Veritone Q4 Earnings Preview: Going Nowhere

Summary

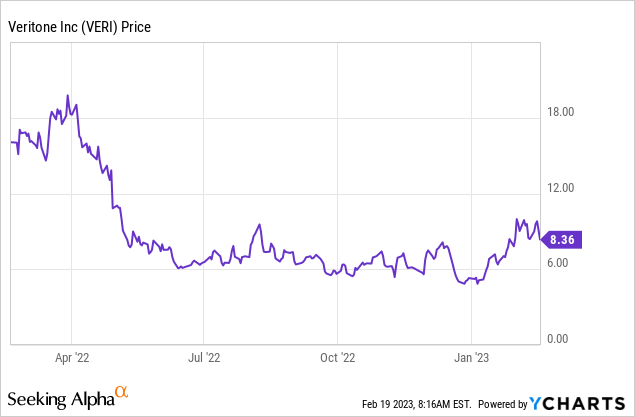

- Shares of Veritone have risen more than 60% year to date, driven by a newly unveiled plan to cut costs.

- Still, the overall business is stagnating, with only single-digit growth rates excluding acquisitions.

- The company is far outclassed by AI companies with much better branding and customer bases, such as C3.ai.

- A >30% concentration risk to Amazon also puts the company’s revenue in jeopardy as the world’s largest retailer looks to cut costs.

- Veritone will next report results on Thursday, March 2.

koto_feja

This has been a big rebound year for a lot of tech stocks, including ones that I consider to be of quite low quality. Investors have deigned to take on risk again, and very speculative small-caps have benefited from this move.

Veritone (NASDAQ:VERI) is no exception. The self-labeled AI company has seen its stock rally nearly 60% year to date, outmatching most of its software peers, despite what I continue to view as major fundamental risks weighing on the name. It’s a good time for investors to take a step back and assess the underlying value here.

Value trap? Cost cuts can’t solve all of Veritone’s problems

Veritone is up this year primarily on a cost-cutting plan. Like many other companies small and large in Silicon Valley, expense trimming and layoffs are the name of the game. The company claims to have identified $12-$15 million in annual savings (worth roughly 10% of its revenue), and at the same time also moved its CEO to a Chairman role and replaced him with co-founder Ryan Steelberg.

Now, on paper, Veritone still looks like a cheap company. At current share prices near $8, Veritone trades at a market cap of just $303.4 million. After netting off the $196.1 million of cash and $196.0 million of convertible debt on Veritone’s most recent balance sheet, its enterprise value is also $303.3 million.

This represents a 1.9x EV/FY23 revenue multiple, against Wall Street’s consensus FY23 revenue of $161.0 million (+7% y/y, data from Yahoo Finance).

The question we have to ask ourselves, however: is Veritone going anywhere? The underlying business is barely seeing any growth when we strip out acquisitions (more on that in the next section). And even if Veritone does manage to achieve $15 million in annualized savings, this won’t make a huge dent on its bottom line: in the first nine months of FY22, the company lost -$30.3 million on a GAAP basis (-$18.1 million on a pro forma basis, adding back depreciation, amortization and stock-based comp). Veritone will still be unprofitable - and with a relatively flat revenue base, it’s unlikely to achieve additional economies of scale.

The bottom line here: I remain bearish on Veritone and view this stock as a software company that continues to struggle in proving its relevance amid much flashier competitors like C3.ai. Steer clear here: and if you were holding onto a position, it’s a good time to take advantage of this year’s gains to lock in upside and exit the trade ahead of the upcoming earnings release.

Little growth outside of acquisitions

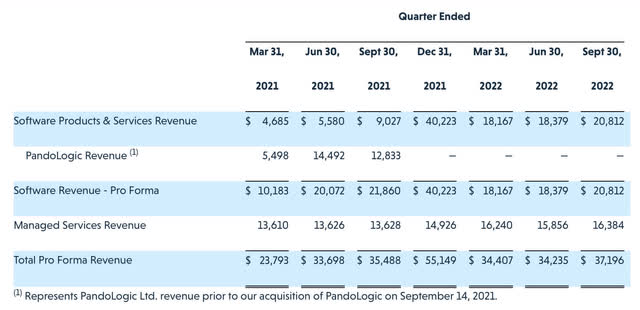

Even despite its small scale, Veritone has already adopted the playbook of much larger software companies in using M&A to chase growth. Last year, the company acquired a company called PandoLogic that is responsible for optically driving the majority of the company’s growth. In Q3, the company made a smaller $2 million acquisition called Vision Semantics, which it expects will have less than a 1% impact on total financials.

On paper, Veritone grew revenue at a 64% y/y clip in its most recently reported quarter, Q3 (the September quarter). But almost all of this was driven by the PandoLogic acquisition, which closed in September 2021 and had no prior-year comp. On a pro forma basis, treating PandoLogic as part of the combined company in both years, Veritone’s growth would only have been 5% y/y:

Veritone pro forma revenue (Veritone Q3 earnings release)

We also can’t see the breakout of PandoLogic’s revenue in the current period anymore, which is now a large chunk of Veritone’s consolidated revenue since the September acquisition. As a reminder, PandoLogic is a recruiting/talent hiring application. There are two worries here: first, the fact that the presumed majority of Veritone’s revenue comes from a top-layer application instead of the AI operating system platform that it purports to be may signal that Veritone’s core mission isn’t working out. Secondly, recruiting functions are among the primary departments being cut in the current recession: so PandoLogic revenue may see a steep slide.

Watch out for Q4 and beyond: firstly, the PandoLogic acquisition will start being comped in last-year results, and so Veritone’s reported growth rates will fall substantially; and secondly, PandoLogic’s direct concentration to the recruiting industry will also pose a significant headwind to growth.

Amazon customer concentration risk

Here’s the other big risk to be wary of: Veritone relies on Amazon for a huge chunk of its revenue. Despite the company continually stressing its brand-name marquee customers plus its sales to government organizations, the company’s single largest customer is Amazon, providing over 30% of its revenue.

Veritone verticals and customers (Veritone Q3 earnings deck)

Like other tech companies, Amazon has been on an efficiency binge this year, and Veritone is in the firing range. Per CFO Michael Zemetra’s remarks on the Q3 earnings call:

On a pro forma basis, Q3 2022 revenue was up 5% year-over-year driven by the increase in Managed Services, offset by a 5% decline in Software Products & Services. The pro forma decline in software was in large part driven by Amazon's continued efforts to drive headcount savings across their business, which resulted in a decline in revenue from Amazon of 28% year-over-year, offset by an over 100% improvement in non-volume hiring or enterprise revenues. Year-over-year, we saw net customer growth of over 65% with customers using our HR software.

On a consolidated basis, Amazon represented 31% of our consolidated revenue in Q3 2022, down substantially from 40% in Q3 2021 on a pro forma basis. As we continue to reduce the concentration of revenue from Amazon and grow our customer base, we also expect our AAR to also fluctuate accordingly.”

Sharply falling spend from Amazon, whose buying patterns are difficult to predict, may cause additional disappointment in top-line results when Veritone next reports earnings.

Q4 earnings expectations

Needless to say, I think Veritone stock is a clear sell ahead of the upcoming earnings cycle. I think several of the factors we’ll need to watch out for - and which have substantial potential to take the stock downward - are as follows:

- Decelerating revenue growth/Amazon performance. This is almost a given due to the inclusion of PandoLogic in prior-year results starting in Q4, but we’ll need to watch how organic revenue growth is trending as well. On the latter, Amazon is of key importance. If buying behavior materially worsens from Q3 to Q4 from Veritone’s largest customer, the company will suffer tremendously.

- Updated commentary around how the macro situation is impacting results. Hiring freezes and layoffs really stepped up in the fourth quarter of 2022, which will have direct impacts to PandoLogic - which is now a large chunk of Veritone’s revenue.

- Restated cost-cutting expectations. Veritone will likely stick to its plan of saving $12-$15 million per year, but if revenue declines are worse than expected, it will need to slash more expenses in order to hit the same level of profitability.

- New acquisitions. Veritone has been in the habit of making small tuck-in acquisitions, including spending $2 million in the third quarter. Investors may have looked the other way on these deals in the past, but with Veritone holding no net cash (after netting off debt) and in this tighter macro environment, announcements of new deals may trigger more downward reaction.

Key takeaways

I view Veritone’s year to date gains as a phantom rally that ignores a myriad of risks, including direct exposure to a pressured recruiting industry, comping last year’s major acquisition and the certainty of deceleration in reported growth rates, and risk in buying slowdown from Amazon. Steer clear here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.