The Williams Companies: Handbrake Still Applied To Dividend Growth

Summary

- One year ago in early 2022, the expectations for The Williams Companies were quite low.

- They ended up posting surprisingly strong financial performance that saw their operating cash flow grow around 24% year-on-year.

- Despite being very positive, their guidance for 2023 sees no material growth forthcoming.

- When combined with their accompanying capital expenditure guidance that leaves little excess free cash flow after dividend payments and high leverage, I still see a handbrake on their dividend growth.

- Even though their moderate near-6% dividend yield is appealing, I believe that maintaining my hold rating is appropriate given this outlook.

Ratchapon Supprasert/iStock via Getty Images

Introduction

When last discussing The Williams Companies (NYSE:WMB) back in early 2022, their results for 2021 far exceeded expectations. However, as my previous article discussed, there was still a handbrake on dividend growth, metaphorically speaking. Despite once again seeing surprisingly strong financial performance during 2022, I still see the handbrake applied to their dividend growth going forwards into 2023.

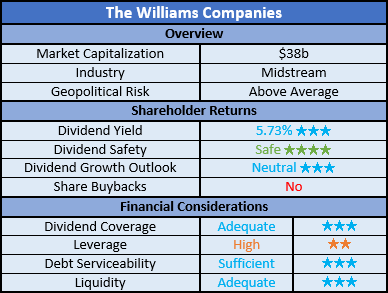

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

When I conducted the previous analysis early in 2022, expectations for the year ahead were not too high given WMB guidance at the time that only saw adjusted EBITDA growth of circa 3% year-on-year at the midpoint, as per my previously linked article. Well, as time showed, this ultimately proved far too conservative, with their financial performance coming in surprisingly strong and driving their operating cash flow to a result of $4.889b.

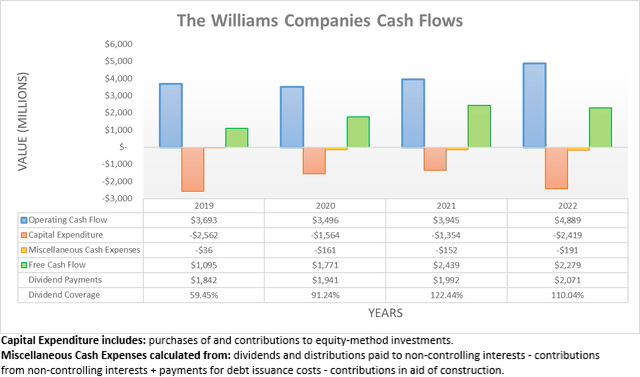

This represents a very impressive increase of almost 24% year-on-year versus their previous result of $3.945b during 2021, as their natural gas-focused assets benefitted from the otherwise tragic Russia-Ukraine war, sending commodity prices to levels seldom ever seen. That said, they were still only left with free cash flow ("FCF") of $2.279b that only modestly outpaced their accompanying dividend payments of $2.071b. Whilst this sees adequate dividend coverage of 110.04% that leaves them safe, it does not see much scope to fund higher dividends.

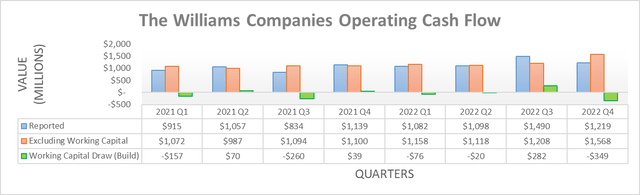

After viewing on a quarterly basis, their reported operating cash flow during 2022 beat their previous results during 2021 during every quarter. Even more importantly, this also applies to their underlying results that exclude working capital movements, therefore making for a consistently strong year instead of one that merely benefitted from a one-off extreme event during a single quarter. When looking ahead into 2023, it seems the good times are set to continue rolling onwards, but a little disappointingly, not set to keep growing much stronger.

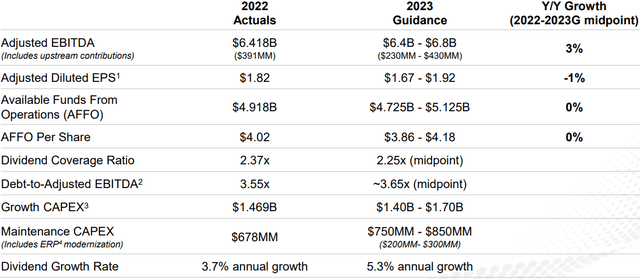

The Williams Companies Fourth Quarter Of 2022 Results Presentation

If reviewing WMB stock's guidance for 2023, management is forecasting their adjusted EBITDA to hit $6.6b at the midpoint, and thus circa 3% higher year-on-year versus their result of $6.418b during 2022. More disappointingly, their accompanying available funds from operations forecast, which is effectively a non-GAAP version of operating cash flow, sees no material increase versus 2022. Sure, it is not necessarily bad to cement their surprisingly strong financial performance during 2022 into a further year, but at the same time, it leaves nothing new on the horizon to excite shareholders.

Meanwhile, on the other end of their guidance for 2023, it sees growth capital expenditure increasing slightly to $1.55b at the midpoint, whilst their accompanying maintenance capital expenditure is forecast to also increase slightly to $800m at the midpoint. Depending on their working capital movements, this is likely to chew up the slight bit of excess free cash flow after dividend payments they saw during 2022.

Consequently, I still see a handbrake placed upon their dividend growth due to a lack of excess free cash flow, barring another surprisingly strong set of results. Admittedly, yes they appear to have scope to fund higher dividends if ignoring their growth capital expenditure but as the last few years have shown, the paradigm shifted after the Covid-19 pandemic whereby it is far more common for cash inflows and outflows to be balanced in the midstream industry, especially for those already sporting high leverage.

It should be remembered the division of growth and maintenance capital expenditure can be somewhat dubious across the medium to long term. Say, for example, there is a company with ten cars and they buy a new one, which is obviously considered growth capital expenditure. Although, say, one year later they scrap another old car as it reaches the end of its useful life, they are back to ten cars and thus, in fact, the eleventh car purchased was in part maintenance.

Now, apply this same logic to literally thousands of assets across their massive operations and, therefore, in my eyes, dividend coverage should be assessed via free cash flow including both growth and maintenance capital expenditure. Whether their growth capital expenditure propels their financial performance higher in 2024 and beyond remains to be seen but as a reminder, they invested over $35b during 2011 and 2021, which ultimately saw only minimal earnings growth, as per my previously linked article.

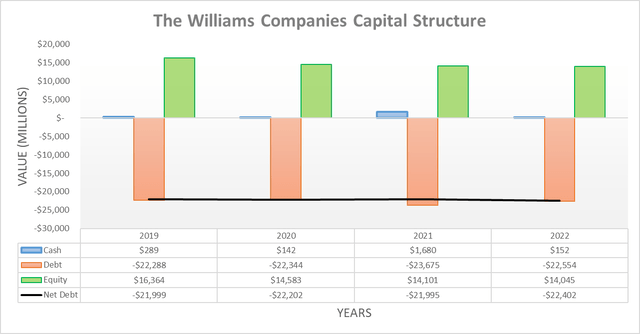

Since their free cash flow only modestly outpaced their dividend payments, there was not much scope to see their capital structure change during 2022. Unsurprisingly, their net debt ended the year at $22.402b and thus slightly higher than where it ended 2021 at $21.955b, which was largely down to the $921m spent on acquisitions net of divestitures. When looking ahead, their aforementioned guidance for 2023 indicates their net debt should broadly track sideways in the year ahead, absent of further acquisitions. That said, they are expecting to close a $1.5b acquisition for MountainWest Pipelines before 2023 ends, thereby meaning we should be looking at circa $24b of net debt this time next year, assuming no further material acquisitions or divestitures.

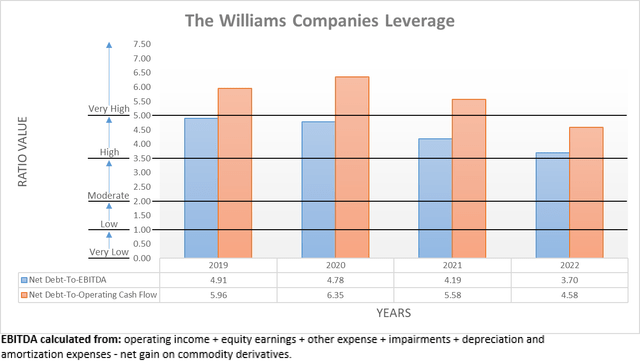

Even though their net debt edged slightly higher during 2022, their leverage still dropped noticeably thanks to their surprisingly strong financial performance with their net debt-to-EBITDA hitting 3.70 versus its previous result of 4.19 at the end of 2021. More importantly, the accompanying benefit to their cash flow performance saw their net debt-to-operating cash flow decrease to 4.58 versus its previous result of 5.58 across these same two points in time. As a result, it now drops out of the very high territory and thus joins their net debt-to-EBITDA in the high territory of between 3.51 and 5.00.

Despite sounding scary or concerning, high leverage is not problematic for a midstream company given their stable financial performance. Although, it nevertheless cannot safely increase significantly in the short-term and thus, it only further tightens the handbrake placed upon their dividend growth. When looking ahead into 2023, their combined outlook for low earnings growth and slightly higher net debt means their leverage is likely to remain immaterially different this time next year, barring any surprises.

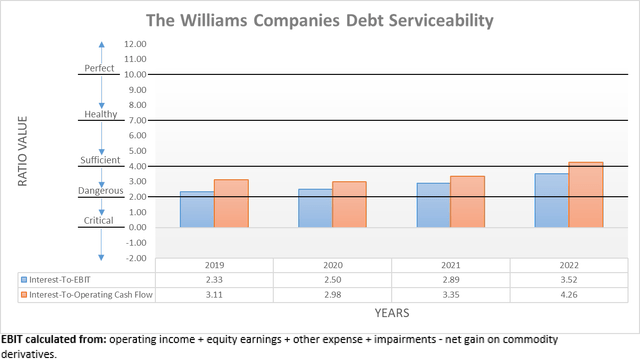

Similar to their leverage, 2022 was a good year for their debt serviceability as they managed to defy the additional pressure from central banks. To this point, their interest coverage when compared against their EBIT increased to 3.52 versus its previous result of 2.89 at the end of 2021, whilst their accompanying coverage against their operating cash flow also increased to 4.26 versus 3.35 across the same two points in time. Whilst the latter is now within the range that I consider healthy, I prefer to judge on the worse side as the former is only within what I consider a sufficient range. Also similarly to their leverage, this does not pose any threats to their dividends but at the same time, it certainly does not provide wriggle room to ease the handbrake on their dividend growth.

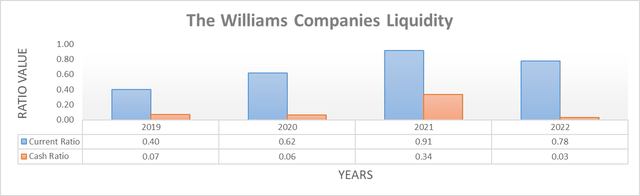

Due to their cash balance reverting back to a barely visible $152m at the end of 2022 versus its previous abnormally large level of $1.68b at the end of 2021, their previously strong liquidity eased in tandem. As a result, their respective current and cash ratios are now 0.78 and 0.03 versus their previous respective results of 0.91 and 0.34 at the end of 2021. Whilst not necessarily a positive development, it does not cause any material problems given they are a large company, which means they should have no issues accessing liquidity from debt markets as required, which also removes most risks from debt refinancing, regardless of where monetary policy heads.

Conclusion

Despite 2022 proving surprisingly strong, there nevertheless is still a handbrake placed upon The Williams Companies, Inc. dividend growth, unless they somehow surprise once again. Whilst anything is possible, 2022 was an abnormally strong year as Russia invaded Ukraine and sent commodity prices to levels seldom ever seen. This means a repeat is unlikely in my eyes, and even though a moderate near-6% dividend yield is appealing, I believe this outlook means that maintaining my hold rating on The Williams Companies, Inc. is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from The Williams Companies’ SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.