An Update On Sorrento: Hitting Rock Bottom And Finding A Shovel

Summary

- Sorrento Therapeutics has filed for Chapter 11 bankruptcy protection following two significant legal awards against the company, totaling $173.5 million.

- The legal battles stem from disputes with Dr. Patrick Soon-Shiong and his controlled entities regarding breaches of fiduciary duties related to the sale of the cancer drug Cynviloq in 2015.

- The bankruptcy filing offers Sorrento a temporary reprieve but also presents significant uncertainty for investors. The recent Scilex dividend raises even further questions about the management's intentions.

Solskin

Sorrento Therapeutics (NASDAQ:SRNE) has decided to take a questionable step by entering into Chapter 11 proceedings along with its subsidiary, Scintilla Pharmaceuticals. The company made this tough decision after being hit with a $156.8 million arbitration award to NantCell and a $16.7 million to NANTibody. Arguably, in order to safeguard its business, the company sought the protection of Chapter 11 bankruptcy, as it believed that NantCell and NANTibody might seize its assets to satisfy the unstayed $50 million portion of the Nant Award, causing significant disruption to Sorrento's operations. Tough times, indeed, but it's always better to be safe than sorry.

One should note that Sorrento Therapeutics has been involved in multiple legal actions with Dr. Patrick Soon-Shiong and his controlled entities. One such action relates to breaches of fiduciary duties and seeks to restore $90.05 million to the NANTibody capital account. As you can see this a mess.

There is also a legal action asserting that Dr. Soon-Shiong acquired the drug Cynviloq with the intention of preventing its progression to the market, leading to claims of fraudulent inducement and common law fraud. As a result, Sorrento was awarded $125 million, and they are entitled to receive this amount from NantPharma for alleged breaches of their agreement related to the development of Cynviloq.

The Complicated History of Sorrento Therapeutics' Cynviloq Deal with NantPharma

Back in 2015, Sorrento Therapeutics made a big sale to NantPharma for a cancer drug called Cynviloq, which was worth over $1.3 billion. The deal involved upfront payments of $90 million and additional payments contingent upon meeting regulatory and commercial milestones. However, things went south as Sorrento later claimed that the purchaser, Patrick Soon-Shiong, didn't have any plans to develop Cynviloq. Instead, it appeared that he wanted to safeguard revenues from his popular product, Abraxane.

Sorrento argues that by 2016, Dr. Soon-Shiong and his team had not moved forward with research and allowed patents to expire. Additionally, Sorrento claims that Soon-Shiong redirected funds from a joint venture the company had with NantCell, a Soon-Shiong company. Sorrento claims that Soon-Shiong took $90.5 million from NANTibody and paid NantPharma $90.05 million for the Cynviloq assets.

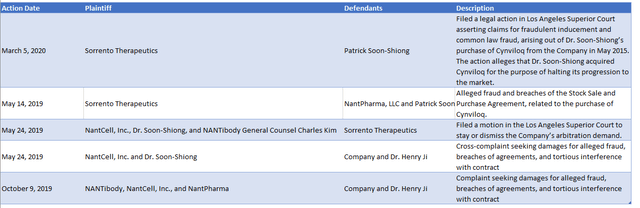

Let's take a look at a table I put together summarizing some of the legal battles that Sorrento Therapeutics is currently embroiled in. It's important to note that this list is not exhaustive and although it is based on Sorrento's own filings, I cannot guarantee its accuracy. Nevertheless, the table serves to illustrate that this situation is far from straightforward, and there are many competing claims and counterclaims being made.

Author compilation based on 2021 10-K

What can we expect next?

As you can see, the situation is rife with conflicting claims and it's difficult to discern whether Sorrento will come out on top. It seems that the firm has opted to pursue bankruptcy, which could be a strategic move to circumvent the burden of paying the outstanding $50 million owed to the Nant Award.

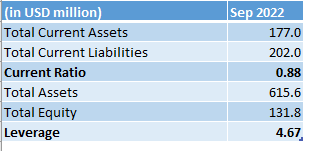

The company's balance sheet was already is bad shape, and in need of fresh capital. Look at how the company's balance sheet looked like in September of 2022, before all this:

Author's compilation based on Seeking Alpha Financials

In considering the balance sheet and the magnitude of the award, one could argue that Sorrento's choice to pursue bankruptcy was a necessary course of action. However, this move undoubtedly represents a major setback for the company's shareholders, who are now exchanging one set of problems for another. Although Sorrento may avoid paying the award at present, the risk of future losses remains uncertain. The unpredictable nature of the bankruptcy court's rulings means that small investors may suffer adverse consequences.

Problems from the past

As evidenced in the 10-K, the auditors displayed little enthusiasm in 2022 regarding Sorrento's internal controls. They pointed out a material weakness that could potentially lead to a delayed prevention of a significant misstatement. Specifically, the auditors highlighted insufficient accounting resources employed by the management to effectively execute controls. While the auditors issued an unqualified opinion on the financial statements, they included an explanatory paragraph regarding the company's ability to continue functioning as a going concern.

The auditor went so far as to highlight two specific issues in their report. The first issue, a critical audit matter, pertains to the valuation of acquired intangible assets that were recorded in connection with the acquisition of ACEA Therapeutics, Inc. The auditors determined that the company's accounting for this acquisition was a complex matter due to the estimation uncertainty involved in determining the fair value of intangible assets and other recorded contingent consideration liabilities.

The second critical audit matter pertains to the carrying value of Scilex (NASDAQ:SCLX) notes and the valuation of embedded derivative liabilities. The auditors encountered difficulties when auditing the carrying value of Scilex notes due to the subjective judgment. Additionally, the auditors faced challenges when auditing the company's valuation methodologies and significant assumptions.

Conclusion

It's worth noting that there may be a potential plot twist in the Sorrento story. Specifically, the company recently declared a stock dividend for its common stockholders that consists of an aggregate of 76 million shares of common stock of Scilex Holding Company (SCLX) held by Sorrento. This dividend has already been paid and granted a dividend ratio of 0.1410127 of a share of Scilex common stock for every one share of Sorrento common stock.

There are two implications to consider. First, shareholders may potentially salvage some value in the process, how much will depend on Scilex's stock performance. Second, Sorrento still retains ownership of over 40% of the shares, which could lead to several outcomes.

One possible scenario involves Sorrento restructuring itself around Scilex, whereby Scilex acquires some or all of Sorrento's assets and the company undergoes a transformation. However, this avenue is not without its difficulties, and the high degree of uncertainty surrounding the situation makes it difficult for me to formulate a conclusive opinion on the company. Nonetheless, the timing of the stock dividend gives rise to doubts regarding the intentions of Sorrento's board, and given their past issues with internal controls and auditing, I believe investors might want to consider to err on the side of caution and just step aside.

In yet another plot twist, as I write, Sorrento Therapeutics has some stirring news. The company has been granted approval by the U.S. Bankruptcy Court for the Southern District of Texas to secure a $75 million debtor-in-possession financing from JMB Capital Partners. This financing will allow Sorrento to continue its business operations as usual during its chapter 11 process.

As a result of this development, the company's stock has seen an immediate uptick, rising by about 35% during after-hours trading (as I write). Bear in mind that the approval mentioned in the press release is only interim approval. A hearing for final approval of the financing is currently set for March 29, 2023.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SCLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.