International Money Express Is Positioned For Potential Future Growth

Summary

- International Money Express, Inc. reported its Q3 financial results on November 9, 2022.

- The company provides a variety of remittance and related financial services primarily focused on the Americas.

- International Money Express has produced solid results, but the U.S. consumer may be running low on excess cash built up from the pandemic stimulus.

- Interested investors could make a long case for International Money Express, but I'm more cautious, so I'm on Hold for the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

pcess609/iStock via Getty Images

A Quick Take On International Money Express

International Money Express, Inc. (NASDAQ:IMXI) reported its Q3 2022 financial results on November 9, 2022, missing revenue while beating EPS consensus estimates.

The firm provides a range of money remittance and related services for domestic and international customers located primarily in the Americas.

International Money Express, Inc. has performed well, but faces an uncertain U.S. consumer and flattening average remittance levels.

I’m on Hold for IMXI for the near term.

International Money Express Overview

Miami, Florida-based International Money Express was founded to provide a wide range of money remittance and ancillary services to businesses and individuals operating globally.

IMXI operates payment services from the U.S. primarily to the regions of Latin America and parts of Africa.

The firm is headed by president, Chairman and CEO Bob Lisy, who joined the firm in 2009 and previously was Chief Marketing and Sales Officer at Vigo Remittance Corp. and also held various positions at Western Union.

The company’s primary offerings include the following:

Remittances

Financial processing and reporting

Prepaid debit cards

Direct deposit payroll cards.

The firm acquires customers and merchant partners through its in-house and partner referral efforts.

IMXI’s Market & Competition

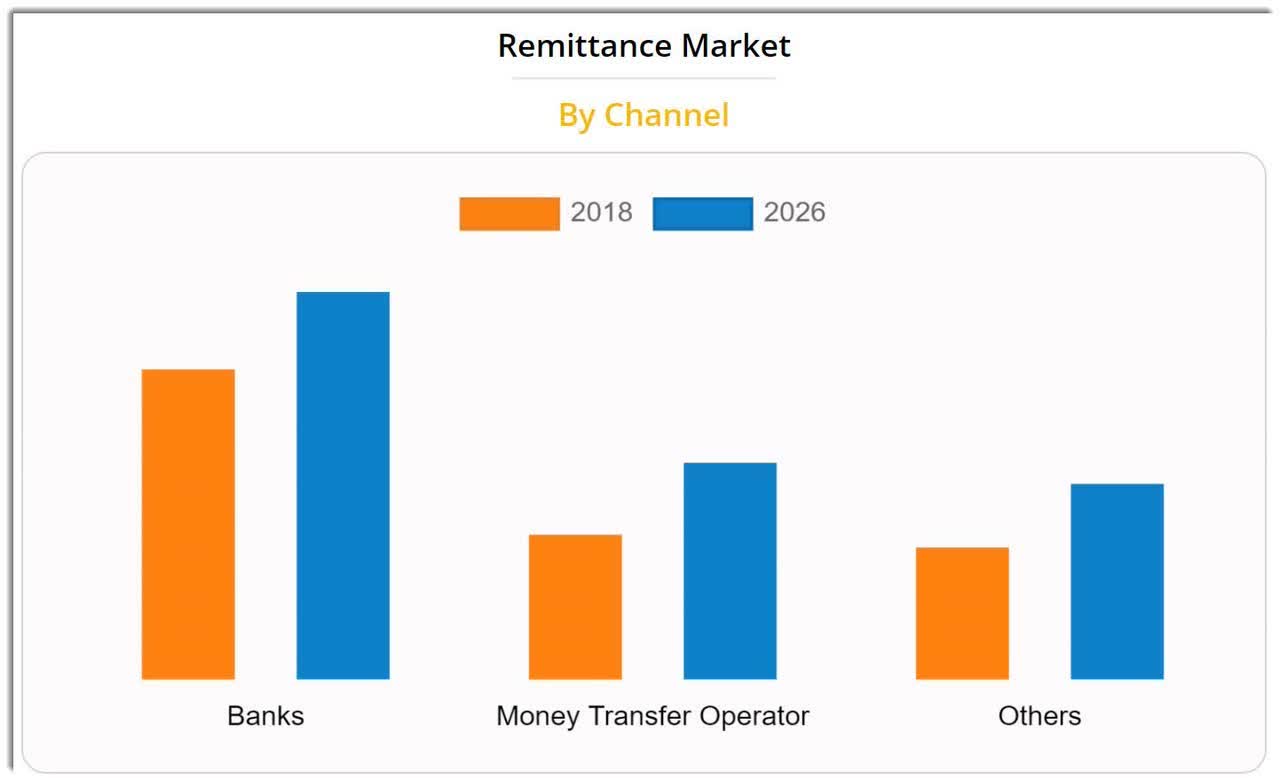

According to a 2020 market research report by Allied Market Research, the global remittance market was an estimated $683 billion in 2018 and is forecast to reach $930 billion by 2026.

This represents a forecast CAGR of 3.9% from 2019 to 2026.

The main drivers for this expected growth are an increase in population migration and growth in business remittances and more businesses producing goods and services for export.

Also, the chart below indicates that the bank segment will continue to dominate the global remittance market, at least through 2026:

Global Remittance Market (Allied Market Research)

Major competitive or other industry participants by type include:

Traditional providers and banks

Digital-first cross-border providers

Cryptocurrency systems

Person-to-person informal channels.

IMXI’s Recent Financial Performance

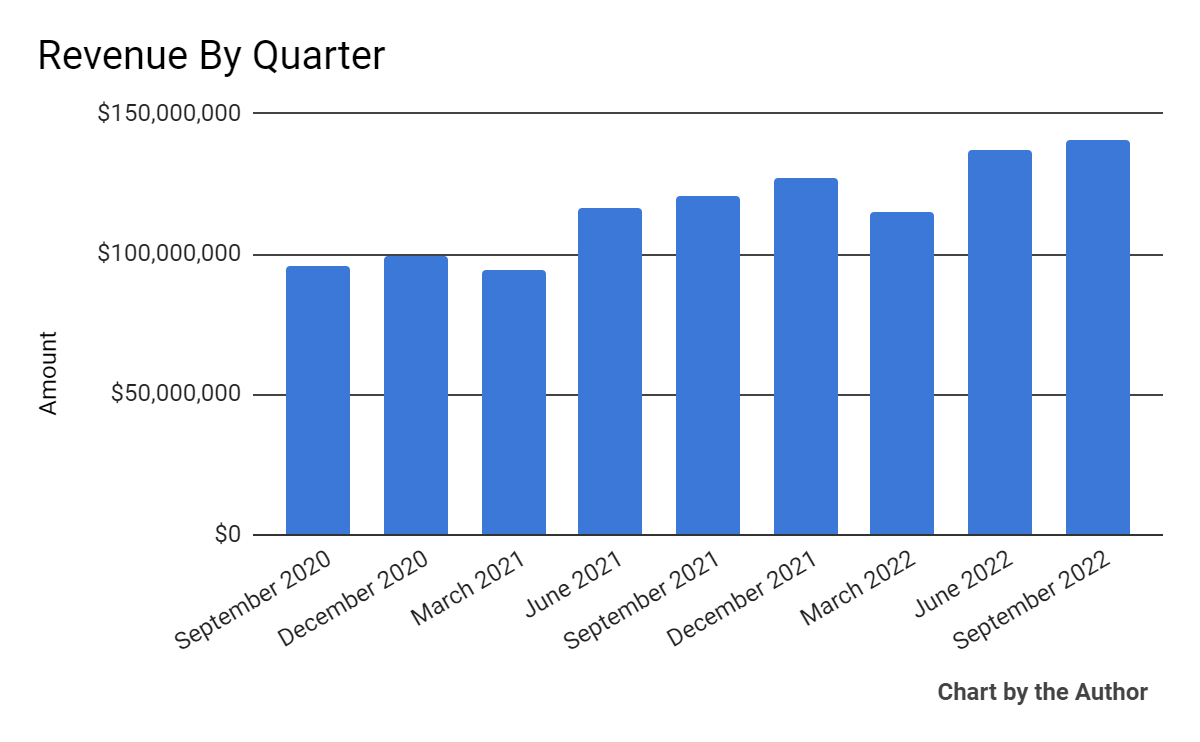

Total revenue by quarter has risen according to the following chart:

Total Revenue (Seeking Alpha)

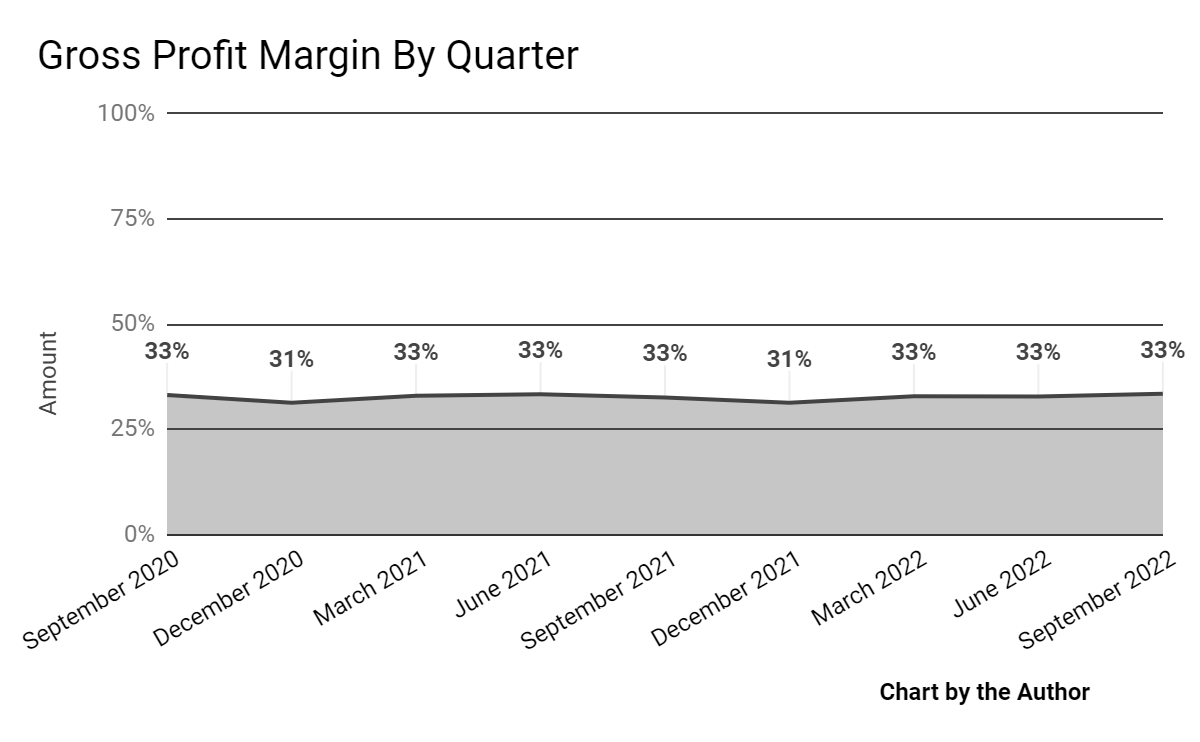

Gross profit margin by quarter has been largely flat in recent quarters:

Gross Profit Margin (Seeking Alpha)

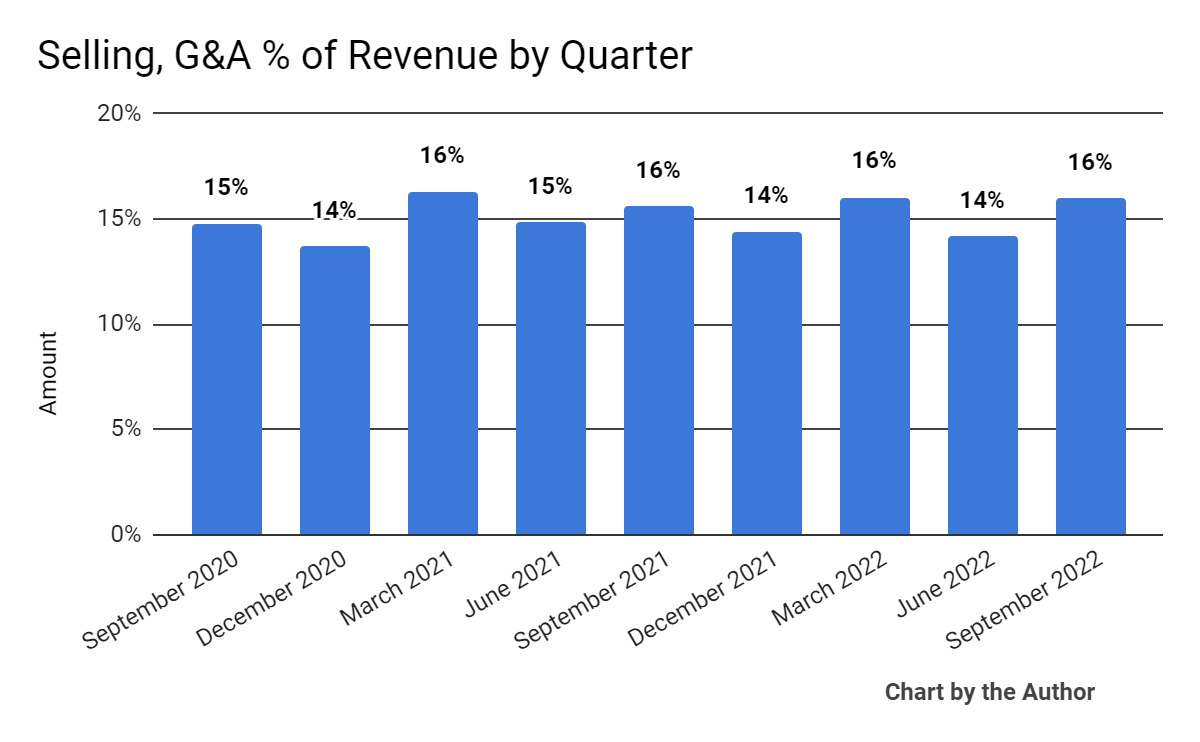

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a narrow range:

Selling, G&A % Of Revenue (Seeking Alpha)

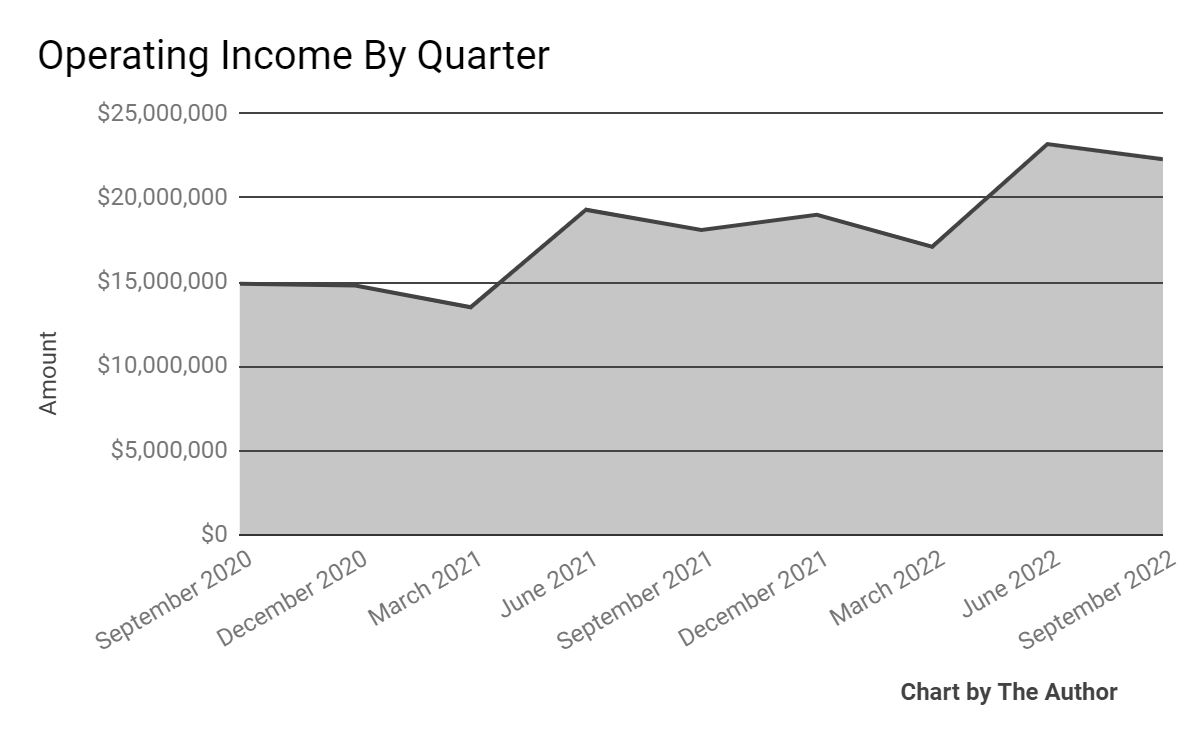

Operating income by quarter has risen in recent quarters:

Operating Income (Seeking Alpha)

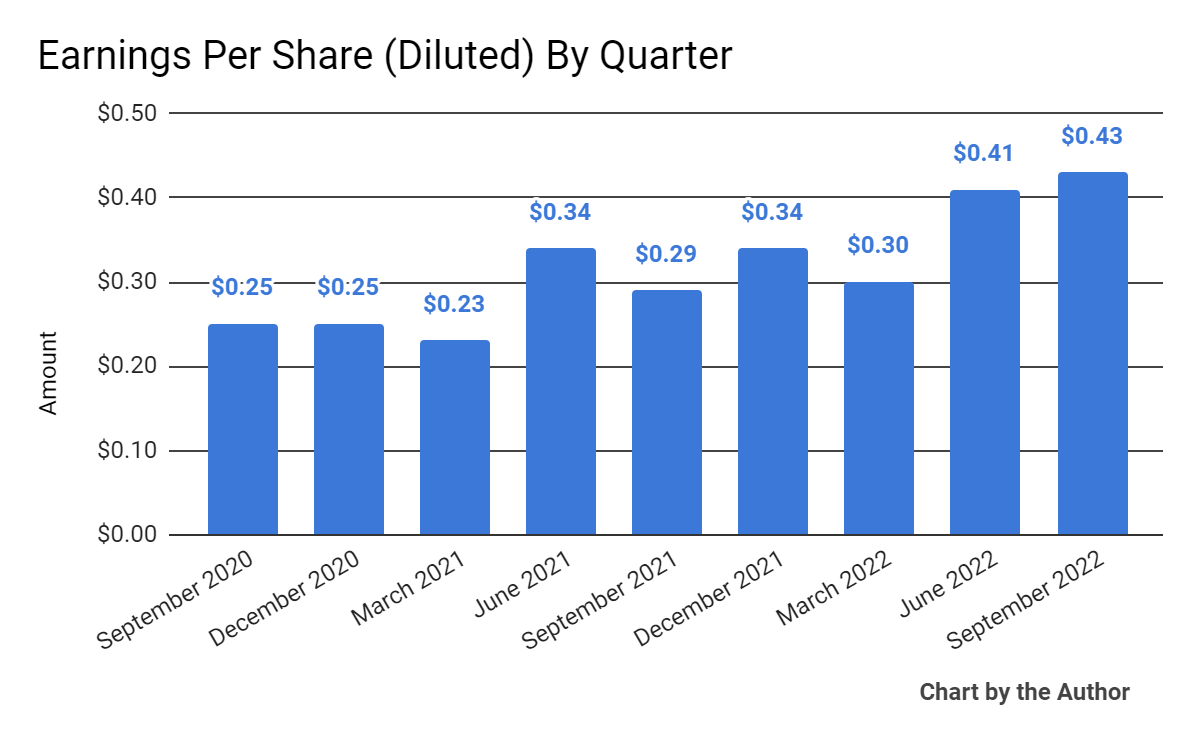

Earnings per share (Diluted) have also risen recently:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

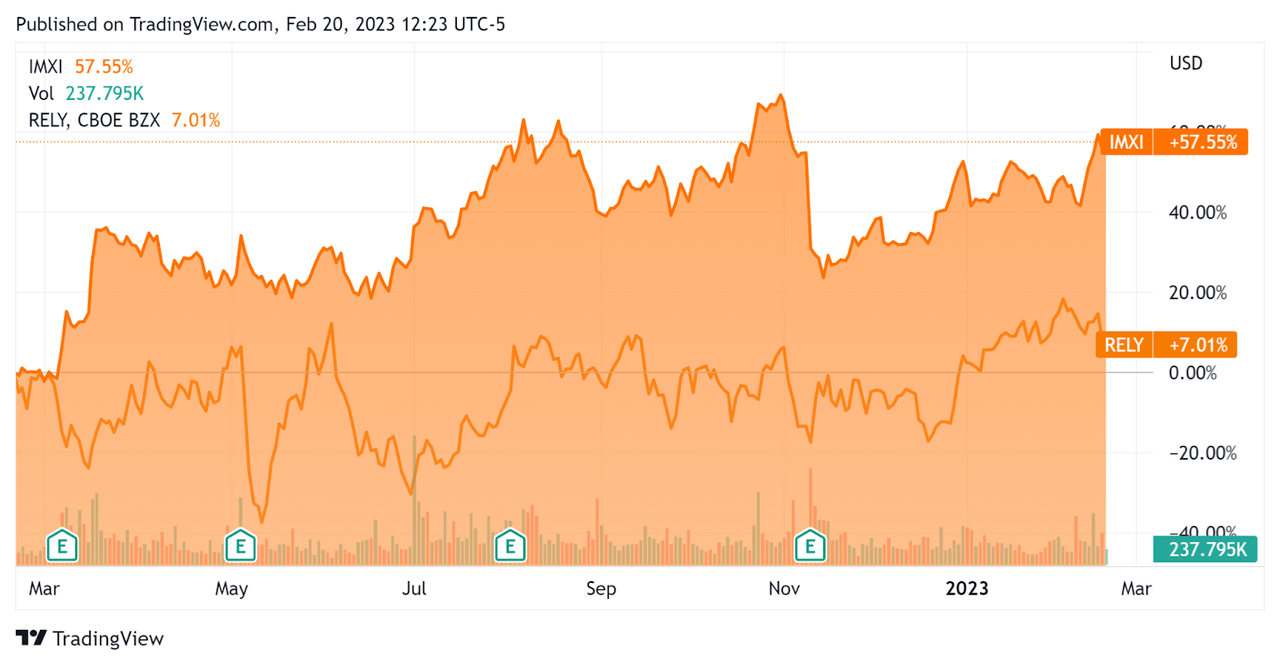

In the past 12 months, IMXI’s stock price has risen 57.6% vs. that of Remitly Global, Inc.'s (RELY) rise of only 7%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For International Money Express

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 1.8 |

Price / Sales | 1.9 |

Revenue Growth Rate | 20.5% |

Market Capitalization | $932,490,940 |

Enterprise Value | $953,418,940 |

Operating Cash Flow | $7,545,000 |

Earnings Per Share (Fully Diluted) | $1.48 |

(Source - Seeking Alpha.)

As a reference, a relevant partial public comparable would be Remitly Global; shown below is a comparison of their primary valuation metrics:

Metric [TTM] | Remitly Global | International Money Express, Inc. | Variance |

Enterprise Value / Sales | 2.7 | 1.8 | -32.8% |

Revenue Growth Rate | 48.2% | 20.5% | -57.6% |

Operating Cash Flow | -$65,610,000 | $7,545,000 | --% |

(Source - Seeking Alpha.)

Commentary On IMXI

In its last earnings call (Source - Seeking Alpha), covering Q3 2022’s results, management highlighted its record-setting results in the areas of total remittances, revenue, net income, and adjusted EBITDA during the quarter.

The firm is continuing to focus its retail agents on its IMX Connect system, "which unifies all the company's retail software, mobile and online applications on a single enterprise integration platform."

Management also is focused on expanding its retail network in the U.S., especially in the western U.S. with its high foreign-born population of Latin Americans.

The company grew its agent base by 9% year-over-year in Q3.

As to its financial results, total revenue rose 16.6% year-over-year, with the average remittance amount of $450, a slight increase.

Adjusted EBITDA rose 21.5% while adjusted net income increased by 32.3% year-over-year. Adjusted figures typically exclude stock-based compensation and one-time expenses.

For the balance sheet, the firm finished the quarter with $105.1 million in cash and equivalents and $123.2 million in total debt.

Over the trailing twelve months, free cash use was $6.7 million, of which capital expenditures accounted for $14.2 million. The company paid $6.8 million in stock-based compensation in the last four quarters.

Looking ahead, the company expects full-year 2022 revenue of around $547 million at the midpoint of the range and adjusted EBITDA of $105 million at the midpoint.

Regarding valuation, compared to Remitly, the market is valuing IMXI at a lower Enterprise Value / Sales multiple, which isn’t surprising given its lower revenue growth rate.

But IMXI has a different market approach than Remitly, so the comparison is inexact.

The primary risk to the company’s outlook is a widely expected downturn in the U.S. economy, which may lower U.S. remittances to Latin America.

A potential upside catalyst to International Money Express, Inc. stock could include a "short and shallow" downturn or perhaps even no downturn at all, as some economists are positing.

So, while the firm appears to be performing well, the near-term future of the remittance market from the U.S. to Latin America is uncertain as U.S. consumers burn through their cash cushion left over from the pandemic stimulus.

Interested investors could make a case for going long on International Money Express, Inc., but I’m more cautious.

As a result, my near-term outlook on International Money Express, Inc. is a Hold.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions.