CQQQ: The Chinese Nasdaq

Summary

- The Invesco China Technology ETF is an exchange traded fund that aims to capture Chinese tech companies' returns.

- The fund is an alternative to the much better known KraneShares CSI China Internet ETF.

- CQQQ contains mostly A-share and B-shares, thus removing to a large degree the U.S. stock exchanges de-listing fears.

- The fund has a superior return profile when compared to KWEB on longer lookback periods, and does have a listed options chain.

- CQQQ is extremely volatile, with a 34 standard deviation on a 3-year lookback.

AUDINDesign

Thesis

The Invesco China Technology ETF (NYSEARCA:CQQQ) is an exchange traded fund that aims to capture Chinese tech companies returns. The fund contains both onshore listed A-shares, as well as U.S. listed ADRs:

The Invesco China Technology ETF is based on the FTSE China Incl A 25% Technology Capped Index. The Fund will invest at least 90% of its total assets in securities that comprise the Index as well as American depositary receipts and global depositary receipts based on the securities in the Index. The Index includes constituents of the FTSE China Index and FTSE China A Stock Connect Index that are classified as information technology securities, including China A-shares and China B-shares. The FTSE China Index represents the performance of large and mid cap Chinese stocks included in the FTSE Global Equity Index Series universe. The FTSE China A Stock Connect Index is designed to represent the performance of eligible securities in the FTSE China A Index. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The Fund and the Index are rebalanced quarterly.

The fund can be considered a Chinese Nasdaq, given its mandate to be overweight Chinese technology stocks. The fund managers have hinted towards this positioning via its naming convention, which brings together the first initial for 'China' and the well-known Nasdaq ticker 'QQQ'.

The fund is an alternative to the much better known KraneShares CSI China Internet ETF (KWEB), and on a long-term basis has a better total return. A glaring difference between the two funds right now is the absence of Alibaba (BABA) or JD.com (JD) from the CQQQ fund. On the other hand, KWEB has a 9% and 5% allocation to these two large U.S. listed Chinese companies.

CQQQ runs much lower de-listing risk via its portfolio, which is mainly composed of on-shore listed A shares and B shares:

China A-shares can be defined as the stock shares of the companies that are based out of China, and these shares are traded in Renminbi (the local currency of China) on the two securities exchange markets of China that is SZSE (Shenzhen Stock Exchange) and the SSE (Shanghai Stock Exchange).

The fund has risen 30% since its October lows, and is now starting a consolidation pattern. With the China re-opening earlier in the year, we expect economic activity to pick up as the year progresses.

Analytics

- AUM: $1 billion.

- Sharpe Ratio: 0.06 (3Y).

- Std. Deviation: 34 (3Y).

- Yield: 0.07%.

- Premium/Discount to NAV: n/a.

- Z-Stat: n/a.

- Leverage Ratio: 0%

Holdings

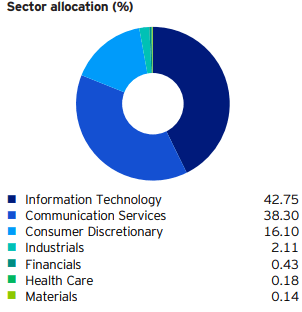

The fund is overweight technology stocks:

Sector Allocation (Fund Fact Sheet)

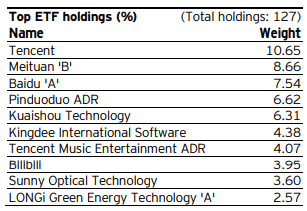

When looking at its top individual names we see a mix of A-shares and ADRs:

Top Holdings (Fund Fact Sheet)

We can see the fund having a very large position in Tencent (OTCPK:TCEHY), followed by onshore listed shares from Meituan (OTCPK:MPNGF) and Baidu (BIDU).

Performance

On a 1-year lookback, KWEB slightly outperforms CQQQ:

However, longer term, CQQQ is the clear winner:

We can see that on a 5-year lookback CQQQ outperforms, and more importantly, it has a total return profile that is constantly higher than KWEB's. By looking at the above graph we can notice the orange line which highlights CQQQ's total return is above the blue line constantly throughout time. This is a stronger statement than just a pure lookback outperformance, since it represents a constant better return profile.

Returns in the space have been extremely volatile in the past decade:

We can observe from the yearly total return table above that absent the 2014-2016 period, the fund posted total returns in excess of 20% on an absolute basis. That is a great deal of volatility, but also offers some years of eye watering returns, such as the 74% return recorded in 2017.

Conclusion

The Invesco China Technology ETF is an exchange traded fund that aims to capture Chinese tech companies' returns. The fund is overweight Technology stocks, which compose over 42% of the fund's portfolio. The vehicle usually invests in Chinese equities via A-shares and B-shares, thus having a very low sensitivity to de-listing fears present via the U.S. listed ADRs. CQQQ represents an alternative to the much better known KraneShares CSI China Internet ETF. While in the past year CQQQ has underperformed KWEB, longer term (5- and 10-year lookbacks) CQQQ is the better performer. To note that there are some glaring absences from CQQQ's portfolio, such as the U.S. listed BABA and JD, which can be found in KWEB's portfolio. After a rough 2022, CQQQ is better set-up for 2023 with the China re-opening.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.