Lifeway: Only Fairly Valued And Does Not Represent An Opportunity

Summary

- Lifeway is the U.S. leader in kefir, a probiotic yogurt beverage.

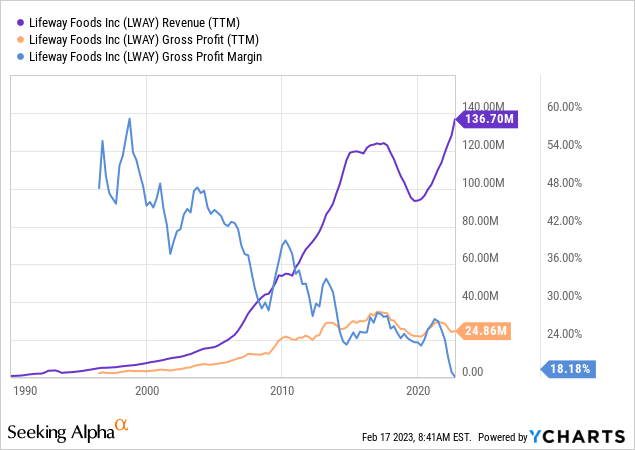

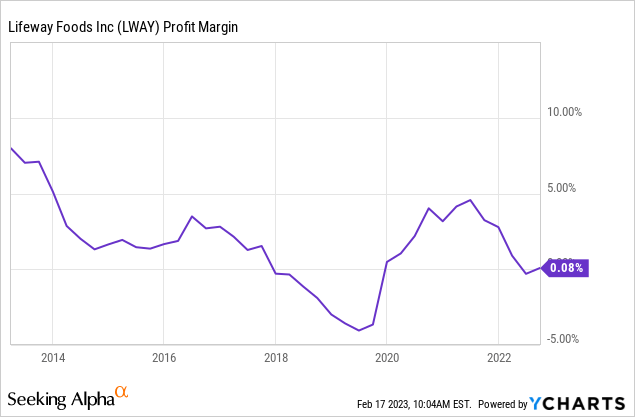

- LWAY has multiplied revenues by 16x since 2000. Unfortunately, all that improvement has been offset by decreasing gross margins. Profitability has not grown in line with revenues.

- The company could only justify its current price based on margin recovery (never seen) or acquisition from a competitor (improbable).

- Even assigning the margin recovery scenario as the base, LWAY stock is only fairly valued.

- The situation could change if the company announced and implemented measures to recover profitability.

Anna Puzatykh/iStock via Getty Images

Lifeway Foods (NASDAQ:LWAY) is the leading manufacturer of kefir yogurt in the U.S. More generally, the company competes in the probiotics segment.

The company has seen tremendous revenue growth in the past two decades, but unfortunately, it has been at the expense of gross margins, more than halving them in the process. This has meant that the company is not increasing profits even though it consistently sells more.

Recently, the company's founder-family and largest shareholders initiated a family feud that could end in a change of control or at least a managerial change.

I prefer not to speculate on such changes before they occur and materialize in better profitability. Also, I do not speculate about the company being acquired by a competitor.

Based on profitability and current business trends, which I believe is the only gauge through which to purchase for long-term holding, LWAY is not attractive at these prices.

Note: Unless otherwise stated, all information has been obtained from LWAY's filings with the SEC.

Business description

Kefir manufacturers: LWAY claims to be the leading kefir manufacturer in the U.S. Kefir is a form of yogurt made from bacteria and milk.

LWAY's founder started manufacturing the beverage to serve immigrant communities in the U.S. The product was then marketed as a novelty with benefits to gut health through probiotics and bacteria.

Novel consumer perishable: Consumer perishables are a great, although competitive, industry. Some of the strongest moats were built around these products. Further, kefir is a novel product, although it competes in a segment similar to yogurt and other probiotics. Novel products can expand their market for many years if things go well. Therefore, a priori LWAY operates in an industry that has projection. Of course, many consumer perishables brands never succeed.

Topline rocket that cannot lift profits: LWAY's revenues have multiplied by more than 16x since 2000. This implies a revenue CAGR of 13% for 22 years. The company has created a national market out of a product originally manufactured only for the consumption of immigrant communities.

Unfortunately, as seen in the chart below, that topline growth did not lift gross profits at the same rate, or even close. The company's explosive revenue growth was accompanied by an almost equivalently explosive gross margin decrease. From 50% in 2000 to 18% in the latest quarterly report.

Strategy or obligation?: The company's revenue and profitability dynamics could be caused by market competition or a deliberate strategy from LWAY's management. The implications for future profitability are very different under these assumptions.

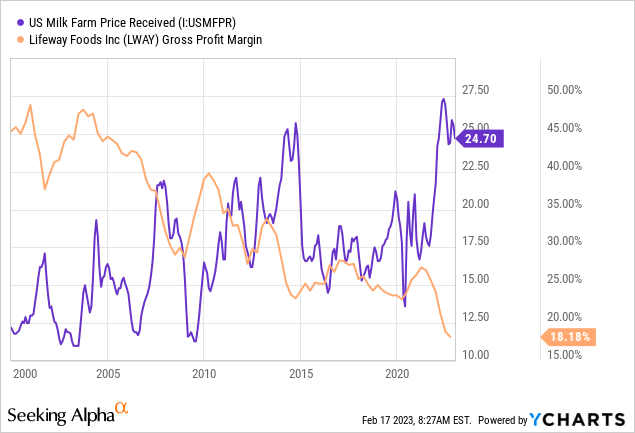

The market-cause thesis implies that LWAY has no competitive moat to defend its profitability. For example, the company has mentioned several times in earnings calls that it has difficulty passing milk costs to customers (4Q07, 4Q13, 3Q22). Effectively there is a relation between milk prices rising and LWAY's margins decreasing.

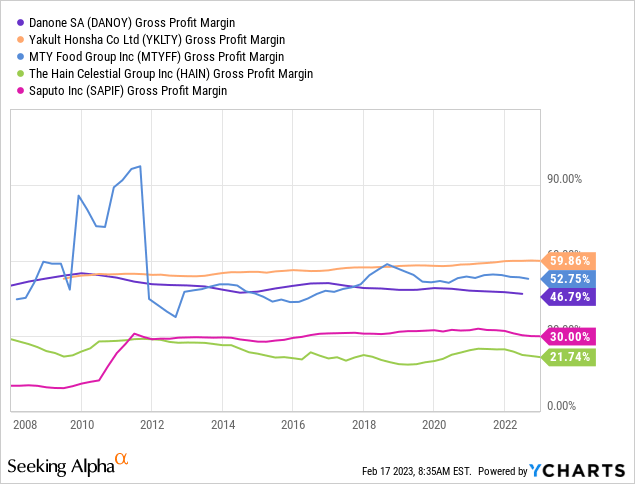

Margins suffering after a commodity price spike is normal. What is not so normal, or at least not so desirable, is that the company cannot recover previous profitability later when commodity prices decrease, or by increasing prices after the commodities do. This signals weakness. Also, if milk affects the margins of dairy manufacturers, why haven't others suffered the same fate?

The strategy-cause thesis is that LWAY's management purposely decreases its margins to gain market share, make the product known, and build brand and customer loyalty.

The thesis is consistent with the company's explosive revenue growth. On many occasions, uncompetitive companies lose margins while keeping revenues constant, or even lose revenues. LWAY's case of falling margins on revenues growing fast is more particular.

A visit to Walmart's webpage, under the search 'probiotic', reveals that LWAY's brands (Lifeway and Glen Oak) sell at a price per ounce between half and one-third of other brands. The company's products are much cheaper than those of competitors.

Walmart's product search for probiotics (Walmart's webpage)

High tax rates: LWAY's effective tax rate was 38% on average before 2022. The company does not declare allowances or net carryforward losses that could explain this elevated level. Rather, on its breakdown from the statutory 21% federal rate on the FY21 10-K, the company indicates that most excess comes from state income taxes. LWAY's manufacturing facilities are in Illinois, Wisconsin, and Pennsylvania, some of the most taxing U.S. states, at rates averaging 9%. Another portion comes from section 162-m of the revenue code, which forbids the deductions of payments above $1 million to the most highly paid employees of public companies (executives usually).

High compensation: As will be covered in the next section, LWAY is a company controlled by the founder's family. Compensation has been excessive for a company of the size of LWAY. The company's CEO was compensated $2.7 million in FY21 and $2.4 million in FY20; the COO (family member) $1 million in FY20; and the company's Chairman (family member) $1 million.

Going forward

Family problems: LWAY is a family company. Three members of the Smolyansky family (widow, daughter, and son of the founder) owned 50% of the company as of July 2022, when the latest proxy statement was published. The company's Chairman was the founder's wife, the daughter has been CEO since 2000, and the son was the COO.

But the family members did not agree on what to do with the company, and a proxy contest was about to ensue last year. On one side was the company's CEO, and on the other side, was her mother and brother, asking for her removal and the search for 'strategic alternatives', which usually means selling the business or at least their stake in it.

The proxy was avoided, the Chairman and COO do not work for the company anymore, and the company agreed to buy 25% of the mother's stake (5% of the company) at a 20% discount on market prices.

Still, the situation is not over, and the company recently communicated that it would delay its FY22 shareholder meeting by 60 days.

Acquisition ahead?: Acquiring LWAY is simple because control is concentrated (as long as the important shareholders agree). The family still owns about 50% of the company's outstanding shares, and Danone (OTCQX:DANOY), a French dairy giant, owns another 22%. Although Danone is technically a competitor, the French company has capital stakes in many smaller competitors. For example, it had a 20% stake in Yakult (OTCPK:YKLTY), the Japanese probiotics manufacturer, until 2020. The possibility is open, but I prefer not to speculate on these developments, given that they are so difficult to predict. Still, we could value the optionality later.

Margin improvement: I tend to incline towards the strategy-based margin compression thesis. That is, LWAY decided to sell at a lower price tag, and avoid increasing prices when its competitors did, to gain market.

At some point, however, the company should grow its margins, or at least keep them constant while increasing revenue, to deliver the profitability embedded in the current stock price. I am not sure the company can do this without losing part of its market once it has established itself as a low-cost competitor.

On the other hand, margins cannot be squeezed much more because the company is already operating at break even. If revenue growth was based on price alone, revenues should stagnate in the next few years.

Valuation

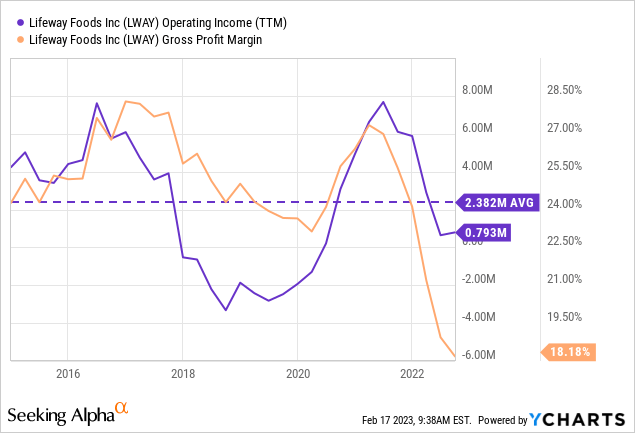

Average earnings: First, we start looking backward, at the operating profitability achieved before the recent dip in gross margins. Operating income averaged $2.4 million. Of course, that level does not justify a market cap of almost $90 million for LWAY.

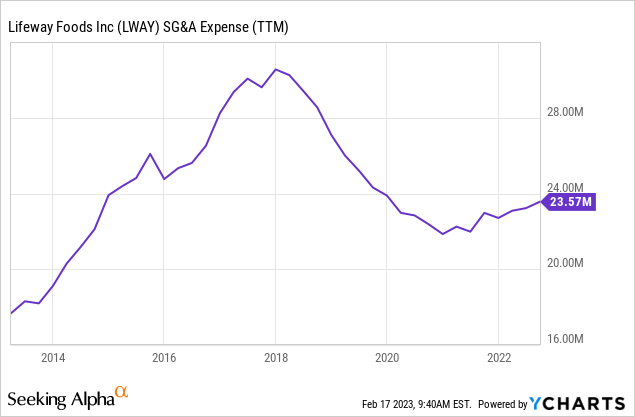

Earnings based on margin recovery: Fortunately, LWAY's SG&A expenses have not grown in line with revenues, but rather have moved with gross profits. If SG&A had grown faster (as happens many times in other companies), LWAY would have been outright unprofitable.

From a starting point of $25 million in yearly SG&A expenses, ignoring interest expenses given that LWAY has very few debts (less than $5 million on average), we can calculate profitability at current revenue levels and different gross margin levels.

At the current level of 20%, the company, with annualized revenues of $160 million (both from 3Q22 data), can generate $32 million in gross profits, and $7 million in operating income. Considering effective income tax rates of 30% (forecasting operations in the same states but lower compensation to management), that comes to $5 million in net income.

However, if we forecast higher margins, of 25%, net income grows to $10.5 million. Of course, this implies the company can grow its margins while keeping revenues constant (which implies a 5% volume decrease). This is difficult to do, and the company has not done so in the past.

Acquisition: According to Aswath Damodaran's database, the average P/S ratio for food processors in the U.S. is 1.6. However, the companies in this industry enjoy net margins above 7% on average. This is significantly above LWAY's current or historical average. Further, LWAY is a small company. Still, if the company was acquired on a multiple of sales, its price should be higher than the current market cap.

Conclusions

On a backward-looking basis, LWAY does not justify its current market cap. It could not generate income above $3 million on average and trades at a market cap of $90 million.

If we look forward and assume a recovery in gross margins, the company is trading at fair value, because it could generate about $10 million in net income with a gross margin of 25%. However, this assumption is strong; it implies that the company is breaking a 20-year-long trend, and also that it can grow margins while keeping revenues constant.

Finally, the (very speculative) possibility of the company getting acquired at a deep discount to the industry's P/S ratio still yields a significant upside.

If these three methods were combined with equal probabilities, the company would be fairly valued. In that case, therefore, the company's stock is not an opportunity.

However, I believe the odds are skewed toward the low return outcome, for two reasons. First, when speculating on a possible acquisition, it is natural to assign a very low probability to it unless the investor has an informational edge. Otherwise, it is reckless investing. Second, the weight of past evidence is very strong on the low return outcome, and the company has not announced any managerial or strategic change that could signal a break from previous trends.

For those reasons, I believe LWAY is not an opportunity at these prices.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.