Fiverr: Turning ChatGPT Lemons Into AI Lemonades

Summary

- Fiverr reported a modest Q4 earnings beat yesterday and the stock gathered some momentum in after-hours trading.

- The deceleration of growth does not come as a surprise and investors should focus on the long-term opportunity for Fiverr that has not changed despite recent developments.

- The launch of ChatGPT has caused widespread fear among Fiverr investors, but some of the bearish arguments do not seem to hold merit.

- Looking for more investing ideas like this one? Get them exclusively at Leads From Gurus. Learn More »

Kateryna Onyshchuk/iStock via Getty Images

ChatGPT made waves last December when it was first made publicly available. Less than two months after its launch, ChatGPT has already impacted a few business sectors, including freelancing platforms. At first glance, it seemed as if ChatGPT would prove to be a significant threat to Fiverr International, Inc. (NYSE:FVRR), one of the leading freelancing marketplaces in the world. Recent website traffic data, Q4 2022 earnings, and evolving use cases of AI technology suggest Fiverr is well-positioned to thrive alongside AI tools including ChatGPT. I am bullish on the prospects for Fiverr, but before discussing the risks and opportunities associated with AI technologies, it seems rational to begin this analysis with a brief commentary on the bigger picture for Fiverr and recent earnings.

The Opportunity

Investing in FVRR stock, in my opinion, is a bet on the future of work. Well before the pandemic, there were signs that freelancing was taking over the employer-employee relationship in an increasingly digitalizing world. Mobility restrictions imposed to prevent the spread of Covid-19 in 2020 accelerated this trend but some investors seem to believe that Covid-19 gave birth to this trend and that this trend will eventually die along with the diminishing threat of the virus. The more I look at freelancing statistics, the more confident I am that freelancing and contract work will dominate the world by 2030.

Studies conducted by PwC, Accenture, and McKinsey show that employers prefer to work with freelancers because of the cost-efficiency of hiring contract workers instead of full-time employees, value for money resulting from the ability to hire highly-qualified industry experts at a fraction of the cost of hiring them on a full-time basis, and the operating efficiencies resulting from the ability to hire multiple contractors to finish parts of a project to reduce the time to market. From a freelancer's perspective, modern professionals prefer to strike a balance between work and life, which is one of the main driving forces behind the recent surge in the number of high-skill professionals embracing contract work.

These findings merely scratch the surface.

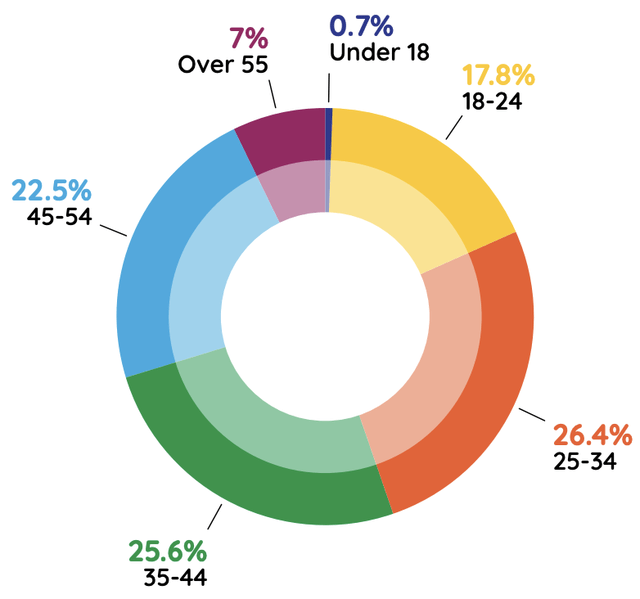

If we dig deeper into freelancing statistics, it becomes evident that freelancing is slowly but surely becoming the preferred choice for skilled professionals, which is forcing companies to look for talent on freelancing marketplaces. Freelancing is often a concept associated with young professionals but recent data shows that this is not the case. Data collected by Free Trade Europa last year shows that almost 30% of freelancers in Europe are over the age of 45, meaning they are not young professionals who are looking for gigs as freelancers just because they failed to land full-time roles.

Exhibit 1: Freelancers in Europe by age

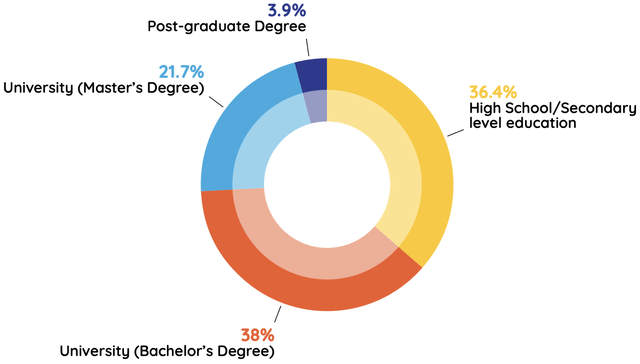

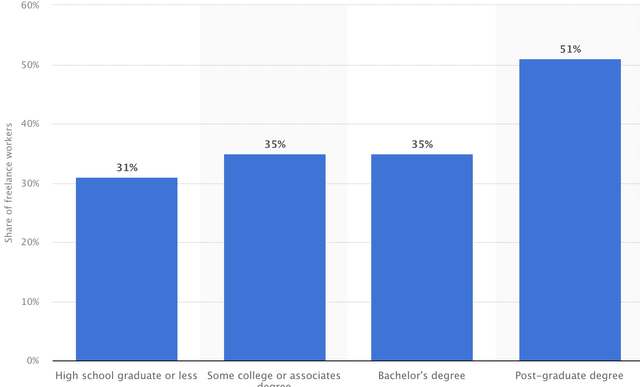

Digging deeper, we find that the majority of freelancers in both Europe and the U.S. are highly qualified individuals.

Exhibit 2: Freelancers in Europe by the level of education (2022)

Exhibit 3: Freelancers in the U.S. by the level of education (2021)

In Europe, Free Trade Europa found that freelancers earn, on average, more than the average income in their respective regions, which does not come as a surprise given that the majority of freelancers take on high-value projects. The same is true in America where freelancers earn $20/hour on average compared to the nation's average hourly rate of $18.80.

In my opinion, we are in the middle of a radical transformation of the work culture as we know it. Fiverr International, as one of the leading freelancing marketplaces in the world, will have a massive role to play in executing this transformation.

Fourth-Quarter Earnings Highlight Slow And Steady Progress

The pandemic accelerated Fiverr's growth and it would not be reasonable to expect the company to grow at the same pace it did in 2020. Not surprisingly, growth has decelerated but importantly, Fiverr continues to see steady growth in its operating metrics in the post-pandemic era, highlighting the strength of the underlying trend of embracing freelancing.

In the fourth quarter of 2022, active buyers grew 1% YoY to 4.3 million, spend per buyer increased 8% YoY to $262, and the take rate increased 100 basis points to 30.2%. All these are signs that Fiverr is continuing to grow even during the fallout from pandemic highs. Fiverr is still loss-making and the company needs to work on its operating margins, but on the bright side, Fiverr has introduced several initiatives including cost reorganization plans to achieve this objective. The adjusted EBITDA of $9.4 million in Q4 marks an all-time high for the company.

Fiverr is focused on onboarding corporate clients with a high spending capacity, which I believe is the right strategy to make the most of the ongoing work model transformation. In Q4, buyers who spend more than $10K/year grew 29% YoY, which is an encouraging sign that confirms Fiverr continues to attract high-value clients.

Scale is key to reaching profitability, and despite naysayers claiming Fiverr is reaching a maturity point, I believe there is a long runway for growth given that we are still at the early stages of a work culture transformation in favor of independent contracting.

Making The Most Of AI

When ChatGPT was launched, some investors and analysts thought that AI would eventually kill Fiverr primarily because of copywriting capabilities of ChatGPT. I believe most of these fears are unreasonable although I agree that AI poses a threat to freelance marketplaces that fail to attract the right talent to make the most of AI tools. Fiverr, feeling the heat from ChatGPT's launch, was quick to roll out AI-related services on its platform including the below.

- AI application development

- AI artists

- AI models

- AI music videos

- Fact-checking

- AI content editing

After going through some of the freelancer profiles offering these services, I reached two conclusions.

- There is demand for all of these services and the top sellers in these categories have seen a consistent flow of work which is evident from the recent reviews they have received.

- On average, freelancers who are offering AI services are charging higher prices compared to other categories.

Both these observations should be welcomed by Fiverr shareholders.

Turning to the legality of using content created by ChatGPT, it is important to remember that most of the work created by an AI tool cannot be used as one's own as the AI tool is deemed to have ownership of such content. In addition, according to the guidelines issued by the U.S. Copyright Office, it would be difficult to claim copyright ownership of AI-generated work. Commenting on this, Margaret Esquenet, a partner with Finnegan, Henderson, Farabow, Garrett & Dunner, LLP, said:

For a work to enjoy copyright protection under current U.S. law, the work must be the result of original and creative authorship by a human author. Absent human creative input, a work is not entitled to copyright protection. As a result, the U.S. Copyright Office will not register a work that was created by an autonomous artificial intelligence tool.

The legal implications of using AI-generated content and the potential legal issues resulting from AI tools using previously published work of authors without citing original sources will remain massive challenges for the AI content creation industry in the foreseeable future. Because of this, I believe the adoption of AI content creation tools will only expand the addressable market opportunity for Fiverr as corporate clients look for ways to make the most of these AI tools while adhering to compliance requirements.

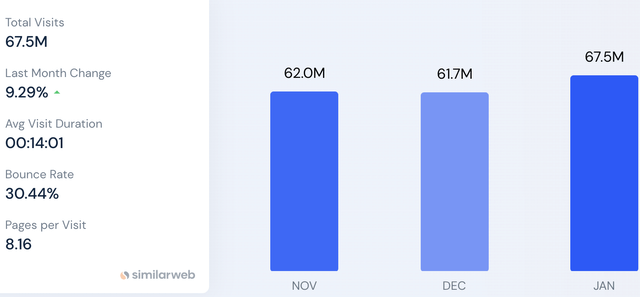

To get a measure of ChatGPT's potential impact on Fiverr, I thought it best to look at website traffic data for December. As illustrated below, Fiverr has seen a notable MoM increase in website traffic in December, which is not a confirmation that ChatGPT did not have any impact on Fiverr but certainly a confirmation that Fiverr moved in the right direction even with the threat of ChatGPT.

Exhibit 4: Total website visits

As an investor, I believe keeping a close eye on the future of AI is important to identify potential inflection points in Fiverr's story but I do not believe there is any reason to panic.

Takeaway

Fiverr did not disappoint in the fourth quarter of 2022 despite reporting a deceleration of growth as expected. Fiverr continues to find ways to improve its operating efficiency while expanding to new service categories and geographic locations, and the company is making the most of the hype around AI to attract high-value clients looking for AI-related services. Based on expectations for stellar growth in the number of freelancers in the global workforce by 2030, I remain bullish on the prospects for Fiverr.

The unexpected moment is always sweeter

At Leads From Gurus, we strive to achieve sweet returns by predicting which companies would report unexpected earnings. Join us to discover the power of earnings surprises.

Your subscription includes access to:

- Weekly actionable ideas that would help you beat the market.

- In-depth research reports on stocks that are well-positioned to beat earnings estimates.

- Three model portfolios designed to help you beat the market.

- Educational articles discussing the strategies followed by gurus.

- An active community of like-minded investors to share your findings.

Act now to secure the launch discount!

This article was written by

I am an investment analyst with 7 years of experience in financial markets. I specialize in U.S. equities and incorporate a top-down approach to identify developing macro-level trends and the companies that would benefit from such trends. I am a strong believer that the best investment opportunities could be found in under-covered equities. Please click the "Follow" button to get timely updates on new articles.

I am the founder of Leads From Gurus, a Marketplace service on Seeking Alpha that focuses on uncovering alpha-generating opportunities.

I currently work with leading financial publications including Refinitiv, Seeking Alpha, ValueWalk, and GuruFocus.

I'm a CFA level 3 candidate, an Associate Member of the Chartered Institute for Securities and Investment (CISI, UK), and a candidate in the Chartered Wealth Manager program.

During my free time, I enjoy reading.

Disclosure: I/we have a beneficial long position in the shares of FVRR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.