Saying Goodbye To VanEck Vectors Africa Index ETF

Summary

- The VanEck Vectors Africa Index ETF has not done well since I first bought in almost nine years ago. In my current clean-up phase, I finally let it go!

- Along with a link to my 2019 article on AFK, here I will review AFK's current make-up and recent performance.

- I will give some thought to why I do not think things will get better in Africa, and link in another Seeking Alpha article that supports my Sell rating.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

da-kuk

(This article was co-produced with Hoya Capital Real Estate)

Introduction

I have been interested in Africa to a larger extent since 1987 when I started funding scholarships at Africa University in Zimbabwe; a university connected to my denomination, the United Methodist Church. When I first found out about the VanEck Vectors Africa Index ETF (NYSEARCA:AFK) and at the time investment professionals talking about the potential of the countries in Africa, I made a small allocation in 2014, adding more in 2017, basically "doubling down" on my original investment. My writing this follow-up article to my 2019 one (Investing In Africa Using The AFK Exchange-Trade Fund) made sense as I decided it was time to sell and rely on wider Frontier/Emerging Market funds to have some, but not focused, allocation to the continent of Africa.

VanEck Vectors Africa Index ETF review

Seeking Alpha describes this ETF as:

The VanEck Africa Index ETF is an exchange traded fund launched and managed by Van Eck Associates Corporation. It invests in public equity markets of Africa / Middle East region. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the MVIS GDP Africa Index. AFK started in 2008.

AFK has just $48m in AUM after all this time. The Managers are collecting 77bps in fess, which is high even for an international indexed ETF. The TTM Yield is 3.4%.

Index review

Market Vectors describes their index as:

The MVIS® GDP Africa Index (MVAFK) is designed to reflect the size of a country's economy instead of the size of its equity market. It defines country weightings based on a country's gross domestic product (GDP). The index also includes non-local companies incorporated outside of Africa that generate at least 50% of their revenues in Africa. MVAFK covers at least 90% of the investable universe.

Index rules include the following:

- Minimum market-cap of $150m in USD.

- 3-month trading value of $1m in USD, and average volume of 250k over the past 6 months.

- GDPs annually in June, components quarterly.

- Index includes non-local stocks.

- Maximum stock weight is 8%.

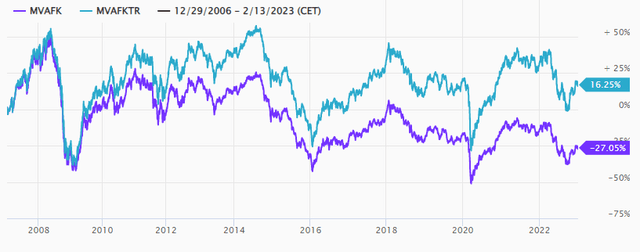

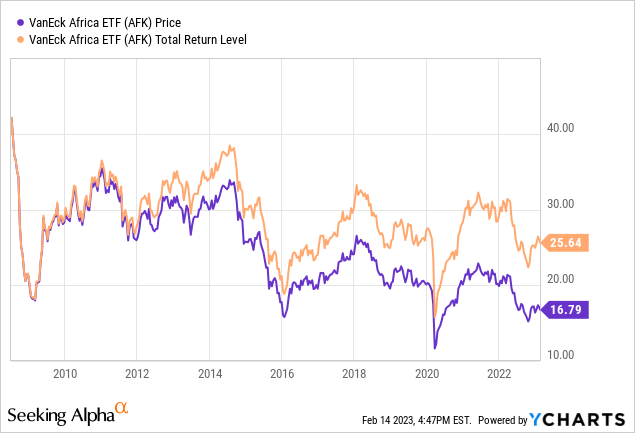

The price and TR value of the index since inception is shown next.

AFK holdings review

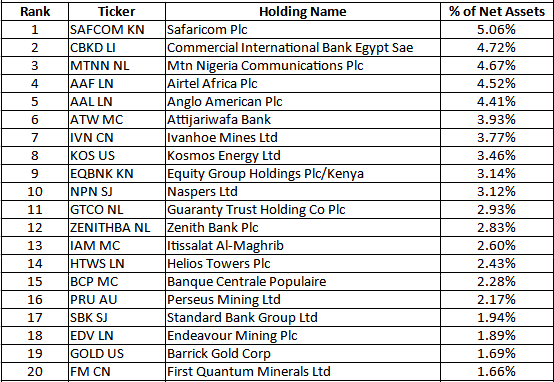

The most recent portfolio data is shown next.

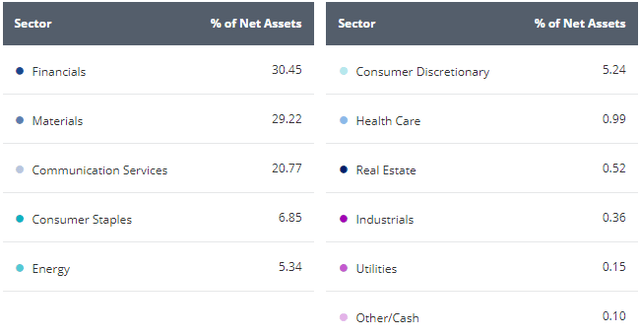

The WAMC is way inside their definition of Large-Cap stocks, almost twice the minimize size for that size range. AFK holds almost no Small-Cap stocks. At 8.8, the P/E ratio is definitely a plus. The sector allocations as of the same date are:

Compared to 2019, the top three sectors are the same, with Financials losing weight and Communication Services almost 50% more in allocation. The Country allocations are:

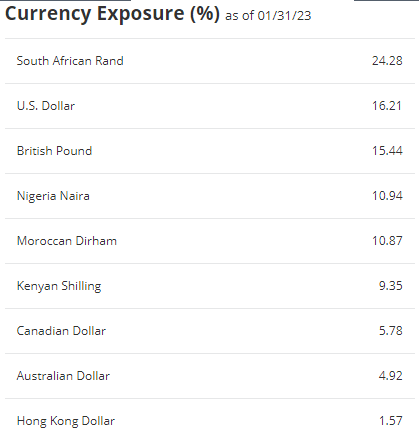

Here, South Africa's weight is down from 47% in 2019, though some of that could be hidden in the non-African countries listed as from the first article, the weights better reflected where the company operated in Africa. As mentioned, the index allows non-local companies when a large (not defined as far as I saw) percent of their business was in Africa. This is also revealed in the currency exposure, though some could be from African countries using a foreign currency as their own.

vaneck.com AFK currencies

Top holdings

vaneck.com; compiled by Author

The tickers indicate that many trade on exchanges outside of Africa, most likely in their home market and currency, as shown above. These stocks, out of 80, account for 63% of the portfolio, whereas the bottom 20 are only 3% of the portfolio weight.

AFK distribution review

vaneck.com AFK payouts

The 2022 payout was the lowest since 2010, not something income investors want to see. The data shows, besides being annual payouts, large variations between years.

AFK performance and risk review

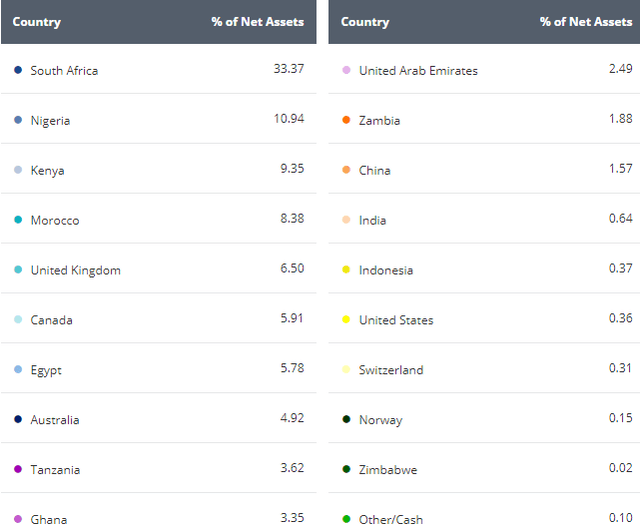

Recent strength might mean AFK is starting another one of their Bull runs. While this next comparison truncates some older AFK data, it does show AFK underperforming both the iShares MSCI Frontier and Select EM ETF (FM) and the iShares MSCI Emerging Markets ETF (EEM).

Portfolio strategy

Africa has several things in its favor, such as:

- Unlike the First world, they have very young populations.

- Minerals that are critical to the world's economy.

On the downside, there are:

- Large percentages of the population living below the poverty line.

- Currency weakness compared to their non-African trading partners, especially the USD in which much of the government debt is in.

- Growing influence of China in their local economies. These investments often come with "strings" and are showing their problems recently.

Modern Income Investor's article AFK: Struggling To Find Stability goes in more detail about the pros/cons facing Africa, which also give the AFK ETF a Sell rating.

My experience

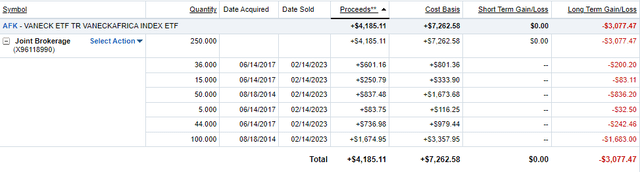

If you go back and look at the MVAFK index chart, you see at least four times when the index made major movements upward, then followed by almost complete retracements. Market timers might have done much better than me. My first purchase of the AFK ETF was in 2014, adding another 100 shares in 2017. As the above chart chows, both were at or near market peaks! As the next table shows, none of those lots were sold at a gain; basically, a lost decade waiting for the continent of Africa to prosper like European Emerging Market countries after the fall of the Berlin Wall and the collapse of the Soviet Union; or the Asian tigers.

Fidelity.com; Contributor's page.

The 14% rally over the last three months might continue, meaning I sold too soon; only time will tell.

Final thoughts

For those wanting Africa exposure, but not exclusively, there are Emerging and Frontier Market funds that allow that. Also, there are a few single-country funds; some of which I list here:

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.