G. Willi-Food International: A Good Buy On Sale

Summary

- WILC's share price is slipping near to its 52-week lows, adding to our reasons for our bullish position on the stock.

- Improving economic conditions, a growing population, and pending tax cuts on food will add to the company's revenue growth and earnings.

- Investors have to consider risks when evaluating the potential opportunity of adding a small company to their portfolio, but this company is worth the risks.

97/E+ via Getty Images

We are extending our bullish position into 2023 for little-known G. Willi-Food International Ltd. (NASDAQ:WILC). We posted several articles after initiating coverage three years ago. Other SA authors posted 36 articles over the years, all but one assigning a potential Buy or Strong Buy grade to the stock.

The Company

Israel-based G. Willi-Food International Ltd. imports to and distributes in Israel. It exports Israeli goods around the world and markets over 600 kosher and other food products. Fruits and vegetables, fish and herring, oils, dairy and cheeses, frozen pizza, and other products sell under G. Willi-Food's brand names. It markets and sells light and alcoholic beverages. Customers are supermarkets, mini-markets, wholesalers, manufacturers, caterers, hotels, and hospitals.

It operates as a subsidiary of Willy-Food Investments Ltd. The market cap is shy of $1B. Public and private corporations own 66% of the shares. The public owns about 17%. Corporate insiders own +7% giving them a vested interest in G. Willi-Food stock's success. Willy-Food Investments Ltd is the largest shareholder.

Overview of G. Willi-Food International (willi-food.com)

Conditions Favor Company Growth

Three reasons to see G. Willi-Food International as a potential opportunity for retail value investors include more favorable business conditions in Israel, increasing demand for its products, and the numbers that impress us.

We consider food an essential industry and an excellent investment opportunity. Food exports have been and continue to be essential to Israel's economy. Imports are growing to ensure food security in Israel, as industrial and residential development consumes more arable land every year. This year, Israel's Manufacturing Assn. began lobbying for the Finance Ministry to cut taxes on food and initiate other measures to strengthen Israel's food competitiveness. Early in his new role, the Minister signed an order in January '23 canceling customs duty on various kinds of cheese, a staple of G. Willi-Food.

Always in Demand

Second, the demand for food is increasing both in quantity and quality, as the population grows and more people move into higher income classes. During 2022, Israel's population grew by 2.2%, an uncommonly high rate for developed nations. The economy grew by 6.5%. Food prices rose in 2022 by 4.9%, lower than in most other countries.

Inflation, higher transportation costs, wage increases, supply shortages and other costs hurt the company's bottom line. For example, citrus exports from Israel fell in 2022 because religious law required the ground to rest for one year of every seven. The company keeps adding new products to its inventory, and we expect the kosher food market to grow at a CAGR of at least 10%. It has grown nearly 12% over the last four years. Kosher food appeals to observant Jews, vegetarians, vegans, Muslims, and health-conscious consumers.

5 Years' Share Price (seekingalpha.com)

Numbers Taste Good

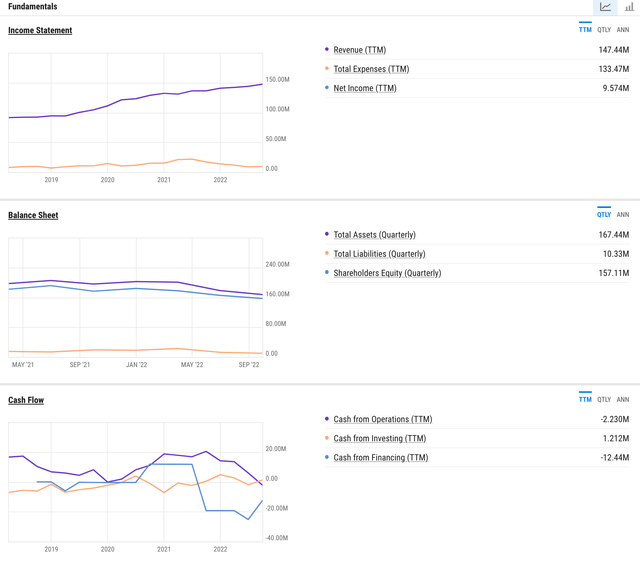

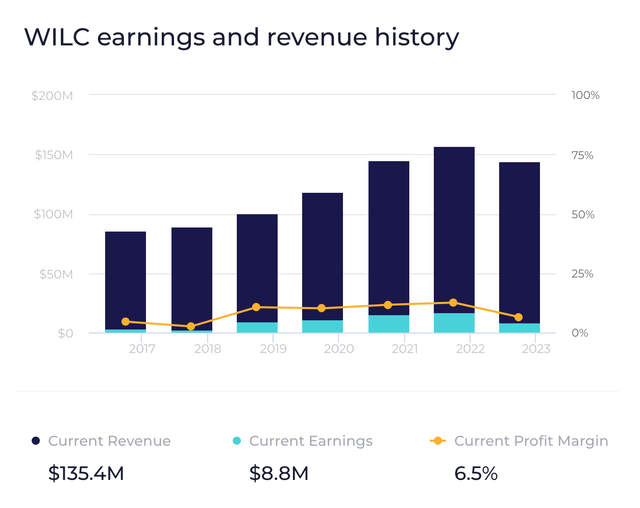

The third reason we are optimistic is the good numbers from G. Willi-Food International. Its share price recently dipped, making it, in our opinion, a stronger buy; the share price at $14.25 (-26.17% over one year) is closer to the $12 low over the last 52 weeks than to its ~$20.48 high. Earnings grew 29.6% annually in the last 5 years, faster than the U.S. Food Distribution industry average of ~3%. The company has low debt, a price-to-earnings ratio of 21.16, short interest is a meager 0.03%, and it gives investors a 6.05% forward dividend yield that is paid semi-annually. We expect the next company earnings report on March 21, '23.

The numbers were sluggish for the first 6 months of FY '22. They got traction in the last quarter. Including last quarter numbers, sales for all 9 months rose 8.2% Y/Y, gross profit +4.4%, and operating profit +9.3%.

Last November, the company reported Q3 '22 positive improvements in results:

- Sales increased by 16.6% to NIS 123.9M ($34.9M) from NIS 106.3M ($29.9M) in Q3 '21.

- Gross profit increased by 15.6% Y/Y.

- Operating income increased by 16.7% Y/Y.

- Net profit increased by 46.1% Y/Y.

- Cash and securities totaled NIS 292.5M (US $82.6M) as of September 30, 2022.

Earnings & Revenue History (wallstreetzen.com)

The average distributor's margin of fast-moving consumer foods ranges from a low of 10% to 30%. Various factors are at play, like farming conditions, packaging, and transportation pricing, and supply chain variables. G. Willi-Food's last reported gross profit margin in November '22 was at the high end, 29.62%. EBIT margin was 9.5% and its net income was 6.5%. The company seems to have carved out a secure spot in the consumer foods wholesale business.

Risks

Poor momentum is the first of several cautionary signs we urge retail value investors to consider. Bounding inattention fueling the poor momentum might keep the stock from reaching our forecast of $19 as the average price target over the next 10 months. The stock is sporadically covered by a few analysts and financial news outlets. We cannot find any significant ownership by hedge funds. The average daily trading volume is less than 5K shares.

A second risk appears to us that makes G. Willi-Food International as an outlier in the food business. A cabal of corporate insiders and other official agents exercise total control; decision-making can be furtive under these circumstances and lack the benefit of healthy debate.

A paucity of news and information about company developments is concerning. The company does not commonly issue updates or news of developments, nor do financial news outlets. It is difficult to find the company website. The site is not interactive and offers little or no information including where to buy company products, coupons, or any of the other accoutrements that stimulate consumer interest. The LinkedIn.com page is a few sentences about the company.

Finally, leadership at the company changed again; last month, the investment company's co-Chair was appointed G. Willi-Food's Chief Executive. Zvi Williger replaced Erez Viner rather abruptly. In 2021, then-CEO Einat Peled resigned. On a positive note, reports have it that Williger bought $2.3M worth of shares at +$16.

Take-Out

It is our opinion that the current share price slump offers retail value investors an opportunity to build their portfolios with an essential industry stock that appears will benefit from improving conditions, increasing demand for the products, and good numbers. We also like that the new CEO is invested and brings to the job intimate knowledge about company operations and the food, and especially the kosher food industry.

Large, mostly multi-national corporations dominate Israel's food industry. G. Willi-Food International Ltd does not even make the top 100 by income and market power. That might make the company an interesting takeover target in a swirling M&A environment, where investments in Israeli food tech companies doubled last year, and small businesses with increasing revenue and steady profits are the "apple of my eye."

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.