Fusion Fuel: EU Decision On Nuclear Hydrogen Changes My Outlook From Strong Buy To Hold

Summary

- Faced with completely losing access to Russian gas, as well as due to environmental reasons, the EU decided to make a major bet on green hydrogen.

- Fusion Fuel is a startup with much promise in solar to hydrogen conversion, especially given all the financial support it has been receiving.

- A recent decision by the EU to tacitly accept nuclear to hydrogen as almost green may dampen Fusion Fuel's longer-term prospects somewhat.

- The one thing that it still has going is the fact that many countries in the EU are against nuclear power, therefore, nuclear-derived hydrogen will not be produced in excessively large volumes, leaving plenty of room for green hydrogen.

Vanit Janthra

Investment thesis: Fusion Fuel (NASDAQ:HTOO) is the solar-to-hydrogen conversion company that is set to start producing at the precise right time when Europe seems to be at a crossroads in terms of its energy future. There is no longer much doubt about the EU going all-in on the post-hydrocarbon energy transition, regardless of how risky of a proposition it may turn out to be. Large subsidies that have been greatly benefiting Fusion Fuel have been awarded, and even more, are in the pipeline. A recent EU decision, however, may potentially lead to a reduced emphasis on the need to transform wind or solar power into hydrogen. Nuclear to hydrogen conversion was lobbied for by France and it obtained a carve-out, where it is considered to be equivalent to green. With this, Fusion Fuel is likely to see somewhat less interest in its success, while price competition against hydrogen derived from nuclear power is likely to squeeze green hydrogen's pricing power in the long term. As a result, I am switching my outlook on HTOO stock, from a Strong Buy, as I indicated in my last article on the company, to a Hold.

Fusion Fuel is yet to prove itself as a viable solar to hydrogen producer, but it is getting closer and the very significant government grants are helping it to implement its projects without having to heavily rely on stock dilution or take on debt to cover its startup costs.

There is yet to be anything of any great significance for investors to sink their teeth into in terms of Fusion Fuel's financial results. It is still in the pre-production stage at this point. The H2Evora project is ready to go and awaiting formal commissioning. It is a small pilot project consisting of 15 Hevo-Solar generators, with hydrogen storage, as well as a Ballard fuel cell to convert the hydrogen into electricity to be fed into the grid. In a best-case scenario, each unit can produce up to a ton of hydrogen per year. Once we will see some concrete results from the project, we will be able to conclude some things, but it will still be limited. It is always nice to see a small step taken by a startup into actual revenue generation, even if at a very small scale.

The H2 HEVO-Sines Project is of far greater consequence to the company's overall future. It is estimated to cost 147 million euros and it is expected to generate over 9,000 tons of green hydrogen annually. We will see how long it will take before we actually see such a large-scale project come to full completion. Based on Fusion Fuel's reporting on the greater Sines project that involves a few other companies, the aim is for 2026. Before that, a few more smaller-scale projects are set to come online.

As I already pointed out, the constant inflow of government grants is great in terms of helping to preserve the share price of investors. Fusion Fuel has not had to issue shares excessively. For the third quarter, the number of shares outstanding increased by about 300,000, to 13.42 million. It is a significant increase, but it is nowhere near as dramatic as what we often see with startups that are yet to experience significant revenue inflows. As long as Fusion Fuel avoids taking on sizable debts, it improves its future prospects of survival as well as profitability, since debt-servicing costs will not weigh it down to an excessive degree, as it sometimes happens with startups.

EU compromise on nuclear hydrogen makes Fusion Fuel's future prospects more uncertain.

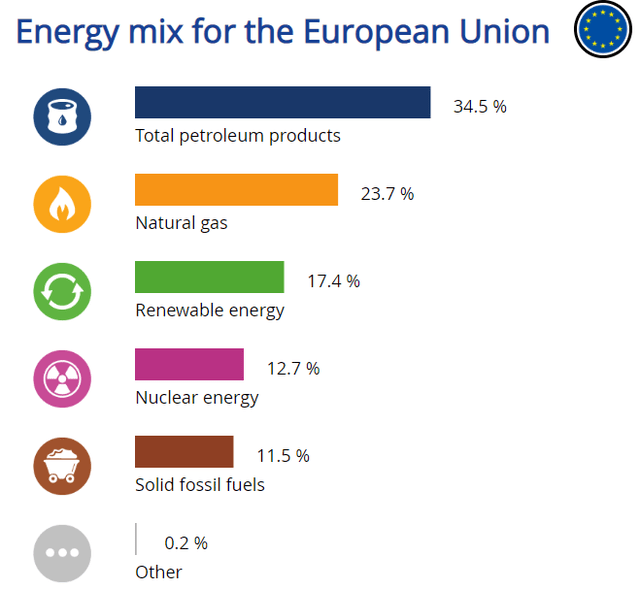

Looking at the EU's current energy mix, within the context of the EU green energy plan, which among other things envisions a roughly 10 million tonne green hydrogen production capacity by 2030, it becomes clear that nuclear hydrogen will not become dominant in terms of future hydrogen volumes. There does not seem to be much nuclear power capacity to spare, especially within the context of utilities having to limit the amount of natural gas that they burn.

Eventually, the EU wants to have as much as 20% of its power come from green hydrogen, by 2050 as the ultimate goal. Based on current nuclear power investment plans, as well as decommissioning plans for the rest of the decade, it does not look like the EU will see much of a change in its nuclear power production capacity. There are a few projects set to add capacity, but there are also a few reactors that are set to be decommissioned this decade.

The French government lobbied for allowing nuclear hydrogen given its massive nuclear power capacity, which would potentially allow it to allocate some portion of the power to hydrogen production. It is unclear how much of an impact it will have on Europe's green hydrogen supply. The one country that could turn out to have a larger impact on the European green hydrogen market with its nuclear hydrogen supplies is Hungary. It is currently building two new reactors at its Paks nuclear facility, and as long as the older reactors will also kept online, Hungary could have significant spare nuclear power capacity to spare, which it could allocate to producing significant volumes of hydrogen. Other than France & Hungary, it does not seem like there are many other countries or companies looking to produce significant volumes of hydrogen from nuclear power.

Investment implications:

Keeping in mind energy loss issues in the electrical energy-to-hydrogen conversion process, as well as the fact that Europe's nuclear power capacity is not likely to grow going forward, it is unlikely that nuclear power-derived hydrogen will account for more than 10% to 20% of all green hydrogen supplies in the EU. There is simply not enough nuclear power capacity in the EU for more hydrogen to be produced in the long term. Only in the unlikely scenario that we will see a sudden revival in nuclear power adoption in the EU will there be more nuclear hydrogen produced. The rest will mostly come from turning solar or wind power into hydrogen through the process of electrolysis.

Even with a minor role in the future green hydrogen supply chain, nuclear hydrogen is likely to impact the overall EU energy market, because it can affect market prices. In the event that it will be cheaper to produce than solar or wind-derived hydrogen, it might be the first to respond to rising prices with extra supplies, thus it could potentially put some pressure on future profit margins for future green hydrogen producers like Fusion Fuel. With this EU decision, its future profitability prospects are set to see a potential net negative impact. In other words, the odds of being invested in this startup paying off have declined, given a deteriorated potential risk versus potential reward picture, which is why I am switching from a Strong Buy rating on Fusion Fuel to a Hold. It may deserve an upgrade back to buy, once it starts to show some actual operational success. Until then, I personally intend to hold my current position, with no plans to increase my exposure to Fusion Fuel stock.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HTOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.