It's A Tsunami And Bitcoin Is My Surfboard

Summary

- In 2023, $1 trillion has been injected into global liquidity.

- If liquidity has already bottomed, then it's likely Bitcoin has too.

- In the short term, I expect a sell-off. One last chance to buy the dip.

- This idea was discussed in more depth with members of my private investing community, Technically Crypto. Learn More »

MAXIM ZHURAVLEV/iStock via Getty Images

Thesis Summary

Bitcoin (BTC-USD) has started off the year with a bang, rallying over 60%. “Risk-on” assets have been performing well, which can be explained by the increase in global liquidity.

Even though the Fed may still have some tightening left to do, from a global perspective, has liquidity bottomed? And if this is the case, has Bitcoin bottomed?

BTC is very strongly linked with liquidity, which is why holding it during increasing liquidity is so important.

Though a bottom could be in, we need more evidence, and we will get it once Bitcoin begins its next pull-back.

The Liquidity Tsunami

The tide has changed, and in 2023 global markets have seen a $1 trillion injection of liquidity.

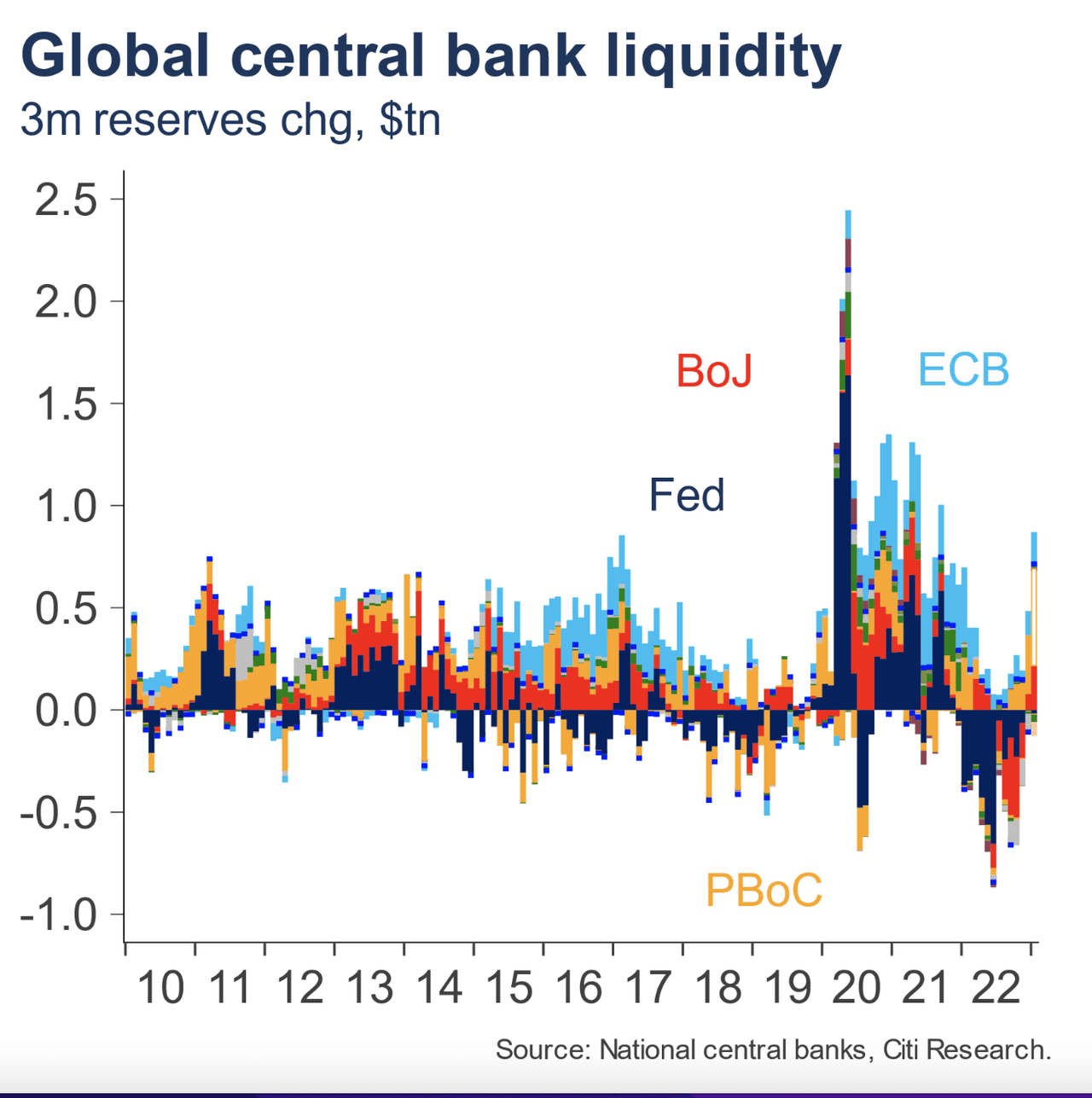

CB reserves (Citi Research)

This chart from Citi Research shows the change in global CB reserves over the years. So far in 2023, we have seen Central Bank liquidity increase by $1 trillion, with the main culprits being China’s PBoC and Japan’s BoJ.

China is, for the moment, experiencing below-average inflation, and with the economy weakening, the country’s CB has vowed to keep monetary policy accommodative. Last week, the bank already injected 199 billion Yuan, $29 billion, via its medium-term lending facility. But that is not all.

The central bank will further strengthen financial support for domestic demand and industrial systems and has vowed to expand the use of an instrument to support private companies' bond financing, the PBOC said on Wednesday following a meeting on Friday.

Source: global.chinadaily.com

So, plenty of liquidity is coming from China and will probably continue to pour in through the year.

What is less clear, is what the BoJ will do:

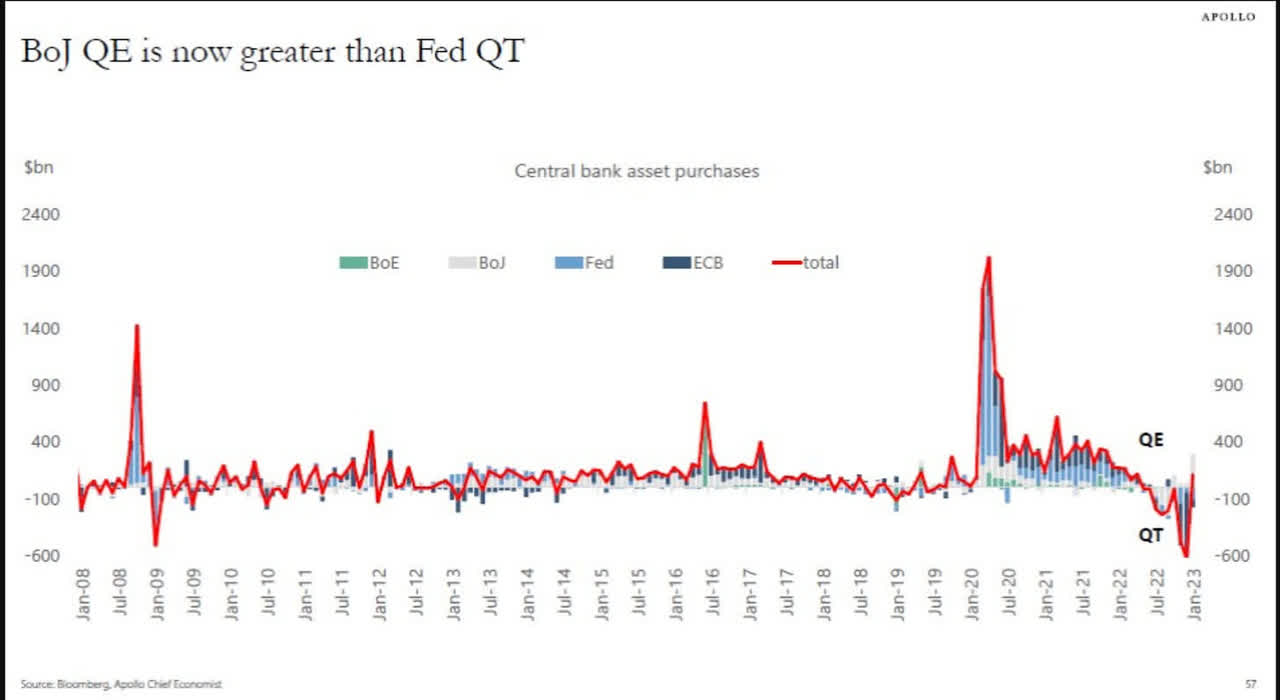

CB Asset Purchases (Bloomberg)

The BoJ has been forced to aggressively buy Japanese government bonds due to its yield curve control program. As we can see in the chart above, the BoJ is adding more liquidity than the Fed is taking out at this point.

However, the BoJ's leadership is changing, Kazuo Ueda is poised to take the helm, and speculation is he may scrap the YCC policy. We will see.

All in all, it seems that global liquidity could have indeed bottomed already, or it could at least be close. While the Fed hasn’t paused yet, it will probably do so this year, and we also have other factors in the US, like the use of the Reverse Repo Facility, which could contribute to loosening financial conditions.

Why You Need Bitcoin

The idea that liquidity could be turning for good was also recently shared by Michael Howell in an insightful YouTube interview.

If we assume this is the case, then where you want to be over the next year and perhaps longer, is in equities and high-beta exposure. In other words, “risk-on” assets.

Out of these, Bitcoin is perhaps the best way to go:

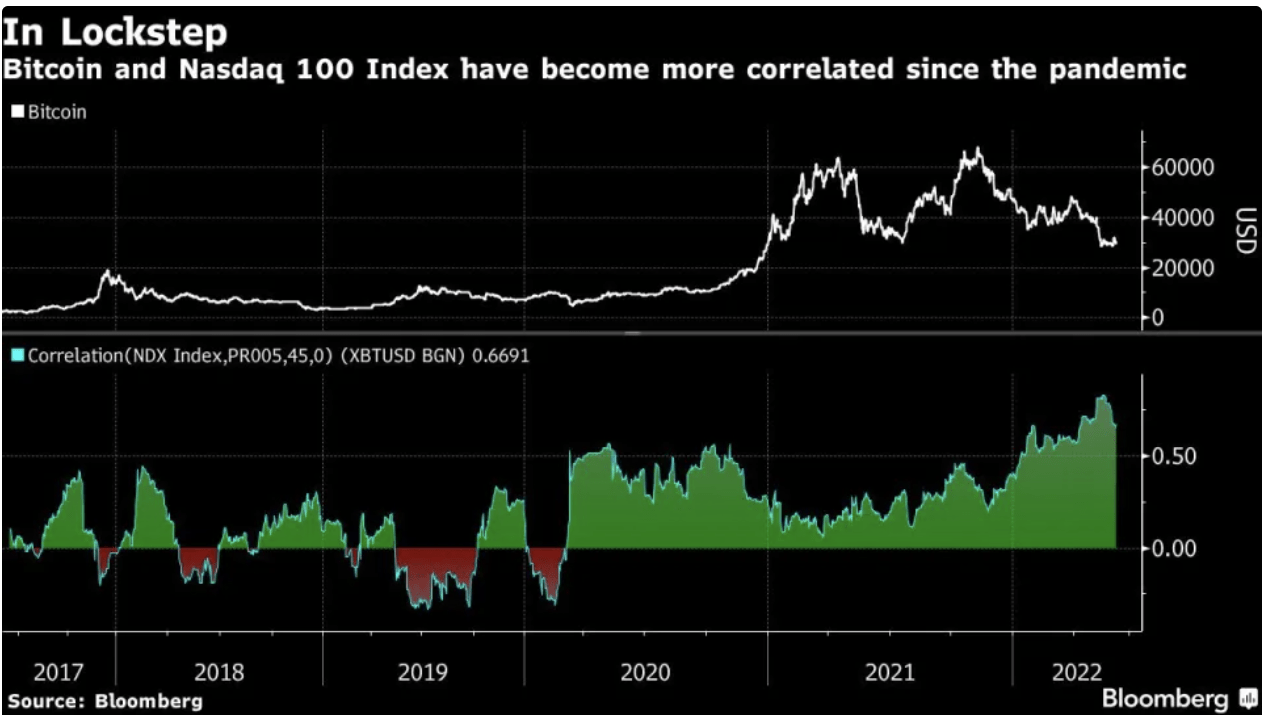

BTC and Nasdaq correlation (Bloomberg)

Bitcoin has become highly correlated with the Nasdaq (NDX) but offers a much higher return potential.

BTC and NDX performance (TradingView)

If we look at the performance since the COVID crash, even after +1 year of bear market, Bitcoin has performed 4x as much as the Nasdaq. At its peak, Bitcoin was up near 700%, while the NDX was up a “measly” 75%.

In short, Bitcoin is perhaps the best asset to capture gains in an environment of increasing liquidity.

Bitcoin Outlook: Where Fundamentals Meet Technicals

Following a significant rally, I think we should see a sell-off in the near future. This makes sense both technically and fundamentally.

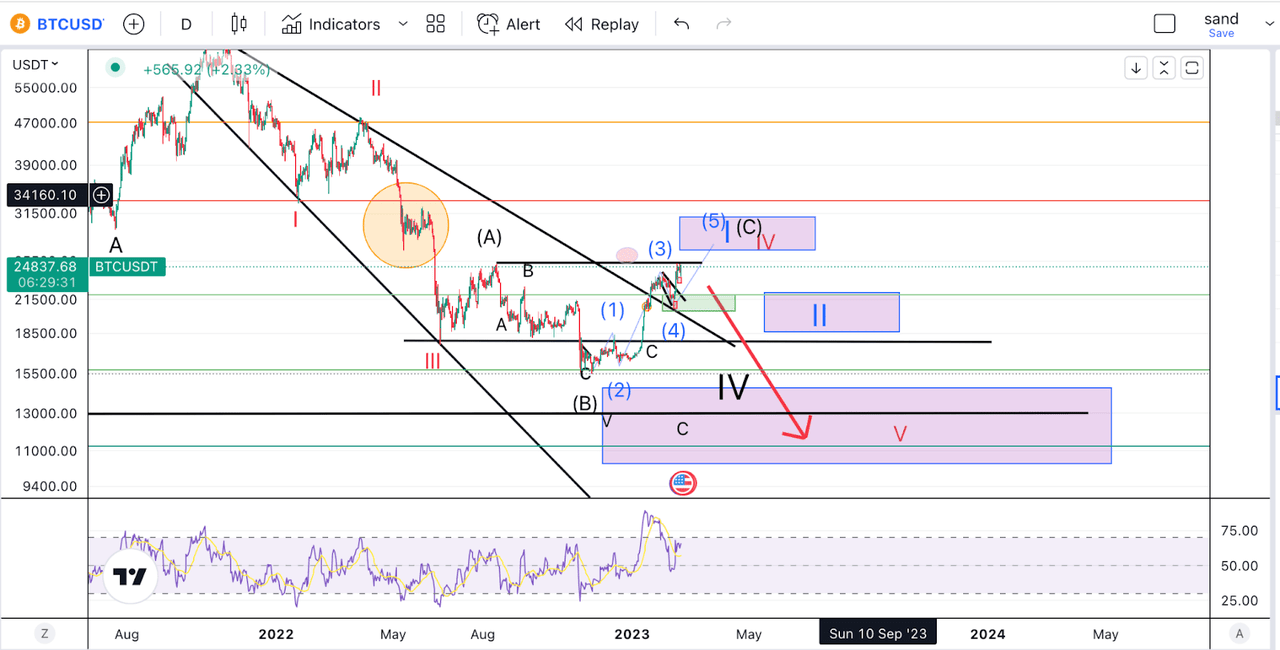

Bitcoin Outlook (Author's work)

Looking at my EWT count, we have two possible scenarios on the table. On the bullish side, we could say that BTC has already completed five waves down. This would mean the rally towards $25,000 where (A) is on this chart would be the top of our red wave IV, and the low at $15,500 would be the end of five.

This puts us now at an initial impulse of the lows to complete a wave I of this new bull market rally. My target for this is around the $28,000 level based on fib extensions. Following this, we should see a retracement in a wave II which could take us back below $20,000.

Alternatively, we could head into new lows, and count this whole structure formed since June 2022 as an ABC correction of the wave IV.

The next pullback is what will determine which count we are on. In either case, we should see some form of a sell-off in the near term, followed by a rally.

This makes sense fundamentally too. The markets have rallied strongly on lower inflation and the hopes of a Fed pivot. However, strong economic data and persistent inflation could cause the Fed to raise rates as far as 6%. This would certainly deliver a shock to markets and probably ignite a sell-off.

However, the Fed will pause in the medium/long term, and other central banks are already injecting liquidity into the system. This means we could be much higher in the next 6-12 months.

Takeaway

In conclusion, liquidity is on the up, and this is great news for Bitcoin stock, which is one of the best vehicles to capture returns in this environment. With that said, some of the altcoins and even crypto-related equities could greatly outperform Bitcoin. I cover all of these in my marketplace.

Ending on a note of caution, and although I am increasingly bullish, there’s no guarantee that Bitcoin has bottomed, but I am watching the signals closely. The dip should be bought, but don’t forget to manage risk.

This is just one of many exciting cryptocurrencies you can buy right now!

Join Technically Crypto to stay ahead of the latest news and trends in the crypto space. Learn the ins and outs of blockchain technology and how you can profit from it. Here's what you will get with your subscription:

Here's what you will get with your subscription:

- Access to our Crypto Portfolio.

- On-chain analysis of Bitcoin and Ethereum.

- Deep dive reports on Altcoins.

- Technical Analysis of major cryptocurrencies.

- News updates.

Crypto is changing the future, don't just watch it, be a part of it!

This article was written by

The Value Trend is now The Digital Trend.

We believe the greatest opportunities of the next decade will be in innovative technologies and cryptocurrencies, so this is where we focus our analysis.

We felt a brand update would help our readers better understand our work.

The world is turning digital and so should your portfolio!

Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.