Alibaba Q3: Big-Short Michael Burry's Long Position

Summary

- Michael Burry’s lasted 13F disclosure reveals he had established a sizable long position in Alibaba at an entry price of around $88.

- At the same time, Alibaba is scheduled to report earnings on 02/23/2023.

- The volatility associated with the earnings report could cause its stock price to revisit the ~$85 range.

- And in this article, I will explain why I think these are good entry prices for us too.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Astrid Stawiarz

Thesis

Michael Burry is best known as the "Big Short" because of his successful bet against the U.S. housing market in the mid-2000s. Burry was one of the first investors to recognize the growing subprime mortgage crisis. He decided to short the market by purchasing credit default swaps on these securities. His bets turned out to be prescient and made huge profits for himself and his investors.

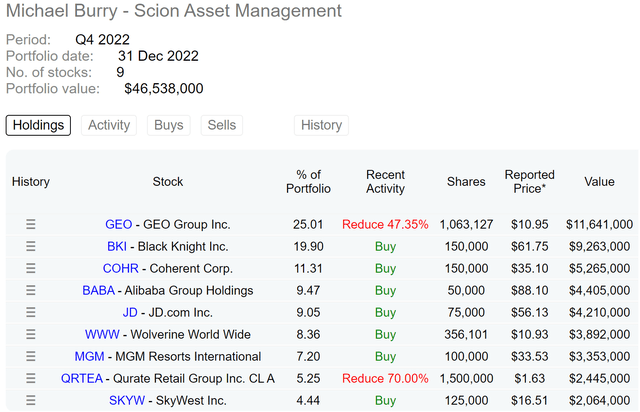

His latest 13F filing shows that he had established a sizable long position on Alibaba Group (NYSE:BABA) as shown in the chart below. To wit, during Q4 2022, his Scion Asset Management accumulated a total of 50,000 BABA shares at around a price of ~$88. His BABA position is now the 4th largest position in his portfolio, representing about 9.5% of his total asset.

In the meantime, BABA is scheduled to release its earnings report (“ER”) on 02/23/2023 before the market opens. The ER will be for its fiscal Quarter ending Dec 2022. With the volatilities historically observed during the ER, I anticipate the stock prices to fluctuate in a wide range and could revisit the $88 level again.

And in the remainder of this article, I will explain why I share Burry’s view and see these levels as attractive entry points for BABA.

Source: DataRoma.com Source: Yahoo! data

BABA: near-term headwinds dissipating and long-term growth intact

BABA financials faced strong headwinds in the past 1 or 2 years. Take its last quarter’s results as an example. Revenues dialed in at $29.1 billion, translating into a contraction of 6% on an annual basis. The lackluster results were due to a range of factors: elevated operating costs, a slowing economy, and consumer demand due to the resurgence of COVID-19 restrictions, and also the ongoing regulatory pressure from the Chinese government on its tech firms.

However, I see these headwinds to be near-term and also see signs that they are dissipating as we speak. I see signs that the Chinese regulatory authorities and its major technology companies are beginning to ease their tensions. Despite the authorities' tough stance on Chinese tech firms in recent years, the struggling domestic economy appears to be prompting a warming trend, largely to stimulate the country’s economic growth. For instance, Ant Group (of which Alibaba owns roughly a third of the fintech company) has been granted the green light to proceed with its plans to raise $1.5 billion in capital for expanding its consumer business. Additionally, the COVID-related restrictions have been mostly lifted lately.

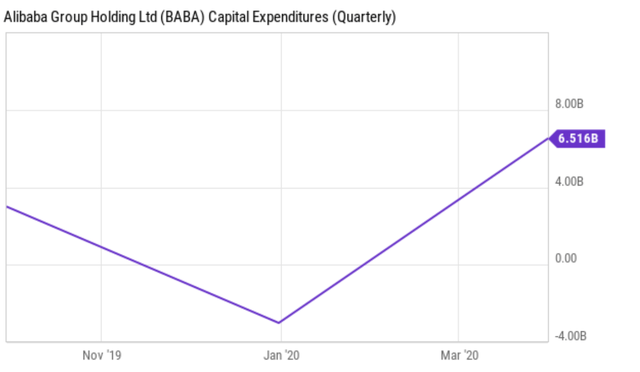

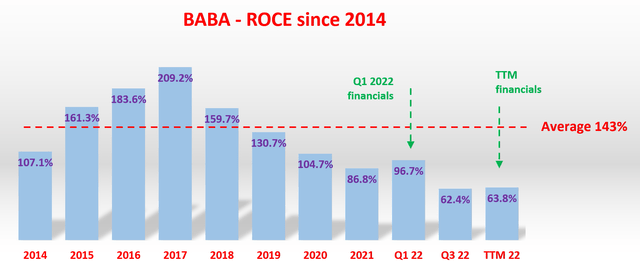

For the long term, thanks to its robust organic cash flow, BABA enjoys superb capital allocation flexibility and invests aggressively in future growth. To wit, its CAPEX expenditures totaled $6.5B in the last quarter, the highest level in recent years. Its profitability is no longer as astronomical as it used to be as seen in the second chart below. However, as measured by its return on capital employed (ROCE, detailed in our earlier writings), it is still hugely profitable. Its ROCE now hovers around 64%, still above the average level of the FAAMG group (around 40% to 50%). In our investment experiences over the past 2 decades, the combination of capital allocation flexibility and high ROCE has been the proven recipe for sustainable long-term growth.

Source: Seeking Alpha data Source: Author based on Seeking Alpha data

The $85~$115 accumulation range

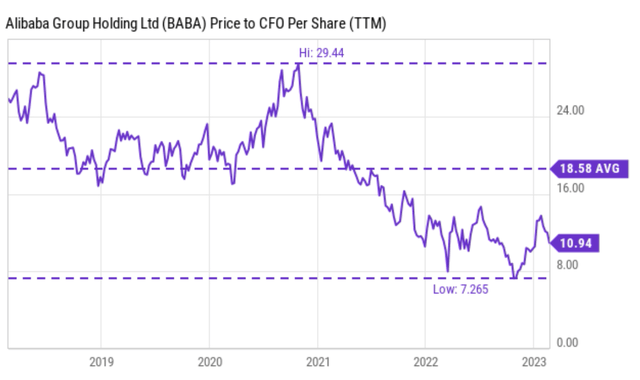

Yet, the stock's valuation appears to be heavily compressed, as evidenced by the two charts provided below. The first chart shows that the stock is currently trading at a price-to-cashflow ratio (“P/OPC” ratio) of 10.9x only, which is near a historic low over the past 5 years. Similarly, the second chart shows that the stock is trading at a compressed valuation in terms of EV/EBITDA multiples too.

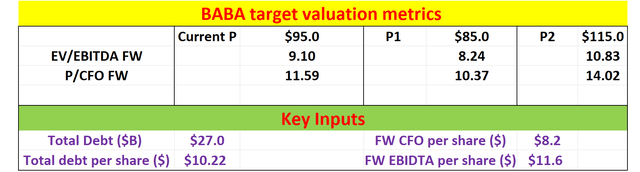

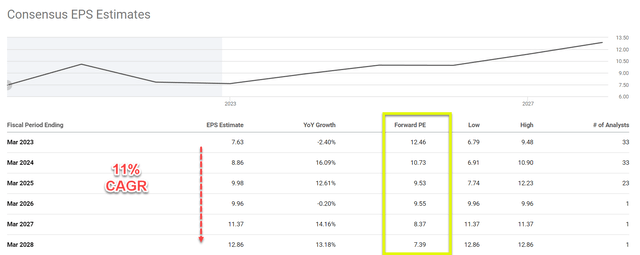

As aforementioned, volatilities historically observed during its recent earning report, the stock could fluctuate in a wide range and revisit the ~$85 level. And as seen, at $85, its EV/EBITDA multiple would be only 8.24x and its P/CFO multiple would only be 10.4x. Even if the ER triggers a price surge to $115, its recent peak level, the EV/EBITDA multiple would be 10.8x and the P/CFO ratio 14x, still very attractive levels given the profitability and growth potential of the stock as you can see from the 3rd chart below. To wit, consensus estimates foresee an EPS growth in the double-digit (11% CAGR) in the next five years. As a result, its FW P/E would shrink to 10.7x next year and fall into the single-digit range after that. As a result, the PEG ratio (P/E to grow ratio) would fall below the 1x threshold for buying growth at a very reasonable price.

Source: Seeking Alpha data Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

Risks and final thoughts

In the longer term, some of the key risks that Alibaba faces include regulatory risks and competition risks. As aforementioned, Alibaba is subject to regulations set by the Chinese government. Any regulatory changes, such as stricter data privacy laws or restrictions on e-commerce activities, could adversely impact the company's business operations. I am seeing signs of these risks dissipating as argued earlier. However, such risks always exist (they exist for the FAAMG stocks in the U.S. too). Also, many areas Alibaba operates in are highly competitive markets, such as e-commerce, cloud computing, and digital payments. Competition from existing players, as well as new entrants, could potentially reduce Alibaba's market share and impact its revenue growth.

To conclude, I share Michael Burry’s view on BABA and could see why BABA is attractive at its current price levels. Looking ahead, the signs of relaxing regulatory restrictions is encouraging. Moreover, the COVID-19-related headwinds should start to abate and support healthier economic growth and improved consumer spending. As mentioned, the upcoming earnings report itself represents a near-term risk, which could large price changes in either direction. And potential investors could take advantage of the volatility in case it causes the stock price to revisit the lower end of the accumulation range.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.