Cheniere: Looking Beyond The Mixed Q4 Earnings

Summary

- Cheniere Energy has uncertain near-term outlooks.

- This is the all-important date, late 2025, for Corpus Christi Stage 3.

- Cheniere Energy's guided distributable cash flows are expected to drop 30% in 2023.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

CHUNYIP WONG

Investment Thesis

Cheniere (NYSE:LNG) is set to become one of the most important global LNG companies in 2025, with its Corpus Christi Stage 3 up and running in less than three years' time.

The geopolitical tensions of 2022 put a spotlight on the fragility of our energy requirements. Today, alongside defense security, countries around the world view energy security as a key government imperative.

From the US to Europe to Asia and others countries around the world, we are now seeing how frail our energy supply chains actually are. This level of vulnerability has meant that the main priority of government agencies around the world is now on securing LNG cargo. And Cheniere is one of the best companies to supply these countries with their LNG demands.

Facing Reality, Natural Markets Are Weak

Presently, the spot market for natural gas prices is at a 30-year low, once we adjust for inflation. Let's take a movement and think about these implications for what's one of the most reliable sources of global energy.

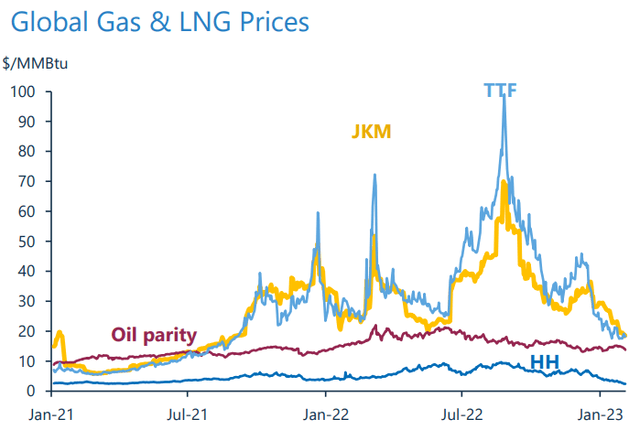

The graphic that follows is a reminder of the underlying reality that prices in Asia and Europe are about seven times higher than in the US, including transportation costs.

In fact, if you think about it, many natural gas producers are right now producing natural gas at a loss. What will be the ramifications for natural gas producers? Will natural gas producers feel confident to ramp up near-term future investment or will they cut back on their capex forecasts?

Simply put, common sense dictates with all these considerations well known, and near-term natural gas supplies being curtailed, natural gas prices in the spot market should be bouncing back hard from these lows. And yet, alas, this is where we find ourselves.

It's with this background that I want to now discuss Cheniere's 2023 capital distribution.

Distributable Cash Flow Are Expected to Reduce

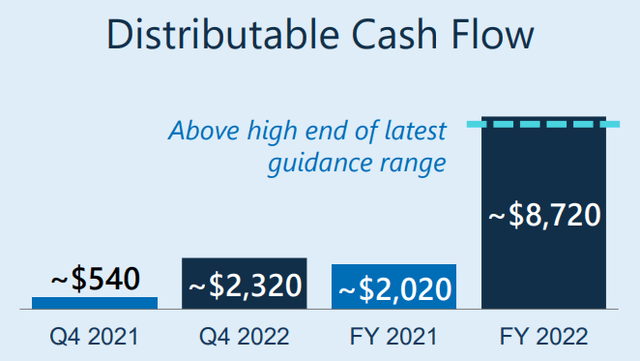

Cheniere's distributable cash flows in 2022 reached a whopping $8.7 billion. This was a dramatic jump from the $2 billion of distributable cash flows seen in 2021. Given everything that happened, investors shouldn't expect 2023 to be a repeat of 2022.

Consequently, Cheniere's guidance at the high end points to about $6 billion of distributable cash flow. This is an approximate 30% drop from 2022.

Furthermore, recall that Cheniere's distributable cash flows are not simply repurchases and buybacks, but it also includes paying down debt.

That being said, note that Cheniere's debt paydown has left the company in a remarkably stronger position throughout 2022. Indeed, Cheniere started 2022 with more than $29 billion of debt and exited 2022 with just over $24 billion of debt.

Consequently, given its much improved financial footing, Cheniere has now been recognized as investment grade by both S&P and Fitch.

What About Cheniere Near-Term Prospects?

LNG Q4 2022

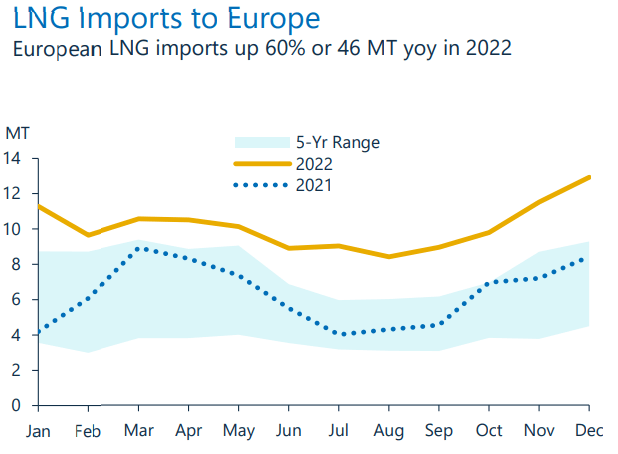

As touched on already, on the one hand, there's massive demand to get LNG to Europe. On the other hand, everywhere one reads it's the same story, LNG storage in Europe is above five-year average full.

However, I simply don't buy the sustainability of point of view. Why?

Because it's only a matter of time before more export terminals are built in Europe to accept excess LNG cargoes. Again, there's no logical reason for this price arbitrage to persist.

After all, contrary to what many think, natural gas is a lot less cyclical than the recent price movements would lead one to believe. Natural gas is the future. Natural gas is the bridge transition fuel source to get us from where we are today to where renewables make up a significantly bigger proportion of energy supply.

The Bottom Line

Natural gas is crucial for our great energy transition. Asides from nuclear energy, how does one get access to:

- Cheap or cost-effective energy,

- Reliable (24/7 energy),

- Scalable (from a few households to megacities), and

- Flexible energy (for instance, thermal, industrial, chemical, and transportation).

I argue that during the next three years, only natural gas can provide this. Not thermal coal, for environmental reasons. Not nuclear energy for near-term constraints in scalability. This only leaves natural gas, the cleanest of the fossil fuels as one of the most covet energy commodities to electrify our modern world.

Cheniere is remarkably well positioned to export LNG out of the US, the cheapest region, to more expensive regions, including Europe. The future looks promising, despite distributable cash flows being guided to drop this year from the highs of 2022.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.