GFL Environmental: Valuation Gap With Peers Should Close Over Time

Summary

- GFL is an excellent, recession-resilient business run by an incentivized management team.

- The market does not appreciate GFL's inflation-protected cash flow stream.

- Given GFL is a relatively new publicly traded company, its discount with peers should narrow over time as it proves it can deliver consistent growth and meet/beat its long-term guidance.

typhoonski

Executive Summary

Despite delivering impressive growth over the past few years, with a CAGR of 30% in revenues and 37% in EBITDA from 2017 to 2021, GFL Environmental (NYSE:GFL) trades at the lowest multiple in its peer group.

Currently, the company's EV/EBITDA multiple stands at just 11.8x, compared to an average of nearly 15x for its peers. This presents an attractive opportunity for investors looking to invest in the waste management industry, which has high barriers to entry, no cyclicality, and little obsolescence risk.

Situation Overview

GFL Environmental is a Canadian-based environmental services company that provides a range of waste management services to customers across North America. The company operates through two primary business segments: solid waste and liquid waste. With a vast network of disposal facilities and assets, GFL Environmental offers a comprehensive suite of services including collection, transportation, disposal, recycling, and processing of solid and liquid waste.

The waste management industry is attractive for two main reasons:

Firstly, it is highly stable, with organic growth of approximately 4-5% per year driven by volume growth and price increases. The waste management industry has significant pricing power due to the fact that waste collection typically represents a small portion of customers' overall cost structure, meaning that even significant pricing increases have a minimal impact on customer behavior.

Secondly, the waste management industry benefits from high barriers to entry in local markets, which limit competition and provide pricing power to major players. These barriers include the need for significant capital investments in equipment and facilities, complex regulations, and the difficulty of building and maintaining relationships with local customers. Additionally, efficient route density (driving more pickup volume per garbage truck) allows larger companies to operate more efficiently, drive better margins, and undercut smaller competitors to gain market share. In fact, scaled waste management companies can leverage their scale to invest in technology, maintenance, and customer service, further strengthening their competitive advantages, while smaller competitors struggle to compete on price, maintain quality and reliability, and keep up with larger competitors. As a result, the waste management industry exhibits a high degree of stability at the top, with large waste collection companies that have achieved local scale rarely being displaced.

Overall, the waste management industry presents an attractive investment opportunity for seeking long-term growth with minimal risk of obsolescence, owing to its combination of high barriers to entry and attractive industry structure.

GFL's Growth Opportunity

Despite benefiting significantly from economies of scale, the waste collection business remains highly fragmented. In Canada and the US, the three largest companies hold only 30% and 50% market share, respectively, with the remaining market consisting of thousands of small mom-and-pop or regional businesses (Source: GFL F-1 filing). This presents a significant opportunity for scaled waste management companies to consolidate these businesses and achieve considerable synergies. GFL, which operates with higher leverage (4-4.5x debt/EBITDA vs 2.5-3x) and deploys more capital into mergers and acquisitions than its peers, has been able to leverage this opportunity to grow faster than its peers. In fact, this levered capital structure is optimal for the business given the attractiveness of tuck-in M&A and the industry's stability.

Since 2007, GFL has completed over 100 acquisitions, which were completed at an average EBITDA multiple of 7.0x, before synergies (Source: GFL 2022 investor presentation). Post synergies, these deals were completed at an average EBITDA multiple of 5.0-6.0x EBITDA, providing high internal rates of return when financed with 4-4.5 turns of leverage. Since its IPO, GFL has committed to continuing this M&A program. Management has indicated that they expect to execute 25-30 tuck-in acquisitions annually for businesses with $1-10MM of EBITDA.

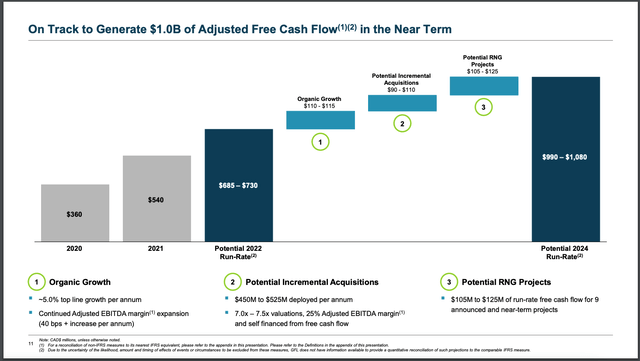

In their 2022 investor day presentation, GFL’s management team outlined a bridge to a 2024 exit FCF run rate of $990-$1,080. The company has consistently surpassed similar guidance in the past, and I believe this trend will continue. The projected FCF run rate and EBITDA are based on conservative volume growth assumptions in the aftermath of COVID, and M&A expectations that are modest compared to GFL's past track record.

Finally, one of the attractive aspects of GFL's waste management business is that it is inflation-protected. This is due in part to the fact that GFL's pricing is typically linked to the consumer price index (CPI). As inflation rises, GFL is able to increase prices accordingly, maintaining its margins and protecting against the negative effects of inflation. In addition, waste management is generally considered to be a non-cyclical industry, meaning that it is less susceptible to economic downturns and recessions. This provides a level of stability to GFL's business model which in turn allows the business to maintain its levered capital structure that is designed to magnify shareholder returns.

Overall, given GFL's history of surpassing guidance, it is likely that the actual results will exceed the projections.

GFL's 2024 guidance (GFL Environmental)

Valuation

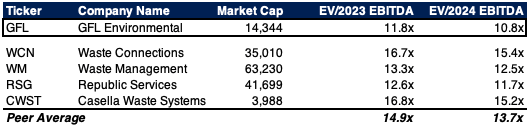

Valuation Table (MontrealValue)

The opportunity and investment thesis in GFL are relatively straightforward.

On the qualitative side, this is a high-quality business run by a shrewd management team with skin in the game –and aligned with creating shareholder value. On the quantitative side, GFL trades at approximately 10x forward EBITDA, which is a significant discount to its peers, with Waste Management (WM) and Republic Services (RSG) trading at around 11-12x, and Waste Connections (WCN) and Casella (CWST) trading at around 15x. This discount appears unjustified, considering that the quality level of GFL's assets is no worse, if not better than some of its peers. In fact, after considering various factors such as GFL's growth, insider alignment, optimal capital structure, and history of successful M&A, it seems reasonable that the company should trade a premium to its peer group.

On 2023 estimates, if GFL stock were to rerate just in line with its peer group, shares would be worth ~$59 per share, or roughly 45% higher than its current price.

Given GFL is a relatively new publicly traded company, its discount with peers should narrow over time as it proves it can deliver consistent growth and meet/beat its long-term guidance.

Risks

Investing in GFL Environmental comes with a few risks. Firstly, waste management is a capital-intensive business, and GFL operates with a leveraged capital structure. This means that any changes in interest rates could impact the company's profitability and ability to service its debt. Additionally, as a Canadian company, GFL has exposure to fluctuations in the Canadian dollar exchange rate, which could impact its revenues and profitability. The company does hedge some of its exposure to foreign exchange risk, but there is still some potential for volatility. Finally, waste management is a heavily regulated industry, and any changes in regulations or enforcement could impact GFL's operations and financial performance.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GFL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.