Wix.com Earnings: Aiming For Rule 40 In 2 Years

Summary

- Wix.com Ltd.'s message to shareholders is that it's cutting back costs and doing what it can to be free cash flow and GAAP positive.

- Wix.com expects to reach a Rule of 40 by 2025.

- Despite the alluring narrative around this stock, I'm not inclined to pay 30x forward free cash flow for Wix.com Ltd.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Dogan Kutukcu/iStock via Getty Images

Investment Thesis

Wix.com Ltd. (NASDAQ:WIX) was once a high-flying stock. Today, WIX stock is priced at a significant discount from its prior highs.

Under the careful watch of an activist shareholder, Wix has been incentivized to move rapidly forward with its profitability targets. This saw Wix bring its GAAP net income guidance forward by at least 1 year.

All that being said, I'm not compelled to pay 30x forward free cash flows. Here's why.

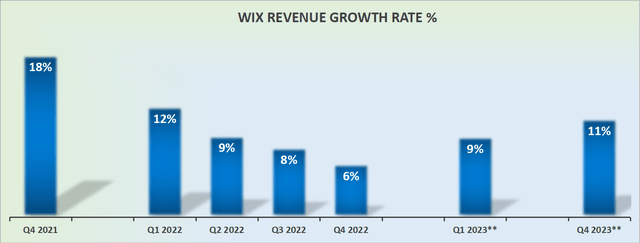

Revenue Growth Rates Reaccelerate

The main problem I have with Wix is that its growth rates are simply not there anymore. And when a stock goes ex-growth, the multiple compresses.

Moreover, not only do I have to navigate uphill against the Fed, with the Fed tightening the money cycle and raising interest rates, but I also have to contend with the fact that post-pandemic, the appetite to ''website build'' will significantly taper off.

On the other side of the argument, consider this:

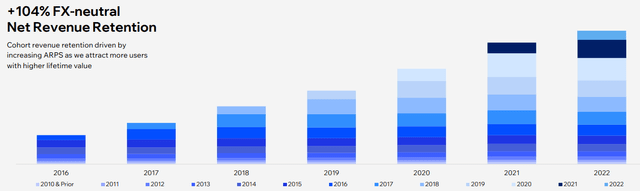

As you can see here, WIX's net retention rates are very strong and ended 2022 above 100%. That means that, through upselling more services and customer retention, WIX's billings remain very strong.

On yet the other hand, this also reinforces my whole argument. Those startups that wanted to build a website as part of their digital transformation already did so back in 2020-2021.

Today, the late adopters aren't going to meaningfully move the needle for WIX. At least in the coming year.

Furthermore, to a large extent management, also recognizes this insight. And that's why WIX is now resolutely focused on improving its profitability profile, which is what we'll discuss next.

Digital Transformation Business That Actually Makes Free Cash Flow

Previously, back in WIX's 2022 Analyst Day, Wix was guiding for GAAP profitability to arrive beyond 2025.

However, together with its Q4 earnings results, Wix has now brought forward this target. WIX now expects to reach GAAP net income in FY2025! Bring forward its profitability by at least 1 year. Whether they achieve their GAAP targets sooner or later than 2025 is plainly unpredictable.

After all, recall, two years ago, when WIX stock was changing hands at $300 per share, few would believe that in just 2 years the stock would be trading at such a dramatically different price. In this case, a full 70% discount from that price point. This discussion naturally brings us to discuss WIX's valuation.

WIX Stock Valuation -- 30x Free Cash Flow

Looking ahead to WIX's exit rate from Q4 2022, in the best case, the business' free cash flow margins will be around 11%.

Yes, this is a massive improvement from 2021 and 2022, and 2022 in particular, which saw WIX end with negative free cash flow margins.

But I have to question whether paying 30x forward free cash flow is a reasonable multiple for a business that's expected to exit this year with little more than 10% CAGR?

The Bottom Line

Finally, on top of all this, Wix.com's balance sheet is not the best. Not only does it carry $200 million of lease liabilities, but perhaps most critically, it also has $360 million of convertible notes due in the next twelve months. This puts Wix.com Ltd. on an enterprise value of more than $6 billion. For $180 million of free cash flow? No thank you.

As a whole, I believe that the verdict is still out on whether Wix.com Ltd. is such a compelling investment, particularly when we're asked to pay 30x forward free cash flow.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.