Mosaic Q4 Preview: Potash Outlook

Summary

- The Mosaic Company is about to report its Q4 earnings on Wednesday.

- I argue that in 2023, Mosaic's potash segment will be significantly weaker than in 2022.

- Nevertheless, including any bearish considerations for its potash prospects, I contend that Mosaic will report close to $2 billion of free cash flow in 2023.

- Looking for a portfolio of ideas like this one? Members of Deep Value Returns get exclusive access to our subscriber-only portfolios. Learn More »

Jacobs Stock Photography Ltd/DigitalVision via Getty Images

Investment Thesis

The Mosaic Company (NYSE:MOS) is about to report its Q4 results on Wednesday February 22, after hours.

Immediately, there are some negative considerations for investors to think about. More specifically, Mosaic's overall exposure to potash and the weakness expected in that segment.

On the other hand, I am inclined to believe that much of this is already old news and that investors will be inclined to sniff out where the potash segment is headed towards the back end of 2023.

According to my assumptions, Mosaic will generate about $2 billion of free cash flow in 2023. Putting the stock at 8x this year's free cash flows.

Here's what investors should think about.

Mosaic's Prospects in Focus

Mosaic has 3 main operations. It has its potash segment, phosphate segment, and its Fertilizantes segment.

Recall, Mosaic's Fertilizantes segment is made up of phosphate and potash sales in Brazil, plus some minor operations in Paraguay.

Consequently, even though the Fertilizantes segment is a meaningful driver of Mosaic's bottom-line profitability, accounting for close to 22% of Mosaic's underlying EBITDA profitability, I believe that overly focusing on that segment is a distraction from Mosaic's core thesis. Therefore, I will not focus on that segment.

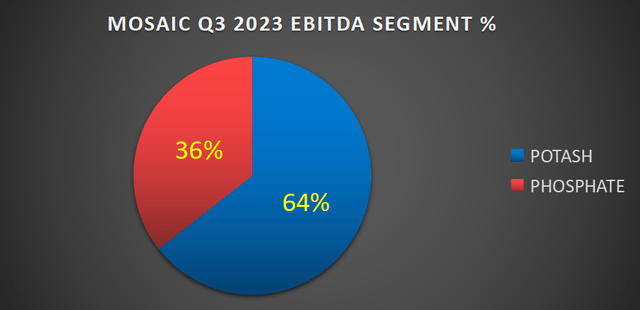

Instead, I turn readers' focus to Mosaic's EBITDA breakdown.

What you see above is a reminder, a painful reminder if you will, that Mosaic's EBITDA is mostly made up of its potash prospects.

And then, on top of that, keep in mind what Nutrien Ltd. (NTR), Mosaic's bigger peer, stated last week on their Q4 earnings call:

As we anticipated, potash volumes in the fourth quarter were down from the prior year as buyers in North America and Brazil limited purchases and drew down inventory.

Hence, to summarize the situation. I don't expect Mosaic to have any room to positively surprise investors with its Q4 results. However, this is not where this story ends.

Natural Gas, Bullish Considerations

I don't believe that investors have put enough emphasis on the lasting impact that low natural gas prices will have on Mosaic's EBITDA profitability.

According to Mosaic, natural gas is used at its Belle Plaine solution mine as a fuel to produce steam and to dry potash products. The Belle Plaine solution mine accounts for approximately 80% of Mosaic's potash segment’s total natural gas requirements for potash production.

To put my argument more concretely, back in 2022, when natural gas prices were high, this dampened Mosaic's cash flow profile. And even though Mosaic hedges some of its natural gas exposure, I argue that if natural gas prices were to remain low, this will lower Mosaic's input cost on its potash products.

In sum, natural gas is a significant energy source used in the potash solution mining process.

Mosaic's Guidance for 2023

The key focus for investors is what will Mosaic's Q4 earnings point to its potash's guidance to be in 2023. For my part, I believe investors should brace themselves for a 20% reduction in potash EBITDA.

Here's my assumption: we know that Nutrien last week guided for its potash segment to be down 30% y/y in 2023.

That being said, Nutrien's exposure to potash sales is more international than Mosaic's. Mosaic's potash sales go mainly to the U.S. and Canada, with the remainder being sold to Canpotex.

Hence, I do not believe that Mosaic's potash segment is expected to be as negatively impacted as Nutrien's recently announced guidance.

Nonetheless, I'm inclined to believe that Mosaic will probably see around $2.5 billion of EBITDA from potash in 2023.

Thus, even though Mosaic will not guide for its 2023 free cash flow this Wednesday, I'm predisposed to believe that including my negative assumptions for potash in 2023, Mosaic will probably end up producing close to $2 billion of free cash flow in 2023.

The Bottom Line

Here's the one-line summary: Mosaic is a strong free cash flow generator that's cheaply valued. The expanded summary is that even if the potash segment in 2023 isn't as strong as in 2022, through lower natural gas prices, I believe that close to $2 billion of free cash flow is possible for Mosaic.

This implies that The Mosaic Company is priced at 8x free cash flow. This is not an expensive valuation whatsoever. There's much to be hopeful about The Mosaic Company at this price point.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.