Acadia Healthcare: Well-Positioned To Capitalize On Growth Trends In Mental Health Care

Summary

- We retain our constructive posture on ACHC stock taking a longer-term view.

- Acadia Healthcare is well-positioned to capitalize on emerging growth trends in the mental healthcare market.

- Profitability remains the standout characteristic with consistent growth in ROE and returns on capital.

- Looking ahead, this bodes in well for its future growth profile, whilst maintaining a healthy portion of FCF distributable to equity holders.

- Net-net, reiterate buy at $94.

naphtalina/iStock via Getty Images

Investment Summary

After a reasonably lengthy run to the upside across FY22', shares of Acadia Healthcare Company, Inc. (NASDAQ:ACHC) are still attractive in our estimation. In our last publication on ACHC , we outlined the company's tremendous growth profile, underscored by the addition of 200 new beds from Q1-Q3 FY22', including its goal of adding 600 beds by the end of FY22'. Turning to the present day, we opine that ACHC presents with robust fundamentals, and trades at a premium to sector peers on forward-looking multiples, indicating the market's expectations for an outsized period of growth for the company. Moreover, ACHC is equally as well positioned to capitalize on emerging growth trends within the broad mental health market, discussed in detail here. In this deep dive, I'll run through the underlying crosscurrents in ACHC's end-market, and illustrate why we are still constructive on the company with a long-term view. Net-net, reiterate buy at $94 price target.

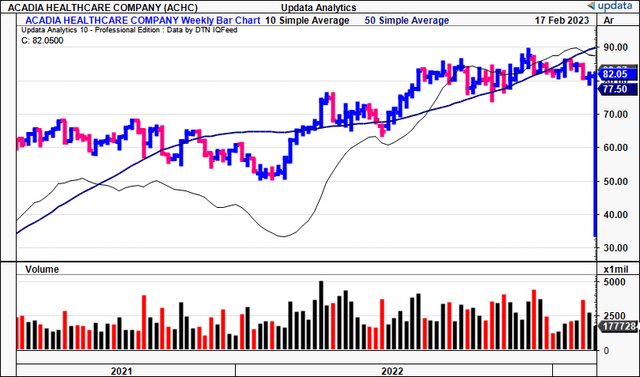

Fig. (1) ACHC 2-year price evolution

ACHC well positioned to capitalize on growth trends in mental health market

As a reminder, ACHC operates in the behavioural healthcare services sector, with a network of facilities distributed across the U.S and UK, and, most recently, in Puerto Rico. The company books revenues mainly on patient admissions and their subsequent length of their stay. As mentioned in our last publication, in Q3 FY22' it reported top-line revenue growth of 13.5% to $667mm on adj. EBITDA of $163mm. On this point, it's worth noting that healthcare services' companies face inherent challenges to growth. Principally, expansion is obtained over a continuum of overall patient growth, the revenue obtained from said patients, and the number of facilities to drive both of these factors. The latter becomes increasingly important, as, one facility can only see a set number of patients at one time, lengths of stay vary, and patient charges can only increase so much before reaching a cap. Hence, looking at its model in greater detail, ACHC has focused on achieving upsides in all 3 domains listed above, ultimately adding to revenue growth and profitability. Critically, its facilities book an average length of stay of ~20 days, and, in its last report, the firm saw another 6.9% gain in its revenue per patient day, notwithstanding its growth in patient beds described earlier.

Looking to the underlying market itself, our findings indicate the mental health industry is facing unique hurdles to overcome. However, said hurdles have also created opportunities for innovation in the development and delivery of mental health services. The market is expected to reach $527Bn globally by FY230', growing geometrically at a 3.4% per year until that time. Additional research points to a CAGR 3.5% over the same period. However, the demand for services [measured by new diagnoses and required services] far outpaces these growth rates, creating a strong investment opportunity for players like ACHC to capitalize on. We believe this is a key point of consideration in the investment debate. Allied Market Research noted that "[t]he key players operating in the global market include Acadia Healthcare" and so the company is considered to be at the tip of the spear with respects to enterprise and investment opportunity. Moreover, ACHC is growing faster than the projected c.3.5% CAGR into FY30' [12.5% and 25% revenue and FCF 5-year average growth, respectively], illustrating it is likely capturing further market share. Put simply, to close the gap in service demand to supply, players such as ACHC are the centre point of focus to achieve this by expanding footprint, and thus, patient services.

Furthermore, investor confidence in mental health companies remains high, as demonstrated by the increasing deal sizes and valuations in the sector. Looking closer at the private sector, average post-deal valuations lifted to $418mm in FY22', up from $182mm in FY20' as a key illustrator of this. Further, despite a much higher rate of mental illness in FY20', thought by the WHO to be accelerated by Covid-19 lockdowns, the use of inpatient mental health services remained unchanged from 2013, which is a promising sign that mental health services may be providing more effective care. These trends highlight the potential for mental health services to continue to grow and improve, providing greater benefits for patients and investors alike.

ACHC profitability a standout

There's mixed signals from economic indicators on the prospects of a "hard landing" versus a "soft landing" for the U.S. and global economies [there's even been talk of no landing at all]. Goldman Sachs U.S. equity strategist David Kostin recently mentioned the U.S. equity market is pricing in a soft landing, whereas S&P 500 earnings revisions "point to a hard landing". In a world where earnings and profit margins are under pressure, profitability remains the key standout for companies to ride out any economic storm. ACHC's fundamentals outperform in this domain. Its railing ROE and return on capital are well above the sector at ~11% and 6.4%, respectively [see: Figure 2]. Moreover, looking at its ROE and ROC to self-averages, it has grown both by ~145% and 36.7% over the last 5-years respectively, further illustrating our point. To appraise the performance of its own investments, you'll note that it turns over $0.53 for every dollar invested into its asset base [asset turnover = 0.53x], and it generated $226mm in TTM FCFE [see: Figure 3]. Here, we measure FCFE as the net operating profit after tax ("NOPAT") minus the investment in future growth, per Mauboussin (2022). FCF is the keystone to corporate valuation as it illustrates the amount of residual cash a company can distribute to its equity holders - an absolutely essential criteria to gauge when establishing value as an investor in the first place. We want a company that is growing earnings, and FCF's, with little investment required to do so - a quandary that ACHC fulfils in out estimation. Looking further ahead, this is key evidence of ACHC's propensity to continue driving value for shareholders, in growing patient count, same-store and new-store growth, and, revenue per patient, as discussed earlier.

Fig. (2)

Data: Seeking Alpha, ACHC, see: "Profitability"

Fig. (3)

Note: Free cash flow is calculated as {NOPAT - Investments], where investments are 'investments for future growth' - measured by the cumulative change per period in invested capital. For more, see Mauboussin (2022): "Good Losses, Bad Losses All Losses Are Not Created Equal", Morgan Stanley Investment Management. (Data: Author, using data from ACHC SEC Filings)

Valuation and conclusion

Shares are trading at a premium to the sector at 26-27x forward consensus earnings [non-GAAP and GAAP respectively]. Despite the premium, this represents the market's expectations for an outsized period of growth in our opinion. It also trades at a 0.63x trailing PEG ratio and 2.6x book value, both at discounts to peers. Subsequently the debate for ACHC illustrates prospective valuation upside by estimation. Last time we valued the company at $94 per share, and this reflects a 28x P/E multiple, ahead of consensus estimates. Given its market leading status, growth trends in the underlying market, robust free cash flows, in addition to its high ratings in profitability, we retain this $94 target, representing ~15% upside potential at the time of writing.

The fundamental momentum ACHC exhibits is attractive and warrants a premium in forward-looking multiples. The underlying growth estimates in the mental health care market is also a standout that must be taken into consideration, given the firm's leading position as a service provider in the mental health domain. Moreover, extrapolating its profitability characteristics to date as we've done here illustrates a robust springboard for the company to continue growing its enterprise into the coming years. Hence, we reiterate ACHC as a buy.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ACHC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.