Michelin: Supportive Q4, Reiterating Buy

Summary

- DPS is up by 11% and there is still a safe balance sheet. All in line (once again).

- Positive price mix evolution which fully supports Michelin's business model resiliency.

- Michelin is more cautious for the current year. However, the company confirmed a stable 2023. Our buy rating is then confirmed.

kenneth-cheung

Since our recent update called 'All in Line' which was released in early January 2023, Compagnie Générale des Établissements Michelin (OTCPK:MGDDF; OTCPK: MGDDY) is up by another 5%. However, we are still a bit far from our target price, and after the Q4 accounts, here at the Lab, we decided to maintain our buy rating expectation. As a reminder, our readers might look at our previous publications titled 1) Looking At The Russia Exit Implications and 2) Tire Market Improvement Continues. In detail, our overweight was supported by a strong track record in offsetting inflationary pressure, Nokian's Russian exit implications, China reopening, and an interesting valuation backed by a safe dividend and a solid balance sheet.

Keeping these key points in mind, here are the Q4 and FY 2022 main highlights:

- In 2022, Michelin's sales increased by 20.2% to €28.6 billion, underlining its rigorous pricing policy and the rapid growth of its Non-Tire activities (which we are not valuing in our sum-of-the-part valuation);

- The tire market is slightly up, driven by original equipment sales and sustained demand from the Truck and Mining segments. However, tire volume fell due to the conflict in Ukraine and the health crisis in China, but this was a key strategic choice to protect margins. In detail, because Michelin is an industrial player, the company was able to preserve the unit margin, offsetting a record increase in costs of more than €2.7 billion;

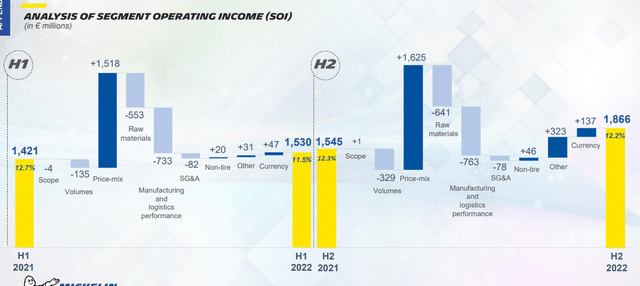

- Mare Evidence Lab's key point was the positive price mix evolution which came to 13.7%, demonstrating Michelin's ability to offset all cost inflation outputs (Fig 1). In our numbers, we also anticipated a positive FX evolution that was linked to the US dollar, in numbers, the French tire manufacturer had a 6.2% benefit;

- Going down to the P&L, the company's operating profit reached €3.4 billion compared to the €2.97 billion achieved in 2021. Net income had the same positive trajectory delivering €2 billion vs €1.85 billion in 2021. Cross-checking Wall Street analyst numbers, according to FactSet, they were forecasting sales, EBIT, and net income of €27.91, €3.27, and € 2.09 billion respectively. Michelin recorded a broad-based-beats. We might expect positive stock price evolution and a few re-ratings in the near term;

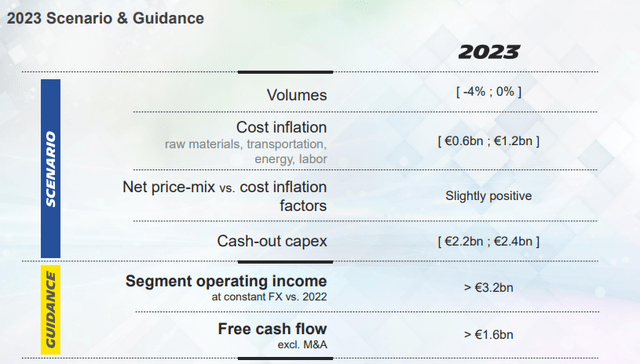

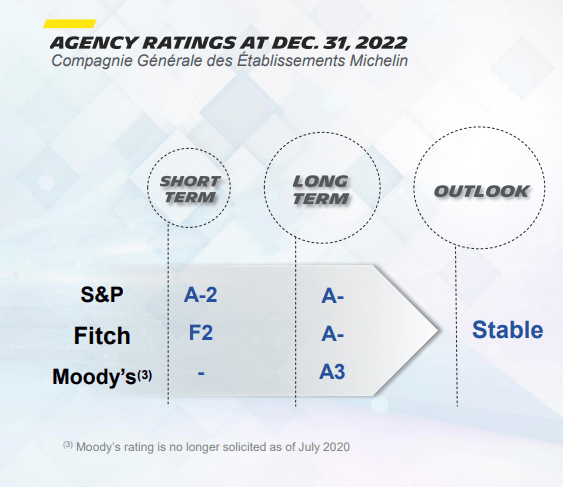

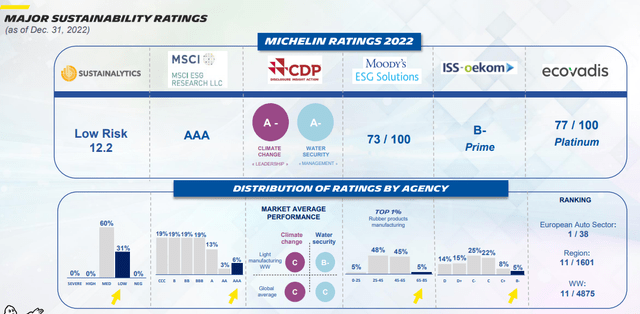

- Still related to our thesis, there is a dividend proposal for €1.25 per share up by 11% which fully supports our thesis (Fig 2). More in detail, Michelin's payout is still below its indication at 44.4% (lower than the 50% target). This is also coupled with a safe balance sheet (Fig 3). To be precise, gearing reached 25.2% at December end and was up by €1.5 billion from the previous year. Aside from the debt agencies, the non-financial rating agencies also confirmed Michelin's excellent ESG performance. In detail, the company scored as top-tier in the European automotive universe and was confirmed by CDP and Moody with ratings of A- and AAA respectively (Fig 4).

(Fig 1)

Michelin dividend proposal

(Fig 2)

Michelin debt rating agency

(Fig 3)

Michelin sustainability ratings

(Fig 4)

Conclusion and Valuation

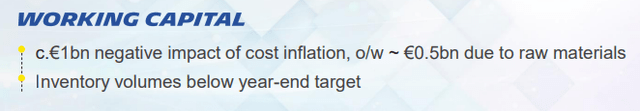

The company is a truly global player and thanks to its strategy are rebalancing its industrial footprint lowering the European Union dependency and increasing the Asia-Pacific geography. With its local-to-local sales and better supply chain management, the company was also able to reduce inventory requirements (Fig 5). In addition, Michelin demonstrated its business model resiliency and is forecasting a 2023 stable market demand. Michelin's objective is once again to generate an operating profit of over €3.2 billion at constant exchange rates and free cash flow before M&A of more than €1.6 billion (Fig 6). For this reason, regarding the company's valuation, we fully confirmed our previous analysis. Michelin is still trading at a lower multiple on the EV/EBITDA basis compared to its historical average (4.69x vs 5.5x). Based on our 2023 accounts (in line with management indication), we confirmed our target price of €33 per share (and $17.6 in ADR).

(Fig 5)

(Fig 6)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.