Livent: A Commodity Play At A Compelling Valuation

Summary

- We think Livent has a compelling story - as long as investors can stomach the risk.

- Secular tailwinds seem to be at Livent's back as long as it can execute.

- We want to see if the company is able to successfully execute its American and Canadian investments in the coming quarters.

simonkr

Thesis

In the midst of a commodity super cycle, lithium has spent the last few years in its own orbit amidst the hype of the coming internal combustion engine [ICE] to electric vehicle [EV] transition. While there are other ideas on how batteries could be manufactured in the future (think: solid-state, the holy grail of battery tech), it is quite difficult to produce effective automotive batteries at great scale without lithium. There are geopolitical factors at play as well with the U.S. government waking up to the fact that an over-reliance on China for critical lithium and battery production may not be wise.

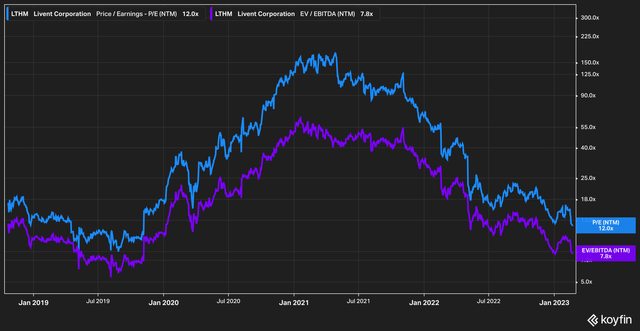

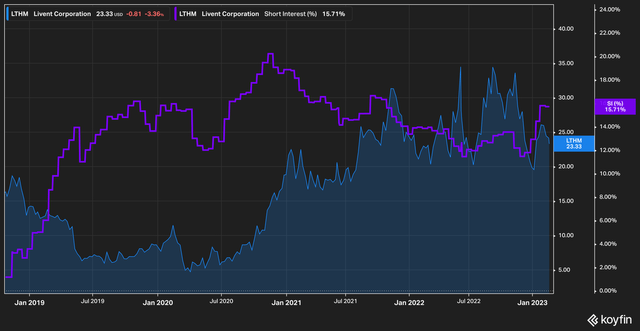

In the middle of this market and political drama is Livent Corporation (NYSE:LTHM). After a strong run up from $5 in mid-2020 to a high of $36 in the back half of 2022, the stock has mostly traded in a range and currently trades hands around $24 per share. In this article we outline why we think the stock could have considerable upside room to run.

A Commodity By Any Other Name

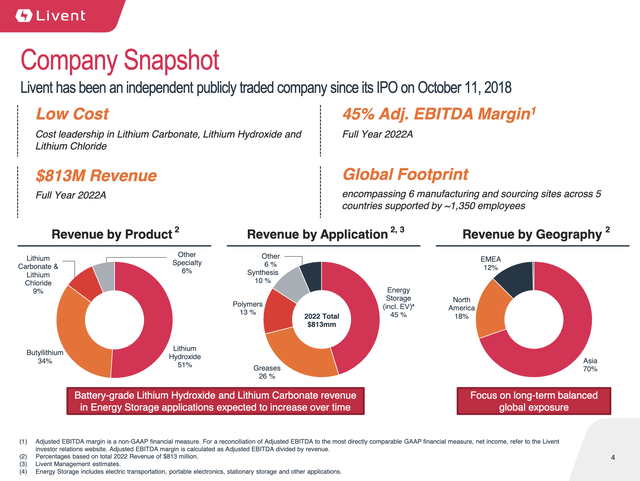

With a market capitalization of a little over $4 billion Livent Corporation is a pure play lithium company. We find this attractive against other competitors in the space, notably mining giant Albemarle (ALB), which has multiple areas of focus.

Before we proceed, a word of caution on what type of investors may be interested here. According to a (possibly apocryphal) story, Warren Buffett once toured an oil rig facility with a team of executives who were attempting to solicit an investment from the legendary investor. When they concluded their pitch, they asked if the Oracle of Omaha would indeed buy into their company.

His response, supposedly, was "Yes - if you can tell me what the price of oil will be in one year."

This anecdote illustrates the risk inherent to all commodity plays, by pointing out that - unlike, say, software or even electricity - the underlying financial health of the company is inextricably tied to the price of whatever commodity they trade in. As goes the price of lithium, oil, iron, coal, copper, gold, silver, (insert your favorite commodity here), etc, so goes the price and profitability of the company which works exclusively in that field.

With that in mind, investors should be aware of the specific risks that come with investing in this field (and why we at Ironside Research are often hesitant to dice in). For a gauge of how widely the current market sentiment views a stock like Livent, we advise investors to take serious consideration of the fact that 15% of the company's shares are sold short. Now, back to our regularly article.

Price vs Short Interest (Koyfin)

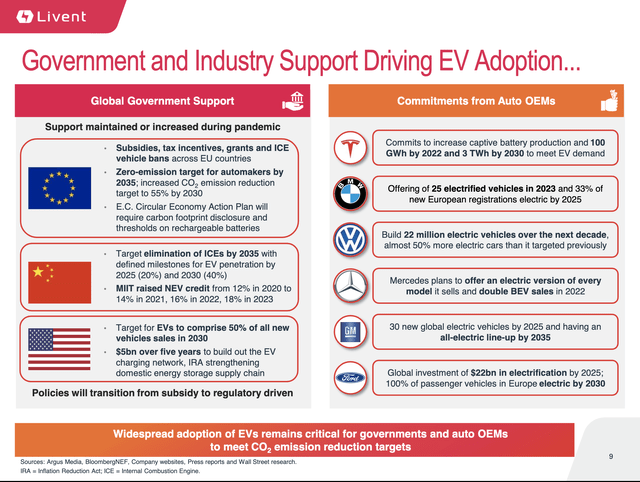

The lithium market has been caught up in recent years within a complicated supply and demand web. Governments around the world (the U.S. and China, most importantly) have been mandating or incentivizing the production of EV over ICE vehicles. Companies around the globe have responded, and the government-influenced demand function for lithium has skyrocketed as a result. This is evidenced by the fact that Livent's overall revenue was up 93% year over year despite lower volume sales.

Supply, meanwhile, remains as constrained as any other commodity that has to be pulled out of the ground. Chemistry being what it is, we think it's important to delve into the basic division of lithium for battery usage.

Lithium Breakdown

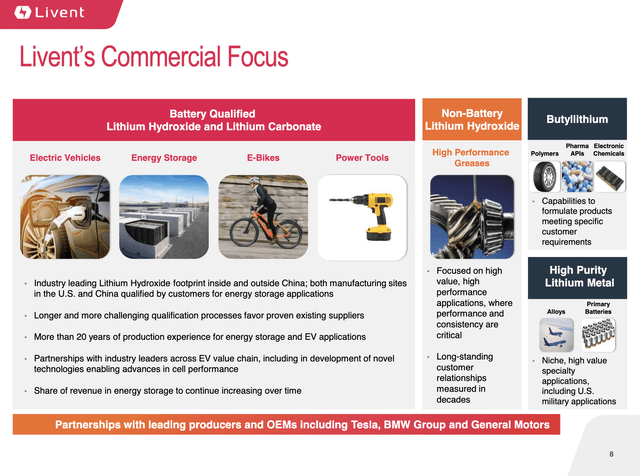

Since (presumably) many investors will be interested in lithium-producing companies for their EV-adjacent capabilities, we think that the first thing investors should know is that not all lithium is created equal. Lithium has a few final forms, but the main type for battery usage is lithium hydroxide. Other forms include lithium carbonate (from which hydroxide is derived), lithium chloride, and butyllithium.

Uses for lithium expand far beyond EV battery manufacturing - lithium has uses in treating bipolar disorder, as a lubricant, as or as an additive for steel or glass.

Of the above listed non-EV uses, lithium carbonate and chloride is generally the lithium of choice. For batteries, lithium hydroxide is preferable. Thus, it isn't enough that a company produce lithium - investors must be judicious about which type of lithium a company produces.

Properties

Livent currently operates three main mining locations. Bessemer City, North Carolina is currently the newest location, with an estimated 5,000 tons of lithium hydroxide per year. The company also operates a mine in Felix, Argentina, as well as a mine in Zhangjiagang, China. The Bessemer City plant is expected to produce 5,000 metric tons of lithium hydroxide. Livent also has a plant in Zhejiang, China in engineering which is expected to produce 15,000 metric tons of lithium hydroxide upon completion.

The company has also entered into a joint venture called Nemaska Lithium, of which Livent is a 50% owner. The project is slated to be pure lithium hydroxide, and the company expects Nemaska to be revenue producing by the first half of 2025.

Our major concern here is that Livent's production at Bessemer City seems to have been delayed by at least a quarter. We think that this delay is largely responsible for the uptick in short interest--especially since the North Carolina facility is expected to bring on 5,000 tons of battery-grade lithium hydroxide annually. If delays continue, it would materially impact our thesis.

Buyer Beware?

For a certain investor (one with quite a high tolerance for risk and uncertainty), Livent presents quite a strong - and complicated - story: it is a stock with quite large revenue exposure within Asia, which produces a compound in massive demand both by consumers and governments with national security interests in mind.

However, we think that (again, for investors of a high risk tolerance) that Livent's story may present a compelling investment thesis. Valuation-wise, the company has fallen from its all-time highs and suddenly finds itself trading within the realm of the reasonable.

It's heartening to see that both the company's forward P/E and EV/EBITDA multiple are tracking more or less in line. This tells us that the company has not onboarded massive loads of debt (which would inflate the enterprise value), and also tells us that the company remains a standard commodity play (the market has valued the company's earnings and EV/EBITDA largely in line).

We believe that the near-term for companies like Livent will be fairly volatile: wide price swings are, we think, part and parcel of owning a stock whose fortunes rest not only on the price of the commodity it pulls from the ground but also the quality of what it pulls from the ground.

However, we think that the winds of change for the automotive industry from ICE to EV are only beginning to blow. It is likely in our view that companies like Livent will benefit from the secular growth in lithium demand as long as they are able to produce. Thus, for highly speculative investors, we think Livent is worth consideration.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.