Metro Sees Some Gross Margin Pressure With More To Come

Summary

- Metro Inc. management made some interesting comments that helped us understand what the next year could look like.

- Consistent with the inflation figures, food inflation has not been irrelevant, chugging along YoY, and this has impacted Metro's food retail.

- Cosmetics and pharmaceuticals, the latter mirroring CVS, show that COVID-19 and the flu season are helping things go in the higher margin segments.

- Despite positive mix effects, promotional programs and people's focus on value is bringing down pricing growth on the new typical basket, and there's new waves of COGS inflation coming.

- Metro valuation is in line with peers, and while it's a reasonable price for the current market environment, it doesn't have the spice to compel investment.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Ibrahim Akcengiz

Metro Inc. (OTCPK:MTRAF, TSX:MRU:CA) has been staying ahead of inflation and producing decent growth of 14% in EPS. The multiple is low at around 12x on a forward basis, and it produces the sort of earnings yield that investors want as rates come up. However, there are continued inflation pressures on the horizon, and negative latent effects on gross margin have built up. Moreover, the demand side is getting more and more competitive. Overall, Metro Inc. is a fairly valued company but not an idea with any special edge.

Discussing Q1 2023

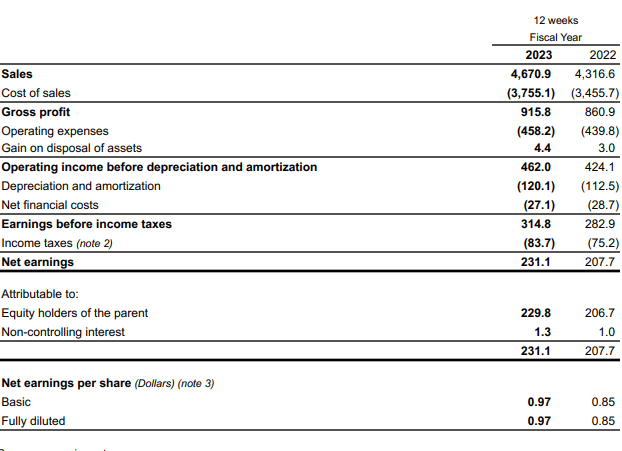

The Q1 results have come out and they're pretty good. Food sales were up 7.5% in retail channels, pharmacy sales were up 7.7% driven by non-prescription products up 10.2% (prescription drugs up 6.5%). Cosmetics and beauty products drove things in the pharmaceutical business, and these are typically higher margin segments that should have produced positive mix effects, but inflation affected the ability to grow gross margins, which shrank from 19.9% to 19.6%. Gross profit still grew over 8% because the 8.2% sales growth outpaced the COGS growth, but inflationary effects are visible. Operating remained quite stable, growing only 4%.

Income Statement (Q1 2023 PR)

Upcoming Pressures

Firstly, the company is expecting further growth in OPEX, where it was 4.5% already. Labor is one issue, where minimum wages in Quebec are up 7% to give an idea, and labor availability still remains tight causing more concerns around how labor costs will rise for the company. Apparently Metro Inc., with its somewhat considerable bargaining power, did a blackout of allowing price increases from its vendors since November that has mitigated the situation so far. That means that over the last few months the next wave of price increases are building up to be released soon, coming from vendors in OPEX but also in inventory, which is one of the areas where inflation is not really very under control, especially in food. So, there's also going to be another wave of price increases coming from vendors in the COGS line.

On the demand side, people are really stretching their dollars, and promotional services in place for customers are being fully utilized. The typical basket for Metro customers is becoming cheaper, and this is a pressure on ARPC, especially with retailers watching each other and drawing red lines for themselves past which prices cannot rise.

Still, things are going decently well in pharma. While some businesses are struggling with COVID-19 reversals, discretionary COVID-19 related spending on things like tests, also being pushed by an oncoming flu season, continue to help demand. Cosmetics are showing some resilience, too. But the issue around gross margins and margins in general remains even for these segments.

Metro Inc.'s forward P/E is around 12x, which is quite low and offers a decent earnings yield ahead of the increasingly higher rates (the dividend of 2.2%, though, is a little lacking). But because there are mounting pressures, and because there are still unbelievable bargains available on global markets, Metro Inc. stock is not cheap enough to really compel a buy. If the direction were better, it might be a better consideration, but as it is, Metro Inc. is not cheap enough.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.