PDO Yields 11.04% And I Am Adding To My Position

Summary

- PDO has paid a dividend each month since its inception and its yield currently exceeds 11%.

- While shares of PDO have declined by -$6.25 (-31.25%) since inception, PDO has spun off $4.28 per share in income and provided a monthly dividend increase of 8.02% in 2022.

- PDO is authorized to use up to 50% of its asset base in leverage and has a current leverage ratio of 48% increasing the risk level of this investment.

Sakorn Sukkasemsakorn

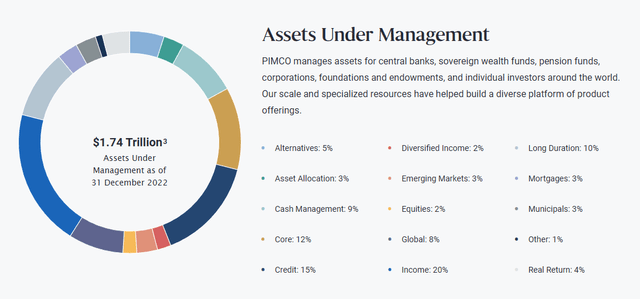

PIMCO is synonymous with fixed income and manages $1.74 trillion for central banks, sovereign wealth funds, pension funds, corporations, foundations, endowments, and individual investors globally. I have recently written articles on their Dynamic Income Fund (PDI) and Corporate & Income Opportunity Fund (PTY) as I found them to be interesting high-yield opportunities to diversify my dividend income stream. After conducting my due diligence, the PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) looks to have broken its downtrend, and I am ready to add PDO to my main dividend account. I write a Dividend Harvesting Series on Seeking Alpha, and I added PDO to the portfolio 13 weeks ago (can be read here). I plan on adding to PDO in this series while having it accompany PDI in my main dividend account over the next several weeks. PDO has bounced off its 2022 low of $12.73 and reached around $14.42 on 2/2/23. Since then, PDO has trended lower and is trading around $13.75. I like PDO on this pullback for a long-term dividend investment, as I believe investments in fixed income will have a better year in 2023.

PIMCO

Some would argue that PDO has been a bust since its IPO, but it really depends how you look at the situation

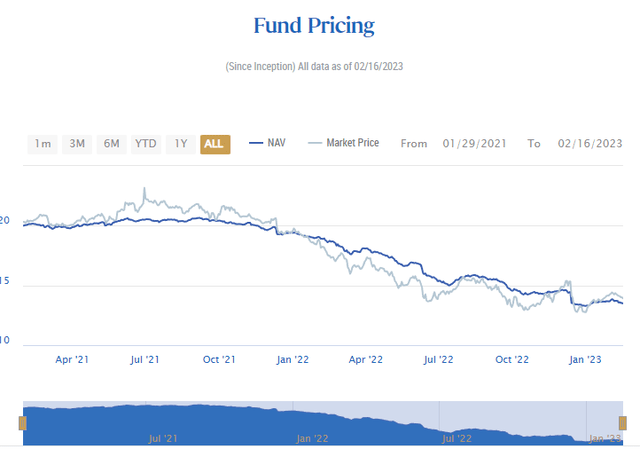

PDO went public on 1/29/21 at $20 per share. Shares of PDO stayed above its IPO price for the better part of the next 9-months before seeing a drastic decline which caused the share price to fall under its net asset value (NAV) for a substantial amount of time. PDO has been public for just over 2 years, and if you had purchased 100 shares at the IPO, it would have cost $2,000. Today that initial investment would be worth $1,375 before accounting for taking the dividends as cash or reinvesting them. This would be an ROI of -31.25% (-$675). On the surface, nobody wants to see their initial investment decline, let alone decline by -31.25%, regardless of how bad 2022 was.

PIMCO

Every day, when you log into your brokerage account, you see an account value. Individual positions fluctuate, and at any given moment, an investment can be in the black or in the red. When you own a business, you don't have the value of the business flashing in front of you each day; all that matters is the net profit and cash being distributed to your pocket. Everyone's definition of a good investment is an opinion that can vary from person to person. I look at high-yield funds as an income-generating vehicle, and I am less concerned with the fluctuation of its share price and more interested in how stable the income is, how much income it can produce in the future, and if the share price can appreciate from where I purchased it.

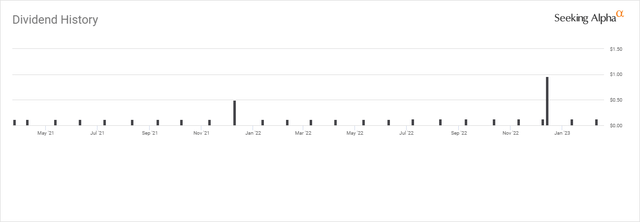

Seeking Alpha

PDO hasn't missed paying a monthly dividend distribution since its inception. Over the previous 24 months, PDO has generated $2.92 per share of dividend income. PDO has also paid 2 separate special cash dividend distributions, $0.37 per share in 2021 and $0.96 per share in 2022, for a total special cash dividend of $1.33 per share. PDO has also generated $0.03 in short and long-term capital gains. In total, each share of PDO has produced $4.28 per share of dividend income since its IPO. To date, PDO has produced 21.4% of its initial price through dividends in just over 2 years. PDO also increased its regularly scheduled monthly dividend in the summer of 2022. The monthly dividend increased by 8.02% from $0.1184 to $0.1279.

PDO is a young fund, but PIMCO is one of the largest global asset managers. Investors have allocated $1.49 billion in AUM to PDO, which I view as a sign of strength, not weakness. On the one hand, an investor could look at PDO as an unsuccessful endeavor to date as the net loss would be -$197 (-9.85%) after the $428 of income is netted against the $625 decline on an initial investment of 100 shares during the IPO. On the other hand, one could look at the initial investment of PDO as having an asset base that fluctuates in value and has produced $428 of income, which is 21.4% of the initial investment, and the income continues to be generated monthly. It all depends on an individual's perception and investment thesis.

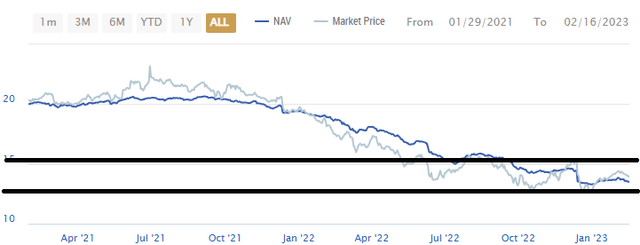

Why I am going to add shares in my Dividend Harvesting Series and make a much bigger purchase in my regular dividend account

When I look at the chart of PDO, I see a bottom forming as the floor was established in October of 2022 and retested at the end of 2022. I feel there is an opportunity under $15 as long as shares don't form another leg down and take out the bottom line around $12.78. If shares stay range bound for some time, that would be fine with me, as they produce a yield exceeding 11%. PDO is strictly an income-producing asset in my eyes, and while getting the share price back into the $20 would be nice, it's not imperative for my investment. Since I am buying when the yield is in the double digits, I am more than fine with PDO trading sideways. As long as it continues to generate its established monthly income, I can reinvest and benefit from the powers of compounding. Purchasing shares under $15 can be a wonderful income investment over time, especially since shares look like they have established a bottom. I can sit back, add to my position on pullbacks, and generate substantial income to reinvest.

PIMCO

Before investing, I needed to be comfortable with PDO's structure and understand what I would be getting myself into. PDO is an income-focused investment that utilizes an asset allocation strategy among multiple fixed-income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds, and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers. PDO normally invests worldwide in a portfolio of debt obligations and other income-producing securities and instruments of any type and credit quality and with varying maturities and related derivative instruments.

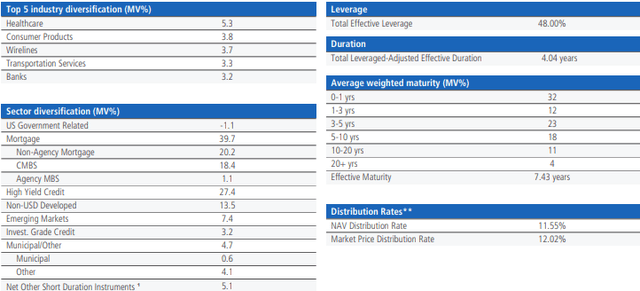

PDO uses leverage through reverse repurchase agreements and may obtain leverage through dollar rolls and borrowings, such as through bank loans, commercial paper, other credit facilities, and other transactions. PDO's leverage ratio will not exceed 50% of its total assets. By utilizing leverage, PDO's ability to generate a larger return for shareholders increases, but it comes with additional risk. If you're considering investing in PDO, or any other fund that utilizes leverage, my advice would be to define your risk tolerance before making an investment. Leverage is a speculative technique, and while it can work to the fund's advantage from an income and appreciation standpoint, there is no guarantee that a speculative strategy will succeed.

PIMCO

PDO has 44% of its bonds maturing within 3 years and another 23% maturing within 3-5 years. The average effective maturity rate is 7.43 years. There are 32% of their bonds maturing within the current year. This should allow PDO to benefit from the Fed continuing to raise rates. We know that there are at least 1-2 more hikes in the cycle, and there is no guarantee that the Fed will begin cutting in the back half of 2022. As the maturing bonds come due, PDO will be in a position to roll these back into new bonds that should theoretically generate larger yields.

Conclusion

I am going into PDO with my eyes wide open. With a maximum leverage utilization ratio of 50% and 48% of total effective leverage being implemented, PDO has an elevated level of risk to it. Having read through the paperwork from PIMCO, For me, PDO CEF fits within my risk profile, but that doesn't mean that it will fit within yours. I am looking at this as an income investment that invests in areas I don't have access to and/or have no interest in following. I am fine with the price fluctuating, and as long as shares don't dip below $10 and the dividend stays at its current level, I will be fine with the investment. If the distribution gets reduced or shares approach $10, I will need to revisit this and decide on my next steps. I am not saying this is a home run, but it's an interesting income play from a world-class asset management firm, and I am willing to take the risk and allocate a small portion of my portfolio to PDO.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PDO, PDI, PTY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.