Riding The Wave: Chesapeake Energy's Strategy For Thriving In A Volatile Market

Summary

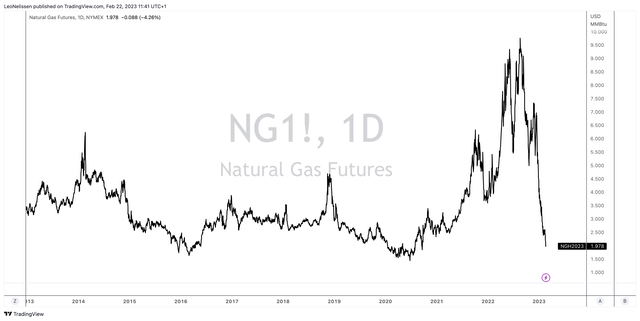

- In this article, I start by assessing the decline in natural gas prices. I believe that we're close to a bottom, due to higher future (export) demand and weather conditions.

- Chesapeake Energy Corporation reported good Q4 earnings, slower production, and an asset sale to focus on LNG opportunities.

- CHK has a strong balance sheet, plenty of hedges, and a favorable valuation.

Nalidsa Sukprasert/iStock via Getty Images

Introduction

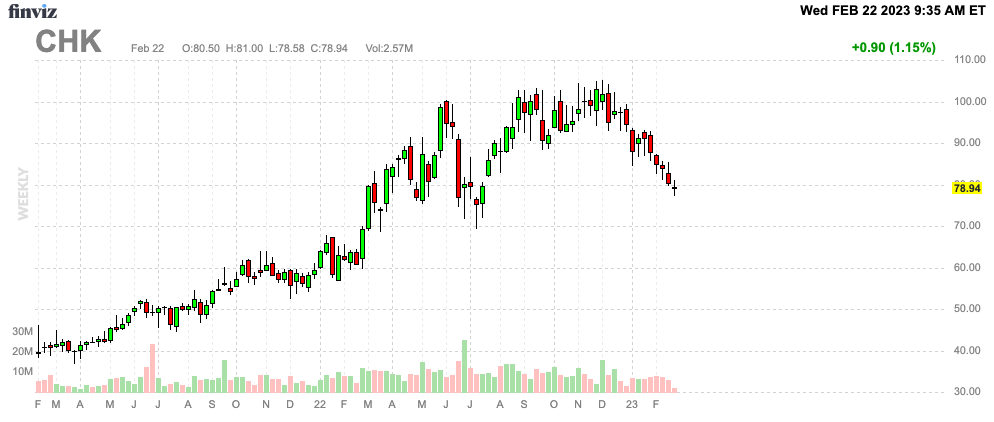

The Chesapeake Energy Corporation (NASDAQ:CHK) is a stock I have followed since I started trading in 2011. While I didn't always own the company, I was fascinated by its position in the North American natural gas industry. Unfortunately, investors didn't find much joy in the stock, as low natural gas prices caused the company to go bankrupt prior to the current energy crisis. After re-emerging from bankruptcy in early 2021, the company is back on track. The company has doubled since February 2021, which includes a 25% selloff from recent highs.

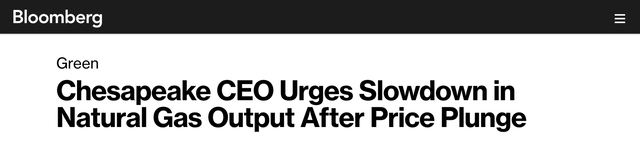

On the one hand, Chesapeake is streamlined, its balance sheet is healthy, and it has low production costs and significant hedges. On the other hand, natural gas prices have imploded, putting tremendous pressure on CHK and its peers. Even the CEO is now calling for subdued natural gas production in the industry.

That said, fundamentals remain strong, and new LNG export capacity should put a permanent floor under natural gas prices at elevated prices.

While the company is in a tough spot, weakness comes with opportunities.

Natural Gas - Waiting For China & Europe's Winter

Natural gas prices are in a tough spot. While I am writing this, Henry Hub futures are down another 4% to less than $2 per MMBtu. This is one of the lowest prices since the shale boom took things to another level in 2012. These prices are comparable to prices we witnessed during the bottom of the oil/gas crash of 2016 and the pandemic.

The biggest problem the market is facing is demand destruction. Plummeting global growth expectations and (related) high recession probabilities are reducing the expected demand for fossil fuels like natural gas.

We're also dealing with very warm winter weather in Europe and (parts of) the U.S. In Europe, gas storage levels are at above-average levels, reducing the need for LNG imports - at least for the time being.

It looks like "we're going to get through winter without any supply issues," Price Futures analyst Phil Flynn told Reuters, adding that even while Freeport LNG's Texas export plant is on the road to reopening, it could still be March before the facility exports any supply, "and at that point, winter is pretty much over."

Moreover, the Fed is now expected to act more aggressively to fight inflation, which is increasing stagflation fears. It has also pushed the dollar higher again, which is bad for commodities.

That said, major banks like The Goldman Sachs Group, Inc. (GS) aren't giving up. As reported by Bloomberg:

Commodities are poised to rally in 2023 as China recovers, US inflation proves to be benign, and Russian oil production contracts, according to Goldman Sachs Group Inc.’s Jeff Currie.

“The real core of the bullish view is the recovery in China,” Currie, global head of commodities research, told Bloomberg TV in an interview in Hong Kong Wednesday. “And everything is pointing to that being A-OK,” he said, sticking with a bullish view despite a soft start to the year for raw materials.

Commodities have eased in the opening weeks of 2023 despite China’s swift abandonment of Covid Zero, with crude oil among the losers. That drop has been driven by US economic data surprising to the upside, aiding the dollar; a collapse in natural gas; and rising metals inventories, according to Currie.

I agree with this assessment. While almost all of my energy exposure is focused on oil, I believe that natural gas is undervalued. One core driver of this is LNG (liquid natural gas demand) demand.

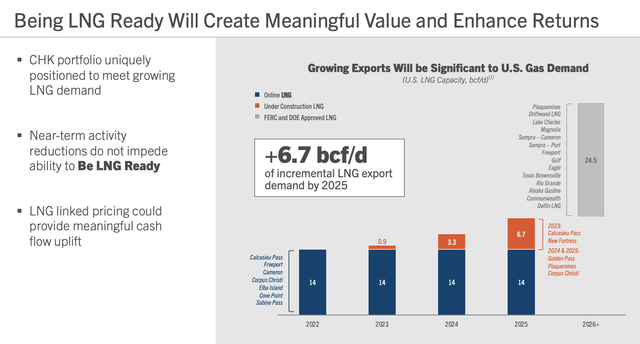

Chesapeake, which has great access to LNG export terminals thanks to its Haynesville operations in the State of Louisiana, expects to benefit from tremendous pricing opportunities that come with higher export opportunities.

The U.S. currently has an export capacity of 13 billion cubic feet per day as the chart above shows. Most of this comes from Sabine Pass and Corpus Christi facilities. Moreover, Freeport LNG is online again after a major incident rendered it unable to export in the second half of 2022. Until 2026, 6 billion cf/d is expected to be added to current capacities. The overview below shows that this is mainly due to three facilities, including Cheniere Energy's (LNG) Corpus Christi expansion, according to EIA data.

Energy Information Administration

After 2026, the expansion will continue, as new projects could add another 24 billion cubic feet per day.

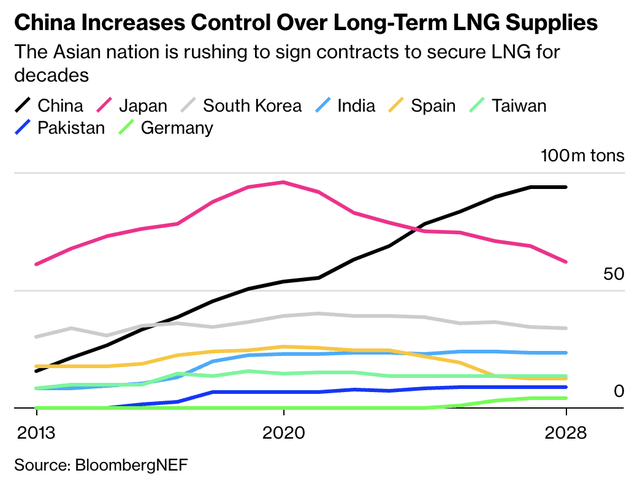

This is good news for United States natural gas prices, as it allows producers to send it overseas. Even better, demand is high as nations are fighting for future LNG supplies. Europe doesn't benefit from Russian gas anymore. China is moving to natural gas without proper access to Russian supplies, and the general trend toward decarbonization benefits LNG demand.

So far, it looks like China has secured 15% of all contracts that will begin delivering LNG through 2027.

China’s influence was highly visible last year during the global energy crunch, when strict Covid policies and high spot prices curbed the nation’s demand, prompting it to divert unwanted shipments to more needy regions.

“If not for the lower Chinese LNG demand in 2022, the global gas market — and Europe’s energy security — would be in a far more perilous state,” said Saul Kavonic, an energy analyst at Credit Suisse Group AG.

In light of these developments, I believe that natural gas will bottom in the next few weeks, with more upside potential ahead as Europe and China will compete for much-needed supplies going into the next winter. I also believe that the market has priced in a lot of economic weakness.

This is favorable for Chesapeake Energy, which just reported its 4Q22 earnings.

Chesapeake Q4 Earnings: What To Make Of the Numbers

In 4Q22, Chesapeake generated adjusted EPS of $4.22, beating the market by $1.32.

One major piece of news is the company's deal with the British Ineos company. The chemical giant bought a part of CHK's remaining Eagle Ford oil assets in a deal worth $1.4 billion.

This deal includes 172K net acres and approximately 2,3000 wells capable of producing 36 thousand barrels of oil equivalent per day. This brings total divestitures in that area to $2.8 billion.

The deal is expected to close in the second quarter of this year. CHK will receive $1.175 billion upon closing. The remaining $225 million will be paid in annual installments of $56.25 million. Proceeds of this deal will be used to repay borrowings under its revolving credit facility and share repurchases.

Thanks to this deal, the company has now more resources to focus on Marcellus and Haynesville production, which includes its emphasis on LNG access.

In light of this, the company is reducing output beyond the Ineos deal.

Last week, Chesapeake CEO Nick Dell'Osso came out saying that a higher gas supply is not needed in the short term.

“Growth in gas supply is not needed in the short term,” Dell’Osso said during an interview on Wednesday. “We do think the industry should acknowledge that and may reduce growth in the near term.”

Prior to that, EQT Corporation (EQT), the largest natural gas producer in the U.S., also said that the plunge in natural gas prices would slow supply growth.

In 4Q22, the company produced 4.05 billion cubic feet equivalent per day (bcfe per day). 90% of this was natural gas. On a full-year basis, that number was 4.0 bcfe with the same breakdown of natural gas and liquids.

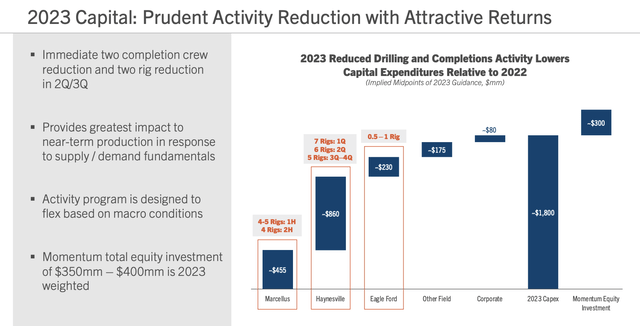

In light of what we just discussed, the company is reducing its production. Currently, the company operates 14 rigs:

- Five in the Marcellus

- Seven in the Haynesville

- Two in the Eagle Ford.

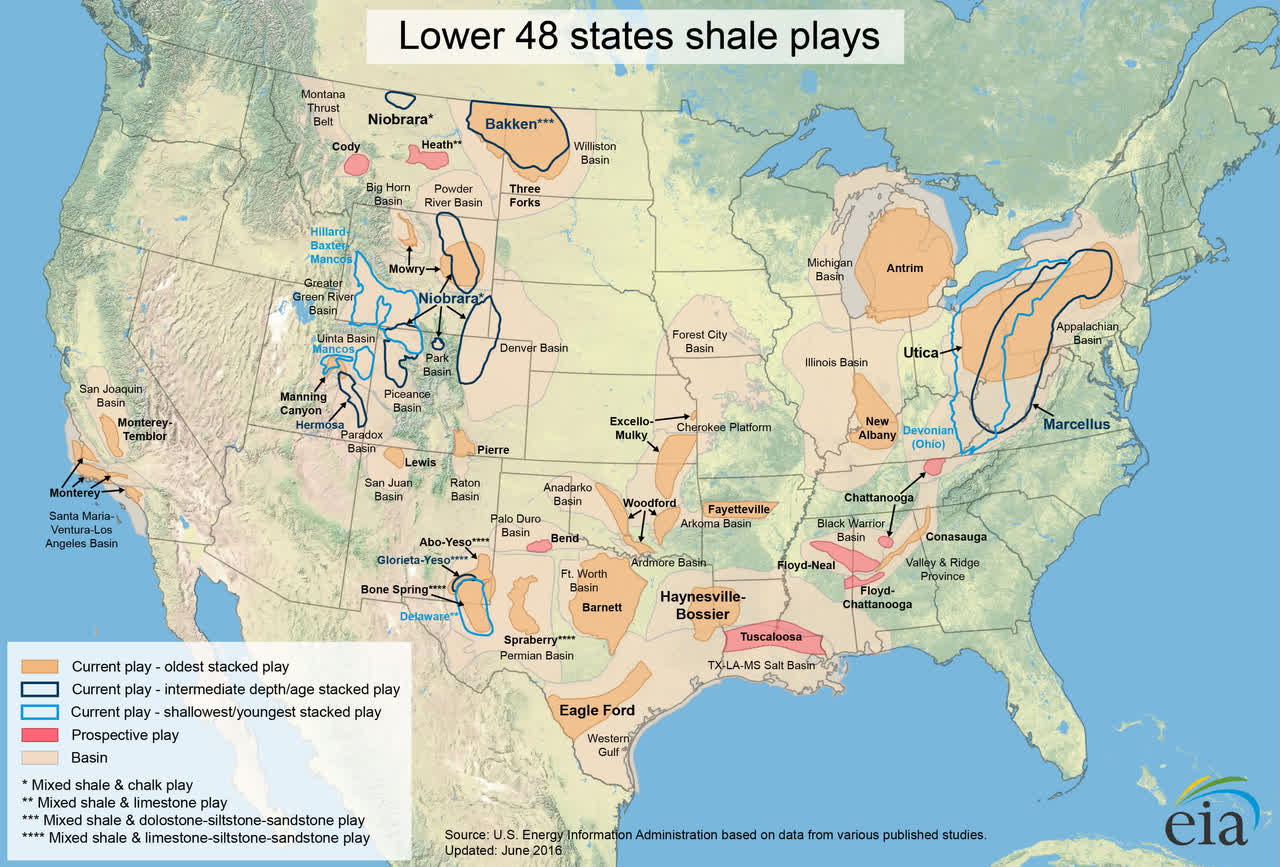

On a side note, if you're new to energy, here's an official map showing the lower 48 states' shale plays (meaning without Alaska and Hawaii):

Energy Information Administration

Chesapeake is also operating five frac crews; one in the Marcellus, two in the Haynesville, and two in the Eagle Ford.

In 2023, the company expects to drop two rigs in the Haynesville Basin, one in the first quarter and another in the third quarter. CHK is also expected to drop one rig in the Marcellus in the third quarter while maintaining one of the two frac crews on each asset throughout the year.

On a full-year basis, the company is now expected to produce between 3.4 and 3.5 bcf per day. 54% of these volumes will be produced in the Marcellus Basin, followed by 43% in Haynesville.

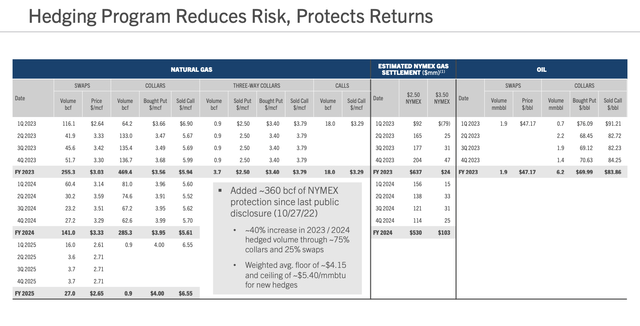

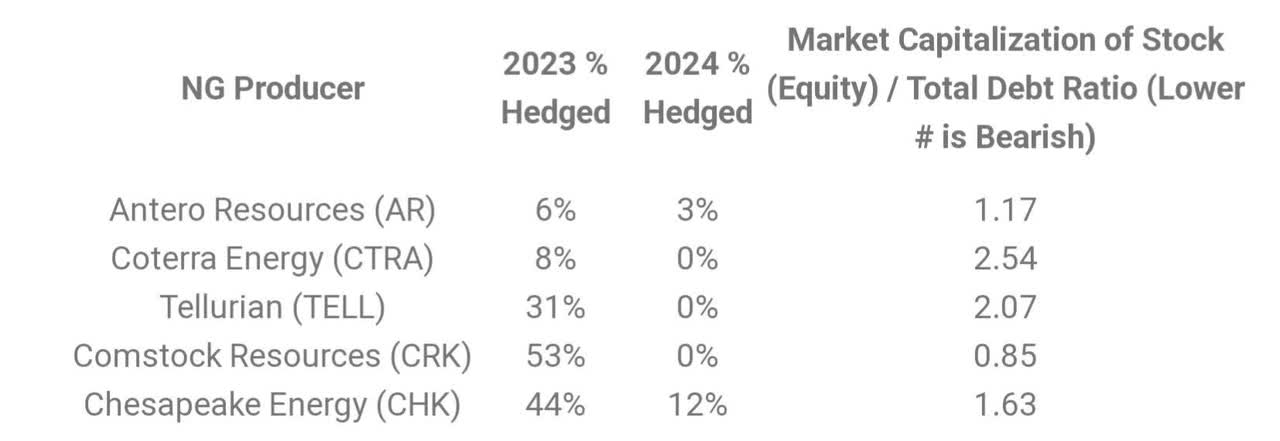

Moreover, the company has boosted its hedges. Prior to its earnings call, the company was one of the gas producers with the most hedges.

Twitter (Josh_Young_1)

For 2023, the company has hedged 30% of Marcellus and 54% of Haynesville production. Moreover, the company has additional in-basin protection through physical sales contracts covering close to 30% of production for 2023.

Since October 27, the company has added protection for another 360 bcf.

In total, the company has now hedged between 55% and 60% of production (depending on realized output) until 4Q23. After that, hedges drop to 30% to 45% of production.

Incorporating these numbers into the bigger picture, the company is dividend breakeven at $2.40/mcf ($2.49/MMBtu). This assumes an oil price of at least $75.

In 4Q22, the company paid $1.29 in dividends per common share. This translates to an annualized yield of 6.4%. $0.55 of this dividend was the company's base dividend. The other part was the variable dividend. The company distributes 50% in adjusted post-common dividend through its variable dividend.

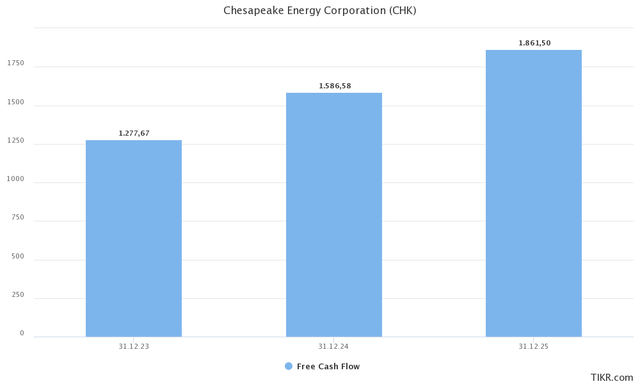

Looking at estimates, we can assume that the company's investments might pay off. Better access to LNG export (and better pricing) and long-term natural gas tailwinds are set to pave the road for an implied free cash flow yield of 13% (on average) in the three years ahead.

It also needs to be said that the company is in a much better position when it comes to its financials. The company has no maturities until 2026. In 2026, it has $500 million due in 5.5% yielding debt.

This allowed Chesapeake Energy Corporation to buy back 11.6 million shares in 2022. Please bear in mind that the company currently has 134.7 million shares outstanding. That is UP compared to March 2022, when that number was 127.1 million. However, the company has only 11.5 million outstanding warrants. That is down from 23.8 million. The total fully diluted number of shares outstanding is now 146.2 million. Down from 150.8 million.

Based on current energy prices, the company has a net leverage ratio of less than 1.0x. The company has a BB credit rating. In 2017, it was B-. I expect the rating to be hiked to BBB within the next two years.

CHK Stock Valuation

Chesapeake Energy Corporation is trading at 7x 2023E EPS, which I believe is undervalued. The current stock price is $80. The average target is $127. However, the latest target is $90, which came from Citigroup earlier this month.

While it's hard to say how much natural gas weakness has been priced in, I believe that Chesapeake Energy Corporation stock is trading at an attractive risk/reward. I believe that as natural gas prices rebound in the quarters ahead, the company has room to rise back to $110, followed by way more upside if my long-term commodity outlook turns out to be correct.

TIKR.com

However, please be aware that natural gas plays tend to be even more volatile than oil-focused stocks. Please be careful if you decide that Chesapeake Energy Corporation or any of its peers is right for you.

Takeaway

The natural gas industry is going through tough times due to the reduced demand and the very warm winter weather in Europe and the U.S. However, Chesapeake Energy Corporation remains a strong investment opportunity, especially with its access to LNG export terminals, thanks to its operations in the Haynesville area in Louisiana. Chesapeake Energy Corporation is expected to benefit from tremendous pricing opportunities due to higher export opportunities, and new projects expected to add another 24 billion cubic feet per day after 2026. China's influence in the market is also expected to increase, as it secured 15% of all contracts that will begin delivering LNG through 2027. In the near future, natural gas is expected to bottom out, with more upside potential ahead as Europe and China fight for future LNG supplies.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.