GDLC: The 59% Discount To NAV Seems Irresistible

Summary

- The Grayscale Digital Large Cap Fund trades at an even steeper discount to NAV than its larger peers.

- This is likely caused partly by its manager selling into a crypto bear market.

- There are legitimate business reasons for Grayscale to desire to turn these products into ETFs.

- My expectation is that this fund will take a much longer time to get converted into an ETF.

- Looking for a portfolio of ideas like this one? Members of Special Situation Report get exclusive access to our subscriber-only portfolios. Learn More »

24K-Production/iStock Editorial via Getty Images

The crypto-related investments currently really appeal to the value investor inside of me. I had been slowly building my Grayscale Bitcoin Trust (OTC:GBTC) allocation back up (read more here). But after the FTX (FTT-USD) implosion, I've become more aggressive in expanding crypto-related holdings. I've also been buying the Grayscale Ethereum Trust (OTCQX:ETHE) (read more here), which I suspect is suffering the same forced selling as its big Bitcoin (BTC-USD) sister fund, the Grayscale Bitcoin Trust. A commenter on the Ethereum Trust article rightfully pointed out Grayscale has another trust that's smaller in size at $236 million in size that trades at an even deeper discount called the Grayscale Digital Large Cap Fund (OTCQX:GDLC). I think that fund is also super interesting, but on balance, I think it is a worse choice, especially GBTC, even though it is trading at a deeper discount.

What's especially interesting here is that the manager of these trusts is under pressure because a related company, Genesis, is involved in bankruptcy proceedings. There are reports Grayscale is trying to raise funds by selling venture investments or selling its own holdings in the Ethereum Trust and other Trusts. I want to highlight John Miller, who has a very good article out that goes into a lot of detail about this.

Starting with the basics, the Grayscale Digital Large Cap Fund offers exposure to five different cryptocurrencies: Bitcoin, Ethereum (ETH-USD), Polygon (MATIC-USD), Solana (SOL-USD), and Cardano (ADA-USD). The majority of its holdings are really Bitcoin and Ethereum, making up 95% of the value per unit:

Grayscale Digital Large Cap Fund Holdings (Grayscale)

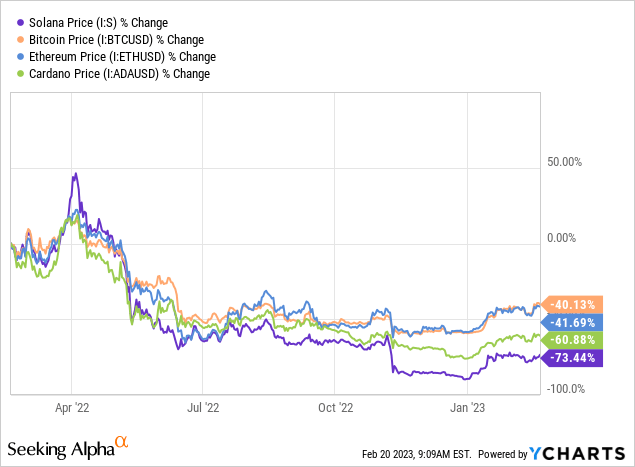

I know very little about Polygon, Solana, and Cardano. I'm really not an expert on their long-term viability. From my understanding, Solana was a major holding on the FTX balance sheet, and it has gotten extra hard around the FTX implosion.

While other cryptos have recovered some of the ground lost during the FTX blow-up, Solana has still quite a bit to go.

The reason I think there is a compelling argument to make for this fund over GBTC or ETHE is because the additional discount buys you so much. I've put together a table to illustrate this. The table below shows how much of crypto exposure the price of the funds buys an investor (the funds all have similarly high 2.5% fees):

| Fund | Price | Bitcoin exposure in % of price | Ethereum exposure in % of price | Other exposure in % of price |

| GBTC | $12.20 | 185% | 0% | 0% |

| ETHE | $7.90 | 211% | 211% | 0% |

| GDLC | $6.17 | 159% | 70% | 12% |

Source: Author's calculations

The GDLC fund buys 241% exposure to a basket of cryptos. The Bitcoin exposure of the GDLC fund is only 30% lower compared to the pure-play GBTC, while you get another 70% of the purchase price per unit in Ethereum, alongside 12% of the purchase price in these other larger cryptocurrencies.

Compared to pure-play ETHE, you get a lot less Ethereum exposure. The exposure to cryptocurrency is 141% lower. However, you get Bitcoin exposure equal to 159% of the purchase price and 12% of the other large cryptocurrencies alongside it.

If you know exactly what you want, either ETHE or GBTC and you think the others are useless, this fund isn't great. If you 1) actually want Bitcoin exposure, but you don't mind the others or 2) aren't completely confident Bitcoin is the way to go, there is merit to going this route.

I'm generally enthusiastic about getting a lot of additional crypto exposure at very low prices. I'm not very confident in picking any winners in this space at all. My strategy is to try and pick up a lot of free stuff, a philosophy that isn't exclusive to the crypto space, by the way. GDLC offers that in spades.

There is one big problem here. The reason I especially like GBTC and ETHE second is that I expect there will be a catalyst to close the discount somewhere down the line. Grayscale is suing the SEC to try and get the agency to allow it to convert its closed-end Bitcoin fund to an ETF.

You're not antagonizing the SEC like this if you don't want to do this. In the prior ETHE article, I've also described why converting makes business sense:

I also believe it makes business sense to do so, even though you risk losing assets or having to lower the management fee. ETFs attract way more capital than closed-end funds and are easier to get access to for investors across the world. The largest ETF in an asset class tends to attract the most flows. GBTC is already the largest Bitcoin fund in the world and would have a leg-up establishing itself as the prime ETF. This is a must-have spot to fight for, and I think the company will do so.

At some point, I believe Bitcoin will be allowed to be in an ETF. Many smaller asset classes are traded in this wrapper, and as the ecosystem and adoption grows, it makes less and less sense to exclude precisely this one. Once Bitcoin is allowed inside an ETF it should be a matter of time before other cryptos are allowed.

However, I think the timeline for Bitcoin is likely the shortest. A multi-asset ETF is a bit more complex and comes with many additional problems. This multi-asset fund is also a lot smaller. With this fund, Grayscale is much worse positioned to become the largest multi-asset crypto ETF. The incentive, business sense, and the timeline make it much less certain this will be converted to an ETF down the line compared to both GBTC and ETHE.

With this fund, I believe investors are much more dependent on the underlying assets to do well. In summary; this fund offers much more raw crypto bang for your buck. However, the probability this is converted into an ETF to serve as a catalyst to instantly close the discount to NAV is much lower. I like the crypto exposure, but I'm here for the discount closing. Although I think all three funds are likely to do well over the very long term, at the end of the day, I prefer GBTC and ETHE.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

I gravitate towards special-situations. That means situations around companies or the market where the price can move in a certain direction based on a specific event or ongoing event. This eclectic and creative style of investing seems to suit my personality and interests most closely.

Since 2020 I host a podcast/videocast where I discuss (special-situation/event-driven) market events and investment ideas with top analysts, portfolio managers, hedge fund managers, experts, and other investment professionals. I highly recommend it (pick episodes around topics that interest you) for the amazing guests that come on with regularity.

I've been writing for Seeking Alpha since 2013 after playing p0ker professionally. In 2018 I founded Starshot Capital B.V. A Dutch AIF manager. Follow me on Twitter @Bramdehaas or email me Dehaas.Bram at Gmail

Disclosure: I/we have a beneficial long position in the shares of GBTC, ETHE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.