Vipshop: Progress On Number Of Active Customers Would Make Me Bullish

Summary

- I believe that increasing marketing spending and expanding the user base will be crucial to driving top-line growth, particularly as consumer sentiment improves in the coming quarters.

- Vipshop has a competitive advantage in the discount retail market due to its specialized order-fulfillment capabilities, which it can leverage in the long term.

- However, I remain concerned about the declining number of active customers and its impact on the company's future revenue growth.

- I keep a hold rating on VIPS stock with a price target in the range of $18.3 to $18.7 based on the forward P/E of 15x.

FG Trade

Thesis

Vipshop Holdings Limited (NYSE:VIPS) has refocused on its apparel offerings, which is expected to lead to greater differentiation, customer loyalty, and profitability in the long run. The company's partnerships with Tencent and JD.com are also anticipated to attract new customers and increase spending frequency among existing users once consumer sentiment in China rebounds. Vipshop currently has 41 million active customers and has collaborated with over 21,000 brand partners since 2010, with a focus on serving lower-tier city shoppers. While there are concerns about declining active customer numbers, Vipshop is likely to see increased revenue in 2023. I keep a hold rating on the stock with a price target in the range of $18.3 to $18.7 based on the forward P/E of 15x.

Q4 Preview: Expectations of Higher Margins

I expect VIPS to report a higher adjusted operating margin for the fourth quarter of 2022 compared to the same period in the previous year, despite a greater decline in revenue than the company had predicted (a drop of 5-10%). This may be due to lower procurement costs during the intense Covid period in China from October to December 2022, as well as increased sales from super VIP customers, could also have helped boost sales of more profitable items.

Vipshop will likely generate more revenue in 2023 as consumer sentiment in China recovers. The discount e-tailer might raise its marketing-to-sales ratio to pre-pandemic levels of 3% vs. about 2.8% in 2022 to lift spending by active customers.

The narrower-than-expected decline in retail sales in mainland China in December 2022 suggests that an easing of restrictions could increase consumer sentiment and result in higher sales for January and February 2023, even if concerns about Covid remain elevated.

Long-term value depends on growth of user base

While I believe that management cutting costs may be a necessary defense against challenging market conditions, I remain concerned about the declining number of active customers and its impact on the company's future revenue growth. In the third quarter of 2022, the number of active customers decreased by 6.6% year-over-year and 1.7% quarter-over-quarter, reaching a total of 41 million. While VIPS management expects a potential narrowing of the decline in user growth in the first half of 2023 due to the low base in 2022, I believe that increasing marketing spending and expanding the user base will be crucial to driving top-line growth, particularly as consumer sentiment improves in the coming quarters.

Due to the current challenging macroeconomic environment, VIPS management believes that investing heavily in sales and marketing may not be an efficient use of resources and that the company should prioritize profitability over user growth in the short term. As a result, I do not anticipate a significant improvement in the growth of active customers over the next six months. However, VIPS has emphasized the importance of a large user base and intends to increase its marketing spending gradually as consumer sentiment improves.

Boosting Value Added Via Logistics-Enabled Assurance

Vipshop has a competitive advantage in the discount retail market due to its specialized order-fulfillment capabilities, which it can leverage in the long term. By owning its logistics facilities, Vipshop can maintain the quality and flexibility necessary for its flash-discount business model. As of December 2021, the company possessed around 3.3 million square meters of warehouse space in China.

Vipshop developed its own logistics capabilities to efficiently fulfill a large order volume. The company offers merchant management and logistics support, as well as warehouse space and logistics to third parties on its platform. In the third quarter, fulfillment expenses made up 7.5% of total sales, compared to 6.5% the previous year, as revenue was impacted by Covid-related mobility disruptions and the potential cost savings from more efficient delivery services were limited.

While the unique value proposition remains, there is a need for reforms in certain areas

Competition in the e-commerce industry is increasing, particularly with the emergence of live-streaming commerce players. Nevertheless, VIPS continues to hold its position as the top discount e-commerce retailer in the long term. Despite some encroachment on VIPS' market share by Douyin, it does not offer the same range of products as VIPS' e-commerce shelf platforms. However, I believe that VIPS will need to enhance its differentiation of products and expand its exclusive offerings to maintain its market share.

Valuation

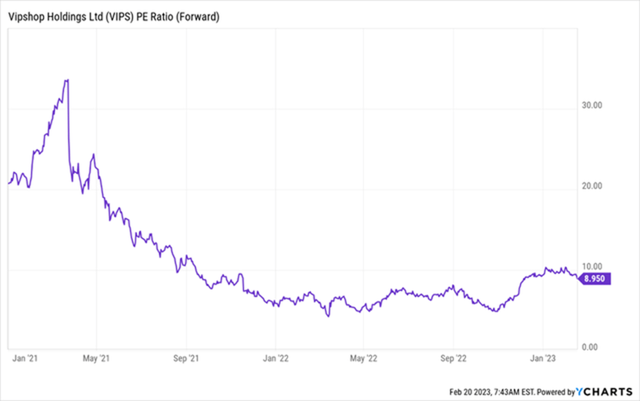

I value VIPS stock on 2023E P/E and assign a new target multiple of 15x, which is in line with the average P/E of the past five years; my end-of-2023 target price on the stock ranges between $18.3 to $18.7.

VIPS forward PE ratio (Ycharts.com)

Risks

There are several risks that could negatively impact VIPS' earnings forecasts. Firstly, if VIPS fails to reach its ARPU target due to factors such as a challenging economic environment, increased competition from other retailers, or changes in consumer behavior, this could have an adverse impact on earnings. Secondly, if user growth weakens and the customer retention rate trends down, and if new users acquired have weaker purchasing power, VIPS' revenue generation could be affected in the face of intense competition. Lastly, VIPS faces competition from many e-commerce companies, and if merchants and buyers prefer more established platforms with stronger brand recognition and better relationships, this could put pressure on the company's margins. Additionally, emerging internet retail channels such as live streaming platforms may take share in certain categories, such as apparel and cosmetics.

Final Thoughts

Vipshop's long-term growth is expected to come from increasing the number of active customers and the frequency of orders until 2024. To achieve this, the discount e-commerce retailer may focus on enhancing its collaboration with brands to support the growth of key labels and maintain a healthy product selection on its platform. In addition, an increase in revenue contribution from SuperVIP-paid members may result in higher order volumes and average revenue per user. However, the declining number of active users remains a concern for the company and remains the key to long-term success. I keep a hold rating on VIPS stock with a price target in the range of $18.3 to $18.7 based on the forward P/E of 15x.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VIPS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.