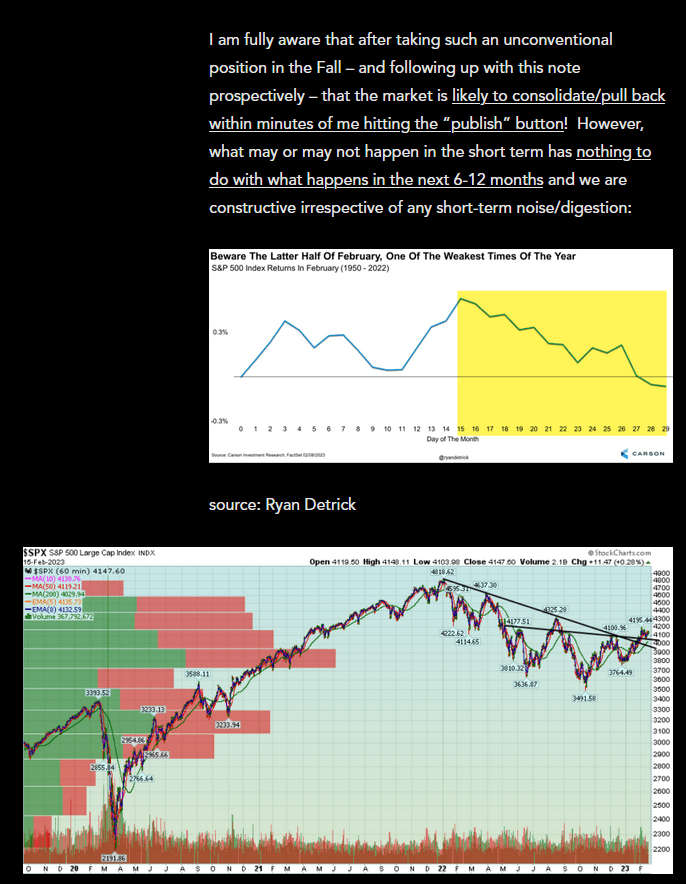

In last week’s note we reiterated our case from October that the “pain trade” was UP in the first half of this year DESPITE the short-term seasonal headwinds and possibility of near-term weakness (read full note for context):

Hedgefundtips.com

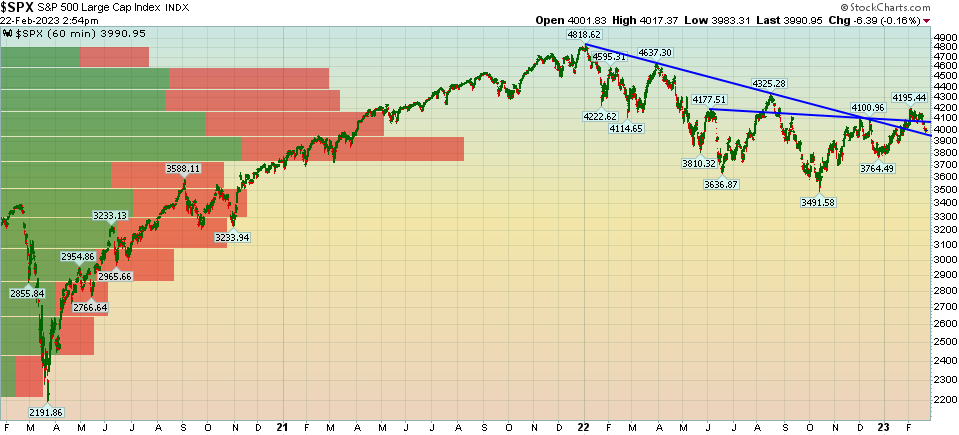

Here’s what the chart above looks like this week:

stockcharts.com

On Tuesday (during the 700pt DOW flush), I joined Seana Smith and Dave Briggs on Yahoo! Finance. Thanks to Taylor Clothier, Sydnee Fried, Dave and Seana for having me on the show.

Key Takeaway from the segment: “Bears should curb their enthusiasm. This is a normal consolidation after an ~18.5% rally off the October lows in a period of (end of Feb.) seasonal weakness. Markets don’t TOP when everyone is overweight BONDS, they top when everyone is overweight STOCKS…”

Watch in HD directly on Yahoo! Finance

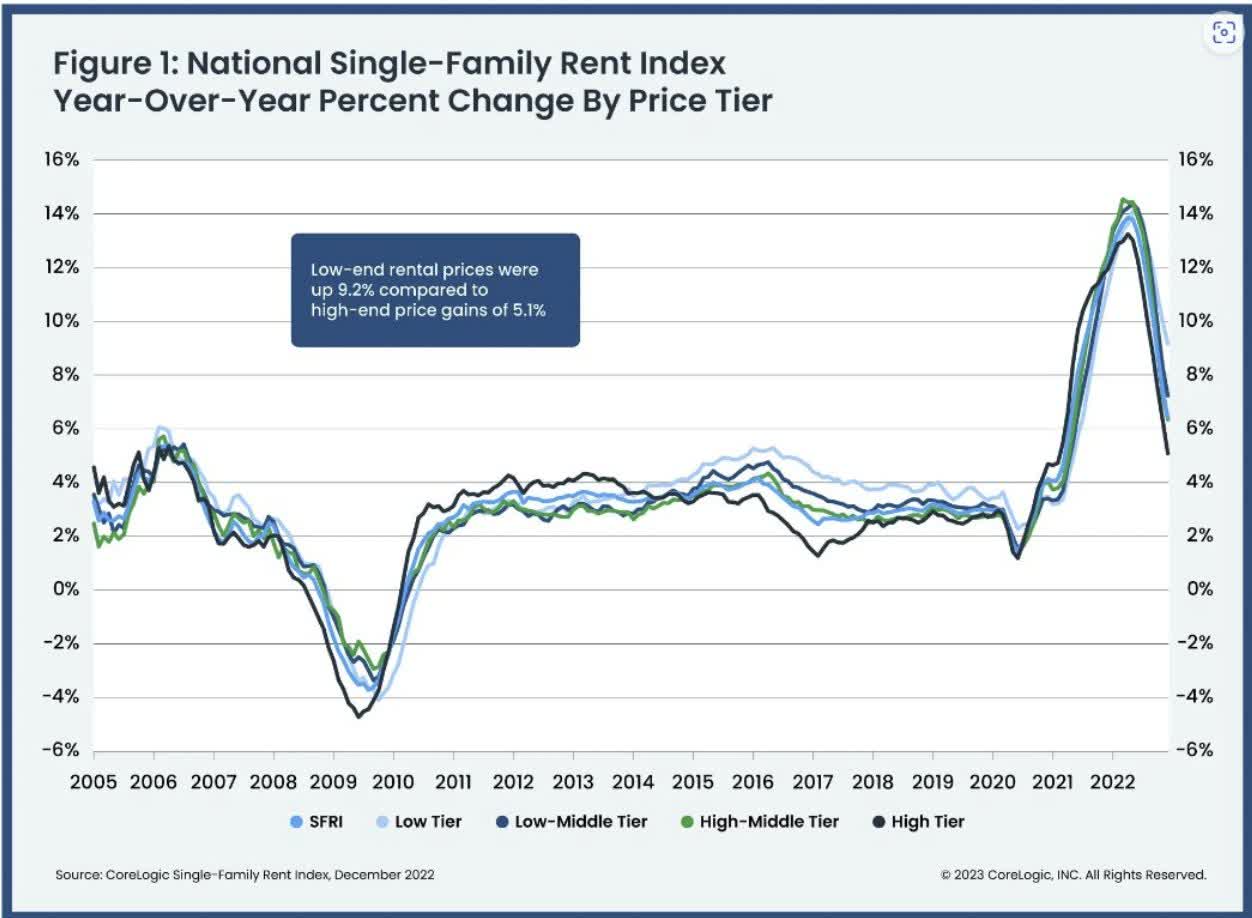

Here is some of the rental data I reference:

CoreLogic

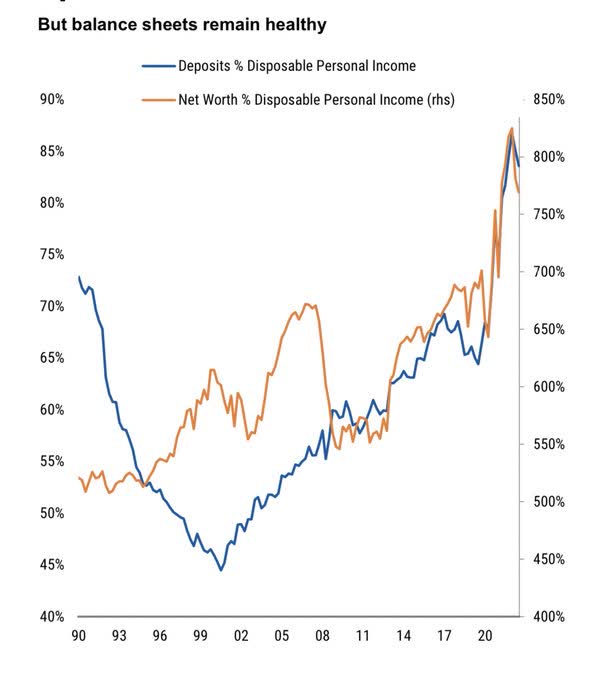

Here’s a visual of household balance sheets (declining but historically peerless):

Morgan Stanley

On Friday I joined Cheryl Casone in-studio to talk markets, positioning, inflation and opportunities on Fox Business – The Claman Countdown. Thanks to Kathryn Meyers, Cheryl and Liz Claman for having me on:

Watch FULL interview in HD directly on Fox Business

Data Referenced in Segment:

BofA

BofA

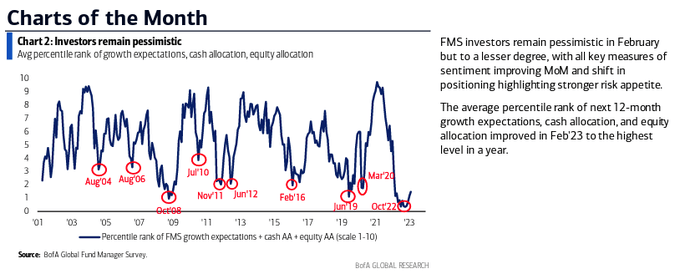

BofA

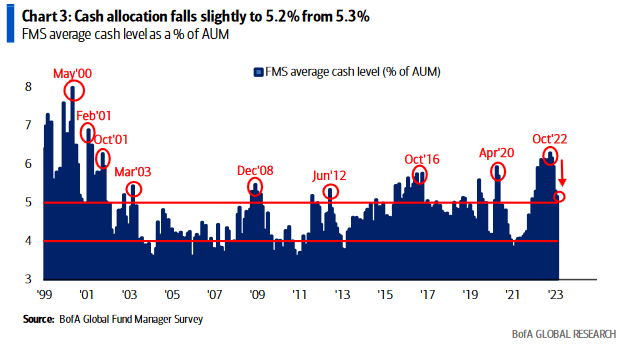

BofA

And finally, on Friday evening I joined Phillip Yin on CGTN America to discuss inflation and markets. Thanks to Longwei Zheng and Phil for having me on:

Pretty Darn Good…

While most of what you have found in the last few months is negativity, here are some concepts we’ve been reminding viewers of in our weekly podcast|videocast.

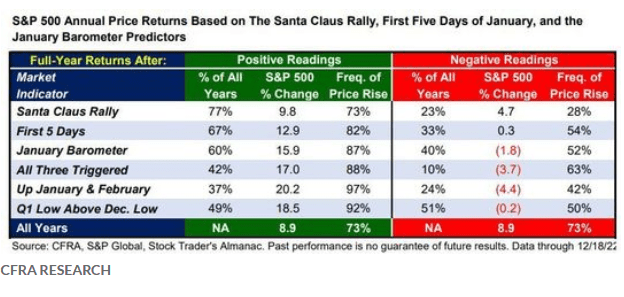

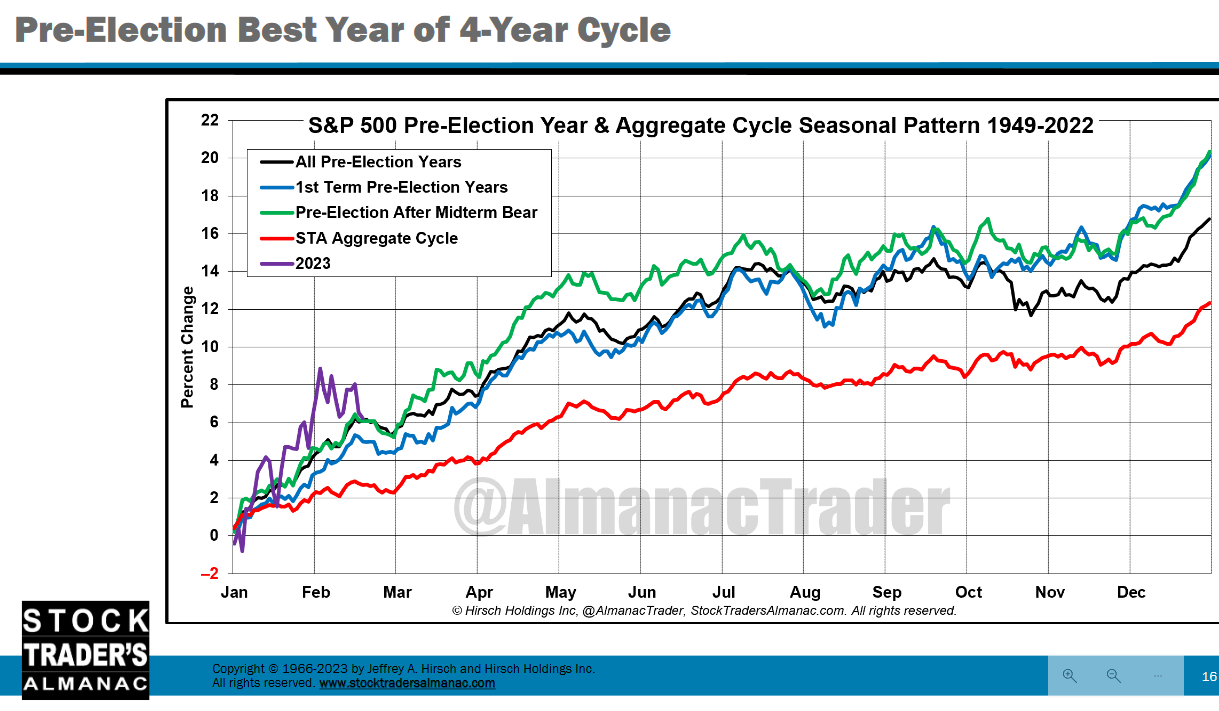

This weekend I spoke at the MoneyShow. One of the other speakers was Jeff Hirsch of the legendary “Stock Trader's Almanac.” You may remember this table we put out all of January – pointing to good things for 2023:

CFRA

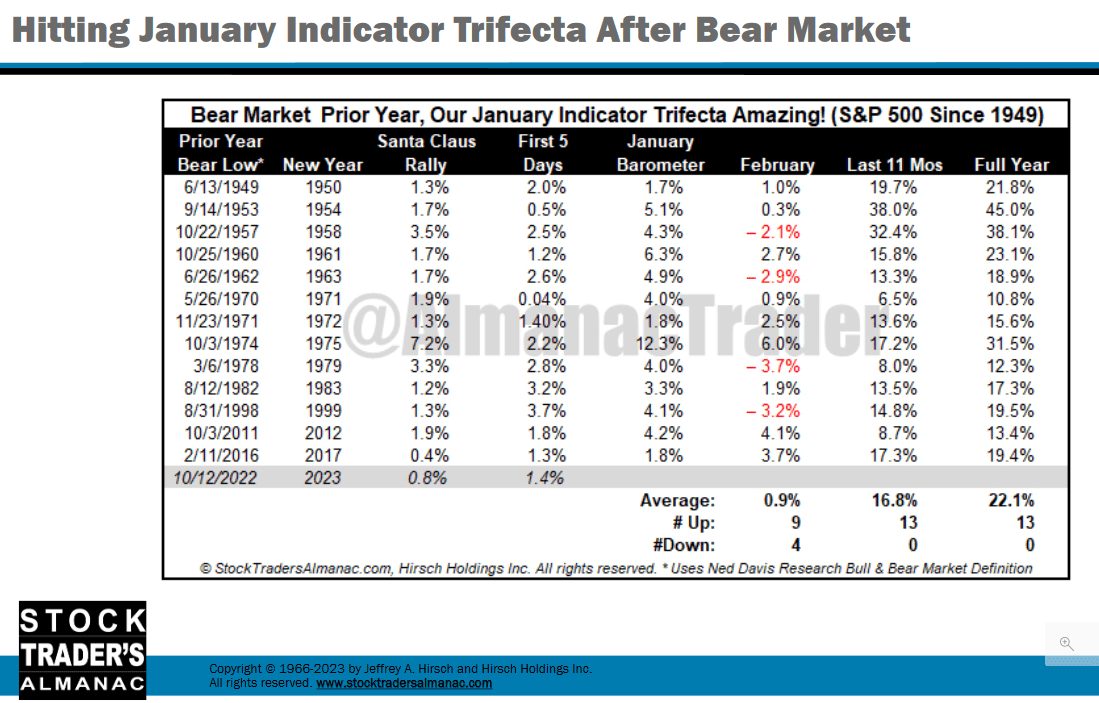

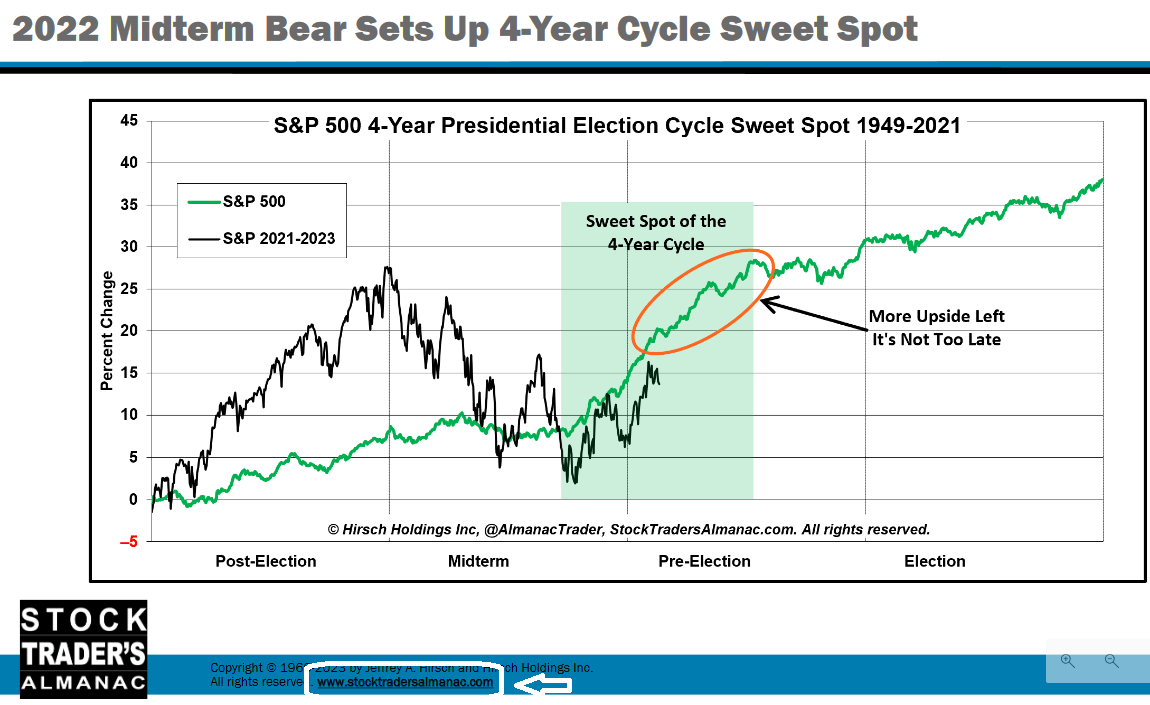

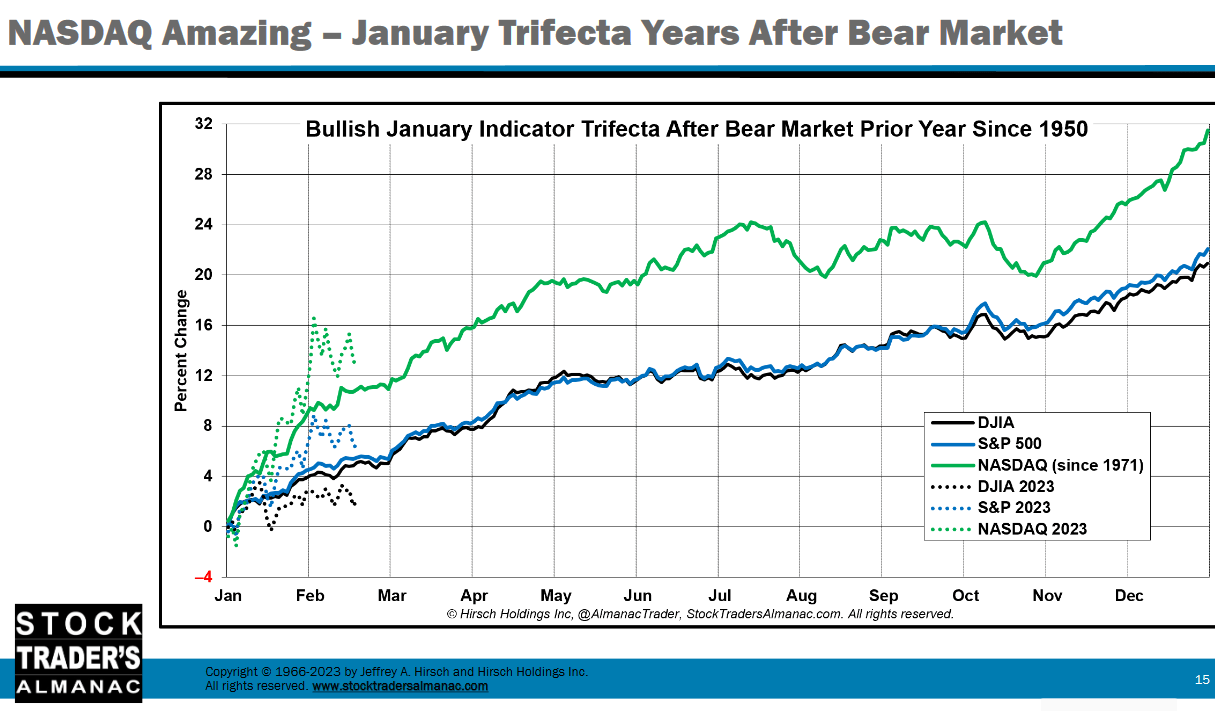

In Jeff’s presentation, he presented a number of slides that speak to this statistical advantage – which point to good things to come:

Stock Trader's Almanac

Stock Trader's Almanac

Stock Trader's Almanac

Stock Trader's Almanac

All courtesy of Jeff Hirsch at StockTradersAlmanac.com.

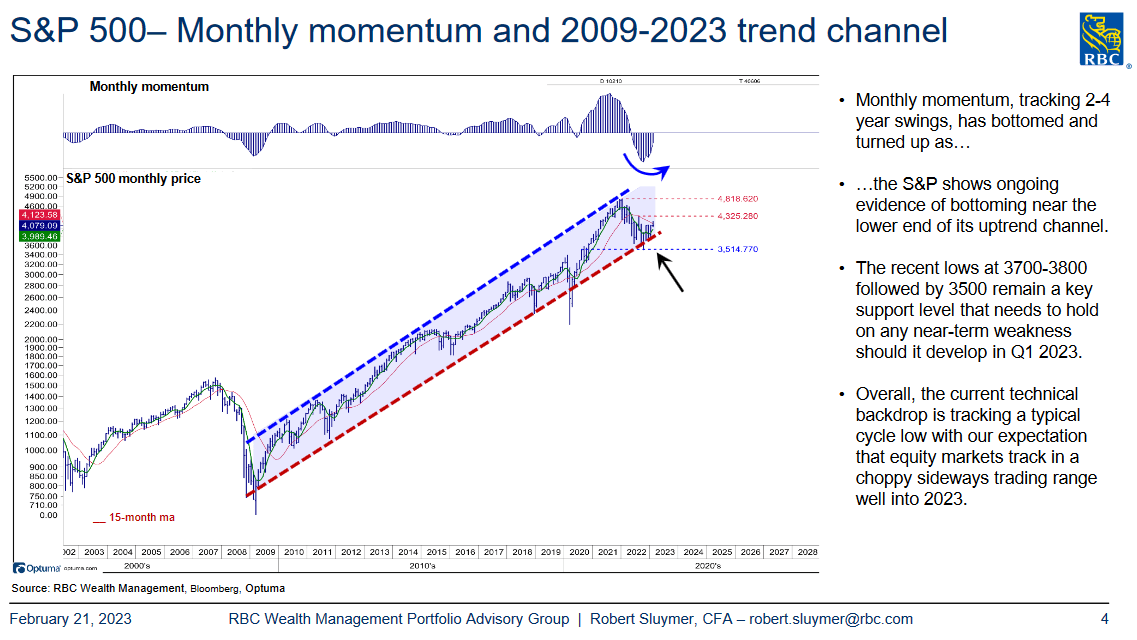

The trend is your friend:

RBC Wealth Management

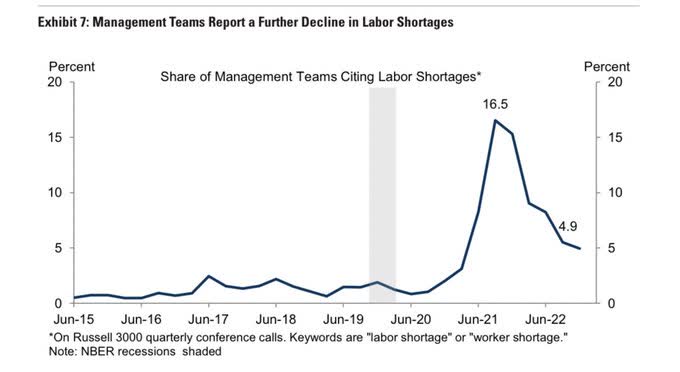

Labor supply coming back online:

Jeff Hirsch at StockTradersAlmanac.com

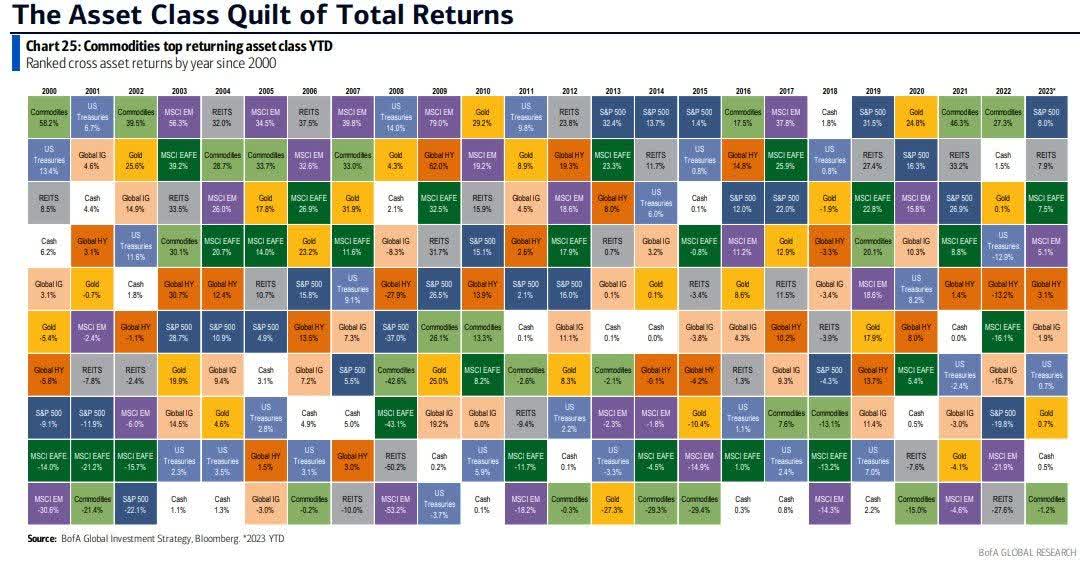

The “Last Shall Be First” theme we highlighted in our notes in Q4 is playing out in spades:

BofA

In our view, despite the short term consolidation, the intermediate term outlook for equities is pretty darn good.

Now onto the shorter term view for the General Market:

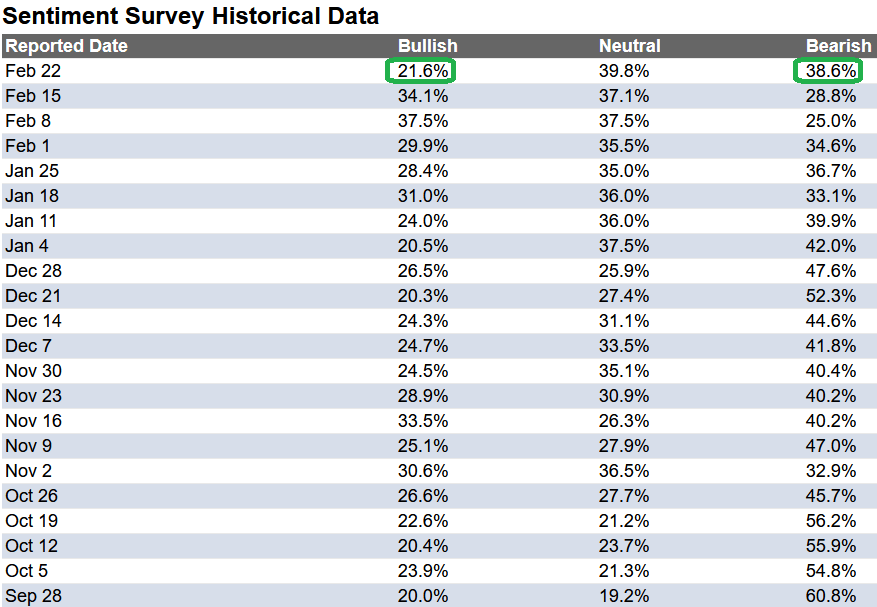

In this week’s AAII Sentiment Survey result, Bullish Percent collapsed to 21.6% from 34.1% the previous week. Bearish Percent jumped to 38.6% from 28.8%. I have rarely seen retail investors panic this much, this quickly.

AAII

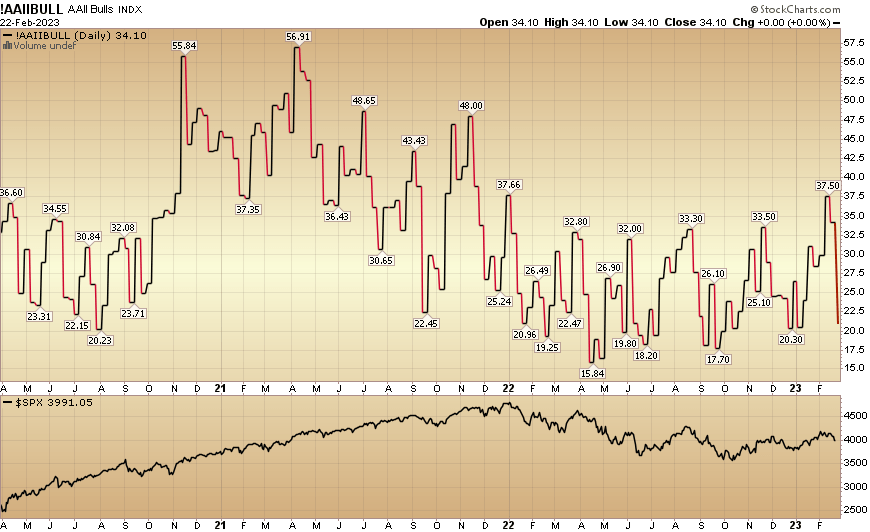

stockcharts.com

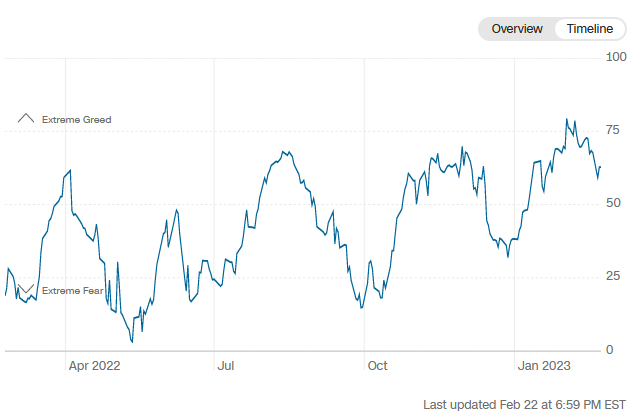

The CNN “Fear and Greed” dropped from 74 last week to 63 this week. Sentiment cooled.

CNN

CNN

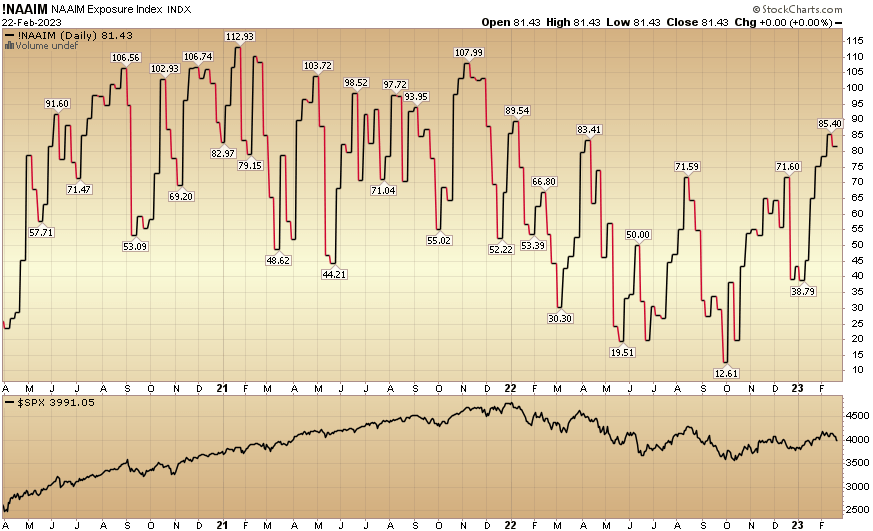

And finally, the NAAIM (National Association of Active Investment Managers Index) ticked down to 81.43% this week from 85.4% equity exposure last week.

stockcharts.com

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: *Opinion, not advice. See “terms” at hedgefundtips.com.