Games Workshop: An Excellent Business, But At A Cost

Summary

- Games Workshop is a highly profitable company with truly excellent intellectual property and a sticky customer base.

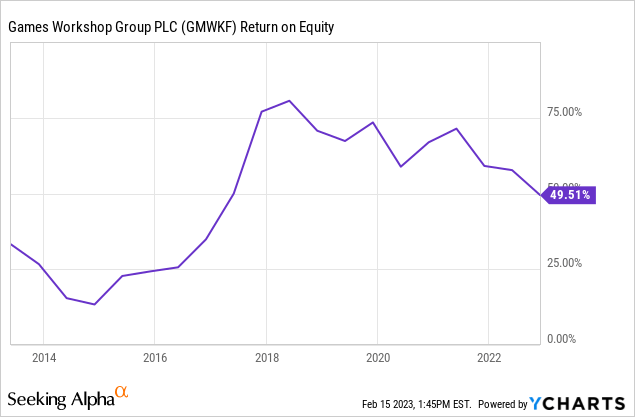

- The company has a wide moat, with correspondingly high margins and returns on equity.

- A major catalyst in the form of an upcoming Warhammer TV series on Amazon Prime offers an exciting opportunity to gain new customers.

- However, the stock comes at a premium. Given looming short-term economic headwinds, I think it's worth waiting for a better buying opportunity.

Editor's note: Seeking Alpha is proud to welcome Finlay Robertson as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Manuel Milan

Games Workshop Group (OTCPK:GMWKF) is a quality business by almost any conceivable metric. It has a unique offering, high margins, consistent returns on equity, a rock-solid balance sheet - the list goes on. However, every business has its fair price and, at current trading levels, I don't believe there is a sufficient margin of safety to justify pulling the trigger here just yet. This is a stock to watch closely.

Business Summary

Games Workshop's primary business is in the design, manufacture, and sale of miniature Warhammer figurines. These figurines are assembled and painted by the customer and can be used to play tabletop strategy games, or just collected and displayed in their own right. The Warhammer universe is a fantasy setting where armies of humans, elves, orcs, and other creatures fight for control over a world of magic, monsters, and ancient powers. This entire fictional universe was created by Games Workshop and has developed a cult-like following over the years.

In addition to the figurines, Games Workshop also sells a host of supplementary materials such as paints, novels, video games, etc. Basically, they've created a fantasy universe with a game to go with it. They'll sell you the figures to play the game, the materials to paint the figures, and the books to read about the story. This business is all about the IP (intellectual property); it's what gives it its moat and allows for its sky-high margins. If you're a Warhammer fan (and there are many), there is nowhere else you can get your fix than from the Games Workshop and their trade partners.

Revenue is split into licensing revenue (6% of total revenue as of the most recent half-year filing) paid by third parties for the rights to use Warhammer IP in video games, books, etc., and core revenue primarily from the sale and distribution of Warhammer figurines (94%). Core revenue is derived from trade sales (57% core sales) to ~6,300 accounts - mostly independent retailers, sales made through their network of ~500 physical Games Workshop stores worldwide (23%), and sales made through their website (20%). A big part of the consumer experience is going into the store itself and perusing the latest figures in the Warhammer universe, which is why online sales account for a relatively small amount of total revenue. That said, a new online store is scheduled to be released over the summer, which is, frankly, long overdue.

The company is headquartered in the UK and has its primary listing on the London Stock Exchange. It trades in the U.S. OTC market under the ticker GMWKF.

The Good

Without a doubt, the selling point for Games Workshop is its brilliant IP and the loyal customer base that comes with it. According to their most recent filing, the Warhammer website sees more than 100,000 visits a day and has 718,000 accounts (up 22% over six months), as well as an aggregate of 1.9m followers across social media platforms.

In August 2021, Games workshop released Warhammer+, a £4.99-a-month streaming service dedicated entirely to Warhammer-based shows - as of November 2022, they had 115,000 subscribers and over 5m views. While revenue from this service is not material (£3m in the most recent half-year) and I can't see it overthrowing Netflix (NFLX) any time soon, I do think it demonstrates nicely the strength of the IP. Furthermore, over 50 video games have been produced (by third parties), including the bestselling "Total War: Warhammer" series, which, although sales figures are unavailable, is estimated to have sold copies in the millions.

I think it's safe to say that the IP they have created is strong. However, at the end of the day business is about making money, and Games Workshop is a business. With a gross margin of 66% and a net margin of 29% as of the most recent filing, it's a profitable one at that. One just needs to look at their return on equity to see how resilient this business model really is: 51% as of November, and it has been consistently high over the last five years. I can imagine Warren Buffett's ears pricking up right about now.

Take a look at their online store and you can see why. A 9cm tall Daemon Prince model costs £47.50, and that's before you've even thought about buying paint. They have you covered in that department, 12ml of paint for only £2.75 a pop - they recommend nine colors for a Daemon Prince. You then need a minimum of about 20-30 figures to play a game (many players have hundreds of pieces in their collections). You can start to see how this all begins to add up. But the beauty of it is that people will pay this because there is nowhere else you can buy Warhammer. Sure, you can shop for second-hand models on sites like eBay, but a large part of the experience is in the assembly, painting, and customization itself - which you really don't get by purchasing someone's pre-used model.

In my opinion, management has been effective in allocating capital. They have stated that they're not interested in pursuing acquisitions and are primarily looking to grow the business organically, which I agree is the best strategy in this case. The jewel in Games Workshop's crown is its IP, so it doesn't really make sense to go on an acquisition spree.

Management's policy is to return any excess cash to shareholders; as such, they have been paying a dividend relatively consistently since 2012, with a 10-year CAGR of 18.93%. While the dividend payout ratio is too high for my liking at 84%, I am satisfied that they are investing sufficiently in the business. Obviously, such a high payout ratio makes the dividend unpredictable as it fluctuates with profits and potentially due to factors outside of management's control (state of the economic climate, etc.), so one can't necessarily expect the company to maintain the current dividend.

Furthermore, they have a healthy balance sheet with almost no debt and an ample £85m in cash as of the most recent filing. This company is a cash-generating machine, which is a byproduct of its IP-centric business model requiring relatively little capex. TTM levered free cash flow was £96m, and the business has been consistently free cash flow positive.

In December, Games Workshop reached an agreement in principle with Amazon (AMZN), exploring the possibility of Amazon developing the Warhammer universe into film and TV projects; actor Henry Cavill is rumored to be heavily involved. While a Warhammer TV series on Amazon Prime is still a long way off, this is exciting news for Games Workshop. As an example, the hugely popular Netflix series "The Witcher," which was based on a video game of the same name, and which coincidentally saw Cavill in the lead role, spurred sales of the video game to rise by over 500% and introduced a whole new audience to the franchise. Even if a Warhammer series has a fraction of the impact of "The Witcher" it could be great news for the stock.

The Bad

As with any business, there are risks. For one, the business is based entirely on discretionary spending. The high margins are a double-edged sword as they allow for huge profitability but in a poor economic climate could become its downfall as people can't afford to spend £50 on plastic miniatures. In my opinion, this is the greatest risk facing Games Workshop. However, sales fared well in 2022 - in fact, they were at record highs despite a global cost of living crisis and soaring inflation.

There have been concerns that the rise in 3D printing could pose a threat to the business. I am not particularly worried about this; entry-level 3D printers have been available at a relatively low price for a number of years now, with seemingly no impact on the top line. I believe that people value having official Warhammer figures as a matter of pride, and value the community experience. In the same way, you wouldn't really 3D print a Lego set or a "Star Wars" figurine, even though you could and it would probably be cheaper.

IT is an issue, as one quick look at their online store will reveal. They are currently heavily reliant on legacy IT infrastructure and are working on implementing a new IT system, which has been beset with delays. Their new online store has been delayed until the summer. However, only 20% of sales are made on their website as the in-store experience is particularly good.

Games Workshop clearly has great IP, but it requires updating so as to not get stale. They need to constantly be evolving the story, releasing new figures, and keeping their audience captivated - otherwise, there is a real risk of stagnating and boring their customer base. I am reassured that this will not be the case, though; in the most recent half-year, they spent a healthy £7m on product development - half of investing cash spent and an increase in the number of jobs in the design department by 20 to 304. I am confident that management understands that success is strongly dependent on investment in their design studios.

Recent Performance

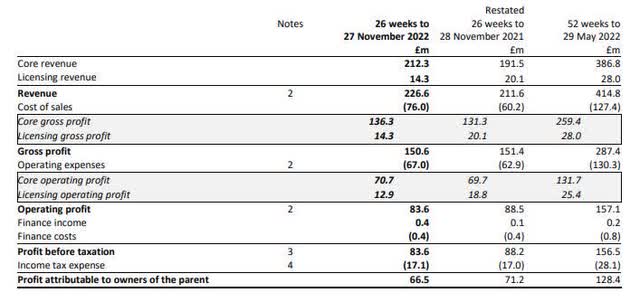

In January, Games Workshop posted relatively strong results for the half year up to Nov. 27, 2022. Revenues were £226.6m for the period, up 7% during the same period the prior year, with a profit of £66.5m vs. £71.2m the year before. The drop in profits is mainly down to the higher cost of goods sold squeezing gross margins, as well as a drop in licensing revenue. The latter is extremely profitable, with 100% gross margin, so drops in licensing revenue have an overweight impact on the bottom line.

On a constant currency basis, revenue actually remained level with the same period last year. This lackluster growth was for a number of reasons including ~£2m of lost revenues from Russia and poor performance in China due to lockdowns. Trade and retail revenue both increased slightly over the period and online decreased very slightly. This is in line with expectations as online sales were expected to slow with the continual reopening of retail stores worldwide.

Licensing revenue was £14.3m vs. £20.1m for the same period last year, but this doesn't concern me as last year's figure was abnormally high due to a high level of guaranteed income on multiyear contracts signed in that period - including one guarantee of £7.5m. This income is recognized in the period, but the cash is paid over the lifetime of the license. Of the £66.5m profit, £54.2m (82%) was paid out as dividends over the period.

Games Workshop income statement for the half-year ending 27th November 2022 (Games Workshop Investor Relations)

Valuation

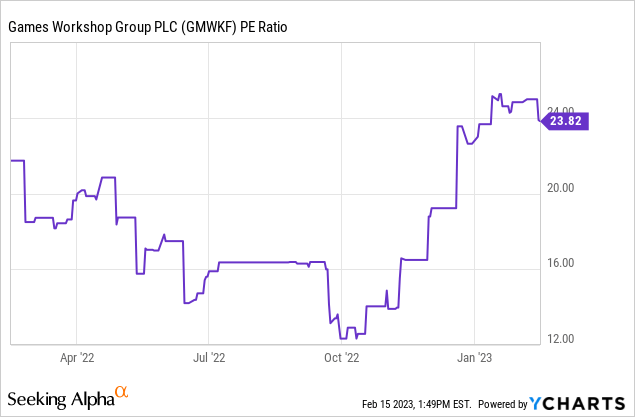

The Games Workshop is a great company, but does it come at a great price? With a current P/E of about 24, almost at its highest point in the last 12 months and above its five-year average of 22, I don't think so. While there is no perfect comparison to conduct relative value analysis owing to the unique business, looking at companies like game manufacturer Hasbro (HAS) trading at a P/E of 20, toy manufacturer Mattel (MAT) trading at a P/E of 15, and a median P/E across the consumer discretionary sector of 15, it seems as if Games Workshop isn't cheap relative to the sector at this moment in time. While I do believe this stock should definitely be priced at some premium, there is not a sufficient margin of safety here to interest me at the current trading levels.

Conclusion

Games Workshop is a wonderful business, and I think I have made my opinion on it pretty clear. However, 2023 will be a difficult year for the company, with a worsening global economic climate likely impacting top-line sales while inflation squeezes the margins. As such, I think there will be opportunities to pick up this stock at a discounted price in the coming months as we start to see this impact the financials and the stock price. Fundamentally, this is somewhat of a short-term hurdle that I don't think will impact the business significantly in the medium to long run. I will be looking to buy this stock at a sub-20 P/E.

Having said that, I do think it's probably trading at a roughly fair price right now given the strength and profitability of the business. If you take a long-term view this could be interesting at current levels. In the words of Warren Buffett himself, "it's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." Of course, I would rather buy a wonderful company at a wonderful price, and I think with some patience this is achievable. I would recommend keeping a close eye on Games Workshop.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.