Vera Bradley: Moving On After A Nice Run

Summary

- Vera Bradley's market value has generated strong returns over the last six months without a clear connection to fundamentals.

- It faces many of the same challenges of other softline consumer names, especially elevated inventory and no sales growth.

- Although the shares may be supported with buybacks, the company's cash cushion is low enough now that conserving cash is likely to become the higher priority.

Jeff Hahne/Getty Images Entertainment

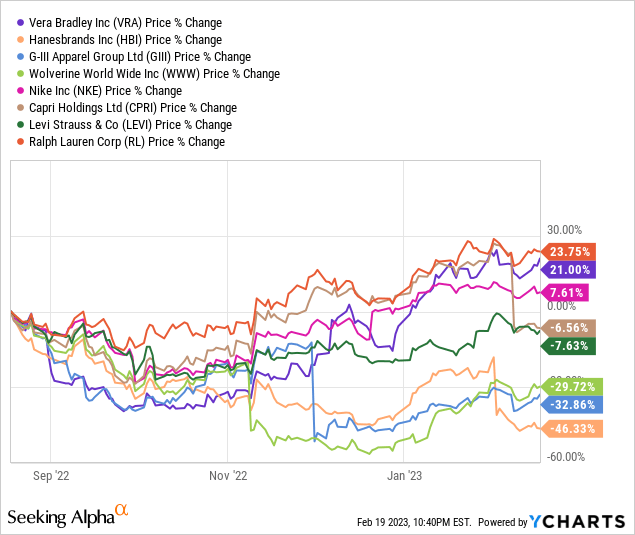

In spite of the tribulations being faced by retailer Bed Bath & Beyond (BBBY), in my own little bubble I was starting to think that softline businesses had been having a nice moment over the last six months. This was because of my own little bias, thinking that a couple of the names that I have been bullish on in the past and I have written about previously, namely Kontoor Brands (KTB) and Vera Bradley (NASDAQ:VRA), had seen pretty strong returns relative to the overall market. What I did not realize was how broad-based the struggles for clothing makers and others in the softlines categories had been. Apart from two distressed names I follow for curiosity and consideration for long positions, V.F. Corp (VFC) and Hanesbrands (HBI), I had been thinking the sector was doing better over the last few quarters. So I was surprised when I realized that Vera Bradley was more of the positive exception in terms of shareholder value creation. There could easily be dozens of names on the chart below, but to keep it from getting too messy, I've limited it to just 8 generally well known softline companies that sell items including clothing, bedding, women's bags, and shoes to a fairly broad swath of consumers, including some in the more luxury category.

Time to Reassess Vera Bradley

On seeing the kind of results on the chart above, I determined it made sense to revisit Vera Bradley. The company is known most of all for its colorful quilted tote bags, but also sells luggage, backpacks, and assorted accessories like sandals and beach towels. It is also now the 100% owner of Pura Vida, a brand line of accessories like bracelets, that was an on-line, social media first type of brand that is now becoming a bit more of a hybrid in terms of having some brick and mortar locations. For the Vera Bradley merchandise, the products are available through some third-party retailers, but the company also has a small fleet of 60 full-price stores, as well as 80 factory outlet stores, and of course consumers can buy on-line.

In early August 2022, when I last wrote about Vera Bradley, shares were trading hands for around $4.25, and I assigned a "buy" rating with the caveat that I did not see it as a long-term holding, as historically the company has struggled to hold margins up. With the general problem of too much inventory supply relative to demand, it was not clear that Vera would be able to deliver value for its shareholders, although I thought it had the chance, hence my rating. Since then, we have Q3 results released (as of 10/29/2022), combined with some management commentary and overall macro-economic data points.

To start with, there are three data points that I think are key for Vera Bradley from an investment thesis standpoint at this juncture. I'll lay out the three metrics and explain why I've picked them, and then check in with the Q3 results and see if management is offering any guidance. The first category is sales trends, especially the sales of the Pura Vida line of accessories that Vera purchased 75% of in 2019 and had now bought the remaining share. This acquisition was intended to buy growth, but Pura Vida has not had the type of sales growth that was expected, with the pandemic context surely being a legitimate impediment. Secondly, as I touched on my last article, is operating margin; I find this critical because Vera Bradley has often lagged its peers, and the stock price has historically had some general positive correlation to its ability to raise these. Finally, Vera has typically kept a very clean balance sheet, with minimal to no debt. However, in Vera's case, analyzing the balance sheet is going to be first and foremost about inventory, and checking for clues about potential future problems with margins if inventory is elevated to an alarming level. With that said, its cash position will need to be scrutinized more strongly, since Vera is paying $10 million to complete the purchase of Pura Vida.

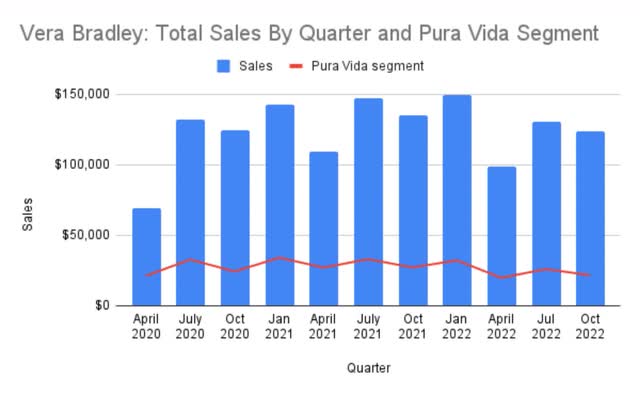

Looking back over three years, in order to start right around the onset of Covid-19 and proceed from there, there are some interesting trends through the most recent quarter. Starting with sales, it is abundantly clear by now that Pura Vida has not been a growth engine. Whether the victim of unfortunate timing with all of the pandemic-related fall out in terms of supply chains or for other reasons, its segments sales have been consistently flat. The amounts in the chart below are in thousands of US dollars.

Vera Bradley Sales By Quarter with Pura Vida segment (author's spreadsheet; data from Vera Bradley SEC filings)

Total revenue for Q3 was $124 million, down $10 million over the same period in 2021 and down from the prior quarter by $6.3 million. The revenue guidance for Q4 provided on the Q3 earnings call, and of course normally the peak quarter for holiday, was a range of $136 million to $141 million. Even at the high end, it would clearly be down from nearly $150 million for last year. In summary on sales, Vera Bradley is not gaining momentum, and the benefit of Pura Vida to the top line has not materialized as of yet. In fact, in Q2, the company took an impairment charge to goodwill and intangible assets to the tune of $18.2 million, so there is a realization that this brand hasn't worked out as well as hoped.

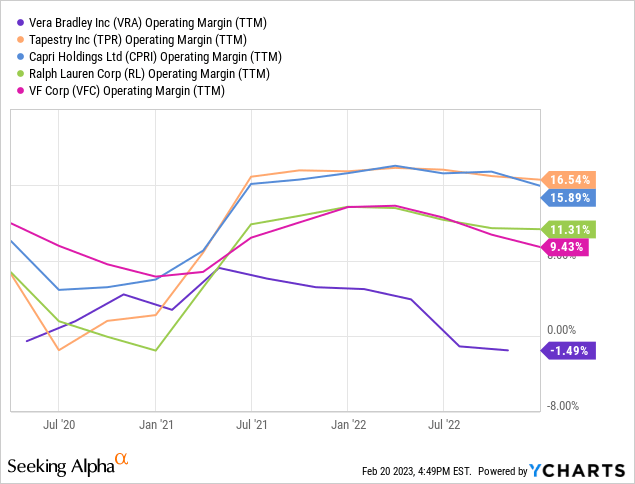

On the operating margin front, these figures jump around quite a bit quarter to quarter, and are probably only meaningful in comparison to other similar businesses. In terms of just the raw data without context, the operating margin in Q3 was 4.8%, but we can see the overall trend and how it stacks up to some others, presented here on a trailing twelve month basis.

Obviously a negative operating margin is not typically part of a recipe for success, although the market value of Vera Bradley has improved in spite of the operating margin strain. A good portion of the tough environment for the operating margins begins higher up the income statement, with gross margins under pressure as well. Management has specifically called out the challenges of expensive freight, even if raw material costs from cotton or other fibers has moderated.

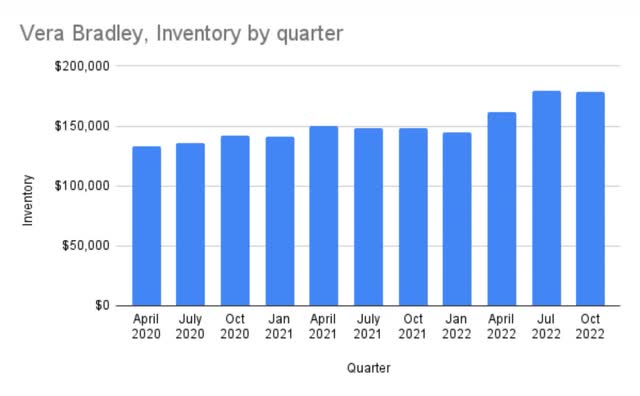

Lastly, inventory has risen steadily, and does not appear to be solely in preparation for the holiday quarter, but rather to historic highs for a company whose overall revenues are not growing and has low margins.

Vera Bradley inventory by quarter (Author's spreadsheet; data from Vera Bradley SEC filings)

This kind of inventory build-up does not seem to bode well for improving margins in the near future. Generally, inventory has been slightly larger than quarterly revenue, running between $130 million and $150 million, but now has been over $160 million for 3 consecutive quarters, with an ending value at Q3 for $178.3 million, versus expected sales of ~$140 million for the following quarter.

Management recognizes this is not a great position to be in, and John Enwright, the company's CFO, addressed it directly in response to an analyst question in December:

As we kind of work through inventories a little bit higher than we would want it to be, we expected this also would be a little bit different when we started this year, so inventory built. As we detailed, a lot of the build is associated with just the cost to get inventory from Southeast Asia to Indiana. . . we anticipate by the end of next year getting inventory back in line to where we would normally be, and so ultimately we would expect to see some free cash flow benefit next year associated with that and a reduction in inventory.

I expect to see inventory hitting the brakes with meaningful decline by the end of Q1 (ending in April 2023). Whether the company can get there without giving up even more margin is a tricky problem, and in the end it may have to live with those low margins for a while longer.

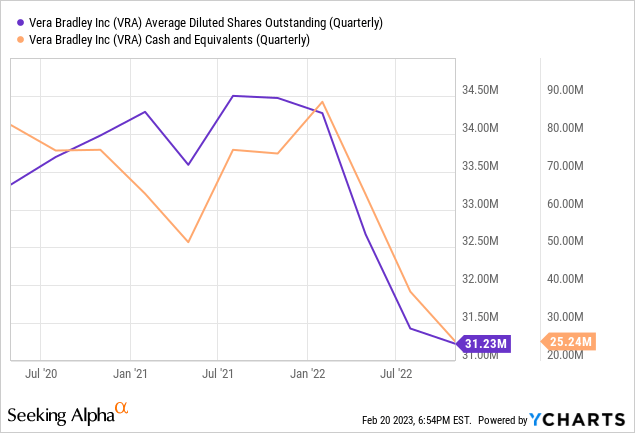

Impact of Share Buybacks

So with the trifecta of no real sales growth, operating on low margins with elevated inventory, what reason could there be on fundamentals that might explain the price action? Offering an explanation on valuation is probably never something that can be reduced to a single factor, and I do not think that is the case here. However, I do want to make sure investors are aware of the capital allocation strategy at work, which consists in large part of a $50 million share repurchase program.

Total cash and equivalents have deteriorated pretty quickly, from $64 million at the end of Q1 last year to just $25 million at Q3, taking the cash backing each share from about $2 to now under $1. Another $10 million is spoken for in the acquisition of the remaining 25% of Pura Vida. However, a good chunk of the cash is tied up in inventory, and as that corrects itself, one hopes the improvements to cash flow will show up in a stronger cash balance again. My point here for the moment is simply that shares have also come down at a fairly steep rate, with approximately an 11% reduction of the diluted shares since the beginning of 2022, though I would be surprised to see more added to that number, and am fairly certain cash conservation is now the greater priority. Is the repurchase program enough to make a major impact to the market value? Given the other negative factors going on at the moment, share repurchasing is likely playing some role in supporting the price, but other factors like the general strength in retail sales are probably contributing to market sentiment as well.

Options From Here

As much I would like to see green shoots of a turnaround story at work here, I personally don't yet see the evidence to support that narrative yet. So with the shares having gained some 30% since I suggested them as a speculative buy in August, I think the time has come to move to the sideline and either take profits or protect profits with trailing stops.

The company is in the middle of major leadership changes, not just with the new CEO Jacqueline Ardrey coming on board last fall. Now a whole cleaning out of some top leadership positions was announced in January, without plans to replace all of them, as well as the Pura Vida co-presidents leaving with the buyout of their interests. While these eliminations could help cut costs, it also could bring some organizational uncertainty, and will require some excellent management to guide the business through these changes while facing the underlying business challenges, all under a CEO new to the company.

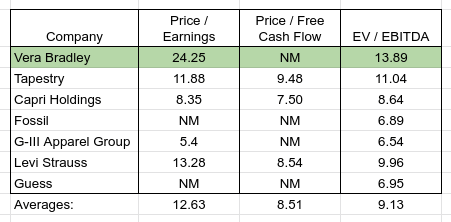

I realize I have not directly addressed valuation per se, so let me do so briefly now. In my previous article, I had compared Vera Bradley to some other fashion and accessories businesses, and thought the company had a slight undervaluation. In the intervening months, those comparisons have flipped, and now Vera is currently valued at higher P/E and EV/EBITDA multiples than any of the names I compared it to, and by a considerable premium in some cases.

Vera Bradley valuation versus peers (Author's spreadsheet; data from Seeking Alpha)

I see no special reason to justify the premium based on operations, nor catalysts for the business, and as a result I think it looks fully valued if not overvalued. Therefore, I am updating my rating, and now consider it a hold at best, and perhaps better considered as a sell to redeploy to better opportunities.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of KTB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.