VIGI: Foreign Dividend Growers Losing Relative Steam, But Solid Potential This Year

Summary

- A snapback in the US dollar has resulted in non-US equities underperforming the S&P 500 in the last several weeks.

- VIGI is low-cost and highly liquid with a so-so valuation, but I see a long opportunity developing.

- I outline a key price level to watch, but patience is needed right now.

da-kuk

It's all about the dollar right now. Do you agree with that? While most pundits claim the Fed's hand is the ultimate guiding factor of the market currently, a recent bounce back in the greenback has had important implications for equities. Mainly foreign stocks.

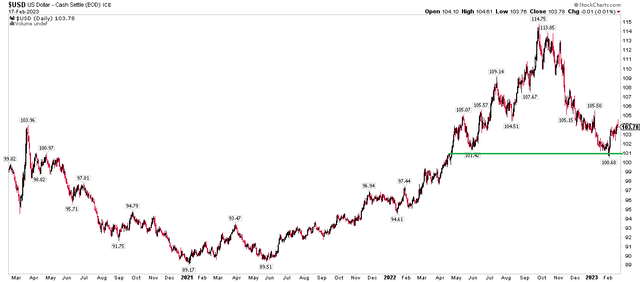

US Dollar Index: More Important Than Investors Realize

International investors know this full well. The ex-US market handily beat the S&P 500 since September when the US Dollar Index peaked, but a bounce off key support on the DXY's chart has resulted in some negative alpha for indexes abroad. One ETF, a favorite among dividend investors, has underperformed in recent weeks, too. But is now the time to buy? Let's outline the risk and reward prospects on the Vanguard International Dividend Appreciation ETF (NASDAQ:VIGI).

According to Vanguard, VIGI offers investors exposure to the S&P Global Ex-US Dividend Growers Index through a passively managed, full-replication strategy. With its cap-weighted nature, it is primarily exposed to large caps, so the top holdings are some of the major growth-oriented blue-chip multinationals domiciled away from the States. There is a bit extra risk compared to a plain vanilla developed markets ETF since VIGI includes emerging market equities so long as an EM name has a track record of growing dividends each year.

What I like about VIGI is that its expense ratio is bottom of the barrel at just 15 basis points. Vanguard notes that the average expense ratio of comparable products is multiples of that at 0.90%. Also ideal for investors and swing traders alike is VIGI's 0.04% 30-day median bid/ask spread, though I consider average daily volume of less than 400,000 shares not overly impressive.

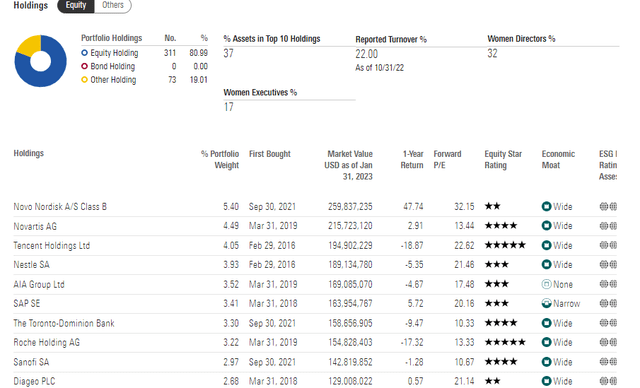

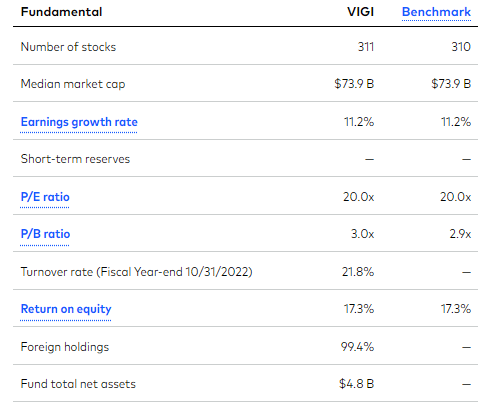

The ETF is not nearly as diversified as broader index funds. Rather, it holds just 311 individual equities with a median market cap of $73.9 billion, and the fund does not turn over very much at just 22% in 2022. Investors get some earnings growth with this fund - Vanguard notes that its EPS growth rate is a solid 11.2% while the forward P/E is 20, so that's a PEG ratio a smidgen below 2 - decent but not too cheap right now.

VIGI Fundamentals & Valuations

Vanguard

Morningstar notes that many of VIGI's biggest positions are highly rated. The fund as a whole sports a robust 4-star silver rating from the research firms due to its low cost and relative performance against its peers. VIGI is not overly concentrated; 37% of assets are in the top 10. I caution investors that about 17% of the ETF is invested in stocks out of Canada - that market can be particularly volatile when commodity prices sway. Switzerland and Japan are the next two largest country weights.

VIGI Portfolio

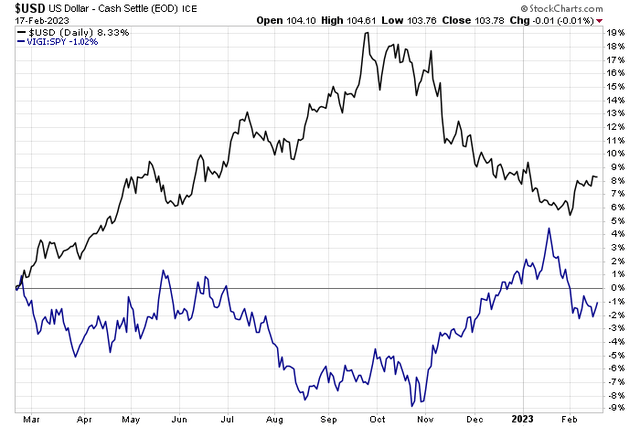

Getting back to the dollar story and how it impacts VIGI. Notice in the chart below that VIGI has sharply underperformed large-cap US stocks in the last month-plus as the DXY has bounced. I am cautious about VIGI until we see the dollar prove that this latest uptick is just temporary. But looking out a few months, I see a long play unfolding. Read on.

VIGI Underperforming the S&P 500 As The Dollar Bounces

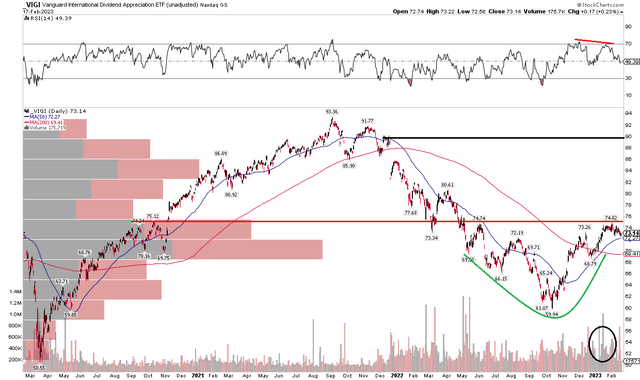

What about the VIGI technical chart itself? I see some potential upside here as it is undergoing a bearish to bullish reversal. If price breaks above the $75 level, then a measured move price objective to $90 is in play - that is near the all-time high from late 2021. We also have the 200-day moving average about to turn positive after a significant volume spike during its latest rally. The bears can point to a very modest negative RSI divergence on the most recent rebound high, however. I think there is more upside likely than significant downside, but a degree of patience is prudent right now.

VIGI: Bearish to Bullish Reversal, Price Objective to $90 On A Close > $75

The Bottom Line

I like VIGI long-term for its low cost and tradeability for those seeking non-US dividend growers. For now, though, my play would be to wait for a close above $75 before getting long or adding the position, so I am a hold. The US dollar's moves will be critical to how VIGI goes from here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.