Rates Spark: Looking Backward To Economic Data And Forward To Geopolitics

Summary

- Today promises another series of upbeat indicators reinforcing the higher-for-longer narrative.

- EUR rates appear to have only just reached fair value, helping to explain why investors still look at them with suspicion.

- Geopolitical tensions are rearing their ugly head.

zoom-zoom/iStock via Getty Images

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

EUR rates are far from stretched. In fact, they’ve just reached fair value

After a slow start this week, markets gear up for the release of important sentiment indicators for the month of February. While the PMI surveys contain specific questions on various aspects of economic activity, they remain essentially sentiment indicators. As such, they are subject to the same biases as the people answering them. One such bias is that economic agents, just like market participants, may well feel that current conditions are better just on the basis of really poor expectations late last year.

We often talk about the circularity of the Zew survey of investors (also published today) having a market impact on the same investors, but this is also true for other surveys. All this is merely to warn our readers that sentiment indicators can lead us astray when it comes to the direction of the economy, and certainly of financial markets. At the margin, an improvement from weak levels in today’s PMIs could go some way towards reinforcing the higher-for-longer narrative, but we would caution that this reflects information already contained in financial market prices.

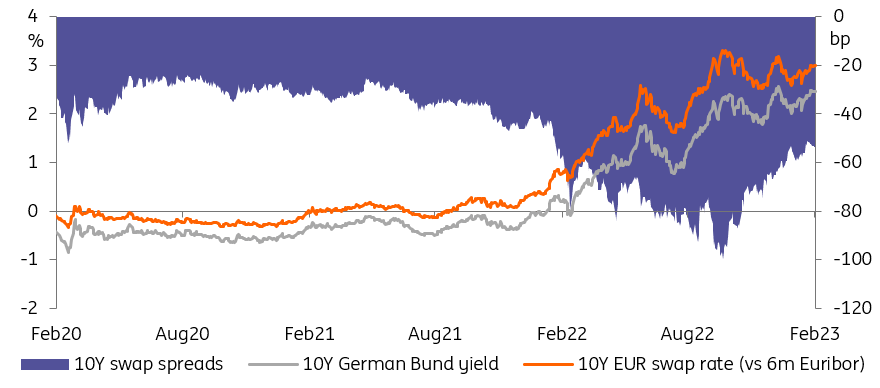

This being said, we do not see current EUR market rates as being particularly high. Yesterday, Olli Rehn made comments consistent with hikes in June and later being acceptable to ECB doves. In fact, he kept the door firmly open to more hikes in the summer. Last week, Panetta, another dove, stressed that hikes are set to continue after March, albeit at a 25bp pace. All these policy signals are indeed conditional on economic data, especially inflation, but they show that the roughly three more hikes priced by the swap curve are far from absurd. Similarly, 10Y Bund yields hovering around 2.5% and 10Y swap rates around 3% is roughly where we pitched fair value at the start of the year, so we’re open to the idea of a further increase in market rates.

10Y EUR Rates Are At Roughly Where We See Fair Value (Refinitiv, ING)

USD bonds find ready buyers despite stronger US data

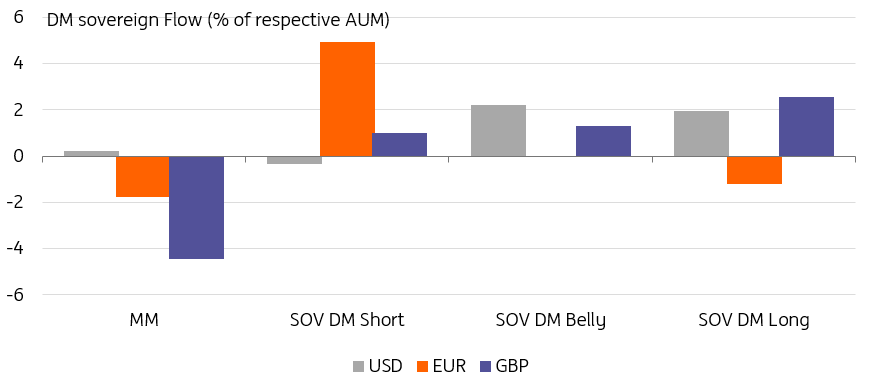

US data should paint a similarly upbeat picture today. Our US economist is fond of repeating that unseasonably warm January temperatures are boosting activity numbers this year, and housing indicators are no exception. The repricing higher in yields has already triggered inflows worth 2%+ in USD and GBP medium and long sovereign bond funds in the past four weeks, according to EPFR. This is in contrast with net selling in EUR (but balanced by inflow at shorter maturities). Past flow data isn’t sufficient to draw conclusions about the future direction of travel, but it seems to echo our view that the ECB is behind the Fed and BoE when it comes to its tightening cycle, and so, EUR-denominated bonds are looked upon with suspicion by investors.

Behind this deluge of upbeat economic news lurks something more concerning. We have highlighted before that risk assets’ interest rates sensitivity this year seems to be much below that of 2022. In other words, despite a loss in momentum in some quarters, more hawkish pricing in rates hasn’t yet derailed the improvement in risk sentiment.

The risks to this state of play are twofold. First, we may well reach the point where investors judge that interest rates exceed feeble developed market economies’ ability to stomach them. Secondly, geopolitical tensions are rearing their ugly head once again - with flashpoints in Europe, the Middle East and East Asia. It is difficult to predict when these will register with the market’s consciousness, but the mix of elevated valuations and rising interest rates makes for a more fraught environment. The latter may well result in higher energy prices, which have proved detrimental to bonds last year, but with better growth prospects the justification for the latest sell-off, the impact on rates is harder to call.

Rising Intermediate And Long USD And GBP Yields Have Met Rising Demand (Refinitiv, ING)

Today’s events and market view

The main event today is the release of February PMIs for the eurozone and the UK. Consensus is for a small improvement to still-modest levels straddling the 50 contraction-expansion line. This will be followed by the Zew survey, which we suspect will be largely ignored as its main point is to predict PMIs.

Germany and the UK are due to auction bonds maturing in 2028 and 2029 respectively. Spain has mandated banks for a 15Y syndicated deal, which should materialise today.

US markets returning from a three-day weekend have to grapple with their own set of PMIs and existing home sales. Both may well extend the string of good US economic numbers, comforting investors in their view that policy rates will remain higher for longer.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by