RCI Hospitality: Why Does Everybody Focus On Bombshells, The Least Important Segment?

Summary

- Bombshells account for less than 10% of RCI Hospitality's revenues.

- Although it's a small segment, a lot of the talk around the company is about this segment.

- Investors should focus on what actually moves the needle.

Konstantin T.

RCI Hospitality (NASDAQ:RICK) is primarily an operator and acquirer of gentleman clubs, more commonly known as strip clubs in the USA. I covered the stock in the past and it is one of my largest holdings, but many investors get it wrong and don't focus on what matters.

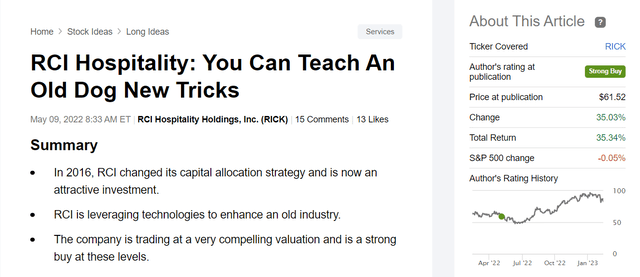

Performance since my last coverage of the stock (Seeking Alpha)

Last earnings call focused on Bombshells again

I went through the last earnings call:

- 9 Analysts and Investors asked questions

- just 3 of them did not ask a question about Bombshells

- In total, over 16 questions were asked

- Throughout the Q&A, the term Bombshells fell 37 times

Adam Wyden, one of RCI's largest shareholders, summed it up well during his questions:

So again, I sort of look back and I say to myself, I don't know why we spent 2 hours or an hour talking about Bombshells when this casino nightclub strip club thing could be 25%, 30% of EBITDA, it could be doing 4x the amount of EBIT that all of Bombshells is doing. So -- and not to mention Baby Dolls alone at maturity is $15 million of EBITDA. That's double. That 1 acquisition is double the amount of Bombshells.

Why aren't Bombshells that exciting?

First off, let's review RICKs operating segments. Right now, they only have two segments: Nightclubs and Bombshells. Below we can see that Nightclubs are the much larger and much more profitable segment.

| Revenue (Q1 23) | Operating margin (Q1 23) | Operating Income (run rate) | |

|---|---|---|---|

| Nightclubs | $56.3 | 40.4% | $22.7m |

| Bombshells | $13.4 | 13.8% | $1.8 |

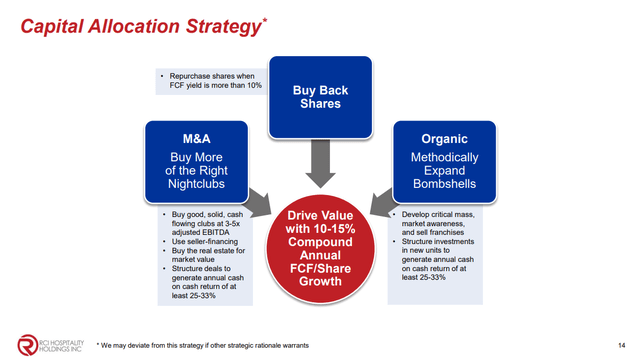

Nightclubs are the better business and what the company should focus on. Let's review the Capital Allocation Strategy the company laid out: Three parts of it should lead to between 10-15% FCF/shares CAGR; I believe this estimate to be conservative, but we'll get to that in the next segment. The nightclub segment can only be grown by M&A because municipalities in the US generally don't give out new licenses for clubs. Overall there are around 2000 clubs in the US, with 500 meeting the acquisition criteria defined in the picture below and over 50 clubs already in the company's portfolio. Nightclubs are the focus if there are deals available and right now, the deal pipeline is full. Bombshells should only be pursued if there are no great clubs to buy at desired prices; the same goes for Buybacks, which the company only does if the FCF yield exceeds 10% and there are no better alternatives.

RICKs Capital Allocation Strategy (RICK Q1 presentation)

The three-year plan

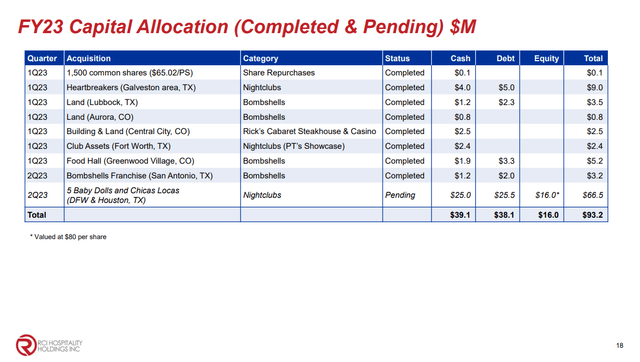

The company talked about its three-year plan of deploying $200 million yearly, for a total of $600 million invested into clubs at 4x EBITDA and other opportunities like bombshells. They are already well on track to deliver in 2023 (see picture below) with $93 million of capital deployed and more deals in the pipeline, to quote CEO Eric Langan:

I am being a little pickier, because we go so much on our plate right now

We can see that most of this capital deployment was towards nightclubs, especially with the 5 Baby Dolls and Chicas Locas deal. The Casino deal also is attractive. The total investment to buy the licenses, do remodeling and buy machines will end up somewhere around $10 million. On the upside, Analyst Adam Wyden expects EBITDA of somewhere between $10-25 million if all goes well. This would be a very asymmetric bet and I'm looking forward to the development here. Overall at $10 million, it is not a high commitment. Meanwhile, the $5.2 million food hall acquisition, which will be a development of the Bombshell concept, gets most of the attention from what I have seen in the media and coverage of RICK.

FY 23 Capital Allocation (RICK Q1 Presentation)

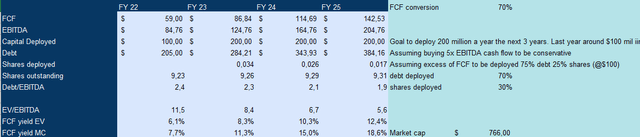

I made some projections in excel to see how far this plan if executed well, could get the company. I used an FCF/EBITDA conversion of 70% based on FY 22 numbers. I also assumed a 5x EBITDA multiple for acquisitions to be conservative. Based on Eric's comment I shared above, we could be optimistic and take 4x, but let's be conservative! I assumed that all FCF would be deployed and no share buybacks. The excess capital to get to $200 million a year is split 70/30 between debt and equity in this model. I believe that RICK will deploy more equity now that shares are trading at a fairer multiple. If they can acquire at 5x EBITDA with shares valued at 10x EBITDA, that's a value-accretive transaction. If we run this model, we would exit FY 25 at >$140 million FCF and >$200 million EBITDA with >$380 million in debt and very slight dilution. This would leave the company well within its leverage ratio. This would make the stock trade at 5.6x FY25 EBITDA and a 12.4% FY25 EV FCF yield. I believe this is still a very attractive price for the stock and I recently purchased more shares at $80 after the company sold off the Q1 results. In my opinion, I think that the sell-off was due to concerns about Bombshells, which are not really critical for the investment case. RICK stock remains a strong buy and a core position in my portfolio.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of RICK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advise.