LendingClub: When Headwinds Turn To Tailwinds

Summary

- LC is facing material headwinds.

- These headwinds however are temporary.

- The key is a Fed pause which is expected in the 1H of 2023.

- Headwinds will turn to tailwinds.

- Time to be greedy when the Street is fearful.

Michael Vi

One could probably not envision a much worse macro setting for a digital marketplace bank such as LendingClub (NYSE:LC). The headwinds are currently remarkably strong and are almost single-handedly attributed to the rapidly rising interest rates.

This affects both the marketplace originations as well as causing a meaningful NIM compression for LC's existing portfolio. The good news is that these headwinds are temporary in nature and should subside in the next two quarters.

The business model remains extremely attractive and the TAM has never been larger with outstanding credit card outstanding balances crossing the $1T mark.

In this article, I will explain the nature of the headwinds, when these will turn into tailwinds, and how this translates to the share price reaction.

The Business Model Summarized

Investors may recall that LC's income predominantly comprises NII from held-for-investment ("HFI") unsecured personal lending and marketplace fee revenue from selling originated loans to partners and investors (which include banks and asset managers).

Since becoming a bank in Q1 2021, LC has grown its HFI portfolio massively as these deliver a very strong return on equity. The marketplace revenue generated supported its profitability and allowed it to generate organic capital which was deployed right back to grow the HFI portfolio. This created a virtuous cycle of increased earnings and growth in book value. It is important to note that retaining loans on the balance sheet requires the recognition of lifetime expected losses under the CECL accounting standard. This effectively means that by retaining loans, LC is generating an accounting loss in the quarter whereas the income will be recognized in future accounting periods. So in other words, it is a timing difference only but requires LC to pre-fund capital upfront. As I discussed in my previous article, LC has always been capital constrained whereas its binding capital constraint is the Tier 1 leverage ratio.

The Headwinds

The rapid raising in interest rates by the Fed has created a number of material headwinds to the business model.

Firstly, the loans originated by LC are generally fixed rates loans whereas the funding cost is based, in large part, on high-yield deposits which reprice instantaneously as the Fed raises rates. This invariably leads to material Net Interest Margin ("NIM") compression which affects LC's profitability. This is a very different outcome from the typical bank's business model that usually benefits from rising rates environment.

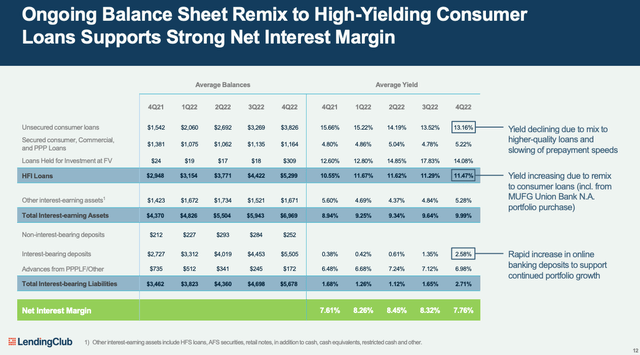

The NIM compression is plainly evident in the below slide:

The second headwind relates to marketplace revenue. Similarly, the rapid rise in rates has completely changed the economics for investors (especially asset managers) for the worse as their funding costs have gone up parabolically whereas the yield on assets reprices with a lag. It is worth noting that investors typically fund the loans with rates based on 18+ months yield curves which naturally prices in the future rate rise. Additionally, certain cohorts of originations previously popular with investors (e.g. near prime) are evidently experiencing rapid normalization of credit and therefore there is very limited investors' appetite for these loans currently. So the combination of the above is resulting in materially lower revenues in the marketplace.

Important to note that borrowers' demand remains exceptionally robust but investors are currently on the sidelines due to these factors (i.e. returns are lower due to higher cost of funds and concerns about the credit performance of certain cohorts).

The third headwind is a manifestation of the previous two headwinds. Lower profitability due to compressed NIM as well as lower marketplace revenue translates to lower GAAP net income prints for LC and in turn, it has less capital to redeploy to retain loans on the balance sheet (i.e. disrupts that virtuous cycle I referred to above). In other words, under the current conditions, it will be challenging for LC to grow its balance sheet given that it is capital-constrained and retaining loans requires LC to pre-fund the associated capital.

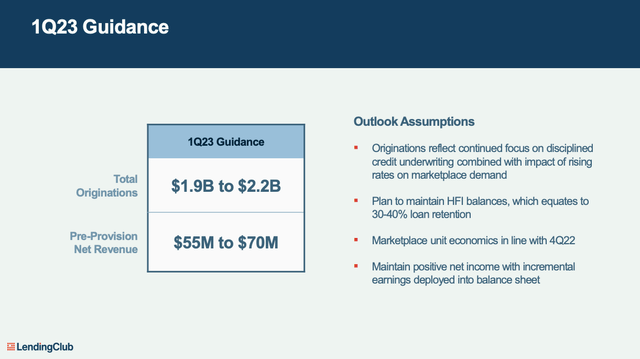

These above headwinds have translated to the Q1 guidance provided by LC's management.

LC has to slow down the growth of the balance sheet in the next quarter or two. Any recovery in marketplace revenue will be redeployed into retaining additional highly rated prime loans. This is also the reason why LC took a restructuring charge in Q4 and reduced its cost base by 24%, all with an eye to preserving profitability.

When will the headwinds turn into tailwinds?

A pause by the Fed is the key ingredient for the momentum to change. This allows LC to "catch up" on the gross yield on assets and restore the required economics for investors.

A reduction in rates will clearly be beneficial as well as it immediately translates to the widening of NIM in the existing portfolio as well as makes the economics for investors much more attractive. Of course, the flip side is that if the reduction of the rates is due to a deep recession then the credit losses are also likely to be higher.

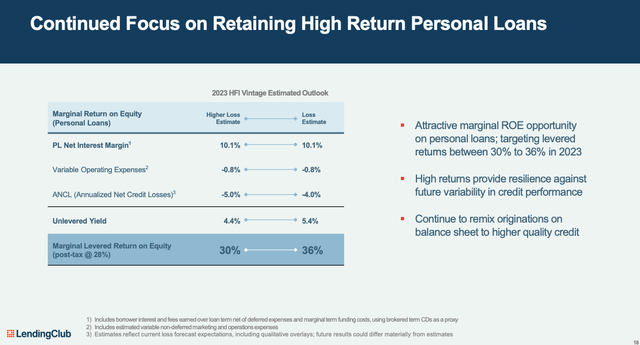

Management provided an illustration of the profitability of its loans:

As can be seen from above, the post-tax (and expenses) marginal ROE is 36% even in this challenging environment. Even if factored in higher credit losses, it holds at ~30%. These are exceptionally strong returns for this asset class.

Final thoughts

The headwinds currently for the business model are very strong. Still, LC remains resilient and is carefully managing credit risks by remixing the portfolio to higher-quality assets. The path of interest rates is the key game-changer, if you believe the Fed is getting closer to a pause in rates, this will likely be the turning point where headwinds turn into tailwinds.

The market is also concerned about a potential recession and loan losses to come. LC management, quite prudently, is conservatively provisioned at a ~5% unemployment rate. My base case is that once the unemployment market cracks, the Fed will cut rates quite rapidly, so any incremental loan losses (above provisions) will be offset somewhat by a widening NIM number.

The business model remains very attractive and I expect profitability to boomerang back up once the environment normalizes. Under normal macro conditions, I would value the business at around 3x tangible book value. It is currently trading at only ~1x tangible book value. To me, this is a classic case of being greedy where the Street is fearful. I remain very bullish and will continue to monitor the stock and developments very closely.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of LC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.