Talon Metals: Tamarack Nickel Project Is Progressing Well, U.S. Government Support And Tesla Off-Take Are Positives

Summary

- Talon owns 51% of the underground Tamarack Nickel (sulphide) Project in Minnesota. Talon also has the option to acquire up to 80% of the early-stage Michigan Nickel Project.

- The U.S. Gov. is supporting Talon Metals' proposed North Dakota nickel processing facility with a ~US$114m grant. Talon already has an off-take agreement with Tesla for 75,000t of nickel-in-concentrate from 2026-32.

- Market Screener shows a consensus 'buy' rating and a consensus analyst's price target of C$0.98, representing a 135% upside.

- We rate Talon Metals as a speculative accumulation (high risk/high reward), suitable for a 5-year plus time frame.

- I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

NoDerog

This article first appeared in 'Trend Investing marketplace' on January 17, 2023; but has been updated for this article.

Talon Metals Corp. [TSX:TLO] (OTCPK:TLOFF) ("Talon")

Talon is a Canadian company with a focus on producing nickel in the USA and supplying the emerging USA battery industry with nickel, as well as some by-products such as copper, cobalt, PGMs, and iron.

Talon has a favorable position owning two U.S nickel projects. Talon also plans to build a nickel ore processing facility in North Dakota, which has already been awarded a US$114m U.S government grant.

Talon state on their website:

Discovering & developing the USA's only high-grade nickel resource for the domestic battery supply chain.

For a background on Talon Metals you can read our past article:

Talon Metals Corp. [TSX:TLO] 5 year price chart - Price = CAD 0.415, USD 0.31

Yahoo Finance![Talon Metals Corp. [TSX:TLO] 5 year price chart](https://static.seekingalpha.com/uploads/2023/2/16/37628986-16766023144477382.png)

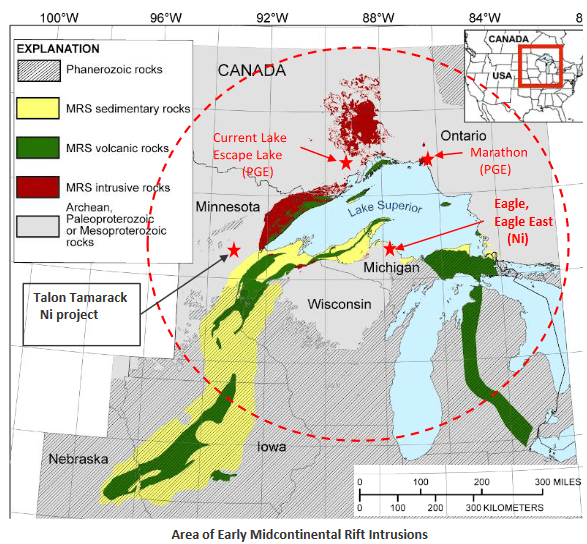

Talon's two USA Projects are:

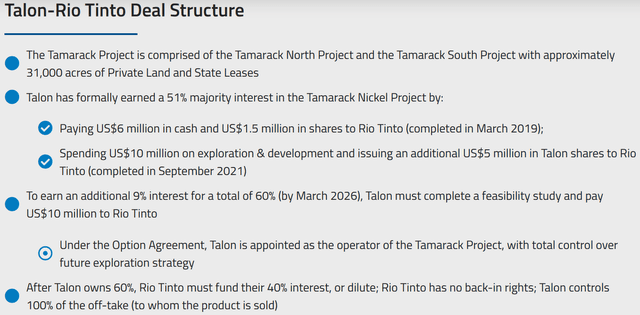

- The underground Tamarack Nickel (Copper-Cobalt) Project in Minnesota, USA (currently 51% owned). Talon has an earn-in to acquire up to 60% of the Tamarack Project and a JV project partner in Rio Tinto (RIO).

- The Michigan Nickel Project in Michigan, USA (option to acquire up to 80%) - The Project is a ~400,000 acres property formerly owned by Ford (F) and then Rio Tinto. It lies just 1.7 miles (2.8 km) from the Eagle Mine (the only nickel producing mine in USA) and has similar geology. It has historic grades up to 7.4% nickel within the land package (similar grades to the Tamarack Nickel Project). The Project is at the early stage of exploration and was acquired only in August 2022.

Location map (red stars) showing Talon's 2 nickel projects in USA - Tamarack & Michigan

Company presentation

This article will focus on the Tamarack Nickel Project as it is a lot more advanced.

The Tamarack Nickel Project

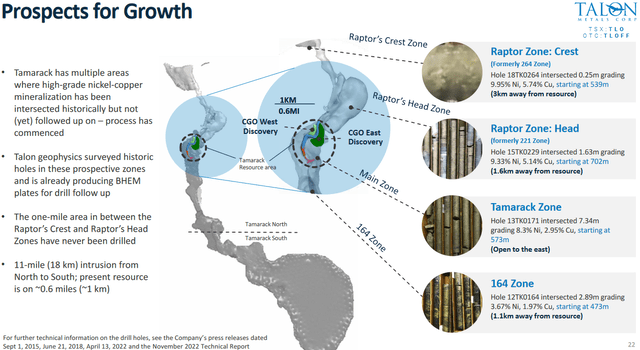

Talon is the 51% owner and operator of the Tamarack Nickel Project in central Minnesota, USA. Talon has an option to earn up to 60% from its JV partner Rio Tinto. The Tamarack Project comprises a large land position of ~31,000 acres (with 18km of strike length) with numerous high-grade intercepts outside the current resource area. The ore is very favorable for extraction being a nickel suplhide ore.

Details of the JV deal with Rio Tinto

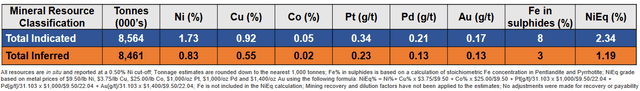

The total Indicated Resource estimate is 8.564 million tonnes grading 1.73% nickel plus by-products (2.34% NiEq) containing 148,000 tonnes of contained nickel. There is also a total Inferred Resource of 8.46 million tonnes grading 0.83% nickel plus by-products (1.19% NiEq) containing 70,000 tonnes of nickel.

Tamarack Nickel Project Resource estimate as of Oct. 2022

As shown below Tamarack has an 11 mile (18km) strike length with significant exploration upside potential

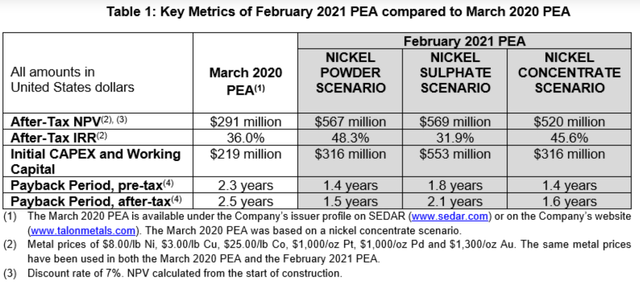

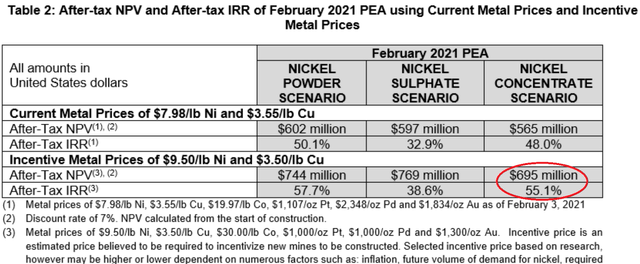

February 2021 PEA results

As announced on Feb. 4, 2021, Talon's updated PEA for the Tamarack Project resulted in an after tax NPV7% of US$520m ('nickel concentrate scenario') and an after-tax IRR of 45.6% (based on nickel at US$8.00/lb). The initial CapEx and working capital was estimated at US$316m. The C1 cash costs (Opex) (net of by-product revenue) was estimated at US$2.05/lb nickel (All-in Sustaining Cost of $3.01/lb nickel).

Note: Based on the U.S Gov. grant details the US$316m appears to now be quite a bit higher. We used the 'nickel concentrate scenario' as it is the lower of the three scenarios NPV, or worst case scenario to be conservative. The nickel powder scenario after-tax NPV7% was US$567m and the nickel sulphate scenario after-tax NPV7% was US$569m.

February 2021 PEA results summary

At US$9.50 nickel (& US$3.50 copper) the nickel concentrate after-tax NPV7% rises to US$695m and after-tax IRR of 55.1%

Note: Red circle by the author.

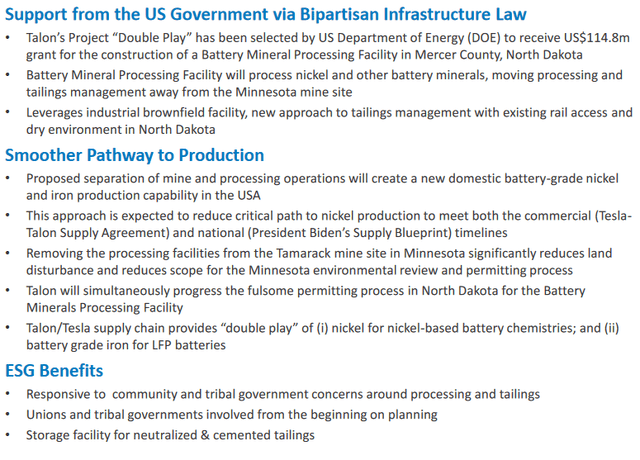

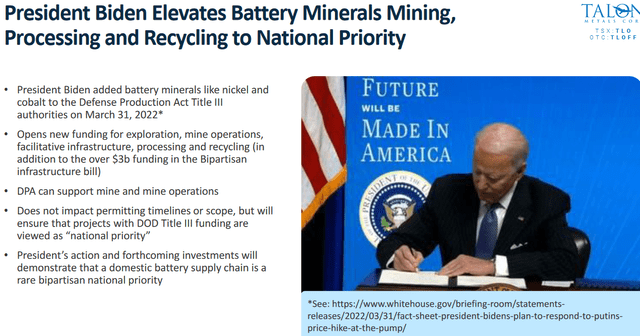

The U.S Government is supporting Talon Metals proposed North Dakota nickel concentrate processing facility (US$114m grant)

Talon's JV Tamarack Nickel Project in Minnesota and potentially other sources will provide the ore for the North Dakota processing operations.

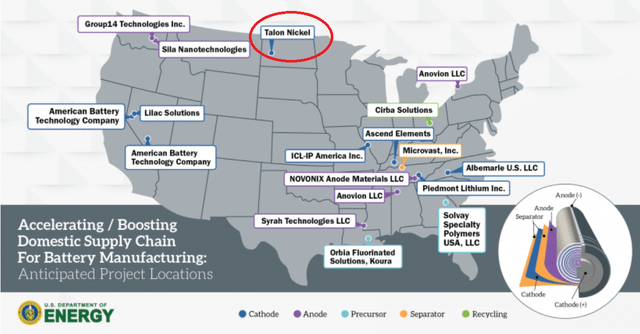

As shown in the charts below Talon Metals is seen by the U.S government as a key future supplier of nickel for cathodes/batteries in the USA. As announced in 2022 Talon Nickel was awarded a ~US$114m grant to develop a nickel ore processing facility in North Dakota. Talon Nickel will need to also contribute US$318m to develop the facility.

Note: Talon Nickel [USA] LLC is a wholly owned subsidiary of Talon Metals.

Key highlights of the proposed North Dakota nickel concentrate processing facility

Talon Metals stated in October 2022:

The application proposed an ore processing and tailings management facility (the "Battery Minerals Processing Facility") located at an existing industrial brownfields site in Mercer County, North Dakota, receiving feedstock from the Company's underground Tamarack mine in central Minnesota and other potential sources in North America. The acquisition of the preferred site in North Dakota is actively under negotiations. Removing the processing facilities from the Tamarack mine site in Minnesota significantly reduces land disturbance and the scope of environmental review and permitting. Both facilities will undergo the science based permitting process in both states that include an opportunity for public comment and government-to-government consultations with tribal sovereign governments.

The proposed separation of mine and processing operations will create a new domestic battery grade nickel and iron production capability designed to meet the timelines set in both the Biden Administration's National Blueprint for Lithium Batteries | Department of Energy[1] and the Tesla-Talon agreement entered into on January 7, 2022 ("Tesla-Talon Supply Agreement"). On a cost-share basis and subject to final negotiations, the US Department of Energy will provide $114 million grant (estimated to be 27% of total project cost) towards project construction and execution costs for the Battery Minerals Processing Facility in North Dakota.

A chart showing the 21 projects supported by the U.S $2.8 billion Bipartisan Infrastructure Law (includes Talon Nickel) (circled in red by the author)

Note: Red oval by the author.

Talon Metals was awarded a ~US$114m grant to develop a nickel ore processing facility in North Dakota to produce nickel for cathodes

Note: Red oval by the author.

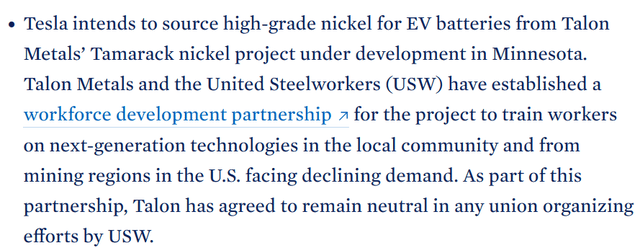

Off-take agreement with Tesla

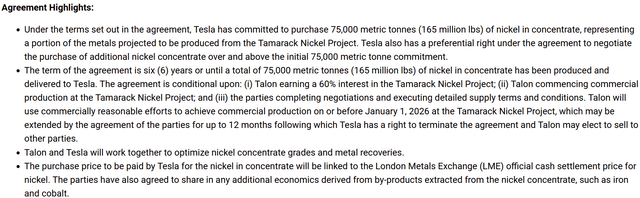

In January 2022, Talon announced the signing of an agreement to supply Tesla with 75,000t of nickel-in-concentrate over the period 2026-2032, subject to certain conditions (see below). Tesla also has a preferential right under the agreement to negotiate the purchase of additional nickel concentrate over and above the initial 75,000 metric tonne commitment.

Some details of the agreement include:

- Purchase price is linked to the LME price of nickel, providing positive exposure to the price of nickel.

- Tesla/Talon have agreed to share in by-product revenues, including from iron, cobalt and PGMs (smelters would have penalized Talon for iron).

- Talon and Tesla will work together as partners to achieve commercial production by 2026."

(source)

Screenshot of the Tesla off-take agreement announcement

Talon Metals news January 10, 2022

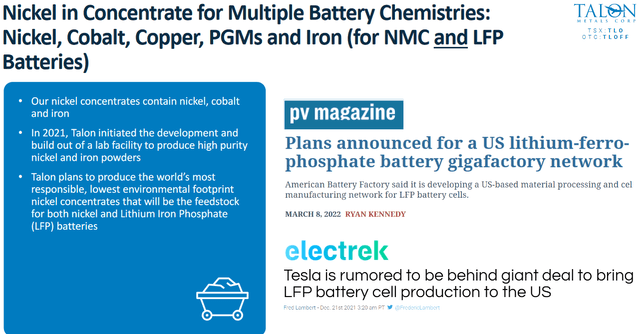

Talon's nickel concentrate will contain several key metals hence called a 'double play' ('NMC' and 'LFP') project

Valuation

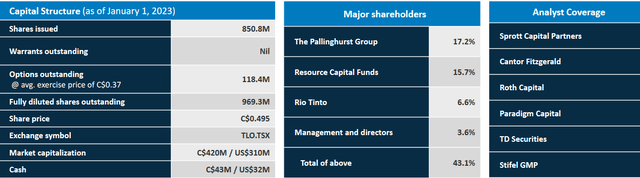

Talon Metals trades on a market cap of C$353m and ~C$43m in cash (and no debt) as of December 31, 2022.

The Tamarack Nickel Project after-tax NPV7% (for the US$9.50 Ni price assumption) in the PEA was US$695m (~C$931m). Based on the current market cap and only the Tamarack Project (assume Talon moves to 60% share = C$559m (C$931m*60%)), Talon Metals trades on 63% of the after-tax NPV7%. Certainly not cheap, but nickel prices are now US$11.71/lb so perhaps closer to reasonable value if nickel prices stay stronger for longer, the USA location, sulphide ore, project expansion potential, ~US$114m (~C$153m) U.S grant for North Dakota, Tesla off-take deal, and 2nd nickel project in Michigan.

Note: If we subtract the C$43m cash, the ~C$153m grant from the current market cap of C$353m; one can argue that Talon trades only at C$157m, of course this is a simplification and not really correct given the grant is conditional etc.

Yahoo Finance shows an analyst price target of C$0.96. Market Screener shows a consensus 'buy' rating and a consensus analyst's price target of C$0.98, representing 135% upside.

Management and top shareholders

Management looks very solid with many years of experience, several at Rio Tinto. Clearly their strong results to date show their diligence and motivation.

You can view the details here.

It was reported that the Pallinghurst Group increased their stake in Talon Metals in December 2022. Insider ownership is only 3.6%.

Institutional ownership is high led by the Pallinghurst Group (17.2% of shares), Resource Capital Funds (15.7%) and Rio Tinto (6.6%)

Catalysts

Near term catalysts include further drilling at Tamarack and other activities to progress the Tamarack Project towards production.

Talon states:

Talon drill rigs have already moved to targets well outside of the current resource area to explore for high-grade nickel deposits using its proven Advanced Exploration System (AES).... Drilling continues in the Main Zone, CGO East and CGO West areas, with extensions of further high-grade nickel being identified (outside of the current resource, which only includes drilling to June 2022).

- Plans to deploy Talon-owned drill rigs to Michigan in 2023. Accelerating towards Nickel Production in the USA.

- Talon will simultaneously seek environmental review and permits for an underground mine and rail loadout facility in Minnesota, as well as the Battery Mineral Processing Facility in North Dakota.

- Separation of mine (Minnesota) and processing operations (North Dakota) is expected to reduce the critical path to nickel production to meet both commercial (Tesla) and national (Biden administration) timelines."

Risks

- Macroeconomic risks - A global recession may reduce demand for nickel.

- The EV boom stalls or moves away from using nickel in cathodes. Looks unlikely for now, although LFP is gaining share over NMC/NCA cathodes.

- Nickel prices falling. Nickel is mostly used in stainless steel so is mostly impacted by any fall in global construction.

- Mining risks - Exploration, funding, permitting, production, project delays/cost blowouts. Underground mining is typically more expensive.

- Processing risks at the North Dakota processing facility.

- JV risks - Talon is partnered with Rio Tinto at the Tamarack Nickel Project.

- Company risks - Management, debt, liquidity, currency risks.

- Sovereign risk - USA is low risk, however permitting can be difficult and slow. A plus is that the USA has already given a significant grant to Talon Metals so appears to want them to succeed, as they want to develop a USA nickel supply.

- Stock market risks - Dilution, takeover (perhaps by Rio Tinto), lack of liquidity (best to buy on local exchange - TSX), market sentiment.

A Feb. 2022 quote from the USA Fact Sheet: Securing a Made in America Supply Chain for Critical Minerals

Further reading

- Talon Metals website

- Talon Metals presentation - Jan. 2022

- Talon Metals news

- Talon Metals videos

- Seeking Alpha article (Nov. 2022) - Talon Metals: The Path Towards Made-In-America Nickel

President Biden supports responsible U.S domestic mining and building a U.S EV supply chain

Talon Metals summary

Conclusion

Talon Metals Corp. is a bit of a mixed bag. The stock has fallen 36% the past year resulting in a potentially better entry point for investors.

- Positives include having two USA nickel projects with Tamarack having reasonable grades (1.73% nickel or 2.34% NiEq), good by-products, and amenable sulphide ore for extraction. At Tamarack Rio Tinto is a strong JV partner. Tesla off-take and USA Gov. support are further positives as is the USA need for nickel to supply 15+ battery factories planned this decade. Talon also has high institutional share ownership + Rio Tinto, and a strong management team.

- Negatives include that Tamarack is an underground project where OpEx and CapEx can rapidly escalate. USA permitting is the other main concern. Quite low insider share ownership.

Valuation looks good on a market cap of C$353m if nickel prices remain strong; however valuation also depends if Talon can make it to profitable production (see valuation section). Market Screener shows a consensus 'buy' rating and a consensus analyst's price target of C$0.98, representing 135% upside.

Key risks include project funding, permitting, and the risks associated with underground mining. Also nickel prices falling.

We rate Talon Metals as a speculative accumulate (high risk/high reward), suitable for a 5 year plus time frame, especially if you are positive on the outlook for nickel sulphide opportunities in the USA.

As usual all comments are welcome.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Trend Investing

Trend Investing subscribers benefit from early access to articles and exclusive articles on investing ideas and the latest trends (especially in the EV and EV metals sector). Plus CEO interviews, chat room access with other professional investors. Read "The Trend Investing Difference", or sign up here.

Trend Investing articles:

This article was written by

The Trend Investing group includes qualified financial personnel with a Graduate Diploma in Applied Finance and Investment (similar to CFA) and well over 20 years of professional experience in financial markets. Trend Investing searches the globe for great investments with a focus on "trend investing" themes. Some focus trends include electric vehicles and the lithium/cobalt/graphite/nickel/copper/vanadium miners, battery and plastics recycling, the online data boom, 5G, IoTs, AI, cloud computing, renewable energy, energy storage etc. Trend Investing was recently selected as the leading expert consultancy for a U.S government project on the EV supply chain. Trend Investing hosts a Marketplace Service called Trend Investing for professional and sophisticated investors. The service is information only and does not offer advise or recommendations. See Seeking Alpha's Terms of use. https://seekingalpha.com/page/terms-of-use

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for ‘information purposes only’ and should not be considered as any type of advice or recommendation. Readers should "Do Your Own Research" ("DYOR") and all decisions are your own. See also Seeking Alpha Terms of Use of which all site users have agreed to follow. https://about.seekingalpha.com/terms