Inozyme Pharma: Rare Disease Player Merits Revaluation Higher After POC Data

Summary

- Shares are down 58% over the past year.

- Enzyme replacement therapy is an attractive area of drug development with less risk than more exotic modalities like gene therapy.

- Enterprise value is just $15M as contrasted to aggregate blockbuster opportunity across two rare diseases (ENPP1 and ABBC6 Deficiency).

- Initial clinical data achieved proof of concept via restoration of PPi to normal levels and improvement in patient reported outcomes.

- INZY is a Buy with key data updates expected 2H 23. Risk factors include adverse events of concern at highest dose, lack of long term follow-up and regulatory clarity.

- Looking for a helping hand in the market? Members of ROTY Biotech Community get exclusive ideas and guidance to navigate any climate. Learn More »

nambitomo

Shares of Boston-based Inozyme Pharma (NASDAQ:INZY) have fallen by over 80% since IPO was priced at $16 in July of 2020. During the past 12 months, they've posted a still dismal -58% performance.

With enterprise value of just $15M (taking into consideration $25M initial drawdowns from $70M facility inked with K2 HealthVentures in 2022), it would seem that the market is quite skeptical of this small company's future in addressing two rare mineralization disorders where no drugs are approved. Even more interesting, aggregate market opportunity of up to $1 billion contrasts favorably to current valuation.

With recently reported data providing the element of derisking that I require for my clinical-stage portfolio holdings, I look forward to digging deeper and determining with readers whether near-term entry is merited.

Chart

FinViz

Figure 1: INZY daily chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what's going on. In the daily chart above, we can see the share price take a hit in July last year when the company released initial results for INZ-701 for ABCC6 Deficiency. While rapid PPi increases were observed in all three subjects at the lowest 0.2mg/kg dose level, these results were deemed weak by Wall Street given the drug effect waned over time (to be fair, these results were very preliminary). From there, in the absence of material news flow shares experienced further weakness and bottomed out at the $1 level in December. So, 2023 on the other hand, has gotten off to a swift start with shares nearly tripling from lows on the heels of updated results where greater treatment effect was observed along with promising improvements in patients' quality of life. Thus, my initial take is that investors interested in this name would do well to establish a pilot position in the near term.

Overview

Founded in 2016 with headquarters in Boston (50 employees), Inozyme Pharma currently sports enterprise value of ~$15M and year-end cash position of $128M providing them operational runway into 1H 2024.

There are ~41M shares outstanding out of 200M authorized. To clarify on the aforementioned debt, the company drew $5M in July of 2022 and they drew the second tranche of $20M in mid-February for a total of $25M in debt. Accumulated deficit to date is $196M, which does seem on the high side to me in contrast to progress made in the clinic to date.

The company is developing a potential first-in-class therapy for the two rare mineralization disorders of ENPP1 Deficiency and ABCC6 Deficiency. These are diseases where patients suffer severely with up to 50% mortality and no approved therapeutic options.

Corporate Slides

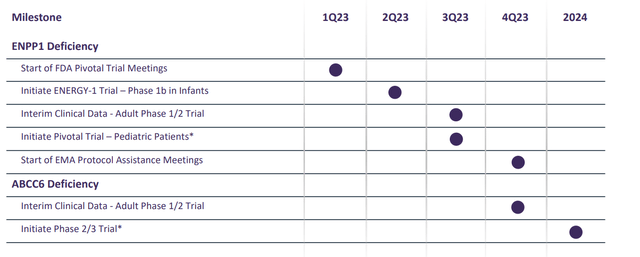

Figure 2: Pipeline & Milestones (Source: corporate presentation)

INZ-701 is a phase-3 ready asset (ENPP1 pivotal trial to start by Q3, ABCC6 Deficiency phase 2/3 trial to get underway in 2024). The company also could pursue other diseases of abnormal mineralization later on (such as calciphylaxis).

On that last note, color me skeptical as Sanifit/Vifor's calcification inhibitor SNF472 already is in phase 3 for calciphylaxis and Daiichi's DS-1211 (alkaline phosphatase inhibitor) is in phase 2 for pseudoxanthoma elasticum (also known as PXE) and could be moved directly to pivotal phase. Keep the overlap in mind and competition that could pose as ABCC6 Deficiency presents in older patients as PXE.

Safety profile to date for INZ-701 has been "favorable" (more later on adverse events of concern) and clinical proof-of-concept data is now in hand (mechanism of action and improvement in patients' quality of life). Addressable market has blockbuster potential for ENPP1-deficiency alone with 500 patients already identified (and list keeps growing). Two current phase 1/2 trials in adult patients are ongoing with clinical effects of treatment with INZ-701 only recently unveiled (February 16th). Data from exploratory phase 2 portion will be released later this year with goal of selecting dose for phase 3.

As opposed to riskier areas of drug development like gene therapy, ERT (enzyme replacement therapy) would appear to be more straightforward with successful precedent established by such treatments as Fabrazyme in Fabry disease (getting close to a $1 billion run rate after Sanofi's Q3 report). ERT market on the whole is expected to grow to over $15 billion by 2028, providing a relevant backdrop when taking a closer look at prospects for tiny Inozyme.

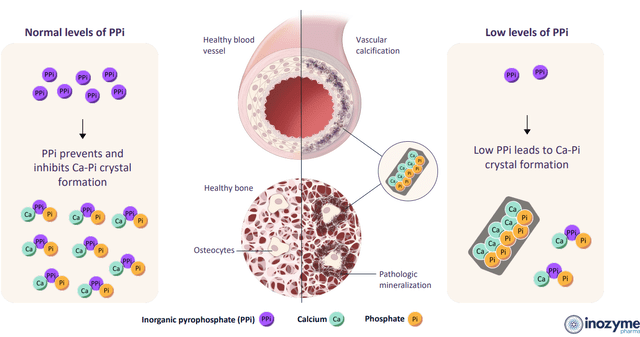

Delving briefly into the science, genetic mutations affecting ENPP1 (critical enzyme in mineralization pathway) result in low levels of PPi (pyrophosphate) and AMP (precursor of adenosine). Similarly, genetic mutations affecting ABCC6 (critical protein in the mineralization pathway) decrease the availability of extracellular ATP required for proper ENPP1 function and indirectly leads to low levels of PPi and AMP. These low levels of PPi lead to abnormal mineralization and pathological calcification in areas of the body where that is not desirable (vasculature, soft tissue, organ systems) resulting in disease (heart, kidney and skin are especially vulnerable).

Corporate Slides

Figure 3: PPi as a master regulator of mineralization (Source: corporate presentation)

Disease is progressive over the patient's lifetime (starting as early as fetal development then spanning into adulthood) and leads to high mortality and morbidity. ENPP1 Deficiency includes infantile phase, pediatric phase and an adult phase. Unfortunately, 45% to 50% of babies with the disease die within the first six months of birth and those that survive have low quality of life with significant morbidity. Pediatric phase is characterized by onset of rickets, severe skeletal deformities, short stature, severe bone pain and potentially excess calcification in joints and ligaments (impaired quality of life and ability to engage in normal childhood activities). Adult phase also involves significant functional and cognitive impairment.

As for prevalence, ENPP1 Deficiency is estimated to occur in 200,000 births with over 11,000 patients worldwide (3,500 of whom are in US, EU and other major markets). While there are no approved treatments, retrospective studies have reported therapeutic effect in infants of first-generation phosphonate etidronate (has been discontinued in US and associated with longer term adverse effects on skeletal development). Supplemental vitamin D3 and oral phosphate are sometimes used to address the rickets of ENPP1 Deficiency, but keep in mind the latter could actually increase the risk of pathological calcification. Third party healthy volunteer study showed that treating PPi Deficiency by adjusting diet was inefficient with only a small fraction of dietary PPi being absorbed.

Moving on to ABCC6 Deficiency, infants are diagnosed with a vascular calcification condition called GACI Type II while presenting in older patients (as mentioned before) as PXE (calcification of soft connective tissues including eyes, cardiovascular system and skin). A 2019 report stated that 37% of PXE patients over the age of 50 experienced visual impairment and 15% were legally blind. Other signs caused by mineralization of blood vessels include cramping and pain during exercise, bleeding in gastrointestinal tract (13% of PXE patients) and higher incidence of cardiovascular incidents (ischemic stroke, early myocardial infarction, etc). The disease is estimated to afflict one per 25,000 to 50,000 individuals or more than 67,000 patients worldwide (20,000 of whom reside in major markets). Current treatment approach for slowing or limiting the cardiovascular manifestations of PXE is based on the reduction of cardiovascular risk factors through lifestyle changes or in some cases by taking cholesterol-lowering agents (also bypast and angioplasty procedures in the event of severe vascular disease). Competitors mentioned previously are focused on calciphylaxis (manifestation of chronic kidney disease) which affects 1% to 4% of patients with end stage renal disease (incidence of 1,800 new patients per year with no approved therapies though use of sodium thiosulfate reportedly improves wound healing and low phosphate diet is often advised).

Enter INZ-701, which is a soluble, recombinant protein containing the extracellular domain of native human ENPP1 fused to the Fc domain of the immunoglobulin IgG1. The drug candidate is designed to replace the lost enzymatic function of genetically deficient ENPP1, increasing PPi and adenosine to steady-state concentrations in the blood over time (potentially allowing for convenient subcutaneous delivery at weekly dosing interval). Preclinical studies in ENPP1-deficient mouse models resulted in increased plasma PPi levels, reductions of ectopic calcium deposits in a variety of tissues, prevention of calcification in the heart and improvements in overall health. Similar effects were achieved in ABCC6-deficient mouse model and nonclinical toxicology studies showed no systemic adverse effects at doses significantly higher than those used in humans. INZ-701 has already received multiple designations from the FDA (orphan drug, fast track and rare pediatric disease).

Feb. 16 Data

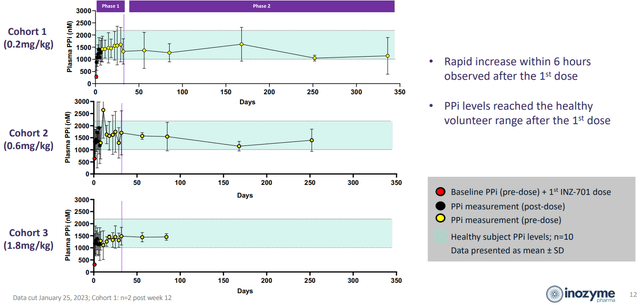

Moving on to the recent clinical data, management touted restoration of PPi to normal levels in all dose cohorts in ENPP1 Deficiency patients (sustained throughout the trial).

Corporate Slides

Figure 4: PPi levels normalized with treatment, best stability with least variation achieved in high dose cohort (Source: corporate presentation)

Half life was long at 126 hours and drug accumulation suggested potential for convenient once-week dosing. Immunogenicity profile showed low titers of non-neutralizing ADAs observed in 7 of 9 patients.

While safety profile was favorable on the whole, there were mild adverse events in 3 of 9 patients (injection site reaction in 2, instances of decreased appetite and fatigue).

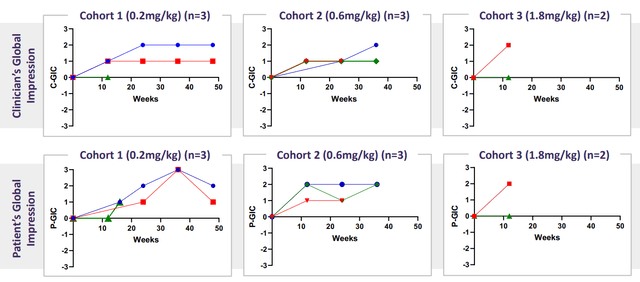

Emerging patient-reported outcome data - GIC - showed 6 of 8 patients with corresponding improvements in overall health from baseline. 5 of 8 patients showed "much improved" or "very much improved" (suggesting that beneficial effects of the drug candidate were far from marginal). Lastly, no patient showed deterioration in overall health from baseline.

corporate slides

Figure 5: Improvement in GIC in all 3 dose cohort levels, both clinician and patient-reported (Source: corporate presentation)

Moving on to the phase 1/2 trial in adults with ABCC6 deficiency, similar improvements in PPi levels were observed with sustained increase in the highest dose cohort as expected (to levels comparable to those observed in healthy volunteers or 1002nM to 2169 nM). Playing devil's advocate, I do have some concerns on safety profile given drug-related events included erythema, fatigue, night sweats, pruritus, and urticaria (one patient at highest dose level withdrew due to moderate AE of erythema/urticaria). I have to wonder what incidence and severity of such events will be in a pivotal study with higher number of patients (impossible to flesh this out from such a small initial trial).

Here are a few nuggets from Investor Day presentation:

- Administration of bisphosphonates (orally or via IV) has not led to significant improvement in overall survival (just a positive trend).

- Increasing awareness within the medical community will be a significant challenge the company is taking on via physician-targeted information and other initiatives. Inozyme has also partnered with Prevention Genetics to provide free genetic screening for ENPP1 mutations.

- Inozyme WILL apply for Breakthrough Therapy designation from the FDA later this year. They also intend to (subject to trial design and feedback for pivotal stage) pursue accelerated approval.

- Phase 1b open-label ENERGY-1 trial will get underway in Q2 in infant patients with ENPP1 Deficiency and GACI. Trial will inform dosing in future pivotal study (primary endpoint of safety and tolerability, secondary endpoints of PK and PPi). Treatment period will be up to 52 weeks and patients (up to 8) will also be assessed for survival, growth, development, functional performance, cardiac function, biomarkers related to bone and mineral metabolism and other relevant measures.

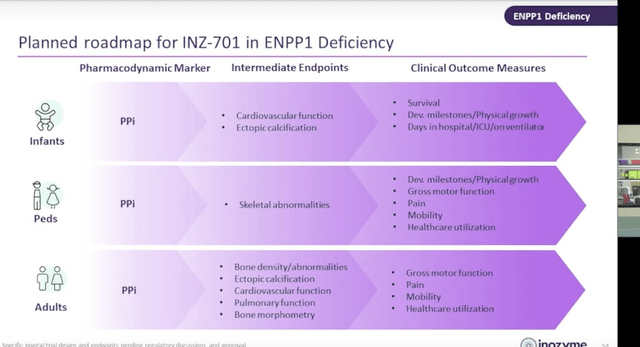

- Outcome measures in pivotal studies will be tailored according to age group. The commonality is PD marker of PPi levels, while intermediate endpoints and clinical outcome measures vary as seen below. Playing devil's advocate, the FDA could easily NOT accept PPi endpoint as primary (or for accelerated approval) as this needs to be linked to definitive outcome measures (function, survival, etc).

Corporate Slides

Figure 6: Roadmap to pivotal trials and endpoints to be utilized according to age group (Source: Investor Day presentation)

- Immunogenicity profile is favorable in both diseases, with low ADA titers detected in the ABCC6 patients (but were not neutralizing with no effect on PK or PPi levels). Titers ranged from less than 40 to 640 with no evidence of relationship between dose and ADA titer. ADA titers were much lower than those with approved enzyme therapies (Strensiq, Aldurazyme, Lumizyme, etc).

- Estimate $128M of year end cash +$20M second tranche of venture debt equates to $148M total (extends runway into Q4 2024).

- On Q&A, Chief Medical Officer states (in response to whether higher doses will be explored) that in ABCC6 Deficiency the 1.8 mg/kg dose demonstrated they can keep PPi in normal level and have arrived at optimal dose (not thinking they will go higher but will explore once weekly dosing). They are looking at a large number of biomarkers and more clarity will be provided on those in Q3's interim data. KOL states that a drug that normalizes phosphate and bone mineralization would demonstrate improvement in 3 to 6 months (can see that on standard X-rays). As for improvements in cardiac function, that could be trickier (take several months or potentially years depending on what the issues are). Regarding PXE, there is indirect evidence from trial of a different drug candidate (PPi analogue) which showed reduction in calcification of arteries (outcome that can be measured, not functional).

- Analyst notes there are solid GIC scores in ENPP1 but not in ABCC6 (yet). They want to correlate GIC with other clinical outcomes to establish internal validity of GIC and look at other PROs (patient-reported outcomes). They don't have GIC data from all 3 cohorts of ABCC6 yet but look forward to showing when available. They are much further identifying patients than they were at Alexion when Senior Advisor was at Alexion developing Strensiq (did $272M in Q4 sales for AstraZeneca).

Other Information

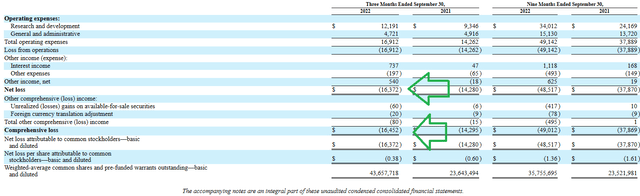

For the third quarter of 2022, the company reported cash and equivalents of $141.5M (guiding for operational runway into Q2 2024, which was further extended to Q4 2024 with recent $20M debt drawdown). Net loss increased slightly to $16.4M (from $14.3M prior year), with G&A falling to $4.7M while research & development expenses rose by ~25% to $12.2M.

10Q filing

Figure 7: Quarterly financials reveal controlled expense growth (Source: 10-Q filing)

Moving on to material catalysts, interim clinical data for the phase 1/2 adult trial in ENPP1 Deficiency is expected in Q3 with interim data in ABCC6 Deficiency to follow in Q4. Initiation of pivotal study in pediatric ENPP1 patients in Q3 could also be a catalyst for valuation expansion (especially if clarity is obtained from FDA in terms of approvable endpoints and possibility of pursuing accelerated pathway). Phase 2/3 study in ABCC6 Deficiency would not start until 2024.

As for competition, especially in related diseases, the 10-K mentions a couple big pharma programs such as Sanifit/Vifor's calcification inhibitor SNF472 in calciphylaxis (phase 2b study showed the drug attenuated the progression of coronary artery calcification and aortic valve calcification in patients with end-stage kidney disease). Perhaps more relevantly, Daiichi's DS-1211 is in a phase 2 study for PXE with primary completion date of August this year according to Clinical Trials website.

As for institutional investors of note, signs of clustering here could be a green flag with sizable stakes owned by Deep Track Capital (8%), Venrock (9.3%), Rock Springs Capital (7.64%), Adage Capital (7%), and Baker Brothers (5%) to name a few. Moving on to insider activity, it's encouraging to see several purchases over the past year.

As for relevant leadership experience, President and CEO Axel Bolte co-founded the company in 2015 (I like founder-led companies as long as the execution is there). Senior Advisor Henric Bjarke served prior as VP Global Metabolic Disorders at Alexion (very relevant experience). SVP and Chief Scientific Officer Yves Sabbagh has relevant experience (20 years) in rare genetic disorders and mineral metabolism including at Sanofi Genzyme in renal and rare bone diseases.

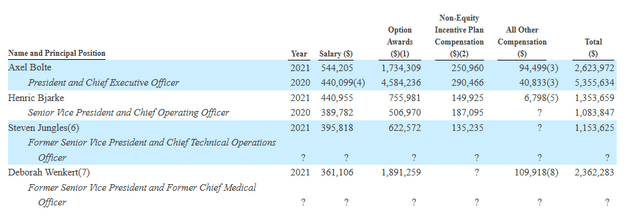

Moving on to executive compensation, cash portion of salary is on the medium to high side for a company this size (but not excessive) while option awards are at an acceptable level.

Proxy Filing

Figure 8: Executive Compensation table (Source: 10-Q filing)

Moving on to IP, management claims to have patent protection in each indication until at least 2036. They obtained exclusive worldwide license to foundational IP rights from Yale in 2017 and in 2020 entered into IP asset purchase agreement with Alexion Pharmaceuticals for rights related to ENPP1. Specifically, they own 20 issued US patents along with over 100 pending US and foreign patent applications. Patent family includes seven issued US patents relating to reducing and/or preventing progression of pathological calcification, ectopic calcification of soft tissue, pathological ossification and pathological calcification of vascular tissue in a human subject having reduced ENPP1 activity or a loss of function mutation in the gene encoding ENPP1. All such methods of treatment patents expire 2034. Patent family covering compositions that contain ENPP1 including INZ-701 expire in 2036.

Final Thoughts

To conclude, at enterprise value of just $15M, Inozyme looks attractively priced for risk-tolerant investors willing to hold for value creation through upcoming data sets in the second half of the year. Blockbuster opportunity in ENPP1 Deficiency (37k patients in key addressable markets) coupled with proven area of drug development (enzyme replacement therapies) and initial POC data merit continued attention as the story continues to make progress.

For readers who are interested in the company and have done their due diligence, INZY is a Buy and I suggest initiating a pilot position in the near term. A prudent strategy could be to accumulate half of desired exposure presently and from there wait until Q3 data (derisking event) before taking further action.

For the purposes of my clinical-stage portfolio, I'm likely to stay on the sidelines until regulatory clarity is obtained or pivotal studies are initiated and well underway. While I could change my mind given the data updates coming 2H 23, I'm also more partial to names with deeper pipelines (multiple shots on goal for additional clinical momentum) or a unique platform technology. Lastly, that patient discontinuation at the high dose due to erythema/urticaria does give me pause (wonder if more cases will show up with higher number of patients).

As for risks, despite the ample cash position together with reasonable burn rate I would still expect further dilution (financing) by year-end 2023. There's no PRO (patient reported outcome) data for ABCC6 patients, and data sets to date are not robust (low number of patients) with insufficient follow-up to gauge longer term effects as well as safety profile. Regulatory risk is a key area of concern to keep an eye on (which endpoints the FDA will accept as approvable and whether accelerated pathway is open for the company). Competition is a risk factor as well, including from big pharma such as Daiichi in PXE.

Aeglea BioTherapeutics (AGLE), down 84% over the past year, serves as a cautionary tale in the enzyme replacement space after the company received Refuse to File letter from the FDA for pegzilarginase for the treatment of Arginase 1 Deficiency. In essence, the company's pivotal trial easily met the primary endpoint of achieving normal plasma arginine levels and even showed positive trend in gross motor function (improvement by 4.2 units on GMFM-E score versus worsening of 0.4 units in placebo arm). However, it was back to the drawing board as the FDA requested additional data to support effectiveness and clinically meaningful outcomes.

FinViz

Figure 9: AGLE weekly chart (Source: Finviz)

Author's Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Take a 2 Week Free Trial and Join 500+ biotech investors and traders in the ROTY Biotech Community!

- Participate in a Live Chat where members generously share due diligence, top holdings and genuinely wish to see each other profit.

- Get access to JF's highest conviction ideas, trades & updates for model portfolios, personal DCA account and all my archives for DD purposes

- Trade to Live, NOT Live to Trade philosophy (low maintenance, follow our thesis and make changes to positions only as merited)

- Multiple 2023 setups on radar currently trading at attractive valuations

This article was written by

Founder of 500+ member ROTY Biotech Community (try the 2-week free trial to see if it adds value for you). Quality over quantity- enjoy connecting with readers.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Commentary presented is NOT individualized investment advice. Opinions offered here are NOT personalized recommendations. Readers are expected to do their own due diligence or consult an investment professional if needed prior to making trades. Strategies discussed should not be mistaken for recommendations, and past performance may not be indicative of future results. Although I do my best to present factual research, I do not in any way guarantee the accuracy of the information I post. I reserve the right to make investment decisions on behalf of myself and affiliates regarding any security without notification except where it is required by law. Keep in mind that any opinion or position disclosed on this platform is subject to change at any moment as the thesis evolves. Investing in common stock can result in partial or total loss of capital. In other words, readers are expected to form their own trading plan, do their own research and take responsibility for their own actions. If they are not able or willing to do so, better to buy index funds or find a thoroughly vetted fee-only financial advisor to handle your account.