Weekly Forecast, Feb. 17: 2-Year/10-Year Treasury Negative Spread Won't End Soon

Summary

- Today's simulation of the U.S. Treasury curve shows that the current streak of inverted 2-year/10-year Treasury yields is likely to persist to 2024 and beyond.

- The simulation uses 500,000 scenarios and 10 risk factors to generate random future U.S. Treasury yields.

- Using proper Heath, Jarrow, and Morton procedures, the Monte Carlo simulation perfectly prices US Treasury bonds for any holding period.

- Looking for a portfolio of ideas like this one? Members of Corporate Bond Investor get exclusive access to our subscriber-only portfolios. Learn More »

FatCamera

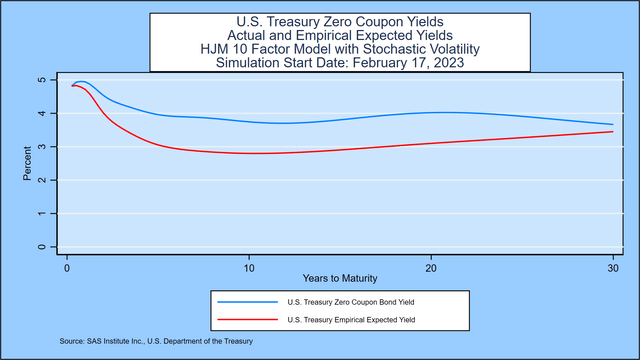

Today's analysis shows that the negative 2-year/10-year U.S. Treasury spread looks likely to persist well into fall, 2023 and beyond. As explained in Prof. Robert Jarrow's book cited below, forward rates contain a risk premium above and beyond the market's expectations for the 1-month forward rate. We document the size of that risk premium in this graph, which shows the zero-coupon yield curve implied by current Treasury prices compared with the annualized compounded yield on 3-month Treasury bills that market participants would expect based on the daily movement of Treasury yields since 1962. The risk premium, the reward for a long-term investment, is large for the full maturity range to 30 years. The graph also shows that historical movements in Treasuries imply a steady decline in expected 3-month rates for 5 years after an initial peak.

For more on this topic, see the analysis of U.S. Treasury yields through December 31, 2022 given in the appendix.

Inverted Yields, Negative Rates, and U.S. Treasury Probabilities 10 Years Forward

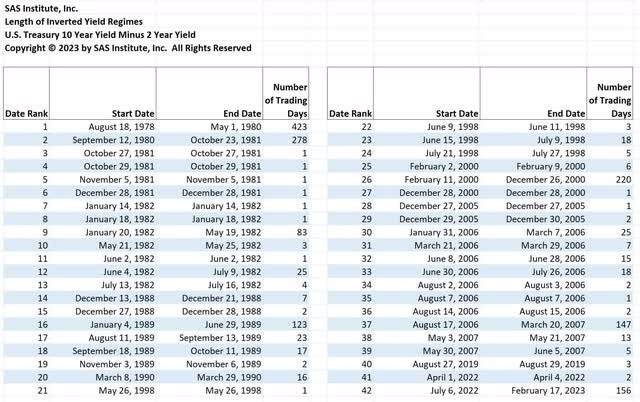

The negative 2-year/10-year Treasury spread has now persisted for 156 trading days, currently at a negative 78 basis points compared to negative 76 last week. The table below shows that the current streak of inverted yield curves is now the fourth longest in the U.S. Treasury market since the 2-year Treasury yield was first reported on June 1, 1976:

In this week's forecast, the focus is on three elements of interest rate behavior: the future probability of the recession-predicting inverted yield curve, the probability of negative rates, and the probability distribution of U.S. Treasury yields over the next decade.

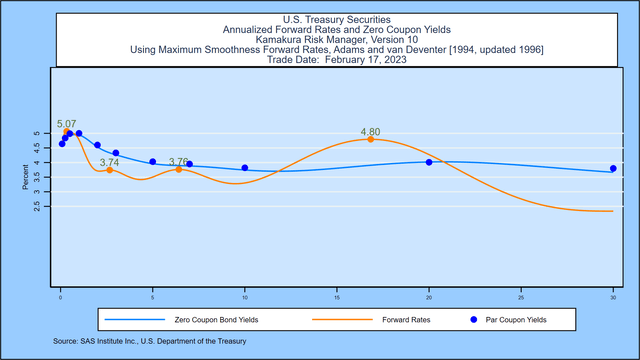

We start from the closing U.S. Treasury yield curve and the interest rate swap quotations based on the Secured Overnight Financing Rate published daily by the Federal Reserve Bank of New York. Using a maximum smoothness forward rate approach, Friday's implied forward rate curve shows a quick rise in 1-month rates to an initial peak of 5.07%, versus 4.92% last week. After the initial rise, there is a decline before rates peak again at 3.76%, compared to 3.66% one week ago. Rates finally peak again at 4.80%, compared to 4.75% last week, and then decline to a lower plateau at the end of the 30-year horizon.

Using the methodology outlined in the appendix, we simulate 500,000 future paths for the U.S. Treasury yield curve out to thirty years. The next three sections summarize our conclusions from that simulation.

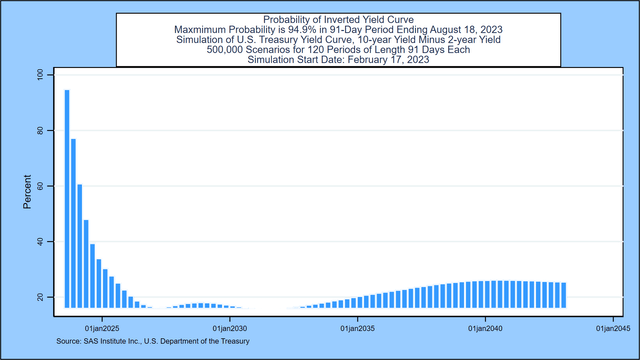

Inverted Treasury Yields: Inverted Now, 94.9% Probability by August 18, 2023

A large number of economists have concluded that a downward sloping U.S. Treasury yield curve is an important indicator of future recessions. A recent example is this paper by Alex Domash and Lawrence H. Summers. We measure the probability that the 10-year par coupon Treasury yield is lower than the 2-year par coupon Treasury for every scenario in each of the first 80 quarterly periods in the simulation. 1

The next graph shows that the probability of an inverted yield remains high, peaking at 94.9%, compared to 93.9% one week before, in the 91-day quarterly period ending August 18, 2023.

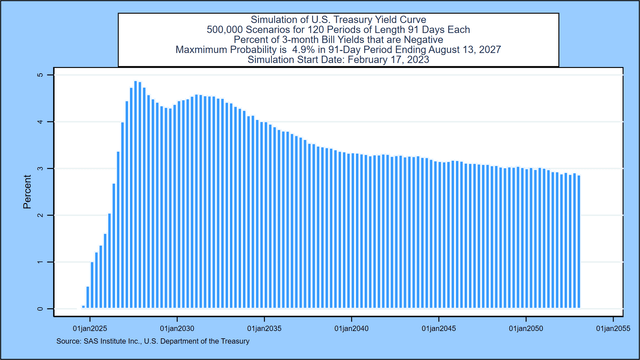

Negative Treasury Bill Yields: 4.9% Probability by August 13, 2027

The next graph describes the probability of negative 3-month Treasury bill rates for all but the first 3 months of the next 3 decades. The probability of negative rates starts near zero but then rises steadily to peak at 4.9%, compared to 4.7% one week earlier, in the period ending August 13, 2027:

U.S. Treasury Probabilities 10 Years Forward

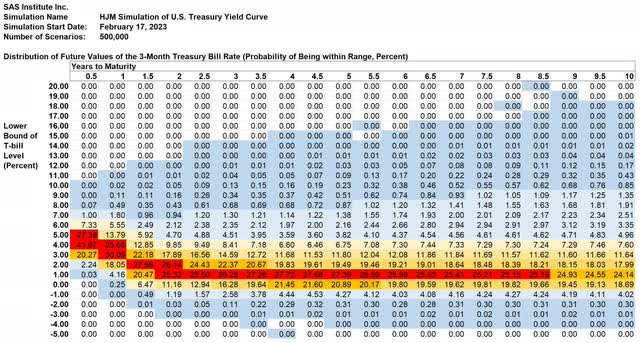

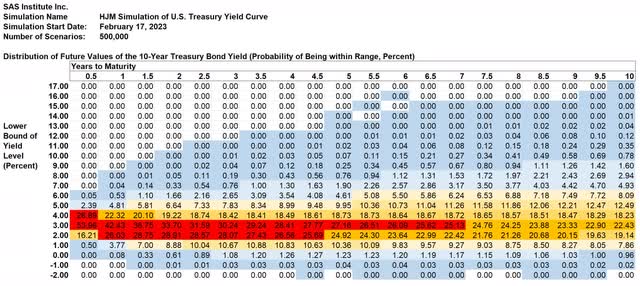

In this section, the focus turns to the decade ahead. This week's simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 1% to 2%. There is a 24.14% probability that the 3-month yield falls in this range, a change from 23.80% one week before. For the 10-year Treasury yield, the most likely range is from 3% to 4%. The probability of being in this range is 22.43%, compared to 20.82% one week prior.

In a recent post on Seeking Alpha, we pointed out that a forecast of "heads" or "tails" in a coin flip leaves out critical information. What a sophisticated bettor needs to know is that, on average for a fair coin, the probability of heads is 50%. A forecast that the next coin flip will be "heads" is literally worth nothing to investors because the outcome is purely random.

The same is true for interest rates.

In this section we present the detailed probability distribution for both the 3-month Treasury bill rate and the 10-year U.S. Treasury yield 10 years forward using semi-annual time steps. We present the probability of where rates will be at each time step in 1 percent "rate buckets." The forecast for 3-month Treasury yields is shown in this graph:

3-Month U.S. Treasury Yield Data:

The probability that the 3-month Treasury bill yield will be between 1% and 2% in 2 years is shown in column 4: 25.32%. The probability that the 3-month Treasury bill yield will be negative (as it has been often in Europe and Japan) in 2 years is 1.19% plus 0.03% plus 0.00% = 1.22% (difference due to rounding). Cells shaded in blue represent positive probabilities of occurring, but the probability has been rounded to the nearest 0.01%. The shading scheme works like this:

- Dark blue: the probability is greater than 0% but less than 1%

- Light blue: the probability is greater than or equal to 1% and less than 5%

- Light yellow: the probability is greater than or equal to 5% and 10%

- Medium yellow: the probability is greater than or equal to 10% and less than 20%

- Orange: the probability is greater than or equal to 20% and less than 25%

- Red: the probability is greater than 25%

The chart below shows the same probabilities for the 10-year U.S. Treasury yield derived as part of the same simulation.

10-Year US Treasury Yield Data:

Appendix: Treasury Simulation Methodology

The probabilities are derived using the same methodology that SAS Institute Inc. recommends to its KRIS® and Kamakura Risk Manager® clients, who currently have more than $38 trillion in assets or assets under management. A moderately technical explanation is given later in the appendix, but we summarize it in plain English first.

Step 1: We take the closing U.S. Treasury yield curve as our starting point.

Step 2: We use the number of points on the yield curve that best explain historical yield curve shifts. Using daily data from 1962 through December 31, 2022, we conclude that 10 "factors" drive almost all movements of U.S. Treasury yields.

Step 3: We measure the volatility of changes in those factors and how it has changed over the same period.

Step 4: Using those measured volatilities, we generate 500,000 random shocks at each time step and derive the resulting yield curve.

Step 5: We "validate" the model to make sure that the simulation EXACTLY prices the starting Treasury curve and that it fits history as well as possible. The methodology for doing this is described below.

Step 6: We take all 500,000 simulated yield curves and calculate the probabilities that yields fall in each of the 1% "buckets" displayed in the graph.

Do Treasury Yields Accurately Reflect Expected Future Inflation?

We showed in a recent post on Seeking Alpha that, on average, investors have almost always done better by buying long term bonds than by rolling over short term Treasury bills. That means that market participants have generally (but not always) been accurate in forecasting future inflation and adding a risk premium to that forecast.

The distribution above helps investors estimate the probability of success from going long.

Finally, as mentioned weekly in The Corporate Bond Investor Friday overview, the future expenses (both the amount and the timing) that all investors are trying to cover with their investments are an important part of investment strategy. The author follows his own advice: cover the short-term cash needs first and then step out to cover more distant cash needs as savings and investment returns accumulate.

Technical Details

Daily Treasury yields form the base historical data for fitting the number of yield curve factors and their volatility. The historical data is provided by the U.S. Department of the Treasury.

An example of the modeling process using data through December 31, 2022 is available at this link.

The modeling process was published in a very important paper by David Heath, Robert Jarrow and Andrew Morton in 1992:

For technically inclined readers, we recommend Prof. Jarrow's book Modeling Fixed Income Securities and Interest Rate Options for those who want to know exactly how the "HJM" model construction works.

The number of factors (10 for the United States) has been stable for some time.

Footnotes:

- After the first 20 years in the simulation, the 10-year Treasury cannot be derived from the initial 30 years of Treasury yields.

For a daily ranking of the best risk-adjusted value of corporate bonds traded in the U.S. market, please check out a free trial of The Corporate Bond Investor. Subscribers are actively arbitraging 161-year-old legacy credit ratings using modern big data default probabilities from Kamakura Corporation. Remember, the Pony Express and credit ratings were both invented in 1860. Are you still using the Pony Express?

Subscribers to the Corporate Bond Investor learn how to

1. Calculate a forward looking assessment of the investor's cash needs

2. Rank bonds from best to worst by the reward-to-risk ratio

This article was written by

Donald R. van Deventer is a Managing Director in the Center for Applied Quantitative Finance at SAS Institute, Inc. Prior to the acquisition of Kamakura Corporation by SAS on June 24, 2022, Dr. van Deventer was the Chairman and Chief Executive Officer of Kamakura Corporation. He founded the Kamakura Corporation in April, 1990. The second edition of his book, Advanced Financial Risk Management (with Kenji Imai and Mark Mesler) was published in 2013. Dr. van Deventer was senior vice president in the investment banking department of Lehman Brothers (then Shearson Lehman Hutton) from 1987 to 1990. During that time, he was responsible for 27 major client relationships including Sony, Canon, Fujitsu, NTT, Tokyo Electric Power Co., and most of Japan's leading banks. From 1982 to 1987, Dr. van Deventer was the treasurer for First Interstate Bancorp in Los Angeles. In this capacity he was responsible for all bond financing requirements, the company’s commercial paper program, and a multi-billion dollar derivatives hedging program for the company. Dr. van Deventer was a Vice President in the risk management department of Security Pacific National Bank from 1977 to 1982. Dr. van Deventer holds a Ph.D. in Business Economics, a joint degree of the Harvard University Department of Economics and the Harvard Graduate School of Business Administration. He was appointed to the Harvard University Graduate School Alumni Association Council in 1999 and served through 2021. Dr. van Deventer was Chairman of the Council for four years from 2012 to 2016. From 2005 through 2009, he served as one of two appointed directors of the Harvard Alumni Association representing the Graduate School of Arts and Sciences. Dr. van Deventer also holds a degree in mathematics and economics from Occidental College, where he graduated second in his class, summa cum laude, and Phi Beta Kappa. Dr. van Deventer speaks Japanese and English.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.