Enbridge: Dividend Yield Continues To Be Compelling

Summary

- Enbridge Inc. reported strong adjusted EBITDA numbers as well as healthy cash flows for 2022.

- The company also added to its organic growth pipeline.

- Consistent dividend growth and solid yield make Enbridge Inc. stock attractive for dividend investors.

JHVEPhoto

Investment rationale

Enbridge Inc. (NYSE:ENB) reported strong adjusted EBITDA numbers as well as healthy cash flows for 2022. The company also added to its organic growth pipeline aided by a disciplined allocation of capital. Enbridge's historical performance has largely been within its guidance range, which gives an optimistic outlook for its 2023 performance. Enbridge's consistent dividend growth and solid yield make it attractive for dividend investors. ENB stock is trading more than 15% below its 52-week high price.

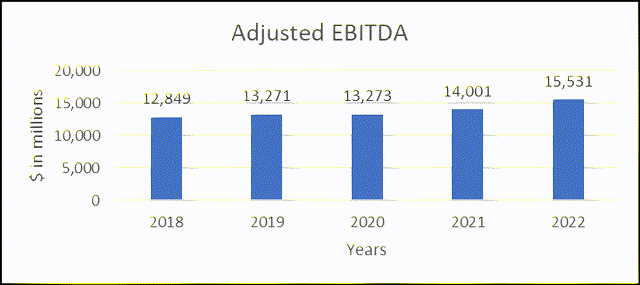

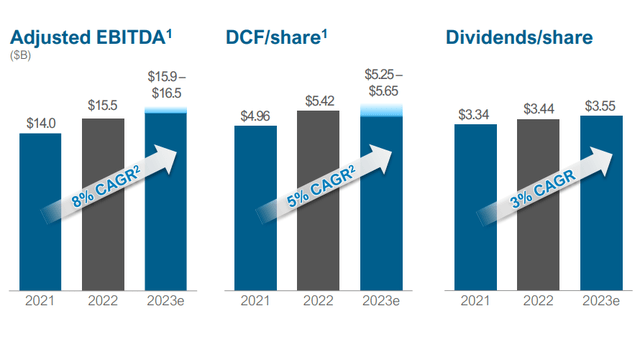

Historically higher adjusted EBITDA

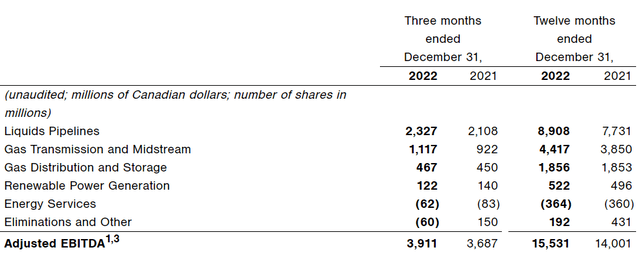

Enbridge reported an adjusted EBITDA of $3,911 million in Q42022 and $15,531 million for the full year 2022. Quarterly, adjusted EBITDA grew 6% YoY, whereas, for 2022, it improved by around 11%. The adjusted EBITDA has improved on an annual basis for the past five years. The adjusted EBITDA in Q42022 was underpinned by some strategic changes as well as an appreciation of CAD per USD in Q42022 as compared to Q42021.

The business segments recorded healthy growth in adjusted EBITDA partially offset by weak performance in the Renewable Power Generation segment in Q42022 due to lower wind production in North America and high operating expenses. The performance of Gas Transmission and Midstream segment improved the most among all the segments owing to higher LNG demand, placing $900 million in assets into service, and securing some new projects.

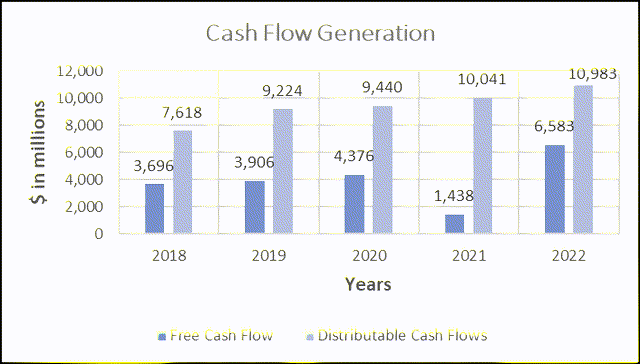

Healthy cash flow generation

In Q4 2022 as well as for the full year 2022, Enbridge generated a positive cash flow from operations as well as higher free cash flows owing to declining capital expenditures. The distributable cash flow generated by Enbridge in Q42022 stood at $2,663 million, 7% more than in Q42021. The distributable cash flow ("DCF") generated in 2022 has been the highest since 2018. The DCF per common share rose from $1.23 to $1.31 quarterly and $4.96 to $5.42 on an annual basis. Higher adjusted EBITDA and higher equity distributions from long-term investments contributed positively, pushing up the DCF number.

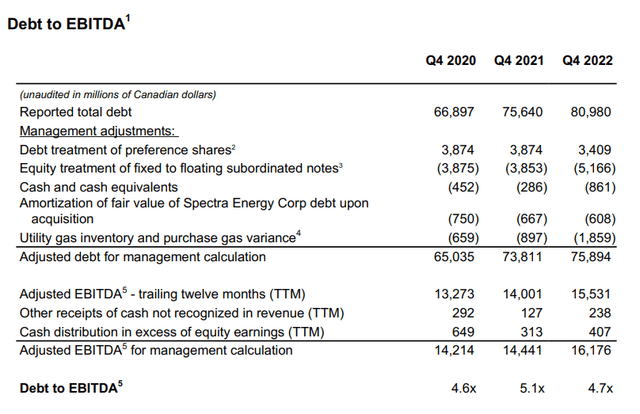

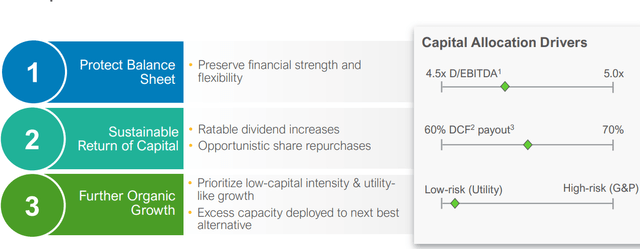

Comfortable debt to EBITDA

At the end of 2022, the Debt to adjusted EBITDA ratio of the company stood at the lower end of its target range of 4.5x to 5.0x. Enbridge mentioned in its Q42022 press release that it has been rated BBB+ by four of its credit rating agencies with a stable outlook. The company's debt book has some percentage of floating rate debt. The company aims to function within a range of 10% to 20% of the debt book to be floating rate debt. A majority of fixed-rate debt lowers the interest rate risk for the company in the rising interest rate environment and helps in managing the interest rate exposure.

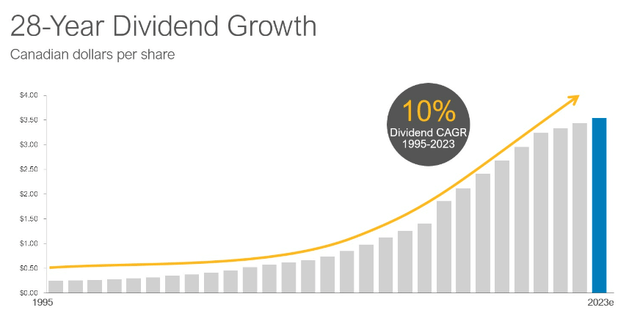

Higher dividends with strong DCF coverage

In Q42022, the company declared a dividend of $0.8875 ($3.55 annualized) per share, a 3.2% growth. Historically, the dividend has been growing consistently. The company pays out 65% of its distributable cash flows in the form of dividends. The dividend declared has a comfortable DCF coverage, which indicates the sustainability of dividends. The dividend yield offered by Enbridge's stock is comparatively higher than several of its peers, making it attractive for dividend investors.

Enbridge

Seeking Alpha's proprietary Quant Ratings rate Enbridge as "hold." The stock is rated high on the profitability factor but low on the momentum factor.

Strong capital allocation

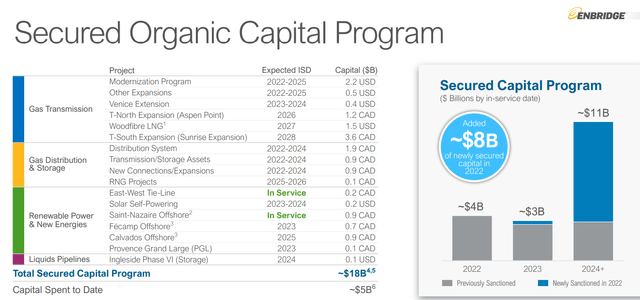

On the capital allocation front, Enbridge has maintained a disciplined approach, which includes placing 6 projects of around $4 billion capital into service and securing $8 billion of new projects aiding future organic growth. The company opts for recycling capital into new opportunities to manage leverage effectively. The secured projects are spread across all the segments, which indicates the company's focus on diversified growth.

Regarding the strategy for effective capital allocation, during the Q42022 conference call, Vern Yu, Enbridge's CFO said,

"We will prioritize low capital intensity and utility-like investments and then deploy any remaining investment capacity to the next available option. All of these opportunities fit our low-risk business model, exceed our risk-adjusted hurdle rates, have a strong strategic fit, and align with our ESG goals. The bottom line is we continue to be focused on maximizing shareholder value."

Positive financial outlook for 2023

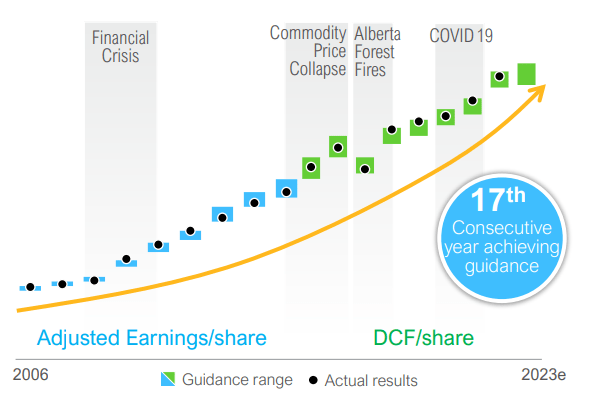

Enbridge has a history of generating earnings and distributable cash flows within the guidance range announced even in times of a volatile environment.

Enbridge

The company forecasts growth in business, which reflects in its optimistic financial guidance for 2023.

The capital investment plans include deployment of $6 billion of capital, including maintenance capital. On the debt side, Enbridge plans to issue an incremental debt of $6 billion, net of maturities, and aims to keep the debt-to-EBITDA ratio near the lower end of its target range. In line with its financial guidance provided in January 2023, Enbridge renewed its normal course issuer bid to repurchase shares for an aggregate amount of up to $1.5 billion. This gives Enbridge Inc. flexibility for opportunistic repurchases and improves its capital allocation further strengthening its balance sheet position. A proven history of performing within guidance indicates predictability of financial performance.

Conclusion

Enbridge Inc. has performed well through 2022 and in Q42022. The company has a stable and robust cash flow generation ability. The company's focus on the effective execution of current projects while obtaining new projects has strengthened its project pipeline which positively fuels the outlook for the company's future performance. The consistent rise in dividends and attractive dividend yield offered by Enbridge Inc. stock are likely to attract more dividend investors. This makes the company a compelling candidate for long-term investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.