GLU: Amortizing NAV Fund

Summary

- GLU invests in utilities and other defensive income-producing securities.

- GLU pays a forward yield of 7.8%. However, the yield has been funded by liquidating NAV, as GLU does not earn sufficient returns to fund the distribution.

- Compared to peer funds, GLU has lower historical returns and higher volatility.

Daniel Balakov

The Gabelli Global Utility & Income Trust (NYSE:GLU) is a closed-end fund that focuses on income producing utilities and defensive equities. The fund appears to be an amortizing 'return of principal' fund as its forward yield is far above the fund's historical 5Yr average annual return. I think investors are better served looking at peer funds like the Reaves Utility Income Fund (UTG) or the DNP Select Income Fund (DNP) with better historical returns and lower volatility.

Fund Overview

The Gabelli Global Utility & Income Trust is a closed-end fund ("CEF") that is focused on equity and income producing securities of companies involved in the utilities industry and other similar defensive industries that pay periodic dividends. GLU can invest in both domestic and international companies.

The GLU fund may use leverage to enhance returns. As of December 31, 2022, the fund had $95 million in net assets and $156 million in total assets for 39% effective leverage. The GLU fund charges a 1.37% expense ratio.

GLU is lead managed by Mario Gabelli, an award winning fund manager and founder of Gabelli Asset Management ("GAMCO"). Mr. Gabelli was inducted to Barron's 'All Century Team' in 2000.

Portfolio Holdings

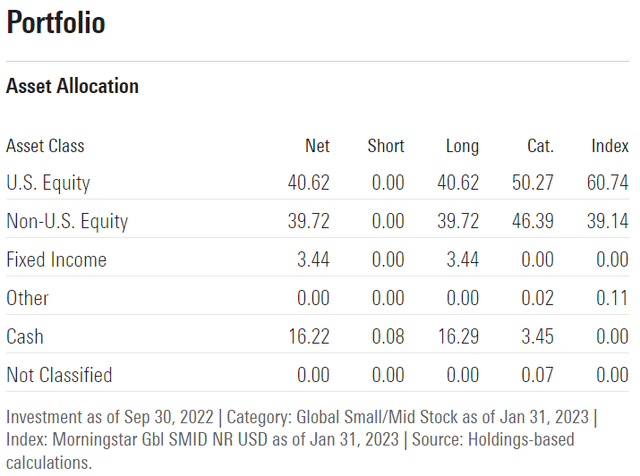

Figure 1 shows GLU's asset allocation. The fund has 41% invested in domestic equities, 40% invested in global equities, 3% invested in fixed income, and 16% allocated to cast, as of January 31, 2023.

Figure 1 - GLU asset allocation (morningstar.com)

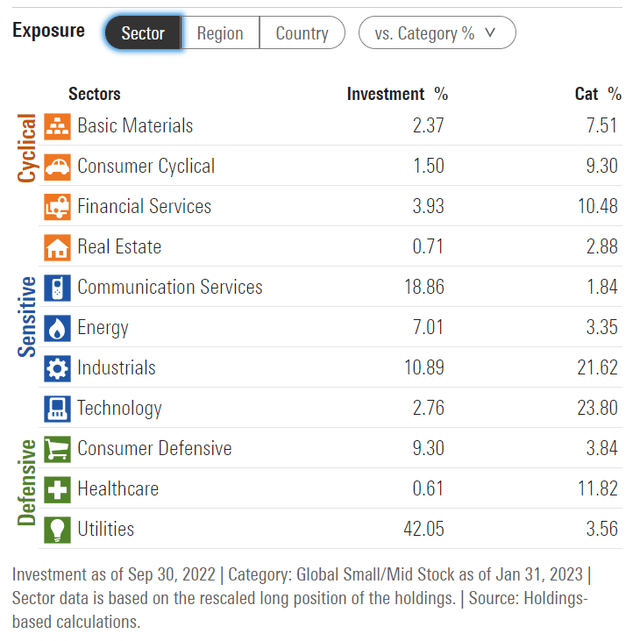

GLU's largest sector exposure is Utilities at 42%, followed by Communications Services at 19% and Industrials at 11% (Figure 2).

Figure 2 - GLU sector allocation (morningstar.com)

Returns

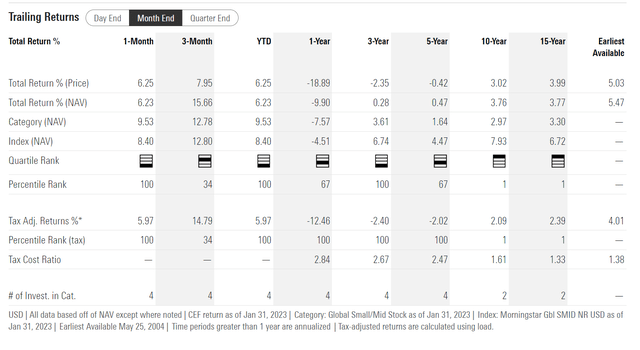

Figure 3 shows GLU's modest historical returns. The GLU fund has 3/5/10/15Yr average annual returns of 0.3%/0.5%/3.8%/3.8% respectively to January 31, 2023.

Figure 3 - GLU historical returns (morningstar.com)

Distribution & Yield

The GLU fund pays a monthly distribution of $0.10 that has been maintained since inception, although the distribution briefly dipped to $0.0657 for a few months in 2019. The monthly yield annualizes to 7.8% on market price and 7.2% on NAV.

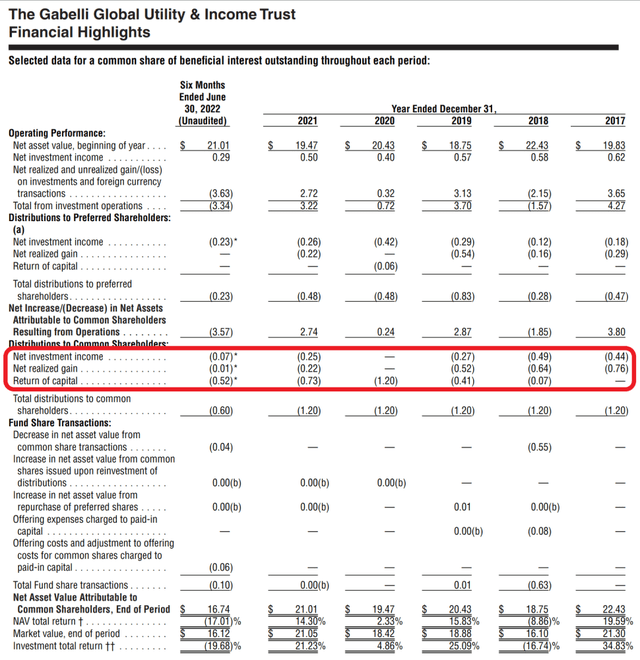

However, investors should note that historically, GLU's distribution has been funded from a combination of net investment income ("NII"), realized gains, and return of capital ("ROC"). ROC usage has ranged from 0% in 2017 to 100% in 2020 (Figure 4).

Figure 4 - GLU has increasingly relied on ROC to fund its distribution (GLU 2022 semi-annual report)

Unfortunately, with a 5-Yr average annual return of only 0.5%, GLU appears to be an amortizing 'return of principal' fund that cannot earn its distribution and must liquidate its NAV to fund its distribution. The GLU fund has a troubling long-term decline in its NAV, which is a classical sign of 'return of principal' funds (Figure 5).

Figure 5 - GLU has an amortizing NAV (morningstar.com)

GLU vs. Peer Funds

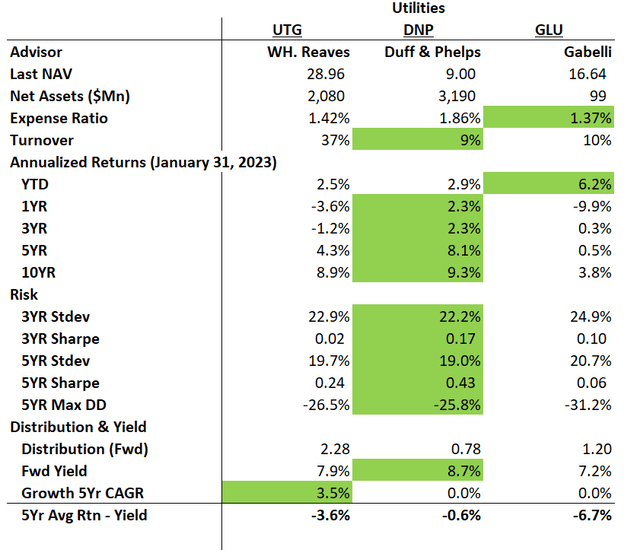

Figure 6 compares the GLU fund against peer utility-focused CEFs like the Reaves Utility Income Fund ("UTG") and DNP Select Income Fund ("DNP") using my unbiased proprietary scorecard.

Comparing the funds on costs, the GLU fund is best, with a 1.37% expense ratio. It also has a low portfolio turnover of only 10%.

Figure 6 - GLU vs. peer funds (Author created with returns and risk from Morningstar and fund details and distribution from Seeking Alpha)

However, GLU lags behind peers in terms of historical returns. The difference is especially stark on longer-term time frames where the GLU fund has only generated 0.5% and 3.8% average annual returns on 5 and 10Yr basis while peers like UTG and DNP have returned 4.3%/8.9% and 8.1%/9.3% respectively.

GLU is also riskier in terms of having higher portfolio volatility and maximum drawdown.

Finally, in terms of distribution yield, GLU has the lowest forward distribution yield and biggest returns to yield gap, which suggests its distribution rate is unsustainable.

Between the three funds analyzed, I believe the GLU fund is the least desirable, as historically it has performed the worst while having the highest volatility. It also has the most unsustainable distribution, as measured by the difference between its 5Yr average annual return and forward distribution yield.

Conclusion

The GLU fund from Gabelli focuses on income producing utilities and defensive equities. The fund appears to be an amortizing 'return of principal' fund that cannot earn its distribution. Compared to peer funds like UTG and DNP, the GLU has lower historical returns and higher volatility. I think investors are better served looking elsewhere.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.