Reinsurance Group of America - Almost Double The S&P 500 Since 2020

Summary

- The time has come to give you an update on Reinsurance Group of America, a quality reinsurer out of the US with global operations.

- I've been covering RGA for several years, and the company was one of my "Coronavirus discounts" that I wrote about between February to August of 2020.

- The outperformance has been absolutely stellar, and a good argument for looking at turnarounds. The lesson here is clear.

- Invest heavily in cheap quality. RGA's update is here.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

JHVEPhoto

Dear readers/followers,

Reinsurance Group of America (NYSE:RGA) is one of those companies that investors look at, but few invest in. The yield is relatively low, from a peer perspective. The company can be volatile at times, and frankly speaking, there are more appealing reinsurers from a fundamental perspective. However, this wasn't the case back when the company traded like a dirt sandwich following the COVID-19 crash. That's when I pounced.

The returns since that time have been very illustrative of value investing success, and I've had many messages since calling for me to provide similar, positive stocks for undervaluation investment and similar return potential to this one.

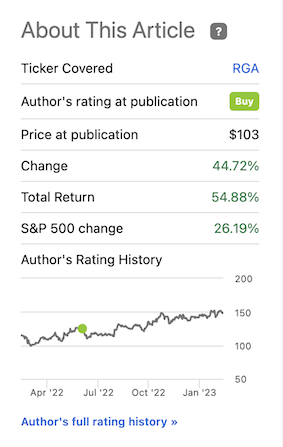

RGA Article (RGA Article)

And the thing is this, dear readers. I do provide these sorts of companies on almost a weekly basis. The problem is that at the time I'm giving you such articles, the view on the companies in question is so negative that most investors pass them over, or look at them and decide not to invest.

It's very easy to now, almost 3 years after the fact, look at this and say "Oh well - of course you should invest at such a valuation for this company. But looking back and remembering intimately the market mood that was, and the way investors were arguing at the time, those investors would have argued at the time that it wasn't "at all" clear.

That's the thing about value investing. You need to ignore the noise - focus on fundamentals. Look at the numbers, not at what the company, or what people are saying.

Let's update this company and see why it has performed the way it has.

Reinsurance Group of America - Quality has risen over 54%

So, what we've essentially seen from RGA is outperformance in a very volatile environment. RGA is a fortune-500 reinsurer that works directly and indirectly with assets worth over $3T, making it one of the largest life reinsurers on earth. The company holds assets worth around $64.5B - few companies are as large, or larger.

It's not a super-old business - 40 years, thereabouts, and the company's history includes MetLife (MET). How Reinsurance works and how RGA makes money is in turn described in my initial article on the company. I suggest you read it here to get an overview of facultative, reinsurance/other types of reinsurance so that you at least know the basics of what you're potentially getting into. It's a difficult field to understand unless you work in it full-time, but you should never go into anything unless you at least know the basics.

It goes without saying that a reinsurance company needs perhaps even better analytics, data understanding, and claims-handling skills than insurance companies to reduce overall costs and risks.

RGA, in turn, claims that a solid understanding of mortality, morbidity risks, shared medical underwriting knowledge, and processes developed from extensive research and experience make their company a leader in facultative underwriting. Their specialization is large cases and substandard risks. The company's claims are backed up by a long history of outperformance, and the latest results more or less confirm this.

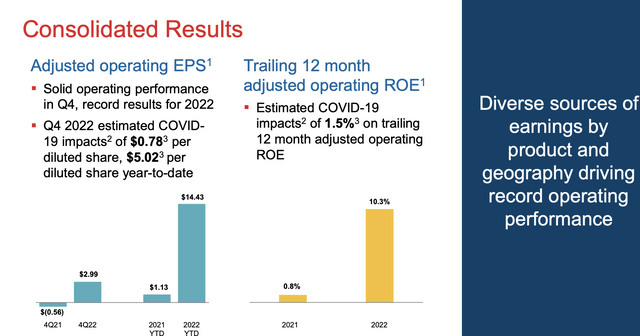

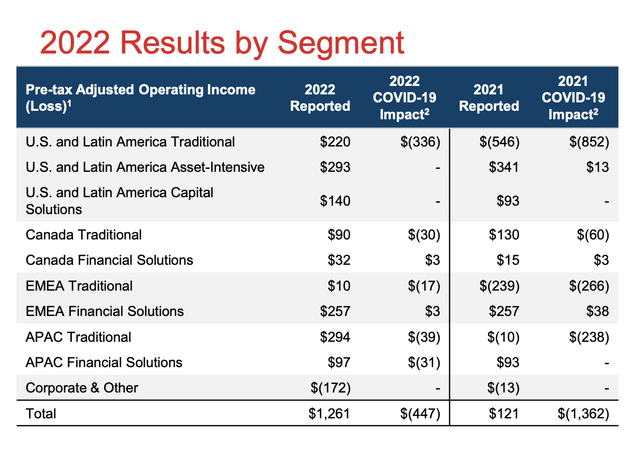

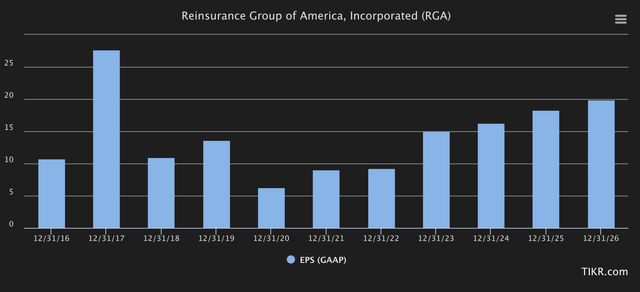

We have 4Q22 results, they were published in early February. The impacts of COVID-19 claims handling are still about $0.8/share, but the company is now absorbing these impacts without much worries. RGA saw strong earnings from all activities, including GFS, Asia, the US, and other segments. The new business activity saw organic growth at an impressive level of around 6%.

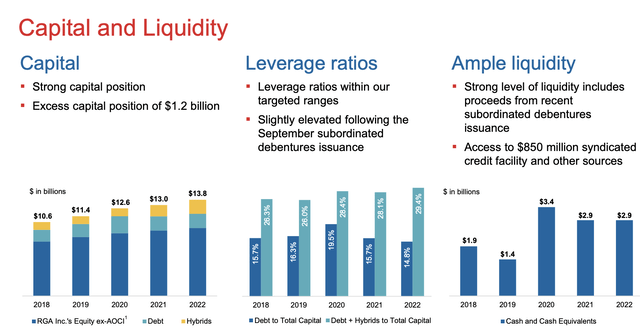

RGA has been busily buying back shares in the dozens of billions of dollars, and even without that, has excess capital upwards of $1.2B on hand for other transactions.

2022 was a good year. RGA delivered record operating income on an adjusted basis, with a 12-month RoE of over 10%. It's not the sector's best - far from it in fact, but it's good. The fact that 1.5% of COVID-19 impacts are still baked into this number tells us that there is still plenty of room for improvement here.

RGA is all about solid risk management - and the company has an attractive pipeline of both in-force and other transactions. The reversal of fortunes after COVID-19 for the company has been significant.

However, there are still headwinds in the US individual mortality segment. These higher claim costs are not expected to go away in 2023 either - so expect some of these things to persist. It can be illustrative to see how exactly these impacts compare, just how exposed RGA is to these trends, and why it was that the market punished the company as heavily as it ended up doing.

Still, at the same time, we've seen significant premium growth at constant currency, up 6% since late 2021, only impacted by current ongoing unfavorable FX. Investment yield for the company has declined somewhat, but is accelerating, especially for the new money rate, reflecting current macro, which is now up over 5%, and the company's investment portfolio remains over 65%-exposed to investment-grade bonds. Over 94% of the company's fixed maturities are investment-grade rated, and the company's capital and liquidity positions do not in any way reflect the market volatility that we've been seeing in the share price.

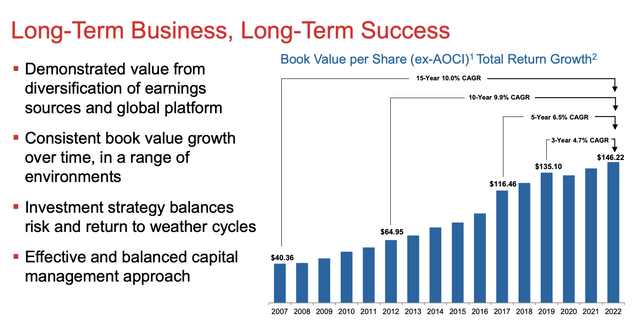

The company's capital allocation priorities remain laser-focused, with priorities towards organic growth and in-force block transactions that are favorable to the company. And the thing is, RGA has a superb history to back it up, that they're doing this extremely well.

RGA is an unexciting, profitable, solidly-managed reinsurance business. It really doesn't matter, as you can see above, where macro goes - RGA will typically come out of it well, even if that macro is a globally-spanning pandemic that directly affects the company's risk parameters.

Current estimates call for the company to continue improving its GAAP - quite significantly, as well, and I see the same trends as likely. Why? Because once we're unwinding the COVID-19 impacts, which at this point seems like a foregone conclusion for the next couple of years, the company's results and margins will improve by at least 100 bps, and this trickles directly to the bottom line. That makes forecast, which is also likely from a capital deployment perspective, like these, likely.

So you can see, overall, why I'm not worried in the least about RGA, and just "enjoying the ride" in my portfolio here.

Let's look at what we have going for us as we move forward here by checking future valuation and return potential.

Reinsurance Group of America - the valuation is not as compelling, but still a "BUY"

So, when I started investing here, forecasting was very difficult due to the visibility of the pandemic. However, I firmly believe that one could say that the pandemic was going to fade away sooner or later and that RGA wouldn't go under because of it. Under those two assumptions, I invested with the expectation of the company seeing a recovery towards the "mean", as we can call it here.

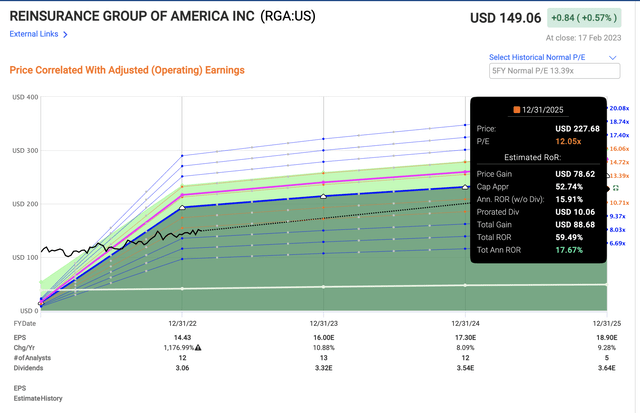

It has mostly materialized. RGA now trades at a blended P/E of just above 10x, to a 5-year average of around 13x. There's some margin of error in there due to volatility, but a 10-13x P/E is something I view as "fair" for this company, all things considered.

It's likely that 2023E will see further unwinding of the COVID-19 impacts, which on this basis alone will see good rates of EPS growth. Based on the continual growth of around 8-9% per year, which is the conservative scenario here (though we'll go even more conservative), I see an upside to RGA that's still at least 17.7% per year. And that's for an A-rated reinsurer.

RGA Valuation (F.A.S.T graphs)

Now, where we do run into some trouble is that the company has not often traded above $150 for extended periods of time without being overvalued. I've talked about this in Allianz (OTCPK:ALIZY) and Munich RE (OTCPK:MURGY), that there are nominal/technical barriers that companies have a hard time breaching. I do believe RGA's operations are significantly improved to where this forward 12-13x P/E will be valid, but I want to point out that we haven't seen the company advance past that $150/share for some time.

Just as with early investors in the Google IPO, the returns until 2010 were almost more than twice the returns seen between 2010-2019, on an annualized basis. Most of the outsized upside has already materialized here. That 54%+ that I and like-minded investors are sitting on here, that's gone. It's possible we'll see another 50-60% ROR until 2025E, but I view that as much less "likely" than the reversal that we've been seeing for the past three years.

I get why not everyone wanted to go in and why they saw the risks as too high - but too often I've seen these sorts of turnarounds, when they do happen, being questioned by investors as to why analysts didn't "inform them earlier of this".

I feel that I do try to inform across a very broad spectrum, but that most people don't pay enough attention when it actually does happen. This is why I'm happy that in iREIT on Alpha, members can ask me direct questions in chat about individual companies, and I can give them my unfiltered stances straight away.

The upside for RGA is still there - sort of. We have an average PT from 12 analysts averaging $155/share in a $116-$170 range. That upside is tightening though - it's less than 5% here, and I would mostly agree with that, though also allowing for outperformance potential due to more earnings growth.

However, the current estimate fails to take into account the potential for further volatility - which in insurance comes suddenly and with a vengeance. That's why analyst accuracy is fairly so-so on RGA - a 25% negative miss ratio even with a 20% margin of error.

So while I still allow a "BUY" for this company, and I do think that $155/share is a fair PT that I can get behind, I would say that overall, some of the upside potential has been realized here.

For me, I'm not prioritizing RGA in my buys. There are companies that trade at lower multiples in relation to their typical range, offer far higher yields, and far more "explosive" upside potential in the case of normalization.

This is what I look for these days.

Nonetheless, here is my current RGA thesis, as it stands.

Thesis

- Reinsurance Group of America is a quality reinsurer that has seen solid development over the past few years. I've seen returns of over 50% on this investment, and from that perspective, it's been extremely successful.

- RGA stock is still a "BUY" for me - but the price target is now closer to the current share price, and I don't see a massive upside beyond that - not on a realistic basis, at least. The upside here is less than 5-6%.

- My PT for the company is $155/share.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is a "BUY" here, albeit less than it was.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of RGA, ALIZY, MURGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.