Urban Outfitters: Q4 Preview And FY2024 Outlook

Summary

- Urban Outfitters is readying their Q4 and Fiscal Year results on Feb. 28, 2023.

- The company recently announced record holiday sales, up 2.3% from last year.

- I reiterate my previous "Hold" rating, but see some positive trends developing for URBN - I forecast a $31 price target over an 18-month term.

Dan Dennison

Introduction

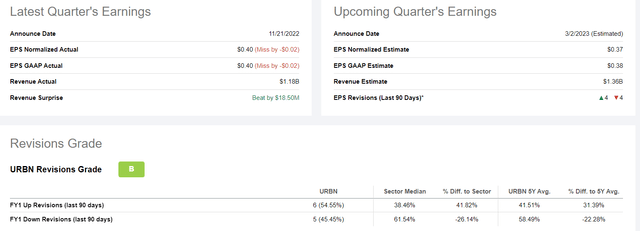

Urban Outfitters (NASDAQ:URBN) is scheduled to release Q4 and FY2023 earnings on February 28, 2023 (URBN's fiscal year runs Feb.-Jan.). The company saw revenues increase in Q3, but tightening margins and elevated inventory may keep the stock from soaring. Ahead of the earnings, I forecast a share price of $31 over a 12-18 month time frame, up $2 from my previous "Hold" rating in November. The company remains supported by several brands, with two key offerings making up the majority of sales; Anthropologie Group, a women's casual apparel, and beauty and wellness line, and Urban Outfitters, a youth brand line. This review showcases some of the industry developments from the holiday season and looks at expectations heading into earnings season. Wall street analysts are split, with 6 of 11 recently revising estimates upwards, and 5 analysts reducing.

Recent Developments

URBN recently reported record holiday revenues for the two months ended December 31, 2022, announcing a 2.3% jump compared to the previous year. Retail net sales increased by 1%, with the increase in comparable net retail sales driven by low single-digit positive growth in both digital channel sales and retail store sales. When distinguishing by brand, net sales increased 15% at the Free People Group and 7% at the Anthropologie Group, but decreased 10% at Urban Outfitters, which follow previously noted trends for the company. Wholesale net sales decreased 22% driven by a decline in Free People wholesale sales and due to a decrease in department store distribution. Overall, the results are positive, but the increases fall flat of the broader industry. Across the U.S., retail sales grew 5.3%, which was below inflation and last year's huge 13.5% jump, but still strong nonetheless. It's difficult to project whether the record revenue will provide momentum for the stock. Shares have been up ~2% since earnings were released, in line with the S&P500. Analysts are not quite bullish on the stock, though that may mean expectations are lower heading into the year end results.

Seeking Alpha - Analyst Ratings

What to Watch for

In the upcoming earnings release there are a few metrics and trends to keep an eye out for. The first would be FY2024 guidance. URBN executives last provided detailed guidance in November for Q4, and some of the key forecasts included a "slight softening of demand", total revenue growth in low single-digits (highlighted by high single digit growth by the Anthropologie group), significantly reduced inventory, speed to market capabilities to soon mirror FY2020 levels, strong growth in the Nuuly brand and more. Important insights on the different brands and if existing trends remain will also provide a base to better forecast the long term strength of the business. The company also forecasted a gross profit margin decline of approximately 50 basis points compared to the prior year - these results will show us how margins fared and guidance for the full year will be expanded upon by executives.

An industry outlook will also be in order, as management will attempt to paint a picture on the retail apparel sector as a whole, and provide us with forecasts of how the consumer is acting now that inflation and rates have both run high for over a year now. A margin decline of over 100 basis points, and soft demand guidance would infer a promotional environment and a troubling scenario. If margins only dip slightly and positive consumer spending trends emerge, the stock could soar, and quickly, given the higher beta of URBN. It's difficult to predict right now, but given the recent sales data was average, and tidbits here and there from leadership referencing some inventory clearing out in Q4, I think sales may impress but margins lag - and depending on how much the margins lag, the stock may slide. The options chain for March 3rd as of the evening of Feb. 20 show more volume on the call side, which implies that investors expect a jump post earnings. In my estimation, it's too early to make a big bet - the model below forecasts a $31 share over a 12-18 month term, which implies minor upside.

Model Shows Minimal Upside

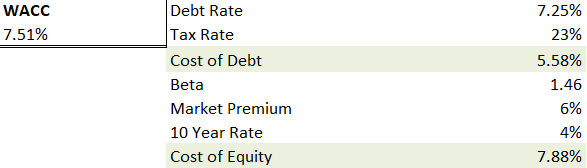

I haven't seen much intangible strength from URBN stock recently, and the model doesn't showcase a ton of upside either. Given their recent performance, I anticipate that their cost of debt rising could be above 7% if they attempted to leverage in this environment, but given their capital structure and liquidity, I doubt that they will need debt any time soon.

Author WACC Forecast

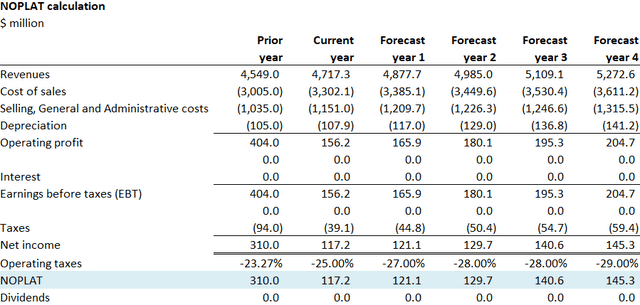

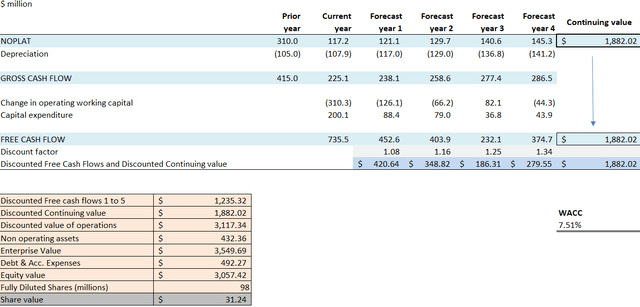

I forecast the continuing value of ~$1.9B, given a 3.7% revenue increase this year and blended revenue growth of ~2.5% for four years, as inflation continues to hit consumer discretionary spending. I hold other cost ratios equal from the previous model post Q3, other than the slight increase in revenue projections. The model shows that a $31 share price (see below) can be supported with fundamentals and a FY2024 EV/EBITDA forecast of ~12.5.

Author Income Statement Forecast Author Share Price Forecast

Conclusion

URBN has been treading water for the past few months, and all eyes will be following gross margins, after revenue sales in the holiday period tracked well. Investors will also be taking a close look at inventory to see if executives kept their promise of an inventory drop from the last earnings call. Traction in multiple business lines may provide some momentum for the stock, but it's tough to see the share price bouncing without new positive news. Investors seem to have a slightly bullish view as per the near term options chain, but that may change the closer we get to earnings day. I don't think URBN stock is worthy of a buy right now, and if you currently own the stock, its likely best to hold into earnings and we get a clear direction from management.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is my opinion only and I am not a licensed financial advisor.