urban-gro Likely To Revive Growth But We Pass

Summary

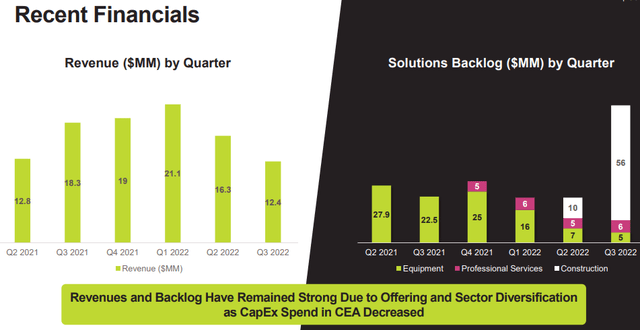

- urban-gro is raking in orders as its backlog is ballooning to $87M at the end of the year and growth is set to recover in Q4.

- One-off costs, acquisitions, and a lot of hiring have turned the company into considerable losses, but the long-term profitability model remains difficult to assess.

- We're not too keen on the increased importance of the Design-Built segment as it's mostly low-margin project work, even though it's booming.

- The shares have probably seen the lows and we wouldn't be surprised if they are considerably higher in 12-18 months for now, but we pass up on the opportunity.

- Looking for more investing ideas like this one? Get them exclusively at SHU Growth Portfolio. Learn More »

Edwin Tan /E+ via Getty Images

urban-gro (NASDAQ:UGRO), is a leading engineering design and services company focused on the commercial horticulture market. We thought last year that the stock had promise as the company was growing rapidly and even had funds for a share buyback program (which they even increased in January 2022).

Then this happened:

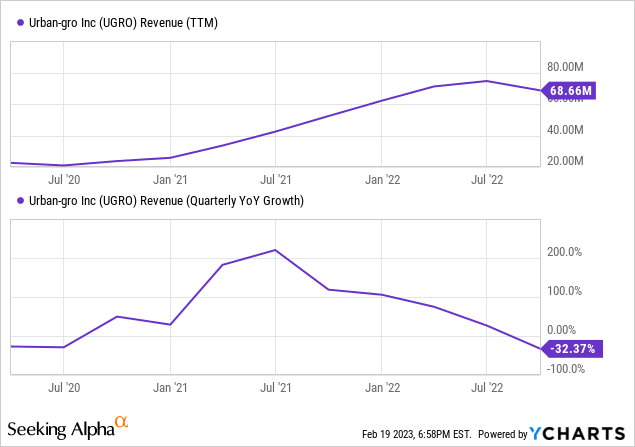

This is a pretty remarkable turn of events, producing negative revenue growth as the company also acquired no less than three companies (albeit the latest one after the close of Q3). And it's not all:

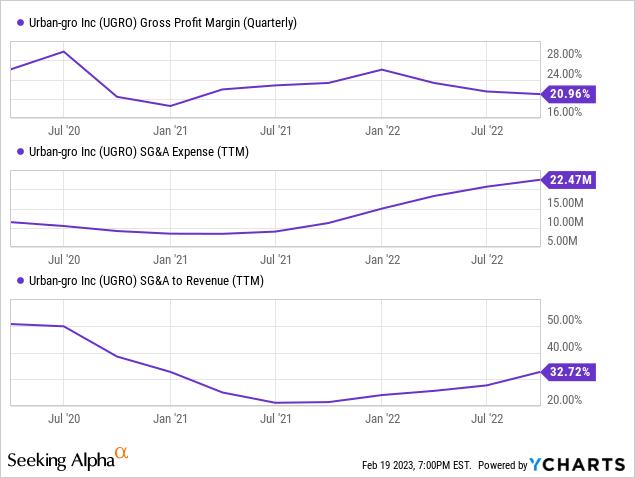

Declining revenue, falling gross margins and a notable increase in OpEx. The company is seemingly plagued by a set of problems and one-off costs:

- $12.6M decline in equipment sales due to regulatory delays, a cooling of the US cannabis market, and hence sectoral CapEx headwinds

- $4.2M one-time expenses

- $1.7M impairment on Edyza investments (completely writing it off).

From the earnings PR:

driven by a decrease in cultivation equipment systems revenue of $12.6 million, primarily reflecting significantly reduced equipment demand in the U.S. cannabis market as a result of ongoing state-level regulatory delays in the license-awarding process, as well as the lack of movement on passing key industry financial support models such as the SAFE Banking Act.

The company has invested heavily in new capabilities through the acquisition of three companies:

Now, management argued on the Q3CC that all acquisitions were immediately accretive and cash flow positive, but acquisitions are never really cheap and efforts have to be expanded to get them onto the same systems, culture, and mission.

In addition, they are also spending considerable resources to increase their footprint in Europe, as they believe the market there is 5-6 years behind that of the US.

Recovery?

Going forward, there is a pretty good chance things will improve:

- Recovery in cannabis in the US

- Europe opportunity, especially Germany

- Integration of acquisitions

- Cross-selling opportunities

- Huge backlog

Management expects a recovery in the US cannabis market in H1/23 with two states legalizing (Missouri and Maryland) and the delays in permitting are expected to start relaxing in H1/23. There could also be progress on the SAFE Banking Act, but that seems a long shot.

In Europe, the company is working in Portugal, Greece, The Netherlands, the United Kingdom, Israel, and Macedonia, but they have especially high hopes for Germany (Q3CC):

For urban-gro, the cannabis side in Europe right now is definitely our strength. We have with Germany opening up and the fact that not only are they opening up, they're going to be building facilities in country and not importing. In the past, Germany look to Canada and other countries to import their cannabis.

The company has to use 'guerilla marketing' as there are not a lot of cannabis facilities in Europe, going to multiple conferences, stuff like that. It's like US 5-6 years ago.

Backlog increased tremendously with $50M+ contracts signed in Q3 for the enhanced Design-Build division as a result of the Emerald acquisition without even adding any signed associated Professional Services or equipment contracts (which matters, as these generate considerably higher margins).

The backlog was $22M at the end of Q2, $67M at the end of Q3 (with $56M of that backlog from Design-Build). Backlog further increased in Q4 to $87M. These won't be built overnight (Q3CC):

As for the time line, it does vary. On the commercial projects, six to nine months, depending on the size of the project. On the CEA side, it's the Design-Build of facilities and as we say, 18 to 24 months there.

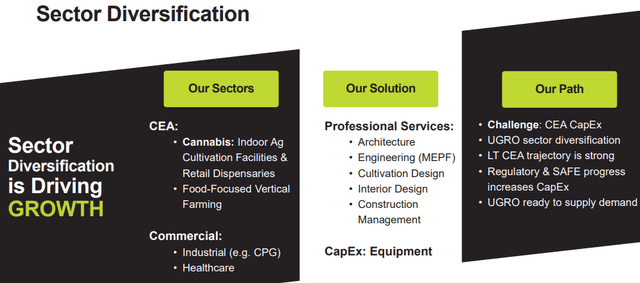

Management is also stressing the cross-selling opportunities from the acquisitions and argues that diversification is a main growth driver, from the November 2022 IR presentation:

By entering commercial segments like CPG (consumer packaged goods) and healthcare, the company becomes less dependent on the CEA (Controlled Environment Agriculture) segment, which is by far their largest segment still (and within CEA, cannabis).

After the acquisitions the company is now able to offer an end-to-end solution:

Acquisition costs will lap out of accounts.

Margins

Gross margin will decline somewhat on the increased importance of the Design-Build division (Q3CC):

In that case, the construction side is only going to be about 6% to 10% margin depending on the size of the project. But that is then brought up with the sales of equipment and also the high-margin 60% plus Professional Services side as well. So blended, our target on a large Design-Build of a commercial CEA facility, we'd be 18 to 24 months, and the blended margin would be somewhere right around 10%.

Indeed, the gross margin was 21% versus 23% a year ago.

OpEx was $9.5M in Q3 an increase of $5.3M from last year, from the earnings PR:

Included in the third quarter operating expenses are one-time expenses including a previously disclosed $3.3 million business development expense attributable to assisting a key enterprise client with a negative situation with an international lighting manufacturer, $0.7 million in severance expenses, and $0.2 million in legal and transaction costs.

So it's not as bad as it may seem as much of the increase is produced by one-off items with the rest produced by increased headcount.

Given that the company has 20+ vacancies and is actively searching for architects and engineers, superintendents, and project managers on the construction side.

They're even allowing them to work from home and hiring a job placement firm to fill these vacancies. While the one-off cost is subsiding, OpEx will trend up on the increased hiring.

Q4 Outlook

Management recently reaffirmed its Q4 outlook:

- Revenue $17M, recovering from the $12.4M in Q3

- AEBITDA -$1.5M (versus -$2.3M in Q3) on increased hiring

- $87M backlog entering 2023

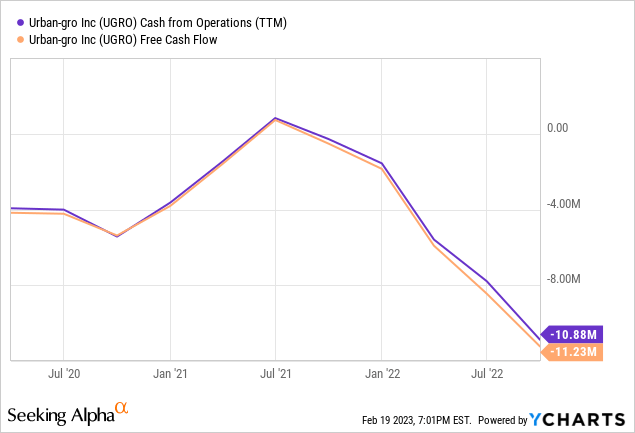

The company still has $18.6M in cash (and no debt) and even managed to still buy back some shares (of about $200K worth), which doesn't seem a good idea in light of the following:

Still, things should be better next year and even with this cash burn, they have 6 quarters to get through it before things turn difficult.

While the backlog and Q4 recovery indicate the company grows again, it's always possible for market circumstances to become more difficult.

Valuation

UGRO IR presentation

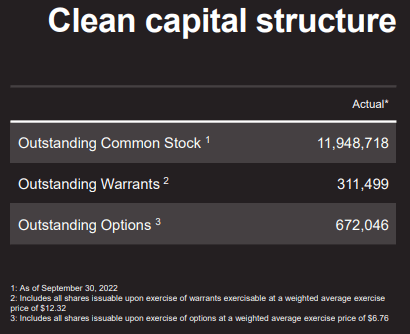

Fully diluted that's 12.9M shares at $4 for a market cap of $51.6M and an EV of just $32.6M on expected revenue of over $93M this year the shares are cheap on a sales multiple, but for a reason as analysts still expect a considerable loss of $0.48 per share this year (down from an estimated loss of $1.30 per share in 2022).

Conclusion

There are reasons to be optimistic:

- Revenue is set to recover in Q4 and is likely to recover further this year on a huge and growing backlog, European expansion, and a possible recovery in CapEx spending in the US cannabis market.

- With one-off costs and acquisition costs lapping out, there is also the likelihood of an improvement in the bottom line, but analysts are still expecting a considerable loss this year as the company keeps hiring more people.

- We're not so keen on the increased importance of the Design-Build segment. It's mostly low-margin and project-based, and it has troubled our view on the long-term model for profitability and cash generation.

- We do think the shares have limited downside from here and probably will be considerably higher 12-18 months out, but we pass on the opportunity.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.

This article was written by

I'm a retired academic with three decades of experience in the financial markets.

Providing a marketplace service Shareholdersunite Portfolio

Finding the next Roku while navigating the high-risk, high reward landscape.

Looking to find small companies with multi-bagger potential whilst mitigating the risks through a portfolio approach.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.