NewLake Capital Partners: A Great Choice To Invest In Cannabis

Summary

- NewLake Capital Partners operates as a provider of real estate solutions to cannabis-licensed operators.

- Cannabis Industry is facing some headwinds, the road is long and time-consuming but it seems that some progress in favor of the industry is proceeding.

- From the geographical risk profile, the company has acquired land in the states that have the best growth prospects.

- To date, there are no disruption situations by any tenants.

ArtistGNDphotography/E+ via Getty Images

NewLake Capital Partners, Inc. (OTCQX:NLCP) is a REIT in the cannabis industry and currently has a dividend yield of 7.64% with a target AFFO pay-out ratio of 80-90%. Revenue and cash flow are growing strongly even if they are small in absolute value. The company has a very clear strategy for geographical diversification and has managed in recent years to have properties in states with a greater probability of growth. The cannabis industry is going through a period of a slowdown compared to the boom years but it is still growing and forecasts are double digits. The investment risk in NewLake Capital Partners is high and is connected to the tenants' solvency, which, analyzed in terms of debt, show high-risk parameters. To date, however, no adverse event has yet occurred and the road seems to be downhill. My rate is Buy.

Company Overview

NewLake Capital Partners is born in 2019, listed in 2021, qualified as a REIT, and operates as a provider of real estate solutions to cannabis-licensed operators. The properties are long-term leased to tenants through a triple-net basis which means tenants take care both of rent and ongoing expenses.

The tenants have in common that they are all in the cannabis industry. These companies base their business on the cultivation or production or sale of cannabis. Federal and state regulations about cannabis could be misaligned and NewLake Capital aims to provide the service needed in this underserved market. On the other side, traditional capital services (banks or similar) are not so open to financing cannabis companies’ facilities and NewLake Capital fits into this context by proposing itself as the purchaser of industrial properties necessary for companies in the cannabis sector to grow and develop their business.

Business strategy

The company focuses the investment strategy on the states with limitations or stringent requirements in terms of licensing. Under these conditions, the best investment opportunities can arise as the operators must be well-capitalized and the properties can potentially acquire greater value. At the same time, stringent municipal laws can also represent excellent investment opportunities.

On the other side, it is not allowed to transport cannabis from one state to another and this determines that each state is a reality in its own right with its laws. States with limited licensing pose a barrier to entry and this creates a favorable business environment as it reduces the risk of companies operating in the cannabis sector.

Industry Outlook

Mid to long-term forecast

As reported by Forbes, Cannabis Industry could grow by double digits until 2026:

BDSA in Q4 - 2022 announced an update of its cannabis market forecast—a five-year rolling global forecast by country, state, province, channel, and category. The report projects global cannabis sales to grow from $30 billion in 2021 to $55 billion in 2026, a compound annual growth rate [CAGR] of almost 13%. In the United States, cannabis sales will grow from $25 billion in 2021 to $40 billion in 2026, a 73% share of total global cannabis sales at that time. Further, legal cannabis sales in the U.S. will reach $27 billion by the end of 2022, a jump of 6% over 2021 sales of $25 billion.

Short-term headwinds

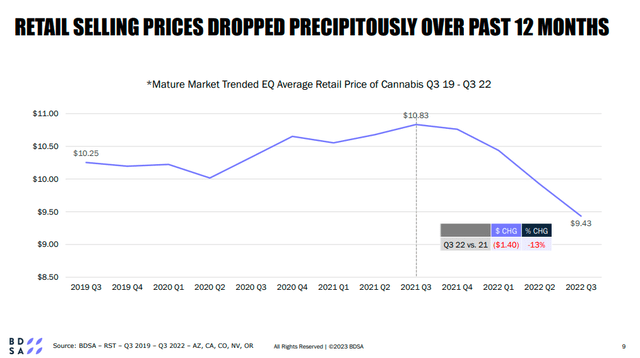

On a general level regulatory, competition from illegal markets and taxes represent the main elements that are slowing down the expansion and development of the industry in the US. The consequence of these headwinds has caused a drop in retail sales prices of 13% as always analyzed by BDSA.

BDSA: THE YEAR AHEAD IN CANNABIS: 2023 PREDICTIONS

At the state level, however, we have witnessed an oversupply (especially in mature markets such as California), and this, accompanied by macroeconomic and regulatory challenges, led to a slowdown in the market in 2022 and the same situation is expected to continue in 2023 as well.

Short-term positive outlook

Wanting to see the positive aspects of the cannabis market we must record that in October 2022 President Biden issued a statement condoning federal offenses related to marijuana possession and has also pushed forward to reclassify marijuana as a Level I drug, which could potentially be a positive key for the industry as it opens the door to being able to cultivate medical cannabis in one state and sell it in another state.

In December 2022 Congress also issued the MMCREA (Medical Marijuana and Cannabidiol Research Expansion Act) promoting studies for research purposes for the cultivation of cannabis and this also opens the door to the development of drugs approved by the FDA through the use of CBD and cannabis.

In 2022, 12 states enacted more than 40 laws related to the use of cannabis. Regarding adult use, three states [RI, MD, MO] have legislated legalization while one state [MS] has legalized medical cannabis. Also last year, three states [NJ, RI, and NY] kicked off sales of recreational cannabis. To date, 39 states have legalized cannabis in some way, and of those 21 have allowed recreational use by adults.

The road is certainly long and time-consuming but it seems that some progress in favor of the industry is proceeding in the short term.

NewLake Capital Partners and the Market

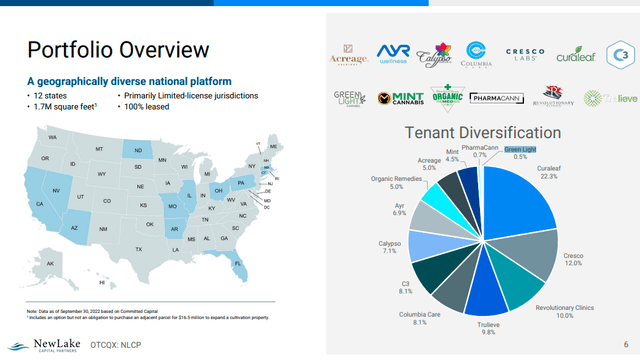

NewLake Partners Investors Presentation

The company is present with its land in 12 states and has a diversified geographical coverage ranging from more mature markets such as California and Nevada arriving on the west coast with new emerging markets such as Florida.

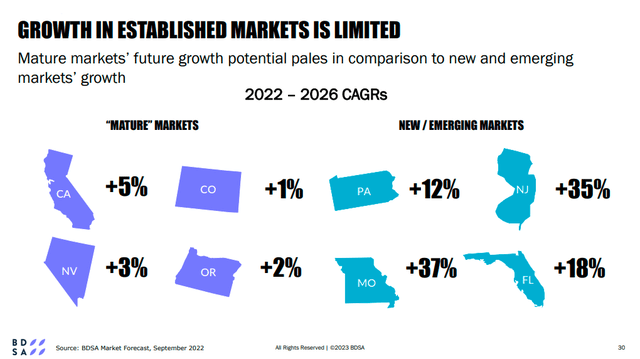

If we look at the BDSA report in geographical terms, we can see that growth (very low but existing) is also forecast for mature markets over a 4-year time horizon.

BDSA: THE YEAR AHEAD IN CANNABIS: 2023 PREDICTIONS

And looking at the worst-case scenario (mature markets with slow growth) we can record how NewLake is present in California and Nevada which have the highest growth forecast (respectively +5% and +3%) while to date it has no land in Colorado and Oregon representing the slowest growth in forecast terms.

If we move to “emerging markets” (high growth rates) we can see how NewLake is present in three (Missouri, Florida, and Pennsylvania) of the four states. To date, only New Jersey is missing.

From the geographical risk profile, we can argue that the company has acquired land in the states that have the best growth prospects (both in the worst case - mature states - and also in the best case - emerging markets)

Tenants outlook

The following table shows the profile of the main public tenant:

Seeking Alpha

Curaleaf (OTCPK:CURLF) is the biggest tenant with a 22.3% share of the Company portfolio. It operates both in the cannabis industry but also has operations outside of cannabis. It is well diversified geographically as it operates in 21 states. The company was born in 2010 and has an EV of $3.65B with a market capitalization of $2.74B.

Cresco Labs (OTCQX:CRLBF) is the second tenant with a 12% share of the Company portfolio. It was born in 2013 and has 15 Cultivation Facilities in 8 Different States. As we can hear from the last earnings call:

At June 30th, we had $90 million of cash on the balance sheet. Cresco continues to be the leader in the Illinois market, where we own their largest cultivation facility. Additionally, Cresco continues to move forward with their acquisition of another one of our times, Columbia Care, which they have indicated, will close this year.

Cresco is the market leader in Illinois and is on the road with the acquisition of Columbia Care which is the fifth tenant with 8.1% of the portfolio share. If the divestitures will include properties in the NewLake portfolio Cresco could maintain these properties and become the first tenant.

Revolutionary Clinics is the third tenant with a 10% portfolio share and is not a public company listening from the last earnings call:

We own their cultivation facility in Massachusetts. As a reminder, revolutionary clinics, is vertically integrated in the state with three well-situated medical dispensaries in the Boston Metro area and we expect them to open two adult-use stores in 2023. Rev Clinics has been able to compete effectively while the market has experienced price compression, by partnering with exciting brands such as the Papi and Teva.

We can say that Revolutionary Clinics represents a growing integrated reality in the industry that is a plus in terms of the ability to face market challenges.

Trulieve Cannabis (OTCQX:TCNNF) is the fourth tenant with a 9.8% portfolio share. It manages medical cannabis operations and cultivates cannabis in 8 states. In Florida sells products through Trulieve branded stores (dispensaries).

Acreage Holdings (OTCQX:ACRHF) is in the top ten tenants (5% portfolio share) and is also a public company. It operates and cultivates in 9 States with 7 active brands and 23 operational dispensaries.

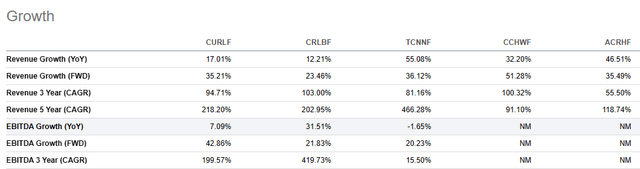

The following table shows the growth rate for each tenant:

Seeking Alpha

In the last year, for each public company, the revenue has grown double-digit, and if we move on to the 5-year [GAGR] the rate is in 3 digits. Moving to the EBITDA Growth rate we can see how in the last year the two main tenants (Curaleaf and Cresco) had a positive growth rate and Trulieve has a positive forward estimate for next year. Unfortunately, the EBITDA did not grow for the other 2 tenants analyzed (Columbia e Acreage).

In terms of revenue and margin growth rates, 50% of the tenant portfolio recorded significantly positive data.

Moving on to a more significant risk indicator, we can record how the debt-to-asset ratio is less than 30% for Curaleaf and Trulieve while Cresco stands at 39% and Columbia and Acreage also represent the riskiest tenants according to this parameter with a ratio of just less than 50%. For all the tenants analyzed the debt-to-asset ratio is very high, the trend of the last 5 years is growing and this identifies highly indebted companies with a fairly high risk of creditworthiness.

Seeking Alpha + Author Graph

As we can hear from the latest earnings call, the management is well aware of the risk and expects a high possibility of non-payment of rent in the future:

With that being said, we have consistently communicated that any net lease business with a 14-year remaining average lease term will encounter tenant disruptions at some point. We are seeing that across the industry, and we previously discussed that we've been closely watching tenants in Pennsylvania and Massachusetts, particularly those that are not vertically integrated.

Financial and Highlight

NewLake is a fast-growing company and although still very small in terms of revenue we can record triple-digit annual growth since 2019 equal to 218.6% [CAGR]. Revenue grew from $1.2M in 2019 to $38.8M [TTM].

In any case, there are two elements of greater prestige in financial terms. The exponential growth of the Cash-flow and consequently of the dividend (which has a payout ratio target of 80-90% in terms of AFFO) which today stands at 7.6% (dividend yield) and the low debt rate which with a total of $3M sets a debt to asset ratio of less than 1%.

NewLake Partners Investors Presentation

The consequence of this financial solidity (at the moment) has also been, in addition to the generous dividend, the possibility for the company to approve a $10M share repurchase through the end of 2023.

All these elements currently shape a highly profitable financial situation which lays the foundations for being able to face organic growth through direct investments and possible tenant crashes.

Company Valuation through FCF/Share Model

I use a simple formula based on FCF/Share and interest rate to define a maximum buying price.

The formula is:

Maximum buying price = Cash profit per Share/interest rate – 20% (safety discount)

The last FCF/share [TTM] figure is $1.61.

Interest Rate=inflation Rate = 6.4%

Maximum price before Safety discount = 1.61/6.4%= $25.2

The maximum price at 20% discount = $21

Under the FCF/Share analysis, it seems that the actual price of $19 is quite fair.

Peer Comparison

To compare NewLake Capital Partners with similar companies in the Cannabis Industry I set the following peers:

- Innovative Industrial Properties, Inc. (IIPR)

- AFC Gamma, Inc. (AFCG)

- Chicago Atlantic Real Estate Finance, Inc. (REFI)

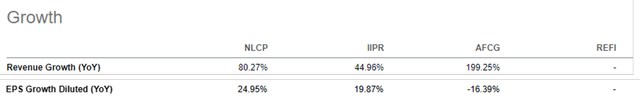

In terms of growth, we can see how Earnings for NewLake grew by 24.95% in the last year and this represents the best result when compared with other companies. If we move instead to Revenue, AFCG appears to be the company with the highest growth rate even if it has sacrificed EPS growth in the last year.

Seeking Alpha

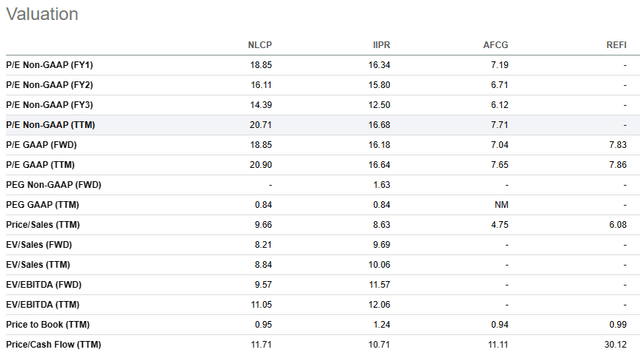

Moving on to the valuation of the share price, the classic P/E [TTM] ratio, both GAAP and NON-GAAP identifies NLCP as the most expensive company among the four compared. P/Sales [TTM] also draws the same scenario. If instead, we look at the Price to Book we can instead see how NLCP becomes the second choice only after AFCG. This could indicate that the company is largely competitive in terms of book value.

Seeking Alpha

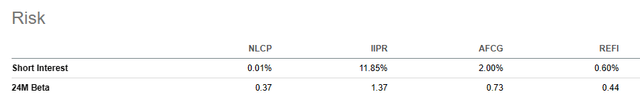

Looking at two relative risk parameters, both the short interest and the Beta indicate NLCP as a less risky company when compared with its peers.

Seeking Alpha

In conclusion, the company is growing well and in line with its peers. The share price is always quite expensive when compared with the competitors, probably also due to a lower relative risk.

Risks

The Cannabis industry appears to be on the way, albeit very slowly, to gradual and high growth and this probably represents a relatively low element of risk. On the other hand, the solvency of the tenants is of a completely different dimension, which represents an element of high risk. To date, there have been no problems with vacant properties but, as also underlined in the last earnings call, the probability that non-vertically integrated tenants could fall into difficult moments is very high. We, therefore, have to ask ourselves what the impact of a fairly probable event like this could be.

We have analyzed in the previous paragraphs how 50% of tenants have a "certain" solidity in terms of company debt, we have also seen how NLCP properties are located in states with the greatest probability of future growth and this could define a way-out in case of tenants at risk of default. The corporate strategy, therefore, seems to be in the direction of minimizing global risk. On the other hand, it should also be emphasized that the company balance sheet is very weak with still very low revenue. Ultimately, the risk of default in the event of persistent headwinds, even if controlled, is very high.

Conclusion

NewLake Capital Partners is a REIT that invests aggressively in the Cannabis industry. To date, the tenants have guaranteed excellent cash flow and solid growth. The share price, although expensive when compared with peers, seems fair with the company's intrinsic profitability parameters. The industry is growing, the REIT represents a great opportunity to diversify into cannabis minimizing the risk. With an eye to the high risk related to tenants, my rating is a Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.