AMD: Growth Story Far From Over

Summary

- Despite an initial surge following earnings, Advanced Micro Devices, Inc. has since pulled back - leaving investors on the edge of their seats.

- While the first half of 2023 may still present challenges for semiconductor companies, the anticipation of brighter prospects in the second half ignites optimism in the industry.

- Opportune investors waiting on the sidelines should seize the current pullback as a prime opportunity to add to their positions.

- AMD's growth potential positions it as an attractive opportunity for investors, and with an NTM EBITDA multiple of 15.8x, it's not expensive.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

David Becker

Advanced Micro Devices, Inc. (NASDAQ:AMD) stock has pulled back from its initial post-earnings highs following the recent market selloff.

We believe the retracement has proffered investors another opportunity to strike, as AMD's valuation is still reasonable.

CEO Dr. Lisa Su & her team telegraphed their optimism at its recent FQ4 earnings, suggesting a stronger H2'23, lifting revenue and profitability growth.

Our assessment of the semi-supply chain suggests management's perspective is in line, bolstering Dr. Su's credibility for subsequent recovery. Accordingly, investors should still expect inventory digestion to carry on in H1. In addition, notebook shipments are still weak in January, as they fell "29% on a monthly basis and almost halved from the previous year in January."

Moreover, DIGITIMES highlighted in a recent commentary that visibility has remained relatively uncertain, as IC designers have moved more toward "short-lead-time orders." As such, it suggests that fabless semi-companies are still worried about the ability of downstream clients to digest their inventory, worsened by the uncertain macroeconomic outlook.

However, China's reopening boost could proffer an H2 bump subsequently, with the focus on "China's Labor Day holiday in May and the country's 618 mid-year shopping festival" in June. Our assessment shows China's broad consumption recovery has not ramped up significantly. Therefore, investors need to watch these shopping festivals carefully, as they could represent significant barometers of the health of the Chinese consumer.

Notwithstanding, better prospects in H2 could also be lifted by China's cloud computing leaders' push toward investing in Southeast Asia. Therefore, it could help mitigate some of the data center demand headwinds faced in China as AMD looks to ramp up its next-gen EPYC processors in 2023.

Moreover, data center demand drivers should remain robust in 2023. DIGITIMES highlighted that data center "supply chain players expect growth to return in a few quarters." The insights are also in line with management's commentary at its recent earnings, as Dr. Su stressed:

We are very positioned well with our product portfolio. We just launched our Genoa 4th Gen EPYC. We also have [cloud-optimized] Bergamo coming this year as well. And so we are expecting a softer first half and then a stronger second half, but we feel very good about our market share position and opportunity to grow with Data Center. Also on the Embedded side, I would say we have a very strong portfolio there. We see strength in a number of the end markets. And so we think that's also a grower for AMD. (AMD FQ4'22 earnings call).

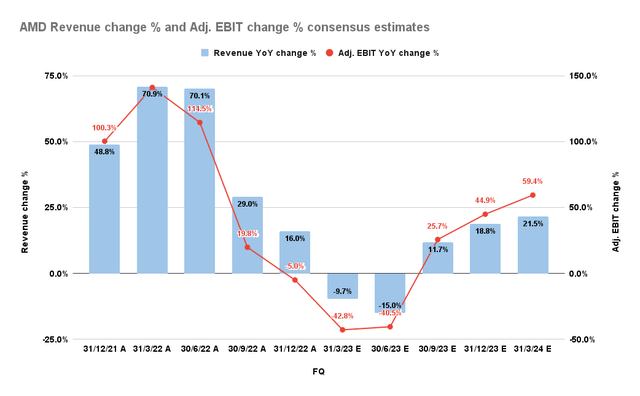

AMD revenue change % and Adjusted EBIT change % consensus estimates (TradingView)

Therefore, we believe the consensus estimates are credible, projecting a trough in AMD's revenue and adjusted EBIT growth by H1'23.

A subsequent recovery in H2 should follow through, lifted by the normalization in inventory digestion and bolstered by the recovery in the data center and embedded demand.

Hence, that should help to undergird the recent recovery in AMD stock's progress from its October 2022 lows. Still, we believe market operators have likely anticipated solid execution by the AMD team, which investors will need to assess carefully.

AMD last traded at an NTM EBITDA of 15.8x or NTM Adjusted P/E of 25.8x. It remains well below its long-term average of 36.5x EBITDA. However, we urge investors to be careful about expecting AMD to surge toward its averages, as the recovery is expected to remain uneven.

Despite that, AMD's valuation remains at a slight premium against the industry's forward P/E of 24x. As such, we believe it's not expensive, and it is still reasonable if AMD executes its recovery accordingly.

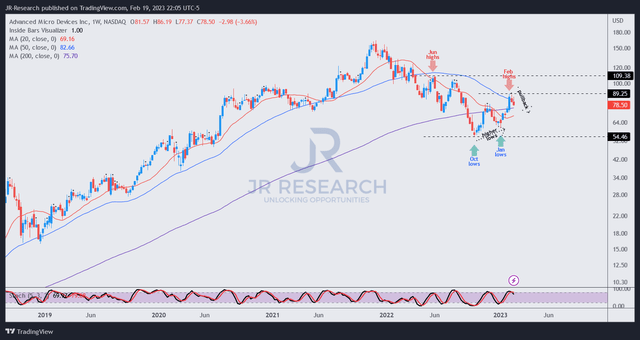

AMD price chart (weekly) (TradingView)

A closer look at AMD's price action suggests market operators have confidence in its recovery.

As dip buyers returned, AMD formed a higher low at its January bottom (pre-earnings), helping to stem a further slide toward its October lows.

The recent pullback from its February highs was expected, as AMD surged into overbought zones post-earnings, coupled with a sharp recovery.

Investors waiting patiently for a pullback after AMD's earnings surge should consider capitalizing on it to add more exposure.

Rating: Buy (Reiterated).

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you'll also gain access to exclusive resources including:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Unlock the secrets of successful investing with JR Research - led by founder and lead writer JR. Our dedicated team is laser-focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular marketplace service - specializing in a price-action-based approach to uncovering the hottest growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.