FactSet Research Systems: Never Bought, Always Regretted

Summary

- The FactSet Research Systems stock has been an impressive performance machine over the last 20 years which the share price has risen by more than 2,000 percent.

- FactSet is growing even in difficult macroeconomic times. The company is very well-positioned and could benefit from AI innovations.

- Well, so why not just take a header and invest in FactSet? It's the old problem. FactSet is simply a very expensively valued company.

- For investors who do not have problems with lofty valuations, a savings plan could be a good way to build up a position over time.

ismagilov

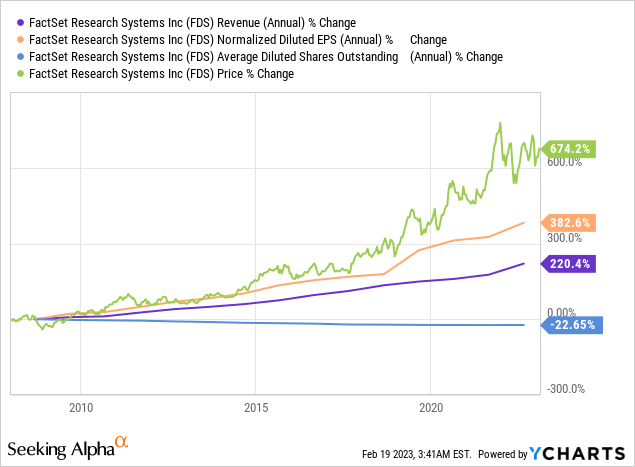

The FactSet Research Systems (NYSE:FDS) stock has been an impressive performance machine over the last 20 years in which the share price has risen by more than 2,000 percent, while the S&P 500, for example, has only risen by 360 percent. In the last 15 years alone, sales grew by 220 percent, EPS rose by as much as 382 percent, while the number of shares outstanding fell by over 22 percent. And even though the dividend yield is below 1.5 percent on average, long-term dividend investors have gotten their money's worth. For example, the yield on cost for a purchase 20 years ago is almost 19 percent; for a purchase 15 years ago, almost 7 percent; and for a purchase 10 years ago, almost 4 percent.

Unfortunately, far too few investors have FactSet on their minds. On the one hand, the management acts conservatively and soberly in an environment that has not been carried by any hype in recent years.

FactSet is a financial data and analytics company that offers a range of products and services to professional investors. FactSet's business model is based on providing high-quality financial data and analytical tools to its clients, i.e., mainly professional investors such as hedge funds, investment banks, asset managers, and institutional investors. Private investors, therefore, hardly come directly into contact with the company's financial data, analytical tools, and information services in their everyday lives.

On the other hand, the company was too expensive for value investors, with an average adjusted PE ratio of over 20, and too unattractive for cash-flow-oriented dividend investors, with a dividend yield below 1.5 percent. I count myself in the latter group. And what can I say, whenever I decided to wait for a more favorable opportunity, the share price pulled away.

Growth momentum remains intact

FactSet's growth momentum remains intact. Despite a challenging macroeconomic environment for companies in the financial and investment industry in recent quarters, FactSet reported strong financial results. For example, revenue increased by 21 percent in 4Q 2022. ASV (Average Subscription value) plus Professional Services grew by 9.3 percent. This performance was immediately followed by a strong 1Q 2023. Revenues increased by almost 19 percent from USD 424 million to USD 504 million, of which organic growth was 8.3 percent. Organic ASV plus Professional Services grew by 8.8 percent. FCF increased from USD 64 million to USD 88.6 million, an increase of 37 percent.

A couple of additional highlights stand out. I have already mentioned the macroeconomic environment. Investors have pulled a lot of capital out of the markets and made life more difficult for asset management companies. In this respect, I would have expected client retention at FactSet to weaken. I would also have thought it possible that FactSet would have to lower its prices, as asset managers may now pay more attention to their budgets. At the same time, FactSet is exposed to strong competition and innovation pressure and competes with its larger rivals Bloomberg or Eikon (Thomson Reuters).

However, FactSet's business model and products and services are extremely sticky. Thus, there were no customer churns in 1Q 2023. ASV retention, i.e., ASV retained from clients over the last twelve months, remained above 95 percent. Client retention, i.e., the percentage of clients retained over the last twelve months, also remained at 92 percent. I was even more impressed that the user count increased by 12 percent YoY. The client count, i.e., companies subscribing to FactSet services with an ASV greater than USD 10,000, increased by 13 percent. And all this did not even come at the expense of profitability. The operating margin increased by 517 bps YoY from 28.9 percent to 31.1 percent (!).

The long-term future is also promising

FactSet's prospects are also good to very good. On the one hand, the company has shown that it can compete well with acquisitions such as the recent USD 1.9 billion acquisition of CUSIP Financial services and its innovative products. For example, my colleague Deep Tech Insights provided great insights on the topic of Big Data and the ESG industry on the good positioning around partnerships and growth prospects in his Seeking Alpha article. In addition, FactSet has cash of 470 million that it can use for further inorganic growth or debt reduction.

Another important aspect could be the use of AI. On the one hand, AI might be able to collect the respective data itself, so that AI tools like OpenAI can compete with FactSet. However, I don't think that is likely. In this respect, it is important to understand that the value of FactSet is not only in the amount of data but in the processing and visualization. More likely, FactSet itself will use AI to collect the data. This, in turn, could reduce the most important cost factor, namely staff:

FactSet Research Systems First Quarter 2023 Adj. Operating Income Walk (Investor relations)

The old story about valuation

Well, so why not just take a header and invest in FactSet? It's the old problem. FactSet is simply a very expensively valued company. With an average P/E of 28 and a price-to-cash flow ratio of just under 21, the stock has been quite expensively valued over the past 10 years. Currently, it has moved even further into overvaluation territory with a P/E ratio of almost 40 (adjusted 27). Conversely, analysts believe the company can continue to grow and achieve an EPS of almost USD 18 in 2026. Based on the current share price of USD 431, this would be a forward PE ratio of 23. In my view, however, this prospect is not attractive enough for an investment.

The same applies to the dividend yield, as already indicated. FactSet is a solid dividend payer, having increased quarterly distributions at sometimes respectable rates over the past 22 years. The quarterly dividend has risen from USD 0.06 in 2000 to USD 0.89. Over the last 10 years, FactSet has raised its dividend by an annual average of 11.08 percent. Looking only at the last 5 years, the annual average growth was still 9.21 percent. Currently, the dividend yield is 0.83 percent. While there is room for future increases, as the payout ratio of 32 percent on profit and 25 percent measured by free cash flow is relatively low, the current yield is well below the long-term corridors.

Dividend Yield 5Y and 10Y (Seeking Alpha)

Conclusion

The FactSet share has shown a more than solid performance over the last decades due to rising share prices and a dividend policy plus share buybacks that benefit the shareholders in the long run. There are good reasons to believe that the company will continue to be successful in the years to come.

FactSet is growing even in difficult macroeconomic times. The company is very well-positioned and could benefit from AI innovations. However, the current valuation of the share already seems to include the future growth potential. For this reason, I still consider the FactSet shares too expensive to buy. They simply do not fit into my investment profile. For investors who do not have problems with high valuations, a savings plan could be a good way to build up a position over time.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.