Hercules Capital: Don't Be Shy, This 12.5% Yielder Is A Buy

Summary

- Hercules Capital covered its dividend with net investment income in the fourth quarter.

- The BDC announced $0.32 per share in supplemental dividends for 2023.

- Portfolio quality remains excellent.

phototechno

Hercules Capital, Inc. (NYSE:HTGC) performed admirably in the fourth quarter, easily covering its increased quarterly distribution with net investment income.

The portfolio continues to grow while the business development company maintains high portfolio quality.

Furthermore, Hercules Capital is poised to benefit from the Fed's aggressive interest rate hike cycle, which could provide tailwinds for the company's portfolio income in 2023.

The current yield is 12.5%, and investors have many good reasons to buy it.

A Growing Portfolio With First Class Credit Quality

Because there are so many of them, passive income investors are spoiled for choice when it comes to investing their hard-earned money in business development companies.

The reason I rate Hercules Capital so highly in a crowded BDC market is because of the company's exceptional portfolio and NII growth that has not come at the expense of declining portfolio quality.

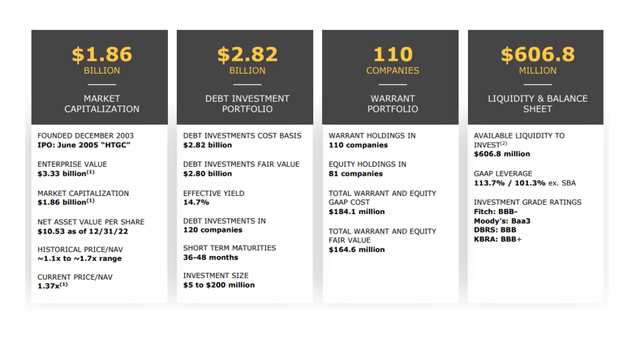

The investment portfolio of Hercules Capital was valued at $2.96 billion, with debt investments (at fair value) accounting for $2.80 billion of investments, or 94% of all investments. Equity holdings and warrants accounted for 6% of the company's portfolio and provide Hercules Capital with income upside if one of its portfolio companies performs exceptionally well.

Portfolio Overview (Hercules Capital)

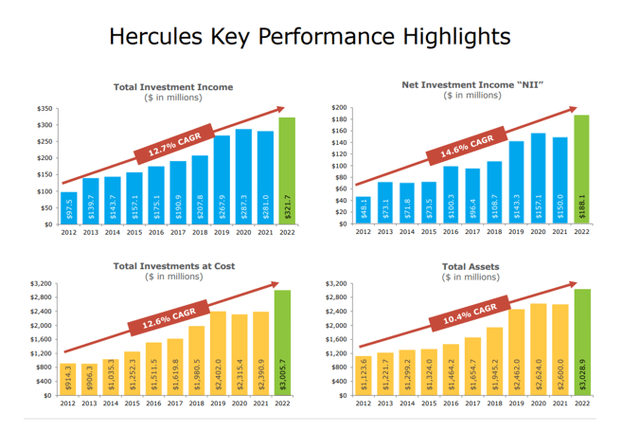

Hercules Capital's portfolio has grown rapidly over time, including during the pandemic.

Hercules Capital has enjoyed a portfolio growth rate of approximately 13% over the last decade, with approximately $3.0 billion in total invested assets at the end of 2022.

At the same time, Hercules Capital's net investment income has increased at a slightly faster rate of 15%.

Key Performance Highlights (Hercules Capital)

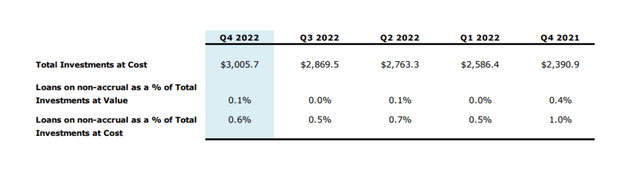

In terms of portfolio quality, Hercules Capital had to write off one more debt investment in the fourth quarter, bringing the total number of non-accruals to two.

However, overall portfolio quality remained very high, with a non-accrual ratio of only 0.1% at the end of the December quarter. Hercules Capital has previously demonstrated strong underwriting discipline and has one of the best credit quality metrics in the BDC sector.

Non-Accruals (Hercules Capital)

Hercules Capital’s Dividend Coverage And Dividend Growth Are Very Good

Passive income investors should consider Hercules Capital's 12.5% dividend yield for two reasons.

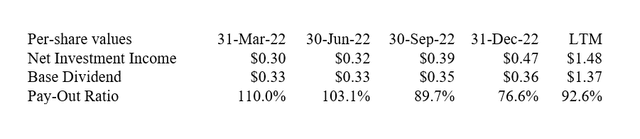

Firstly, in the fourth quarter, Hercules Capital covered its dividend with net investment income. In 4Q-22, the BDC increased its quarterly dividend to $0.36 per share while also paying a supplemental dividend of $0.15 per share. The fourth-quarter dividend pay-out ratio was only 77%, allowing the BDC to increase its base dividend pay-out once more.

Dividend (Author Created Table Using BDC Information)

The BDC increased its base dividend pay-out to $0.39 per share in 1Q-23, representing an 8.3% increase, and Hercules Capital also announced the payment of $0.32 per share in supplemental dividends for 2023, which will be paid in four $0.08 per share installments. This means that passive income investors can expect a total distribution amount of at least $1.88 per share in 2023, which equates to a forward dividend yield of 12.5% based on a stock price of $15.08.

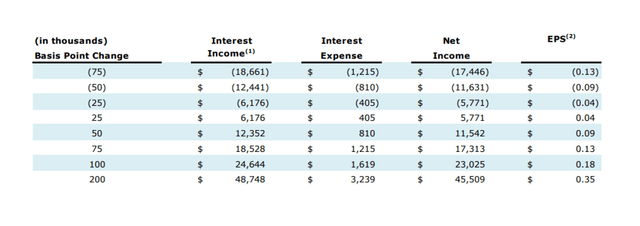

Secondly, Hercules Capital is well-positioned for a rising-rate environment, which could result in additional dividend increases. A 100-basis-point increase in interest rates is expected to result in an additional profit of $0.18 per share for Hercules Capital.

Hercules Capital is well-positioned to profit because a strong labor market and a month-over-month increase in inflation in January make a strong case for the central bank to keep hiking rates.

Basis Point Change (Hercules Capital)

Premium Valuation

In my opinion, Hercules Capital is the only business development company that deserves to trade at a premium to net asset value.

Over the last decade, the BDC has delivered consistent portfolio and net investment income growth, as well as strong credit quality and very solid dividend coverage.

Hercules Capital stock is currently valued at a 43% premium to net asset value, making the BDC an outlier in the sector, as the majority of business development companies trade at or near NAV.

Why Hercules Capital Could See A Lower/Higher NAV Multiple

An increase in the non-accrual ratio is Hercules Capital's biggest risk. A recession could cause this, but given that Hercules Capital has achieved solid credit quality over time and the portfolio has been growing, I believe investors do not need to be concerned for the time being.

A shift in the inflation/interest rate situation could be a drag on Hercules Capital's dividend growth if the central bank no longer sees a compelling reason to keep raising interest rates.

My Conclusion

Hercules Capital recently increased its quarterly dividend from $0.36 to $0.39 per share, representing an 8.3% increase for investors.

The business development company also announced that it would pay out $0.32 per share in supplemental dividends in four equal installments throughout 2023, for a total of $1.88 per share in distributions.

Given Hercules Capital's excellent portfolio quality and low dividend pay-out ratio of 77%, I believe Hercules Capital is one of the best BDC choices for passive income investors right now, despite the premium valuation.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HTGC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.