General Mills: I Am Once Again Bullish And Have 2 Areas Investors Should Watch Closely

Summary

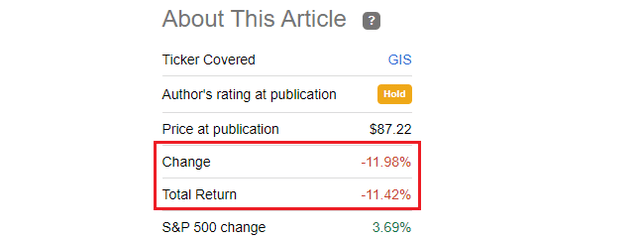

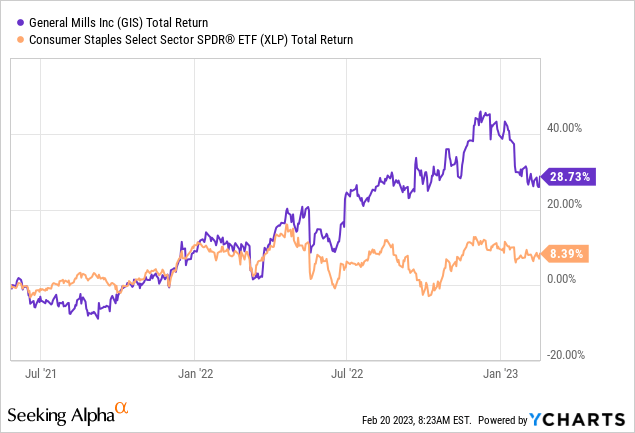

- General Mills continued to outperform the market, in spite of the sharp drop in share price in recent months.

- Organic sales growth remains strong, but the corresponding drop in volumes is unsettling.

- Although the company now trades closer to fair value, weakness in the pet food segment was largely unexpected.

- Looking for a portfolio of ideas like this one? Members of The Roundabout Investor get exclusive access to our subscriber-only portfolios. Learn More »

Justin Sullivan/Getty Images News

General Mills (NYSE:GIS) has been one of the best performing stocks within the large cap consumer staples sector recently. Within a period of roughly one and a half years (from May 2021 to December 2022), the stock returned roughly 40%, before falling sharply since I issued a warning in December of last year.

Since December of last year, GIS's share price has fallen sharply by nearly 20%, while the broader equity market rallied.

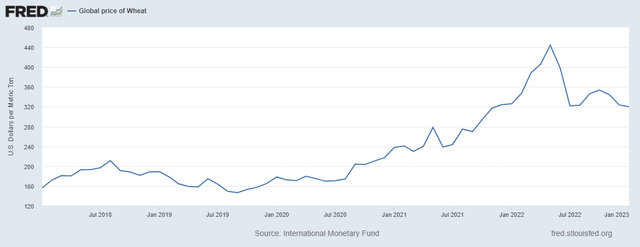

While GIS now trades at lower levels, the business has shown resilience during the unprecedented price increase of raw materials.

Merits Of A Strong Brand Portfolio

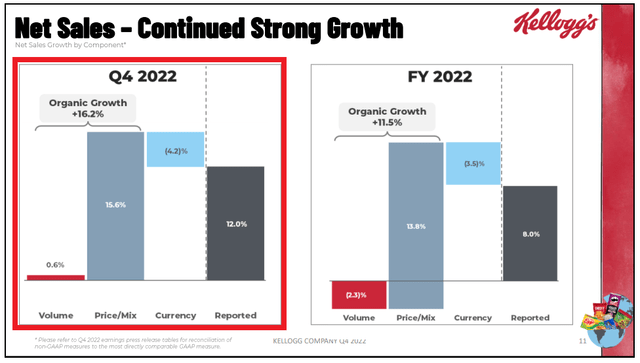

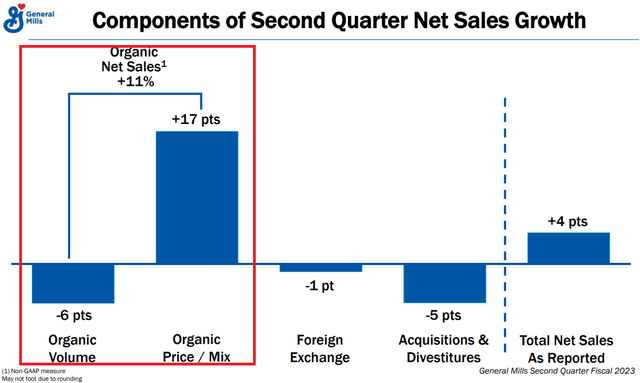

During the latest quarter, General Mills reported organic net sales growth of 11%, which was driven by a 17% increase due to price/mix and a 6% decline in volumes.

General Mills Investor Presentation

The recently restructured brand portfolio allowed General Mills to focus on key product categories where it has pricing power.

General Mills Investor Presentation

So far volumes remained relatively inelastic, although a 6% drop in organic volume during the quarter is concerning.

Volume elasticities continued to remain below historical levels in the first half, particularly in North America Retail. We are watching these trends closely, but we do not expect a return to pre-pandemic elasticity levels during fiscal 2023.

Source: General Mills Q2 2023 Earnings Transcript

Even though GIS management expects an improvement in volumes during the second half, some its competitors are faring better when it comes to organic revenue growth. Kellogg (K) for example, registered a 0.6% volume increase in combination with a 15.6% price/mix tailwind for organic sales growth.

GIS management, however, appears confident that volume declines will taper down as it is was already planning another round of price increases during the first months of this calendar year.

Some of the key things you'll see is we'll expect price/mix to catch up with inflation. We've got another effectively round of pricing coming through at the beginning of calendar year '23. We don't expect the pressure on supply chain to be as acute.

Source: General Mills Q2 2023 Earnings Transcript

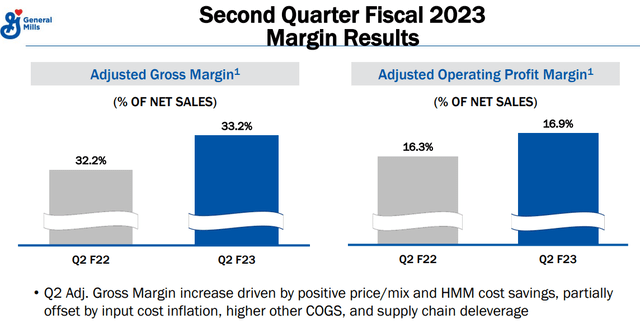

Inflationary pressures are also expected to cool-off somehow during the second half of the fiscal year and this could have a double whammy effect on margins.

So far, GIS margins have already been resilient to the high cost inflation which makes me very optimistic about profitability going forward.

General Mills Investor Presentation

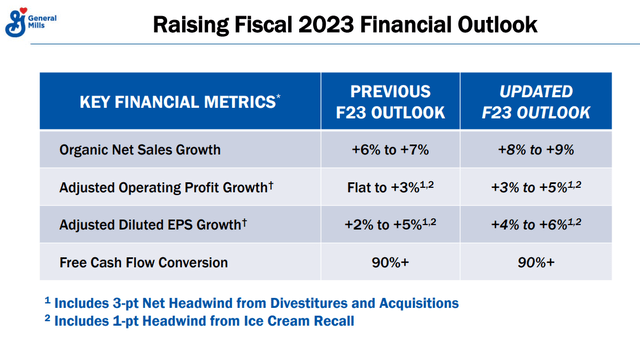

Last but not least, the outlook of fiscal year 2023 was raised again during the last quarter, following the already updated outlook during the first quarter of 2023. This included both higher organic net sales growth and an improvement in operating and net income margins.

General Mills Investor Presentation

Just as I am writing this, management has announced yet another increase in its full year guidance with higher growth rates expected across the board - from organic revenue and operating profit to EPS.

General Mills (GIS) now expects organic sales growth of approximately 10% vs. +8.7% consensus, adjusted operating profit growth of 6% to 7% in constant currency, adjusted diluted EPS growth of 7% to 8% in constant currency vs. +4% to +6% prior guidance, and free cash flow conversion of at least 90% of adjusted after-tax earnings.

Source: Seeking Alpha

How Is General Mills Priced?

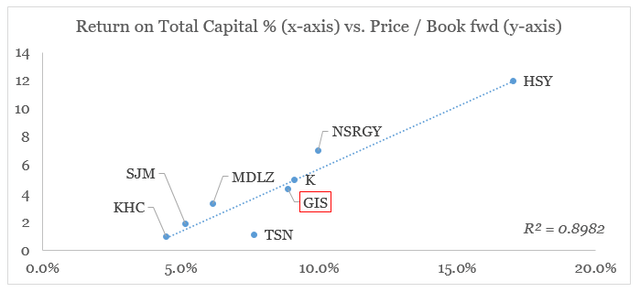

After the recent share price drop, General Mills once again trades near fair value. On a cross-sectional basis, the company sits on the trend line plotted between Returns on Total Capital and Forward Price-to-Book ratios.

prepared by the author, using data from Seeking Alpha

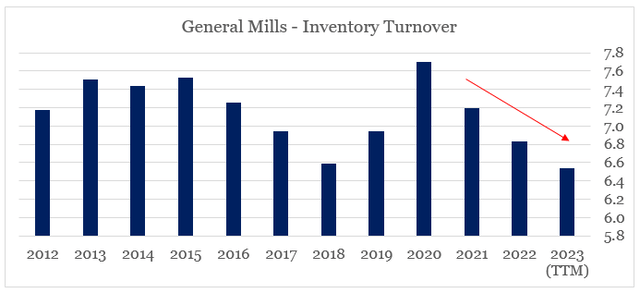

As we saw above, management appears confident that margins in the second half of fiscal 2023 could improve. Asset turnover, however, noted a decline over the past 12-month period on the back of lower inventory turnover. Although a decline was to be expected following the pandemic highs, current inventory levels sit below pre-pandemic levels and the historical average.

prepared by the author, using data from SEC Filings

Retail inventory declines in the Pet Food segment likely had in impact on the company's inventory levels.

Beyond the unexpected retail inventory decline, our Pet results in Q2 largely reflected the continued impact of the capacity limitations and resulting customer service challenges that we called out on our first-quarter earnings call.

Source: General Mills Q2 2023 Earnings Transcript

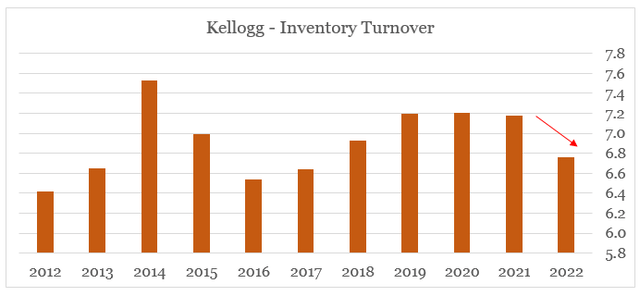

Kellogg also experienced a significant drop in inventory turnover which points to broader market developments as opposed to company specific issues at General Mills.

prepared by the author, using data from SEC Filings

Nonetheless, investors should keep a close eye on General Mills' pet food segment after the recent drop in profits.

Segment operating profit decreased 34 percent to $87 million in the second quarter of fiscal 2023 compared to $132 million in the same period in fiscal 2022, primarily driven by higher input costs and a decrease in contributions from volume growth, partially offset by favorable net price realization and mix.

Source: General Mills 10-Q SEC Filing

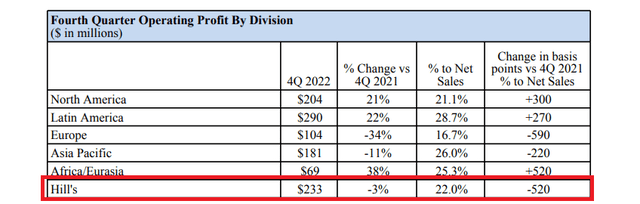

In comparison, other premium brands, such as Colgate-Palmolive's Hill's noted far lower declines in profitability during the last quarter.

Colgate-Palmolive Earnings Release

Conclusion

General Mills is now more attractive than it was back in December of last year when I changed my rating from 'Buy' to 'Hold'. The strong brand portfolio is showing resiliency, in spite of the aggressive price actions taken by GIS management. Management also appears confident in its outlook after a number of upgrades of its annual guidance. That is why I am once again turning bullish on the stock.

Investors, however, should keep a close eye on volumes as more price actions are expected during this calendar year. Profitability in the pet food segment also deserves attention as the recent drop is at odds with developments at other premium brands on the market.

Looking for better positioned high quality consumer staple businesses?

Looking for better positioned high quality consumer staple businesses?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning. The opportunities laid out in the service also capitalize on inefficiencies in the market associated with short-termism, momentum chasing and narrative driven expectations. For more information follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.