Cars.com Q4 Earnings Preview: Path Towards 5% Buybacks

Summary

- Cars.com to announce its Q4 results on Thursday, premarket.

- Cars.com continues to print significant free cash flow. The business is priced at 10x free cash flow.

- Further, Cars.com still has some growth left in the tank.

- On top of all that, Cars.com is also buying back its shares.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

JoZtar

Investment Thesis

Cars.com (NYSE:CARS) will announce its Q4 2022 results on Thursday, premarket.

I'm not going to assert that this is a particularly exciting business. What I will say is that beyond investor apathy towards CARS stock, there's a highly profitable stable business, that's using its excess free cash flow to bring down its debt and repurchase its shares.

Paying 10x its 2022 free cash flows smacks me of an attractive investment opportunity.

Why Cars.com? Why Now?

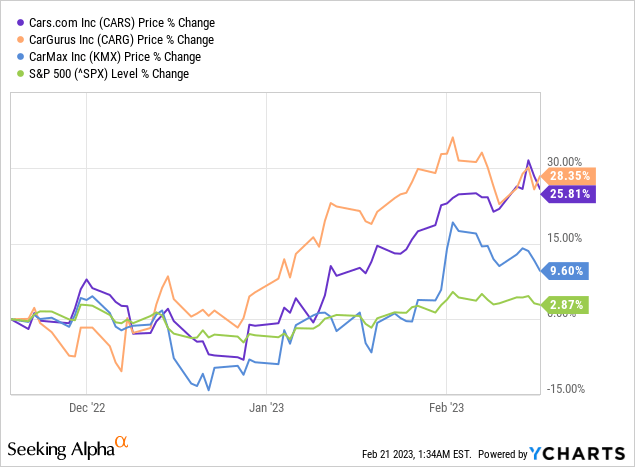

The graphic above puts into focus that despite all the fears about a looming recession, car sales marketplaces are performing very strongly. And not only performing strongly but substantially outperforming the S&P 500.

For its part, the one area where Cars.com is punching above its weight is in getting more traffic at the top of the funnel, up 6% y/y as of Q3 2022, with better digital solutions for customers to compare different auto options, and allowing customers to transact successfully.

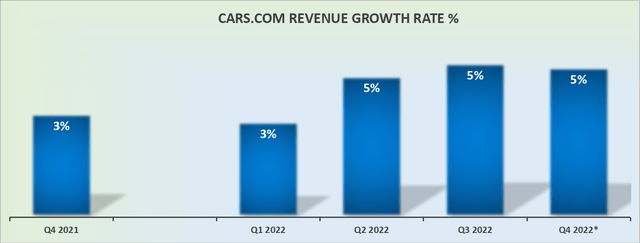

Revenue Growth Rates Are Ticking Along

Author's calculations

Cars.com's Q4 revenues are likely to report 5% y/y growth rates, or perhaps even 6% y/y growth rates. That being said, keep in mind that Cars.com does not have a history of lowballing guidance and then dramatically beating analysts' expectations.

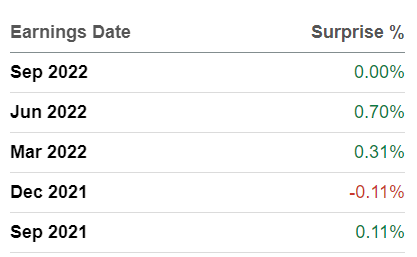

SA Premium

As you can see here, when Cars.com guides, what you see is pretty much what you get.

On the other hand, investors don't need much in the way of fireworks to see a positive return here. If Cars.com can guide for Q1 2023 to be up 5% y/y, this will probably be enough to get investors interested again.

What investors don't like is uncertainty. But a company that is ticking along at about 5%, with a steady story, can be relatively easier to value.

Bull Case Discussed

Anyone seriously interested in Cars.com knows that its bull case does not steam from its strong topline growth. Indeed, as we've discussed already, there's not that much growth to talk of.

What is particularly appealing about Cars.com is that it's got the ability to be extremely free cash flow generative. Case in point, for the trailing 9 months, its free cash flow reached $77 million.

And given that its Q4 guidance points to approximately $48 million of EBITDA, I'm inclined to believe that it's possible that Cars.com's full-year free cash flow could reach $110 million.

This figure would be an ever-so-slight drop from the prior year but given that investors' expectations for Cars.com are relatively muted, as I've already remarked, I don't suspect that investors would be too dismissive of this ever-so-slightly lower free cash flow relative to the prior year.

What's more, this strong free cash flow generation would allow Cars.com's to reduce its net leverage. Case in point, this is what recently appointed CFO Jandy Tomy stated on Cars.com's Q3 earnings call,

Net leverage at quarter-end was 2.6 times, down compared to 2.8 times last quarter and approaching our target range of 2 times to 2.5 times.

Recall that we are temporarily above our target range due to incremental borrowings in the first quarter from the Accu-Trade acquisition.

Given our strong, consistent cash generation, we are comfortable at this level and anticipate getting back into our target range in the coming quarters.

Essentially, there's a clear path ongoing for Cars.com to reach approximately $380 million of net leverage, down from $473 million at the end of Q3 2022. Accordingly, it's very likely that at the present run rate Cars.com would reach its desired target before the end of Q2 2023.

Could All of This Lead the Way to Increased Repurchases?

Cars.com has been using approximately 45% of its free cash flows towards share repurchases.

If we were to assume that Cars.com would be able to reach its desired leverage of 2x net debt to EBITDA by Q2 2023, this would see the company further increasing its capital allocation towards share repurchases.

This would provide a framework for more than 50% of Cars.com's free cash flow to be used to repurchase its shares.

To put a figure to it, there's a logical path here for Cars.com to repurchase 5% of its market cap in 2023.

The Bottom Line

Cars.com isn't a high-flying name. The business is simply ticking along. But where Cars.com truly excels is in its ability to be highly free cash flow producing. I make the argument that paying about 10x free cash flow for this business, that's still got some topline growth to its name is an attractive risk-reward opportunity.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.