We Remain Sellers Of Beyond Meat Ahead Of The Earnings

Summary

- Lapping partnerships are likely to negatively impact Beyond Meat's sales. On the other hand, the launch of new products in MCD restaurants in Europe may help to offset the decline.

- Frequent management changes are concerning for us from an ESG perspective and could be a warning sign for investors.

- The improving macroeconomic environment, along with cost-cutting measures and a revamped strategy, may positively benefit BYND stock in the long term.

- In the near term, uncertainties and associated risks remain high, and for these reasons, we keep our "sell" rating.

Joe Raedle/Getty Images News

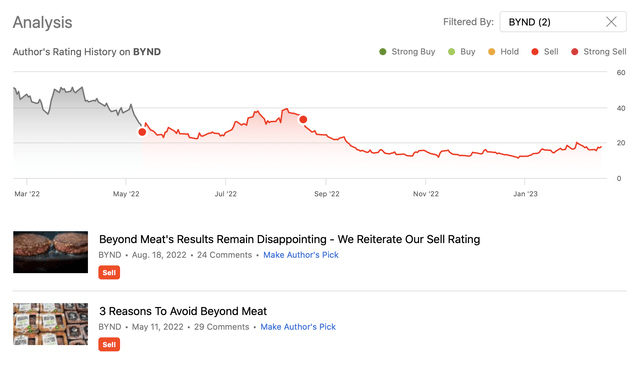

Beyond Meat, Inc. (NASDAQ:BYND) manufactures, markets, and sells plant-based meat products in the United States and internationally. In 2022, we have been bearish on the firm all along, and our bearish outlook has not changed yet. Our main concerns previously have been the declining revenue, widening losses, and potentially worse than expected outcomes from the partnerships.

Today, before BYND's earnings announcement later in February, we will summarise why our view has not turned more optimistic.

1.) Partnerships

In 2022, we have been concerned that partnerships may not turn out to be as successful as expected. Since then, in fact, two "test" partnerships have been completed, once with McDonald's (MCD) and one with KFC.

McPlant has been sold in approximately 600 MCD locations, generating about $3 million - $5 million for BYND during the course of two quarters. The test conducted together with KFC involved about 4000 restaurants and is estimated to have generated between $5 million to $13 million in revenue for BYND.

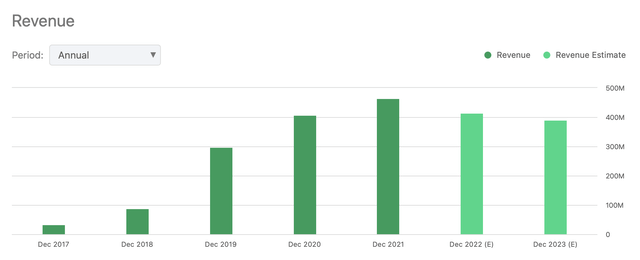

Looking forward, analysts are concerned that these revenues will not be reoccurring in 2023. This is well reflected in their estimates as well.

In our view, this is a significant setback for Beyond Meat's business. But the revenue loss is only one aspect.

We are more concerned about the potential consequences of not being present in widely-known, well-established restaurant chains. The primary reasons for our concerns are:

- BYND may be the only meat-free option in these restaurants. This gives them a significant advantage. They do not have to compete with other firms operating in the meat-free industry in these restaurants. If the partnerships stop, they will be left mainly with in-store sales, where the competition has been significantly intensifying over the past years.

- Due to the competitive environment and the high costs associated with shelf space and refrigeration in supermarkets, BYND's margin may be negatively impacted in the coming quarters.

- If they are no longer present in the above-mentioned restaurant chains, where they had exposure to a large number of customers every single day, now they may also have to spend more money on marketing and advertisement to further build/ keep brand awareness.

For these reasons, we believe that the coming quarters will be difficult for the firm with many uncertainties and risks ahead. As a result, we would not like to be owning BYND currently.

Our view would be definitely different, if one of the restaurant chains would offer a permanent place on their menu for BYND's meat-free products. We believe that could be a game-changer. The latest announcement about the new McPlant in the UK and Ireland could be a good first step towards this goal. Further, the rollout of plant-based McNuggets at 1400 McDonalds locations in Germany starting this week is also a good sign. But for now, we believe this is not yet enough to upgrade our rating.

2.) Management changes

Management changes, especially if they happen frequently, could be warning signs for investors that things are not going as well for the firm as they would like to. Chief Brand Officer Beth Moskowitz is the latest high-ranking executive to depart from the firm in January. Moskowitz has been with the firm for only about a year, which is a relatively short tenure.

In a challenging macroeconomic environment, we would like to see a stable management that is focused on execution, growth, cost reduction and improved brand awareness.

These two concerns are the primary ones that we have to highlight additionally to our previous writings.

To have a balanced view, however, we would also like to highlight some of the positive developments over the past months.

Positive developments

1.) Revamping strategy

Beyond Meat is working on revamping its strategy. They are aiming to limit their presence to specific grocers only. These stores namely are: Kroger (KR), Walmart (WMT), Publix, Costco (COST), and Whole Foods (AMZN). The firm is hoping that the strategy change will help reverse declining sales.

In our opinion, the streamlining of the strategy may help to reduce costs, including transportation and marketing. It will also allow the firm to have a better focus on a narrower, potentially more loyal audience. On the other hand, we are not entirely sure that it will help to stop the decline in revenue. While we are pleased with the development, we would like to see the new strategy being successfully executed, before we would consider upgrading our rating.

2.) Improving macroeconomic environment

The macroeconomic environment has improved significantly since our last writings. Consumer confidence has rebounded significantly from the 2022 lows. This development may fuel demand for more expensive, "discretionary" products. In our opinion, BYND could potentially benefit from this, and they may see their revenue being positively impacted by the stronger sentiment.

The macroeconomic changes are likely to have also a positive impact on the cost side. Declining energy prices are likely to lead to reduced transportation costs, which in turn may positively impact the margins.

Further, as BYND is operating internationally, the FX environment also has a substantial impact on the financial results. The relatively strong USD compared to other currencies in 2022 have created headwinds for many firms. Since its peak reached in the second half of 2022, the dollar index has fallen substantially. Looking ahead, we do not think that the highs will be retested in the near future. As a result, BYND's financial performance may be positively impacted by this development.

Investors, however need to keep in mind that the macroeconomic environment remains volatile. The conflict in the Eastern European region continues, and the tension between the U.S. and China has been intensifying. These are creating significant risks and uncertainties going forward.

3.) Cost cutting measures

In October 2022, Beyond Meat has announced to cut 19% of its workforce. We believe that this has been a good decision back then to control costs. Seeing revenue and demand declining, we appreciate that the management took the step to focus on cost control. While this announcement has been quite long ago already, the impacts of this are likely to be visible in the current/coming quarters as the cost savings to realise.

Going forward, we would like to see BYND keep focusing on costs. As long as the trend in revenue decline is not reversed, their main task is to try minimise expenses and losses. While the firm is expecting to be cash flow positive in the second half of 2023, we are not entirely convinced that the firm manages to deliver on this expectation. Analysts in Goldman Sachs are also having similar concerns: "[...] we believe that the challenges facing BYND remain significant and that the pathway to achieving the company's goal of positive FCF in 2H23 is a narrow one."

Key takeaways

Revenue decline may be further fuelled by the lapping partnerships with MCD and KFC. This development may not only hurt sales, but may also result in increased expenses as a percentage of revenue, along with market share loss.

The high turnover of key management personnel are also raising concerns and could be a warning sign for investors.

On the other hand, the improving macroeconomic environment, along with the cost cutting measures and the revamped strategy, may help the firm's financial performance in the coming quarters.

At this point, we believe that the uncertainties and the associated risks remain high for our risk appetite and for these reasons, we maintain our "sell" rating.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article was co-authored by Mark Lakos.