Insurance and investment should never be combined. Individuals often tend to view an insurance policy as an investment vehicle. (Representative image)

Insurance plays an important role in the overall wellbeing of individuals, by mitigating risk. Apart from providing monetary compensation in the case of unforeseen events, it plays a significant role in ensuring emotional health as well.

We promptly take vehicle insurance despite its value eroding within five years. However, many of us do not put equal effort into insuring our lives, which is far more precious. Research highlights that less than three per cent of individuals have taken term insurance.

So, it is evident that we Indians are underinsured when it comes to Life Insurance.

Why Choose Term Insurance?

Term Insurance is a pure insurance product that covers your life. In the event of death, your nominee/dependent gets the sum insured. The premium for a term policy is the lowest among all life insurance policies.

Every individual who has a financial responsibility or is the sole breadwinner should have a term policy. This will ensure that in case of an untoward incident, the lifestyle of near and dear ones is not disrupted from a financial perspective, as they get the sum assured by the policy.

If the individual survives the tenure of the policy, he/she does not get any money as it is not a money-back plan.

Remember, term insurance is more valuable at the beginning of your career when your savings or investments are low and responsibilities are higher. The tenure of the policy should normally be till the working or retirement age of the individual.

Term insurance requirements can reduce as your investments become / grow more than your financial responsibilities.

Don’t Combine Insurance And Investment

Insurance and investment should never be combined. Individuals often tend to view an insurance policy as an investment vehicle. Hence, they end up buying an investment-cum-insurance policy looking to get the best of both worlds.

The fact that in term insurance you don't get any money back in case you survive the term of the policy prompts some individuals to think that their money (premium) has been wasted.

Also, people do not use a uniform metric to evaluate returns in a money-back insurance policy such as compound annual growth rate (CAGR) or Internal rate of Return (IRR), which are used to evaluate mutual funds or other investment products. Most often individuals use absolute return / point-to-point return to evaluate an investment cum insurance policy.

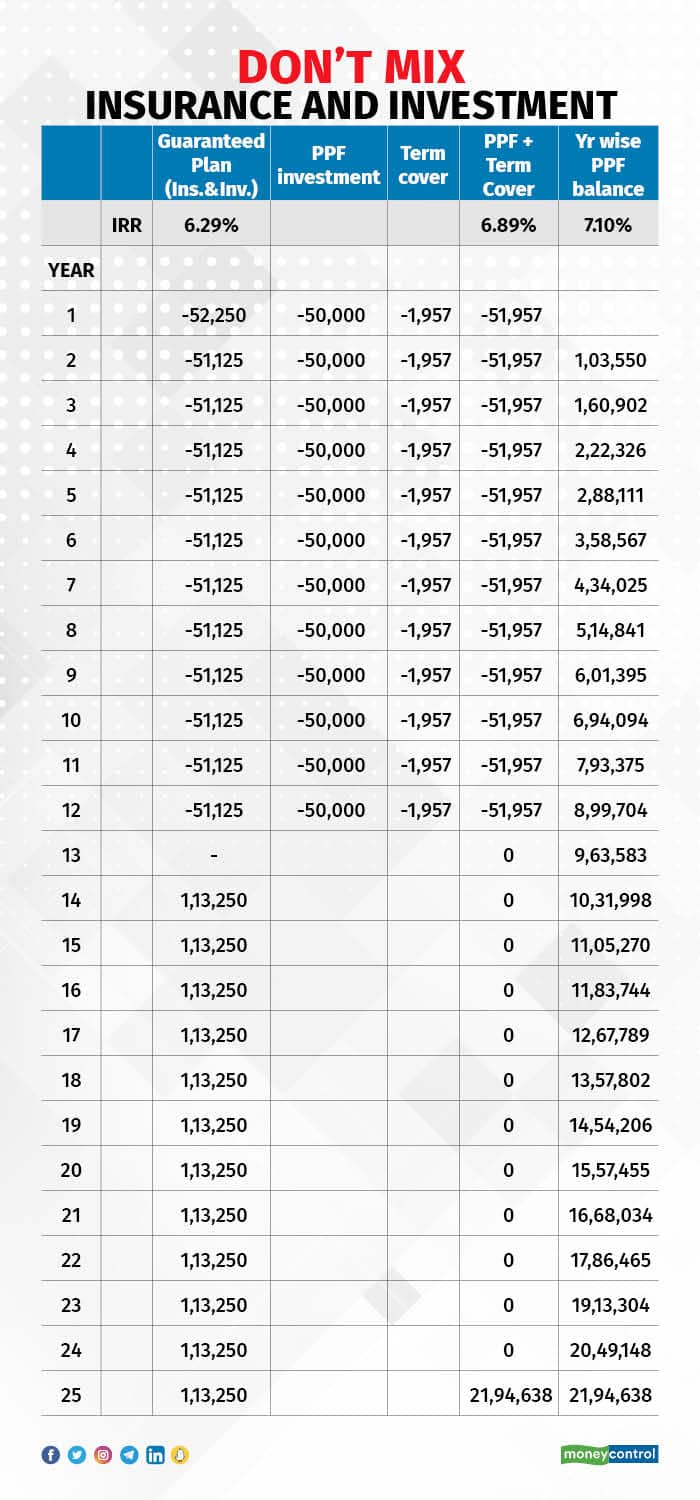

Note: For PPF a/c to remain active one has to deposit a minimum of Rs 500/yr. This has not been factored in as the IRR of (PPF + Term insurance) would be even higher.

The Worst Of Both Worlds

For example, an insurance cum investment policy provides a guaranteed return of Rs 1.13 lakh for 12 yrs (14th to 25th year) for an annual premium payment of Rs 50,000 for the first 12 years. The individual interprets this policy as providing 227 per cent returns (13.6 lakh divided by 6 lakh) or average 9.08 per cent return (227 per cent divided by 25 years). However, the IRR of this policy is 6.3 percent.

The sum assured on this policy is Rs 8.1 lakh.

An investment product such as PPF yields an annual return of 7.1 per cent but is not perceived to be a good investment. In practice, if one had invested in similar fashion in a PPF (which also enjoys similar EEE tax benefits) the investment would be worth Rs 21.95 lakhs in 25 years.

The term insurance premium amount for a separate and equivalent term cover (as in the policy detailed above) for Rs 8.1 lakh would have been approximately Rs 2000 per year. Even after factoring in this premium amount, the individual would still have been richer as the IRR would have been 6.9 per cent if invested in PPF.

In the above example, the comparison is with one of the highest earning guaranteed policies (IRR of 6.3 per cent). Most of the other money-back or endowment policies provide lower returns.

So, it is quite evident that an insurance-cum-investment product does not provide meaningful returns nor does it provide adequate coverage. Since there is a cost to the attached insurance, the return is lower. Since it is a money-back policy, the sum assured is lower.

In other words, it is the worst of both worlds.

The recent Budget had a proposal to tax guaranteed policies (with an annual premium of more than Rs 5 lakh). And that is one more reason for individuals to separate insurance and investment.

K Shankar is co-founder of Finanza Personale. Views are personal and do not represent the stand of this publication.