IEUR: Europe's Recovery On Borrowed Time

Summary

- After an impressive rally, European equity valuations are now no longer attractive in the context of relatively high interest rates and weak nominal growth prospects for the continent.

- The trailing P/E ratio on the MSCI Europe sits at just 13.3x, but on an unadjusted basis, the ratio rises to 15.1%, even as profit margins are at record highs.

- The iShares Core MSCI Europe ETF (IEUR) is highly likely to underperform US Treasuries over the coming years as scope for continued dividend growth is weak.

Andrii Yalanskyi

Since its September lows the iShares Core MSCI Europe ETF (NYSEARCA:IEUR) has returned 36%, for an annualized gain of over 120%. Valuations are now no longer attractive in the context of relatively high interest rates and weak nominal growth prospects for the continent. Meanwhile, the profitability tailwinds from improving terms of trade amid the easing of the energy crisis are nearing an end.

The IEUR ETF

The iShares Core MSCI Europe ETF seeks to track the investment results of an index composed of large-, mid- and small-capitalization European equities. Financial stocks dominate the index with a 17% weighting, closely followed by Industrials (16%) and Health Care (14%). Technology exposure is low at 8%, compared to a 21% weighting in the MSCI World, which helps explain the IEUR's relative valuation discount. In terms of country exposure, the UK has by far the highest weighting at 24%, followed by France (17%), Switzerland (14%) and Germany (13%). The fund pays a dividend yield of 2.8%, slightly below the MSCI Europe's 3.2%, while the expense fee is 0.09%.

Valuations Are Not At Attractive As They Appear

The trailing PE ratio on the MSCI Europe sits at just 13.3x, which is significantly below the long-term average, but this is a misleading picture of the true valuation of the index. For a start, the earnings used to calculate the trailing PE ratio excludes one-off items. When these are included the PE ratio rises to 15.1x.

MSCI Europe Adjusted And Basic EPS (Bloomberg)

Even these unadjusted earnings reflect near-record profit margins, only seen during the pre-global recession peak. The current profit margin on the MSCI Europe is now almost 50% above its long-term average, and margins have an extremely reliable track record of mean reverting around the economic cycle.

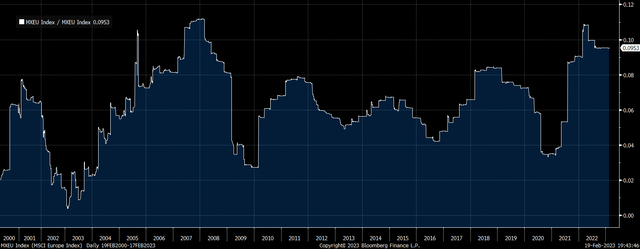

MSCI Europe Profit Margins (Bloomberg)

IEUR To Underperform Treasuries Over Coming Years

With dividend payments already representing 50% of earnings, falling profit margins would suggest that the prospects of continued dividend increases are weak. With the current dividend yield sitting at just 3.2%, this is likely to be an upper pound for returns over the coming years. Indeed, over the past decade sales per share on the MSCI Europe have gone nowhere in local currency terms and have fallen by almost 2% a year in dollar terms. Without a dramatic reversal in this long-term trend, the IEUR is highly likely to underperform US Treasuries over the coming years.

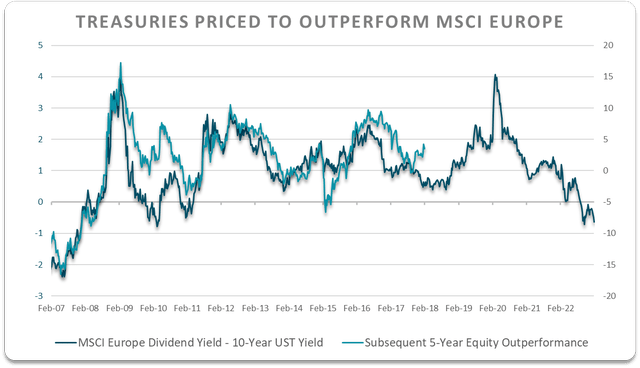

In fact, as the chart below shows, when 10-Year UST yields have been above the MSCI Europe dividend yield over the past 15 years, Treasuries have almost always outperformed. The current spread of 60bps in favor of bonds is consistent with 5-year annual bond outperformance -8%. The same story holds true if we compare the MSCI Europe dividend yield with real 10-year UST yields, even though inflation expectations are currently elevated from a historical perspective, which should theoretically benefit equities.

Bloomberg, Author's calculations

In order to see continued outperformance in the IEUR relative to USTs over the coming years we would need to see a strong recovery in nominal GDP growth that would allow real bond yields in the eurozone and the UK to continue rising without undermining equity valuations. Alternatively, we would need to see a further collapse in energy prices. Regarding the former, with money supply growth across the continent collapsing, nominal GDP growth is likely to slow sharply over the coming quarters. As for a continued easing in the energy crisis, despite an 80% decline in UK wholesale natural gas prices since the August peak, the structural issues facing the region's energy supplies still leave European companies at risk of future price spikes.

Little Scope For Further Currency Gains

As a US dollar-based ETF, a rise in the euro or the pound could create another source of positive returns for the IEUR. The strong rallies in both currencies over the past five months have been a major contributor to IEUR gains. However, the recovery in these currencies reflects a correction from deeply undervalued levels, which no longer prevail. Further euro and pound gains would likely require a dovish reversal in Fed policy, in which case we would also likely see a strong recovery in US bonds.

Summary

There is little value left in the IEUR after the recent strong rally and I would much prefer the relative safety of cash or US Treasuries. The dividend yield of 2.8% on the ETF is inferior to the yield available on cash and bonds, while there is limited scope for dividends to increase as nominal GDP growth prospects are weak. The tailwind provided by euro and sterling strength is also no longer in play after significant rallied in both currencies have returned them back to fair value.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TLT, EDV, TIP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.